The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

PARIS — “It’s not a store, it’s a universe,” Dior’s chief executive Pietro Beccari said, taking a seat in an armchair still draped in a plastic sheet on the shop floor at 30 Avenue Montaigne, the brand’s iconic founding address.

Less than two weeks ahead of its grand opening, saws were still buzzing at the sprawling complex where the fast-growing brand plans to flex its newfound scale. On March 6th, the brand will unveil a flagship store that has tripled in size, as well as an adjoining fashion museum, restaurant, pastry shop, garden and luxury hotel suite. The brand’s historic couture atelier is moving back into the building as well, along with a plush salon for private sales and fittings.

The expansion — designed by luxury’s go-to architect, Peter Marino — required two years of construction as six historic buildings acquired by Christian Dior, including the hôtel particulier where he started the brand in 1946, were combined into an eight-story, 10,000 square-metre complex. The project is a bold statement on the continued importance of physical experiences at a time when e-commerce has seen unprecedented growth.

Look up in the store’s airy atrium and you’ll see a brightly lit sculpture by Paul Cocksedge, meant to evoke Mr. Dior’s sketches tumbling from his desk. Sculptures by Isa Genzken and photos by Brigitte Niedermair, along with a 2,000 square-metre museum dedicated to Dior’s history, are indicative of the company’s push to elevate its brand closer to the plane of art, following craftsmanship documentaries, exhibitions and the major “Christian Dior: Designer of Dreams” retrospective.

ADVERTISEMENT

Look ahead, and you’ll see Dior’s strategy of translating that storytelling into relatable, bankable products on full display. Counters featuring a greatest-hits edit of the brand’s accessories and shoes entice customers before they’re guided into the labyrinthine wings devoted to menswear and womenswear, or to single-category shop-in-shop style areas for homeware, jewellery and beauty.

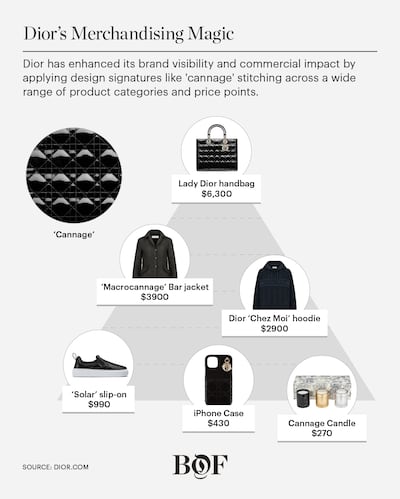

The merchandising offers myriad combinations of classic products, seasonal styles and seasonal twists on the classics. Signatures like “cannage” stitching, black-and-white herringbone and Dior’s “oblique” logo pattern are applied across a wide range of product categories and price points in a way that helps to make the brand’s broad offer feel recognisably Dior.

Further ahead, in Dior’s winter garden and patisserie, a €17 pastry offers another way for visitors to experience the brand without splurging for the €2,900 bag. A restaurant helmed by star chef Jean Imbert — a breakout star on the French culinary scene whose career was launched by a win on “Top Chef” — offers another layer of experience.

“We wanted to build a kind of Luna Park of the senses,” said Beccari, aged 54. “Someone coming here, if they loved Dior they will love it even more. And if they didn’t, they will be convinced about the value of this brand.”

A Mix of Spectacular and Grounded

30 Montaigne’s mix of spectacular and grounded reflects an approach to business that Beccari, who joined from Fendi in 2018, has become known for. At Fendi, the goal of hammering its central message as the Roman house of fantasy and fur was executed in exceptional ways, culminating in a haute fourrure (high fur) runway show that took place not at, but on, the Trevi Fountain, with models walking on plexiglass platforms across the water. At the same time, Fendi cashed in on its renewed focus on fur by pushing small accessories like fuzzy bag charms and keychains.

It’s also the latest chapter in a group-wide push at parent company LVMH to integrate luxury brands and experiences. During Beccari’s tenure at Fendi, the group installed a restaurant and luxury hotel in the brand’s Roman palazzo, as well as opening six Bulgari branded hotels. In 2018, LVMH acquired the hotel group Belmond for $2.6 billion, and last year reopened the Samaritaine department store in Paris after a 10-year renovation that included installing a top-end Cheval Blanc hotel chain in its upper floors.

The massive complex is also the product of a sort of fusion reaction as LVMH chairman Bernard Arnault’s seemingly endless appetite for investing in Dior collides with a moment when the brand and its products are firing on all cylinders.

ADVERTISEMENT

That combination has seen the brand lean into its rapid growth, continuing to spend as much as 10 percent of revenues on marketing even as sales roughly tripled during Beccari’s tenure from €2.2 billion to €6.5 billion ($7.2 billion), according to HSBC estimates. (LVMH does not break out sales for individual brands; Beccari declined to confirm the estimate).

The idea of tripling the size of Dior’s Paris flagships was a bold move when works began — with 2,200 square metres of retail and 600 square metres for private sales, it’s now larger than the historic bases of formerly much-bigger companies like Chanel on Rue Cambon or Hermès’ Faubourg Saint-Honoré base.

