The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — The UK has been embroiled in controversy following the leak of a government Brexit analysis — titled "EU Exit Analysis — Cross Whitehall Briefing" and dated January 2018 — that suggests almost every sector of Britain's economy will be negatively impacted by the country's exit from the European Union, feeding the view the government is ill-prepared. Now, a new report by the UK Trade Policy Observatory (UKTPO) suggests the fashion industry will be one of the hardest-hit industries.

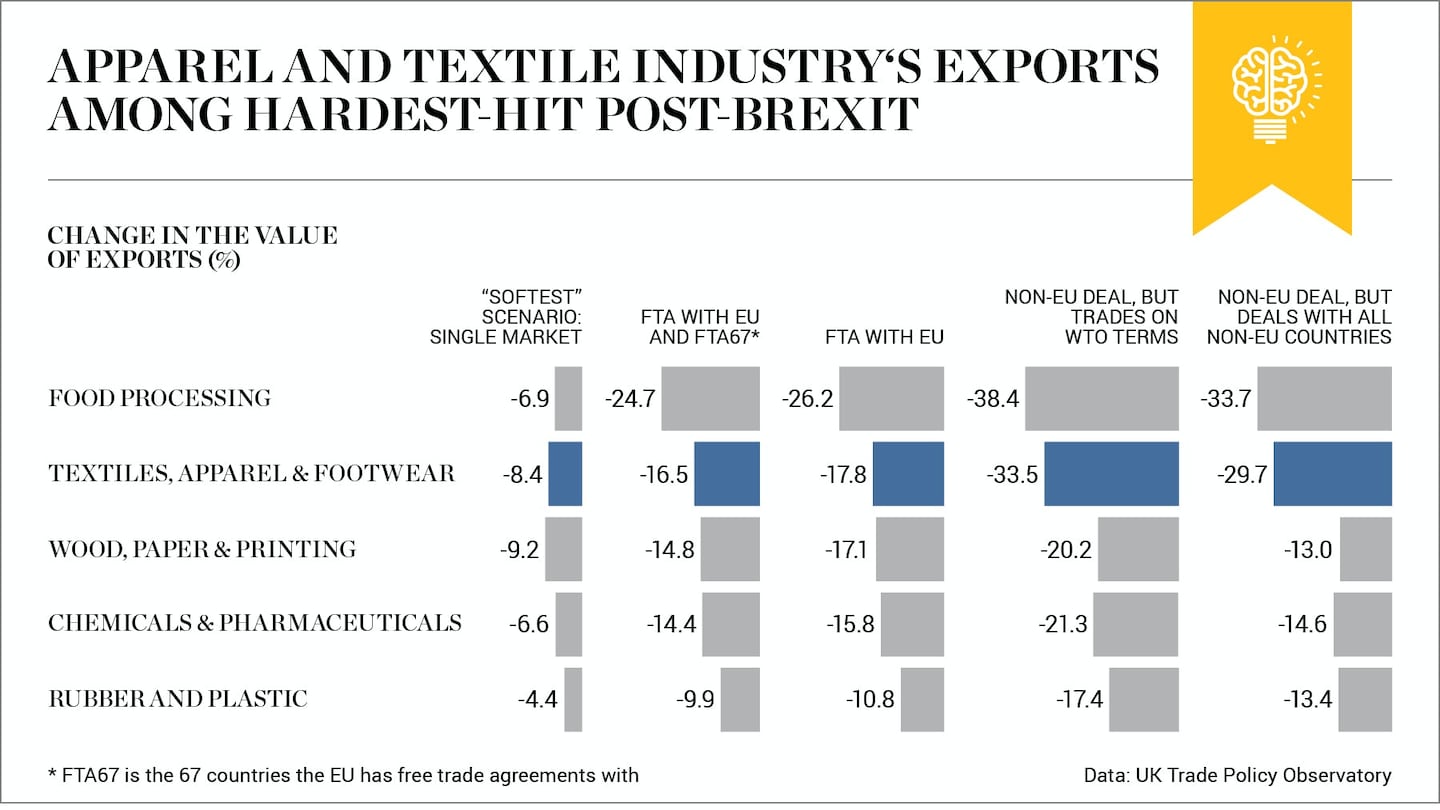

The UKTPO’s report models the potential impact of Brexit across five scenarios, ranging from a “soft Brexit” to a “no deals” scenario where the UK leaves the EU with no free trade agreement (FTA). The middle-of-the-spectrum models involve an FTA with the UK and at least one partner, whether that be with the EU, EU-partner markets or through most favoured nation (MFN) tariffs.

None of the models suggest a positive outcome for the country’s manufacturing sector. In fact, signing new trade deals, regardless of their scope and depth, will not fully compensate for the loss of trade with EU partners, nor will an EEA membership, which will lead to high costs and reduce market access.

While the impact on imports will be negligible, the textiles, apparel and footwear industry is likely to experience large declines in exports after Brexit, being the hardest-hit manufacturing industry after food processing. As an industry reliant on international talent and trade — most raw materials come from abroad — the restriction of free movement of labour and trade will also be particularly problematic.

ADVERTISEMENT

In the best-case scenario of an EEA membership, exports will decline by 8.4 percent, with the magnitude of the effect increasing the larger the size of the policy change. In a scenario of an FTA with the EU, exports are expected to fall by 17.8 percent. The number falls to 29.7 percent should Britain form FTAs through MFN tariffs and the RoW, and to 33.5 percent in case of a “hard Brexit.”

The impact on the apparel and textiles industry also stands out when compared to industries like chemicals and pharmaceuticals and rubber and plastic, where the maximum impact in case of a “hard Brexit” is a 20.2 percent decline; significantly lower than that for the fashion industry.

In the short term, uncertainty surrounding negotiations means headwinds for domestic consumers are mounting, says a report by research firm BMI. While those at the top of the income bracket will remain shielded, higher import costs will mean higher prices for luxury goods as retailers adopt price harmonisation strategies.

The UKTPO’s findings come after the Creative Industries Federation (CIF) produced a report last year outlining the potentially detrimental effects that Brexit will have on the country's fashion industry. Free movement of people, a baseline condition of Eurozone membership, is set to be scraped by the EU by March 2019 to reduce immigration to the UK, potentially undermining an industry employing largely international freelancers.

While the industry has remained optimistic in view of a possible EEA membership scenario, the exports and output in the apparel and textiles industry will be negatively affected regardless of the specific Brexit outcome.

Related Articles:

[ The Great British Break-Up: How Brexit Will Impact Fashion in 2017Opens in new window ]

[ Brexit Poses Serious Risk to UK Fashion Industry, Says New ReportOpens in new window ]

[ Triggering Article 50: What Brexit Means for FashionOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.