The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MUMBAI, India — Gautam Singhania likes to live on the edge. The Indian billionaire can often be found racing Formula One cars at death-defying speeds around European race tracks. Back in India, when he's not speeding through traffic in his exotic fleet of Ferraris and Lamborghinis, Singhania likes to survey his empire from one of four speedboats — which he has tellingly named Octopussy, Goldfinger, Thunderball and Golden Eye, after the James Bond movies.

As chairman and managing director of Raymond Ltd, the flamboyant tycoon has amassed an estimated personal net worth of $1.4 billion through The Raymond Group. The firm exports textiles and apparel to over 55 countries, and includes a much-loved men’s suiting brand called Raymond with a network of over 700 retail shops across India.

When Singhania joined the family firm, he quickly restructured it, selling off Raymond's non-core businesses of synthetics, steel and cement. Under his leadership, the group shifted its focus to fabrics, apparel brands, men’s toiletries and KamaSutra condoms — which gained market traction in the 1990s with a risqué advertising campaign by late fashion and fine art photographer Prabuddah Dasgupta.

Gautam Hari Singhania, chairman and managing director of Raymond Ltd | Source: Courtesy

ADVERTISEMENT

Another reason for Singhani’s success, says GQ India’s fashion features editor Shivangi Lolayekar, is that “the Raymond [brand] once served an older gentleman [but] has changed their marketing and strategy to include a younger audience.”

Today, Singhania is just one of 121 Indian billionaires in India, around 20 per cent of whom have made part of their fortunes from the fashion industry. The wealth generated by the likes of Singhania is a product of India’s booming fashion market and the country's rapid economic rise. The apparel category alone is forecast to grow at an impressive 8 percent annually, reaching $59.3 billion by 2022, and India's dynamic middle class is estimated to grow 19.4 percent annually during the same period.

Flashy Playboys and Discreet Gentlemen

Such is the one-upmanship among some of India’s fashion billionaires that their rivalry is changing the actual landscape of cities like Mumbai. Singhania has built a mega-mansion with a skyscraper nine stories taller than Mukesh Ambani’s. The soaring mansion, called JK House, combines a private residence and textile showroom.

However, Ambani, who last year overtook Alibaba's Jack Ma to become Asia's richest man with a net worth of $45.2 billion, is in a different league. The chairman of Reliance Industries Ltd. gained global attention as his 27-story-high mansion Antilia rose in Mumbai and was crowned one of the most expensive private homes ever built at a cool $1 billion. More recently the fact that Ambani hired Beyonce to perform at his daughter's lavish wedding in Mumbai, reinforced the sheer extent of his wealth and influence.

By most estimates, India now has the fourth highest number of billionaires trailing only the US, China and Germany.

Ambani’s firm Reliance is well known in fashion industry circles because its fashion division has partnered with high-profile designer brands. He has also recently announced he will take on Amazon and Walmart’s Flipkart with a new high tech e-commerce offering of his own.

According to Priya Tanna, editor in chief of Vogue India, Ambani’s success in the fashion sector is down to the fact that “Reliance’s portfolio [caters] to every consumer in the mix,” from mass market players like Reliance Trends and Project Eve to their e-commerce venture Ajio. “They also [formed a joint venture with] Marks & Spencer in India, which along with their current portfolio…marks their foray into high street fashion in a big way,” she adds.

Reliance has direct partnerships with brands like Ermenegildo Zegna, Diesel and Bally for the Indian market and the firm recently upped its stake in Genesis Luxury Fashion, a group that boasts a joint venture with Burberry and distributes brands such as Bottega Veneta, Giorgio Armani, Michael Kors and Coach in the Indian market.

ADVERTISEMENT

Ambani and Singhania are not alone. By most estimates, India now has the fourth highest number of billionaires trailing only the US, China and Germany. Many of India’s billionaires own sprawling diversified conglomerates that operate in fashion manufacturing, the apparel trade, distribution, retail and textiles. Based on BoF’s analysis, around 20 percent of India’s top billionaires can thank the fashion business for part of their fortunes. There are many centimillionaires who are also betting big on fashion.

