The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

PARIS, France — Kering is set to spin off German sportswear label Puma by distributing a majority of its stake to its own shareholders as part of the French conglomerate's long-held plans to focus purely on luxury.

The company will distribute 70 percent of total Puma shares — worth about 3.5 billion euros at Thursday’s closing price — thereby reducing its stake to 16 percent from 86 percent. Artémis, the Pinault family investment vehicle which holds a 40.9 percent stake in Kering, will become a “long-term strategic shareholder” in Puma, with a 29 percent stake.

Kering is believed to have long explored its options to dispose of Puma. More recently, some thought it would pursue a dual track IPO-auction, a move that would involve preparations for a sale of Kering's majority stake in Puma on the public markets while simultaneously inviting bids from potential acquirers. But with a market capitalisation of over $6 billion, Puma may have simply been too large for buyers and Kering sought a route that was safer than a public offering.

"The contemplated distribution of Puma shares to our shareholders would be a significant milestone in the history of the group," said Kering chairman and chief executive François-Henri Pinault in a statement. "Kering would dedicate itself entirely to the development of its luxury houses, whose enduring appeal, built on creative audacity and innovativeness, will allow us to continue to gain market share and create value."

ADVERTISEMENT

“We see this as a positive development for the company's long-term development,” wrote Mario Ortelli, a senior luxury goods analyst at Sanford C. Bernstein, in a note to investors. “Puma is the last remaining non-luxury asset for Kering, which has been disposing its non-luxury assets over the past decade. Both the company structure and its equity story also become cleaner and simpler.” Ortelli expects Kering’s share price to rise as a result of the move and that the company will divest itself of its remaining Puma stake once the sportswear label’s share price stabilises.

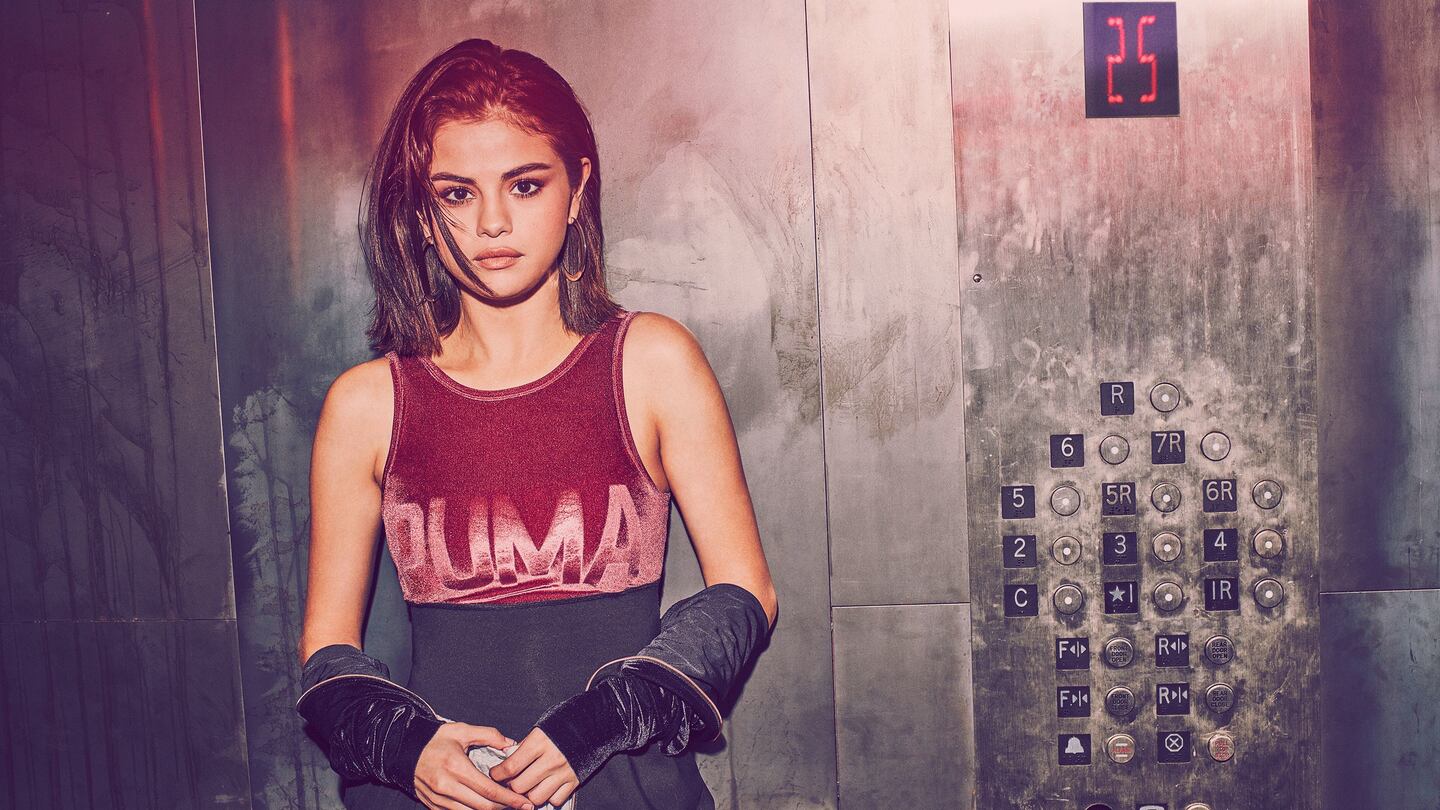

The spinoff follows several quarters of improved performance at Puma, which Pinault acquired in 2007 but did not actively support with new investment until a much-needed reboot five years later, a gap which many say allowed the brand to fall behind sportswear competitors. Since then, new innovative products and high-profile partnerships with celebrities such as Rihanna, Usain Bolt and Selena Gomez as well as French Ligue 1 football club Olympique de Marseille have helped fuelled a comeback.

In the first nine months of 2017, sales at Puma increased 16 percent to about $3.7 billion. In mid-April, Puma’s market capitalisation finally surpassed the valuation at which Pinault originally acquired the company.

“We are proud to have supported the turnaround of Puma, which now has unrivalled capabilities to take full advantage of the specific dynamics of its global markets and is poised to achieve substantial growth, led by its talented and passionate management team,” said Pinault.

"We celebrate this as a landmark achievement for Kering, and a sign that the luxury goods industry is progressing in its consolidation and rationalisation," wrote Luca Solca, head of luxury goods at BNP Exane Paribas, in a note to investors. “The Puma divestiture materialising sooner — rather than later — will add oomph to the stock."

Puma is not Kering's only remaining non-luxury asset, however. Kering's chief financial officer Jean-Marc Duplaix said Thursday that, after the Puma spinoff, the company would "look at options" for Volcom, the underperforming Californian surf, skateboard and snowboard brand bought by Pinault in 2011 for more than $600 million. An offloading of both Puma and Volcom would mark the end of Pinault's investments in sports, which began after he took over the company, then named Pinault-Printemps-Redoute, from his father in 2005.

Related Articles:

[ Kering Puma Deal Likely in 2018, Say BankersOpens in new window ]

[ Why Puma is Key for Kering to Move ForwardOpens in new window ]