But when stores shuttered during the pandemic, and other brands retrenched — slashing marketing and cancelling fashion shows — Dior continued to stage (and aggressively advertise) lavish outings for its collections.

Neck-and-Neck with Chanel

Dior’s bet paid off: Taking together the sales of Christian Dior Couture and its sister company in beauty, Parfums Christian Dior, the Dior name is projected to surpass €11 billion ($12.3 billion) in 2022 — neck-and-neck with Chanel, the fellow Parisian beauty-and-couture player that long dwarfed it. (Chanel has yet to release figures for 2021 but has given guidance for sales to at least surpass 2019′s pre-pandemic levels of $12.2 billion ).

Beccari denies that the brand still benchmarks itself against Chanel, describing it as one of many rivals. “We work on the long-term desirability of Dior, and try to gain market share, from Chanel, Hermès, Gucci — whoever they are,” he said. “That’s what the game is all about.”

The brand’s current success is a far cry from the days when LVMH chairman Bernard Arnault acquired it, then floundering as part of a debt-saddled textile and retail group, from the French government for one symbolic euro in 1987.

“Dior has always been Arnault’s baby,” HSBC analyst Erwan Rambourg said. “A few years ago when it was a 2 billion [euros per year] company, all the marble and the locations didn’t necessarily seem to make a lot of sense. But now that they’ve tripled sales you’re getting the returns.”

ADVERTISEMENT

Beccari has earned a reputation as a “can-do person,” Rambourg said. “He comes across as being a dreamer, then puts in the work to fulfil the dream.”

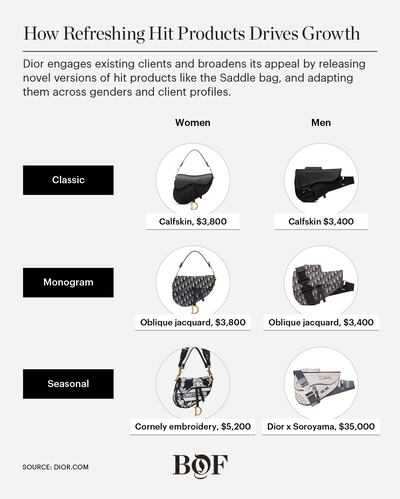

Beccari’s signature mix of the spectacular and the grounded is present more than ever these days in Dior’s boutiques, where high-budget outings like Maria Grazia Chiuri’s globe-trotting cruise shows in Marrakech; Lecce, Italy; and Athens are translated into saleable products like €4,700 limited-edition Saddle bags and €195 hair ties.

Beccari’s pick for menswear director, Kim Jones, has won accolades for his sensitive, androgynous reinterpretation of Dior womenswear signatures like the Bar suit on the runway. But hit products like skateboarding sneakers and crossbody bags serve a gamely, even macho vibe on the street, helping the brand reach a new generation of men.

“It all starts from their freedom to do whatever they want. Then once we have the material we try to package it the best way possible,” Beccari said.

For retail consultant Robert Burke, Dior’s approach of mixing luxury shopping with a more welcoming, accessible experience is a savvy one: Rather than “Pretty Woman”-ing clients, Dior is offering a taste of the wow-factor of its price-upon-request couture for €12 in its museum.

“Strong brands today realise that capturing consumers’ attention is what’s important,” he said. The move to include luxury hospitality, albeit only one suite for now, allows the brand to explore a new way to activate ultra high-net worth clients, while the pastry shop and museum make the store relevant to a wider public. “Brands are realising that there are ways to broaden their audience without diluting their impact,” he added.

Beccari says Dior’s best days are still to come as the brand leverages its newfound financial power to take on more ambitious projects like 30 Montaigne to drive growth.

“Scale is absolutely important. It gives you the freedom of creating impact,” he said. He and Mr. Arnault agreed on the sweeping renovation of 30 Montaigne while the brand’s “economic power” was far less, he explained. “Think about now that we have the money!”

Editors’ Note: This story has been modified 3rd March at 7:40a.m. A previous version of this story misstated the name of a New York-based luxury retail consultant. His name is Robert Burke.

LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholder’s documentation guaranteeing BoF’s complete editorial independence.

How the designer used fashion with a message to make a storied couture house relevant for a new generation — and helped turn it into a commercial juggernaut.

Today, as Dior stages a destination runway show in Italy, a new report shows the LVMH-owned brand's finances inching closer to those of its oldest rival, fashion-and-beauty juggernaut Chanel.

The British designer is following in the footsteps of fashion multi-tasker Karl Lagerfeld, becoming artistic director for womenswear at Rome-based Fendi while keeping his job as designer of Dior Homme.

Robert Williams is Luxury Editor at the Business of Fashion. He is based in Paris and drives BoF’s coverage of the dynamic luxury fashion sector.

A runway show at corporate headquarters underscored how the brand’s nearly decade-long quest to elevate its image — and prices — is finally paying off.

Mining company Anglo American is considering offloading its storied diamond unit. It won’t be an easy sell.

The deal is expected to help tip the company into profit for the first time and has got some speculating whether Beckham may one day eclipse her husband in money-making potential.

The designer has always been an arch perfectionist, a quality that has been central to his success but which clashes with the demands on creative directors today, writes Imran Amed.