While it is fascinating to pick apart their portfolios, the wealthy moguls themselves can be even more interesting. Fashion insiders will be familiar with the likes of Escada's chairperson and managing director Megha Mittal, whose father in law Lakshmi Mittal is a steel magnate with a net worth of $14.1 billion. Yet, India's other billionaires are less known to the European fashion crowds. There’s the investor Rakesh “Big Bull” Jhunjhunwala whose net worth is estimated at $2.8 billion. His most valuable holding is watch and jewellery maker Titan Company (a subsidiary of Tata) worth close to $700 million.

Or take former taxi driver Micky Jagtiani (net worth $4.8 billion). With his wife Renuka Jagtiani, he co-founded Dubai-headquarted Landmark Group, which counts 2,300 stores spread across 22 countries in the Middle East, Africa and India. They own apparel retailer Max, which as well as thriving e-commerce operations, has over 160 stores in 60 cities across India.

Then there’s Radhakishan Damani, a reclusive billionaire whose $12.2 billion can be traced back to the 2017 IPO of D-Mart, his chain of 160 stores across India selling fashion basics and home goods.

The scions and heirs of these storied families tend to be low key about their wealth, rarely appearing in the pages of India’s Hello or Verve magazines, unlike their more flamboyant counterparts the Ambanis and Singhanias. Maintaining a public image of rectitude and respectability is important in India where all too frequently, big business is embroiled in corruption scandals. The recent downfall of celebrity jeweller Nirav Modi who first came to prominence in 2010 is a salutatory example.

Another reclusive tycoon whose fortune is inextricably entwined with the booming Indian fashion market is Pallonji Mistry (worth $14.7 billion). The horse and whiskey-loving billionaire is the largest individual shareholder of Tata Group's holding company Tata Sons. Although Tata is famous for tea, steel, cars such as Land Rover and Jaguar, and heavy industry, fashion too has its place in the empire. Tata International is a leading exporter of leather products, supplying major global brands such as Zara, Mango, Marks & Spencer and many more.

Through its Westside retail chain, Tata also has 132 department stores across India and, through its subsidiary Titan, distributes international watch brand licenses from the likes of Esprit, Kenneth Cole and Timberland. Not least, Trent (the retail hand of the Tata Group) is the company responsible for helping Spanish retail giant Inditex gain a foothold in India through a joint venture with the fast fashion behemoth.

Factory Dynasties Meet Instagram Fame

ADVERTISEMENT

While international fashion and luxury brands have only relatively recently been eyeing India, a number of long established, home grown fashion players have local market knowledge and all important consumer loyalty. Tata and Birla are the two Indian industrialist families most associated with massive wealth and all pervasive brand recognition in India, and both have significant interests in fashion retail.

With an estimated net worth of $11.9 billion, “cement king” Kumar Mangalam Birla is the fourth generation head of the $44.3 billion (revenue) Aditya Birla Group, which he took over when he was just 28 years old. The group is a national leader in cement, aluminium and financial services and owns one of India's largest telecom firms, Vodafone Idea.

In the next few years I see a lot of tie-ups by both Flipkart and Amazon with offline players.

But a significant part of the Birla empire is in fashion, with Aditya Birla Fashion and Retail Limited (ABFRL) claiming to sell three garments every second in India. Their retail arm Madura Fashion & Lifestyle has an incredible 1,980 shops across the subcontinent and also owns several popular brands including Peter England as well as Planet Fashion (the latter is a men's clothing brand with over 150 outlets in 100 Indian cities). ABFRL also operates one of India's most popular multi fashion retail chains Pantaloons, which it acquired from Future Group. Joint ventures with iconic brands including Hackett and Ralph Lauren complete the mix.

The Birla conglomerate also owns extensive mills and factories producing textiles, a speciality being viscose staple fibre (also known as modal), in which Birla has a 21 percent global market share.

