The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

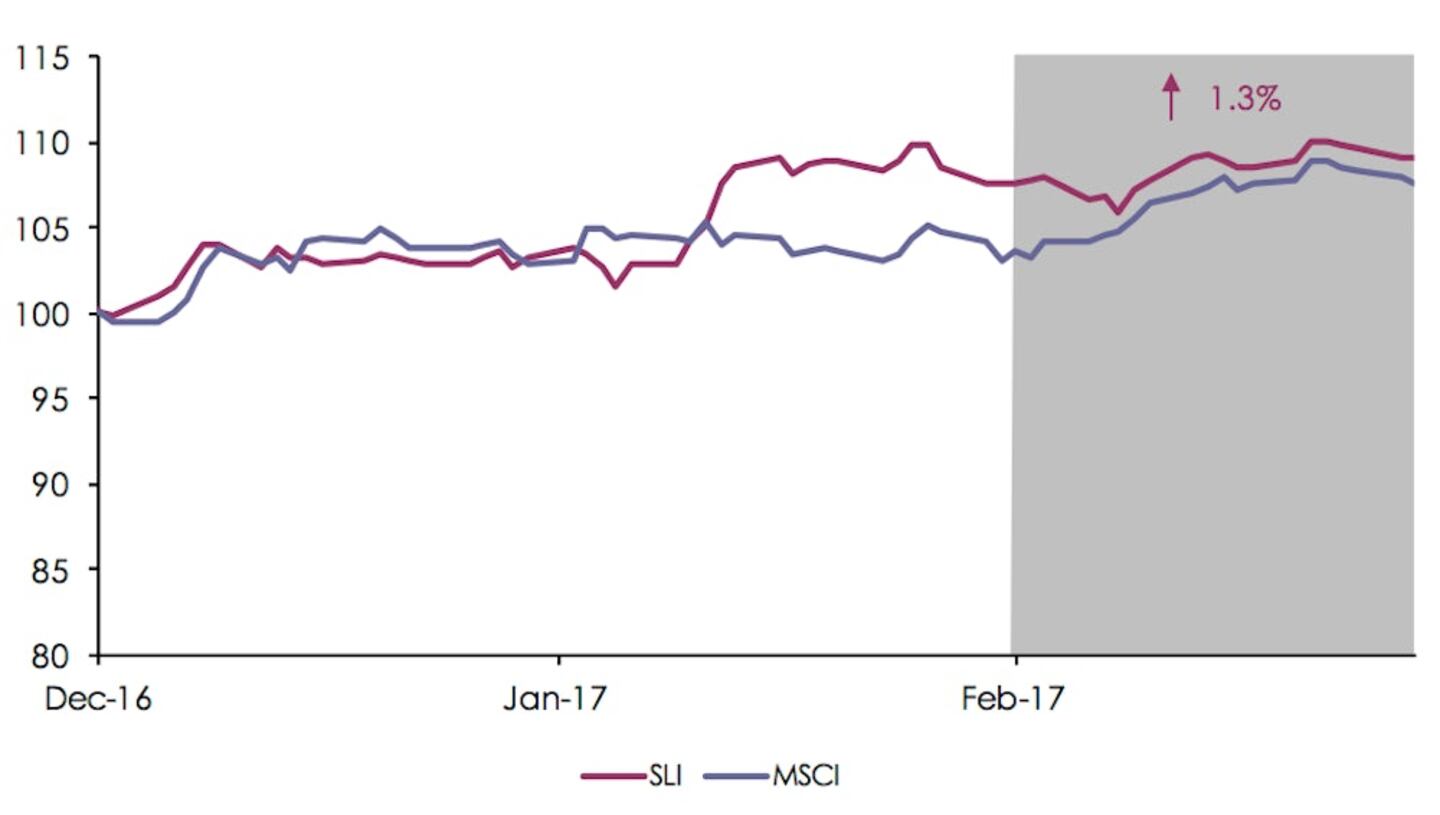

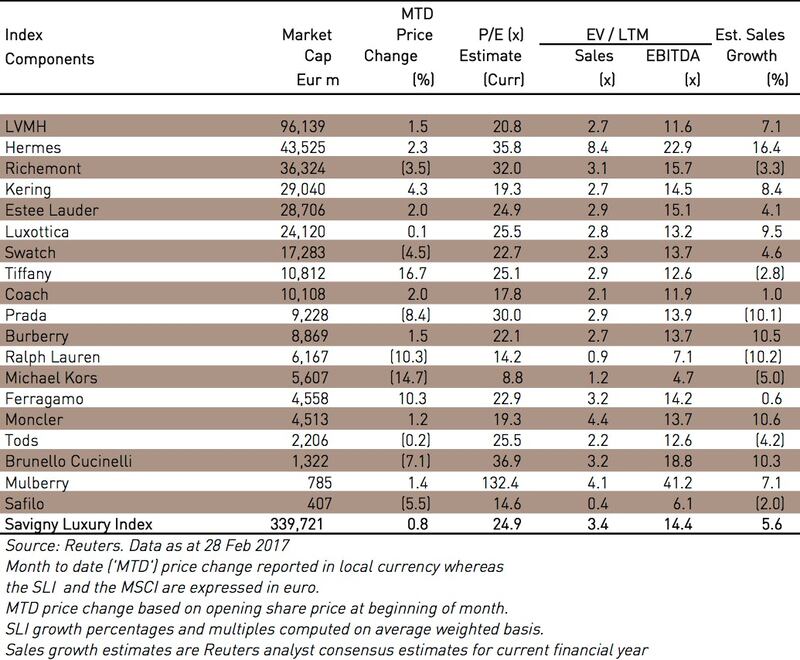

LONDON, United Kingdom — The Savigny Luxury index ("SLI") rose just over 1 percent in February, whilst the MSCI World Index ("MSCI") galloped ahead at 4 percent. Results announcements for 2016 were by and large better than expected (with the exception of our US constituents) and highlighted a resumption of growth from the second half of last year. Nevertheless, the improved outlook for the sector had already been largely priced in January's mini rally of the SLI.

Big news

Further confirmation that the sector has turned the corner came in Hermès, Chanel, Christian Dior Couture, Kering and Prada's results. All five companies highlighted a resumption of growth in the last quarter for 2016 and voiced optimism for 2017. Only Prada posted an overall decrease in sales for 2016 whilst the four others all posted positive growth for the full year, with Kering's results being supercharged by Gucci's recovery and Saint Laurent's continued progress. Tourist spending was also up 17 percent in January, driven principally by Chinese, US and Russian travellers; most importantly France saw a 20 percent growth in tourist spending as the effects of recent terrorist acts started to dissipate.

The US luxury sector has had a turbulent month. Michael Kors reported a bigger-than-expected drop in comparable sales for its third quarter, citing disappointing sales in the USA and Europe; Ralph Lauren reported a sales decrease for the seventh consecutive quarter and its CEO resigned; and Tiffany saw a management shake-up with the departure of its CEO as well as the appointment of three new board directors. Both CEOs had been recruited to help reverse the fortunes of their respective groups but left before the tide could turn.

ADVERTISEMENT

Kate Spade hit the corporate activity headlines this month, being pushed into play by activist shareholders. Reportedly Michael Kors and Coach are in the second round of bidding for the company. LVMH announced the launch LVMH Luxury Ventures, an early-stage growth fund targeting investment sizes of €2 to 10 million.

Going up

Going down

What to watch

Activist funds are taking an interest in the luxury goods sector and it looks like the market is welcoming their intrusions. Such funds have been behind management changes at Tiffany and the potential sale of Kate Spade, resulting in share price increases for both companies. In Europe, Albert Frère's fund GBL disclosed stakes in Burberry and Boss, resulting in 5 and 6 percent share price increases for the respective companies.

Sector valuation

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.