Indeed it is textiles that many of these billionaires can thank for the start of their journey onto India’s rich lists. These include the Singhania (of Raymond fame), Birla, and Lalbhai families.

The latter has a fascinating place in Indian history. The family’s forebearer Kasturbhai Lalbhai was close to Mahatma Gandhi, leader of India’s freedom struggle. Lalbhai financed the anti-colonial Congress Party, and envisioned Arvind Ltd (founded in 1931) as part of Gandhi’s anti-colonial movement for Swadeshi (economic nationalism), creating a capacity to compete with the world’s finest textile mills.

Arvind Limited’s current patriarch Sanjay Lalbhai (net worth $1.1 billion) is known as India’s “denim king”. Arvind is one of the largest producers of denim globally, and owns key vertically integrated household brand names at home, backed by massive textile production and retailing operations and over 800 stores across India.

Before economic liberalisation allowed international brands into India, Arvind created denim label Flying Machine, the local alternative to aspirational — but then impossible to get a hold of — Levis or Wrangler jeans. Today it's estimated Arvind produces over 100 million meters of denim fabric and 6 million pairs of jeans annually. The core textile business accounts for around 60 percent of Arvind's $1 billion revenue, while brands and retail businesses make up an estimated 33 percent.

Punit and Kulin Lalbhai, scions of Arvind Ltd | Source: Courtesy

Samar Srinastava, who reports on India’s rapidly growing retail businesses and consumer goods companies for Forbes India, reflects on Lalbhai’s strategy. “In general vertically integrated fashion players [like this] have an edge in terms of margins as they control the entire value chain,” Srinastava tells BoF. “They’re able to source more effectively and control prices and discounting much more efficiently. Their stores act as crucial intelligence gathering points for customer trends and they are able to change course much more quickly.”

Lalbhai runs Arvind along with his two sons Punit and Kulin, and has launched many international brands in India, including Arrow, Debenhams and Nautica. Both the Lalbhai sons are taking the family business forward in ways that recognise the massive changes and challenges presented by India’s burgeoning economy. Harper’s Bazaar India’s editor in chief Nonita Kalra says of the brothers, “The next generation understands that you need to innovate to succeed.”

Ambition certainly isn't lost on them. The Lalbhai scions now want to create new billion dollar businesses in order to follow in the footsteps of their father's success with denim. Younger son Kulin is keen to create innovative online retail experiences as well as build Arvind's retail arm with brands that include Tommy Hilfiger, Gap, Calvin Klein and Sephora. Elder son Punit is a postgrad in environmental science from Yale. While developing Arvind's leadership in advanced textiles (it is the largest fire protection fabric producer in India), part of his involvement in the family business has been to encourage farmers in central India to grow organic cotton, improving their income by some 30-40 percent.

From Underwear Empires to Luxury Malls

Once the market opened following India’s economic liberalisation policies of the 1990s, international brands sought ways to enter a market plagued by well known challenges from poor infrastructure and tricky FDI policies to a complex consumer market. As a result, some domestic players have profited by taking on the role of gate keepers, with a proven track record of providing market access for foreign players, whether through joint ventures, franchises or licensing.

Sunder Genomal, who along with his two brothers boasts a net worth of 2.7 billion, is managing director of Bangalore-based Page Industries Ltd., one of the biggest licensees in the world for underwear maker Jockey. The firm has exclusive rights to manufacture, distribute and market Jockey in India, Sri Lanka, Bangladesh, Nepal and the UAE.

With India’s poor urban infrastructure and searingly hot summer months, shopping malls continue to be the prime destination for middle class consumers and the fashion brands looking to capture their attention.

At age 87, Kushal Pal Singh Tewatia (net worth $4.5 billion) is an Indian real estate developer, and the chairman of DLF Limited, founded by his father in law. The firm ventured into organised retail complexes in 2002, notably launching India’s first luxury mall, DLF Emporio, in 2008.

In 2016 they launched DLF Mall of India, located in Noida, close to the capital Delhi, the largest mall in India at over 2 million square ft, over seven floors. Of the mall's 330 brands, 100 of which are fashion brands. The year after saw the launch of The Chanakya, a restored art deco cinema transformed into a luxury retail and leisure complex — home to brands including Hermès, Rolex, Thomas Pink, Mont Blanc and Jaeger Le Coultre — in the moneyed, heritage area known as Lutyens' Delhi.

The DLF Emporio mall in New Delhi | Source: Courtesy

Another real estate tycoon whose fortune is inextricably linked with the fashion industry is Chandru Raheja, of the K. Raheja Corp Group. His $3 billion personal net worth is thanks mostly to the group’s IT parks and hotels. A significant part of his fortune, however, comes from well known department store chain Shoppers Stop, which is among India’s largest retailers. From a single store in 1991, the company now operates 258 departmental stores in 38 cities across the country. Its ‘First Citizen Loyalty Programme’ is considered its unique selling point and covers nearly 5.7 million members.

In late 2017 Amazon bought a 5 percent stake in Shopper Stop with business analysts praising the move, saying that Shoppers Stop’s tie-up with Amazon was perfectly timed to leverage the Indian stalwart and US behemoth’s respective offline and online strengths.

“In the next few years I see a lot of tie-ups by both Flipkart and Amazon with offline players, where customers can shop online and pick up at the store, Samar Srivastava, of Forbes India, tells BoF. “This is one reason why Amazon is so keen on taking stakes in offline retail companies [like this].”

All Eyes on the Disruptor Tycoons

Not surprisingly, fierce battles are being waged to capture the potentially lucrative e-commerce fashion market in India. In under ten years, a new wave of tycoons has emerged. Their path has been very different from the industrialists, whose family wealth from textiles enabled them to expand into retail between the 1960s and early 2000s.

One such new age entrepreneur Vijay Shekhar Sharma is also the youngest Indian member of Forbes 2018 rich list. The bespeckled businessman is looking to gain traction in fashion e-commerce with his virtual payment company Paytm, which was one of the largest beneficiaries of India's highly controversial 2016 demonetisation policy — a move that rendered around 86 percent of currency in circulation worthless overnight, driving Indian citizens towards virtual transaction providers. As of 2018, Paytm processed around 16 million transactions per day.

Shekhar Sharma hit international media headlines after persuading Warren Buffet to invest $300 million in Paytm in August 2018. He has also branched out with Paytm Mall, an online shopping site backed by China’s Alibaba and Japan’s SoftBank. According to an Economic Times report, Paytm saw 8 million orders a month in 2018, and a significant proportion of these were for apparel with an average order value of Rs 1,300 (around US $18). Paytm Mall is looking to compete with Walmart-backed Flipkart and Amazon India by increasing Paytm’s focus on fashion to gain all important repeat customer transactions.

There are a lot of fashion labels in India which focus on a Western silhouette but they don't take into account the Indian woman's specific needs.

Flipkart is the unicorn of Indian e-commerce. Founded by the Bansal brothers in 2007, it grew exponentially from 100 orders per day in 2008, to placing the brothers on Forbes India’s Rich list with a net worth of $1.3 billion each in 2015. Flipkart’s acquisition of leading fashion e-commerce players Myntra and Jabong in 2014 and 2016 respectively, now make it Amazon’s biggest rival.

But the person who set the mould for creating wealth from disruptive retail formats in India is self-made billionaire Kishore Biyani. His net worth of $2.4 billion comes from the Future Group, a retail empire which he started in 1987 by selling stonewash fabrics to small shops in Mumbai.

According to an Economic Times report, the Future Group’s value fashion format Fashion Big Bazaar (FBB) sold 200 million garments last year. Between 2004 and 2011, Jaydeep Shetty was Future Lifestyle’s chief of new businesses in lifestyle retailing. Of Biyani, he says: “If you look at Mr Biyani’s formats, he virtually invented them. Pantaloons (as it was then called, later sold to Aditya Birla) was the first private label fashion chain that was home grown. He’s driven by instinct and gumption over anything else.”

Fast fashion is most definitely Biyani’s game plan. In 2016 Biyani made Cover Story, founded by its current CEO Manjula Tiwari, a wholly owned subsidiary of Future Lifestyle. “There are a lot of fashion labels in India which focus on a Western silhouette but they don’t take into account the Indian woman’s specific needs,” Tiwari says. “At Cover Story we look at weather patterns, the Indian woman’s body shape, fits, skin tone and cultural preferences: for example not showing too much cleavage”.

Biyani is also paying heed to the growing might of e-commerce in fashion retail battles ahead. Koovs, founded by Britain’s Lord Waheed Alli to be an “Indian version of Asos”, is hitting back with a revised strategy led by retail veteran Mary Turner. Kishore Biyani recently bought a 30 percent stake in the e-commerce site.

Gold Fever and Small Town Billionaires

Even as battles for India’s online fashion market make headlines, much of India’s fashion purchases are, as yet, made in bricks-and-mortar stores, or in the unorganised retail sector, whose street markets and small independent shops make up an estimated 60 percent of the market in some categories such as footwear. A large portion of this market involves trend-led ethnic wear — not heavily ornamented bridal wear, but everyday wear made up of saris, salwar kameez and kurtas. Although it’s estimated that some 75 per-cent of the ethnic wear market is dominated by unorganised retail, several brands like Fabindia and Biba have emerged as giant players in the organised sector in the past decade.

There's a lot of regional differences in India, and it remains to be seen whether Amazon will sufficiently understand the Indian customer.

As always, India’s 1.3 billion population means that retail — even in relatively smaller segments — is a number’s game, something that Ramesh Kumar Dua is well attuned to. His $1.05 billion personal fortune is thanks to Relaxo Footwears, which produces over 600,000 pairs of shoes daily from nine factories in North India. The rubber company was Dua’s fathers, but it was when he joined in 1976 that they invested the equivalent of $140 in today’s money into starting a brand of rubber flip flops.

Last year, the firm sold 157 million pairs and counts Bollywood heavyweights Salman Khan and Akshay Kumar among its ambassadors. “Relaxo has gone down the mass market route and has got both the product and distribution right. It’s taken years to establish,” Forbes India’s Samar Srivastava says. “Whether or not Amazon will be able to pose serious competition to these kinds of mass market leaders is as yet unknown… there’s a lot of regional differences in India, and it remains to be seen whether Amazon will sufficiently understand the Indian customer”.

Many see Amazon or Walmart’s large scale operations as threats to home grown businesses. However, experts have an eye for the latters’ potential to fuel expansion for a new generation of fashion entrepreneurs, who understand the rich tapestry of Indian culture and regional differences.

If there is one local taste that unites Indians, it is for gold jewellery and precious gems. In India, gold is an auspicious symbol of divinity and prosperity, a key item in marriage rituals, and an important source of wealth and investment. According to an IBEF report, India currently contributes 29 per cent to global jewellery consumption.

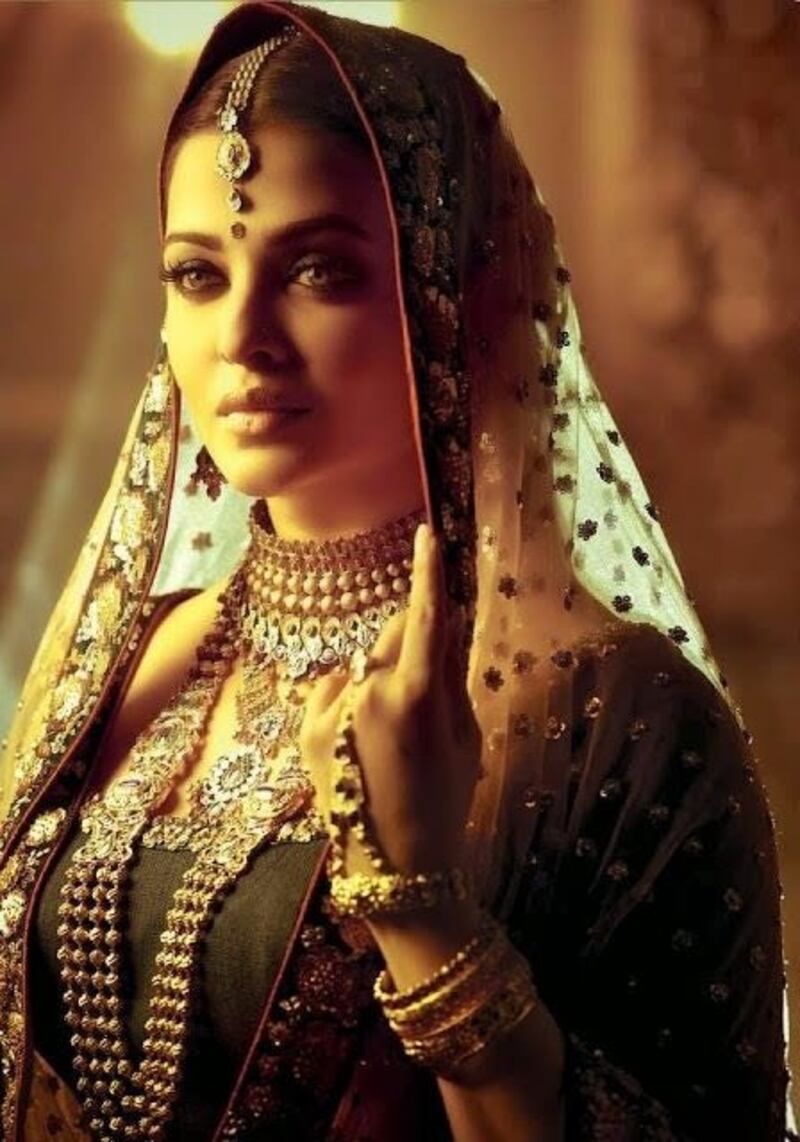

Aishwarya Rai In Kalyan | Source: Kalyan

With a healthy Indian consumer appetite for jewellery there are several businesses making fortunes from the industry, but it is Kalyan who leads the pack. Company founder T.S. Kalyanaraman has turned a small family business started in 1993 into the largest jewellery chain in India. With Bollywood star Aishwarya Rai Bachchan as its brand ambassador, Kalyan has a keen sense of jewellery’s role in the wardrobes of modern Indian women and men.

The Kalyanaraman family also lives up to the image of luxury embodied by their business. Besides a fleet of luxury cars including several Rolls Royce Phantoms, they own two private jets and a helicopter. Luxury vacations and designer clothes help cement an image that inspires profiles in Indian media such as the New Indian Express’ memorable “Keeping Up With the Kalyanaramans”.

However, the serious business of the company is underlined by the fact that T.S. Kalyanaraman and his sons never stay in the same hotel or ride in the same car. In a country plagued by devastating levels of poverty, security for the wealthiest of its citizens can not always be guaranteed. It is not only a reminder of the benefits and burdens of wealth but also the challenges presented by India’s growing economy. For despite the boom times, the gap between the country's richest and poorest continues to widen.

Indeed it is the question of responsibility and legacy that explains why one of the richest billionaires in India is never included on Forbes rich lists, and who in general, shuns a life of excess and conspicuous display so central to fashion and luxury. Much of Ratan Tata's fortune (some of which stems from fashion retail and could theoretically total $70 billion or so), is given away to charity through the family's holding company Tata Sons.

Tata's approach may not inspire every wannabe billionaire, but at least there is a role model for when the next generation make their fashion fortune.

Dr Phyllida Jay is the author of Fashion India.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.