The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

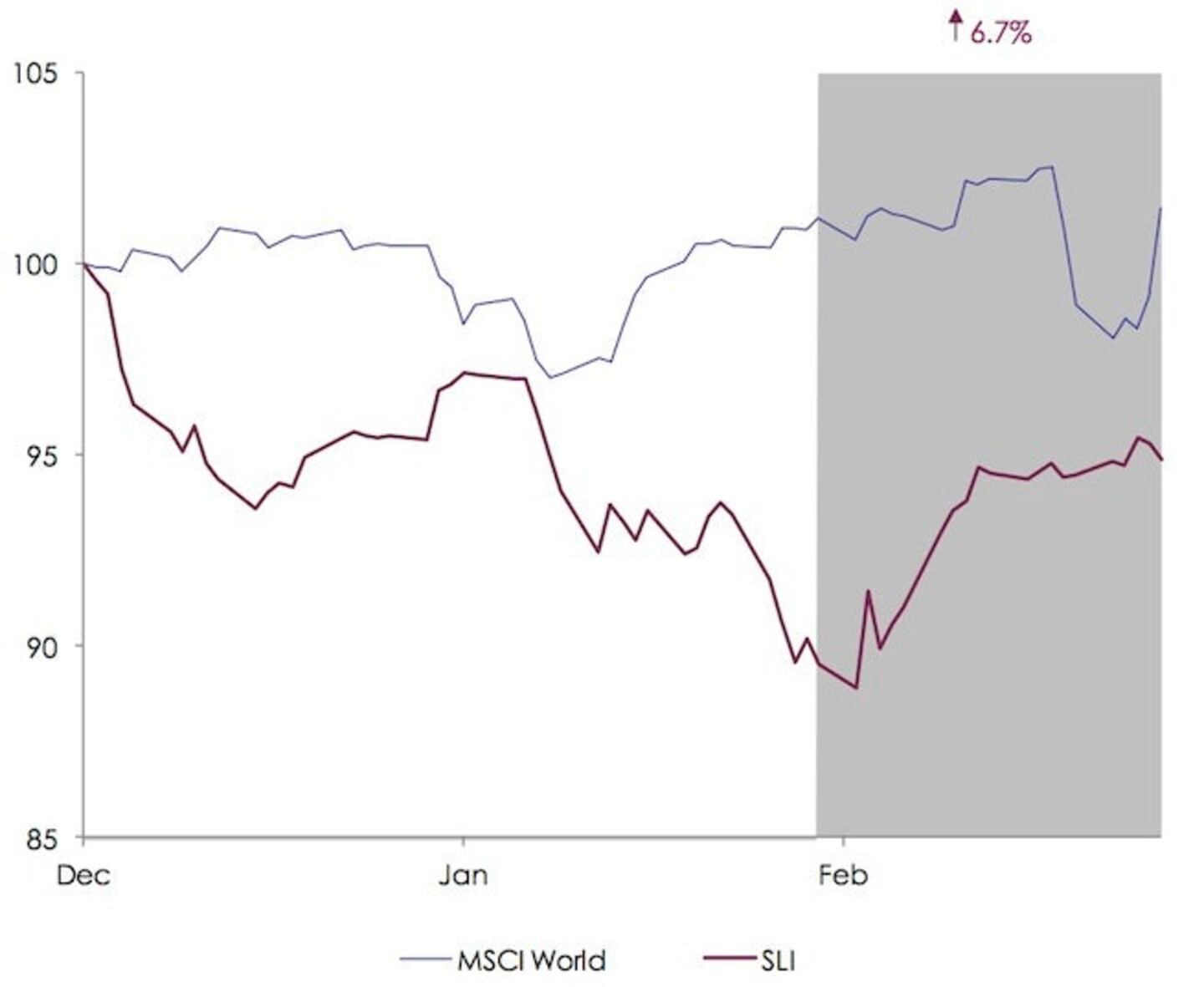

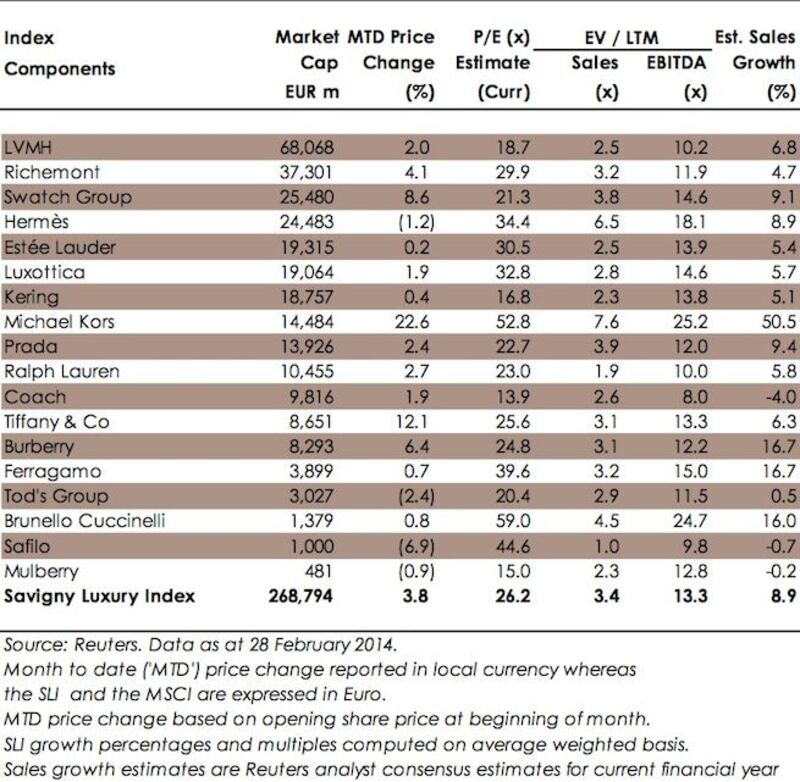

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") leapt by 6.7 percent this month, overperforming the MSCI World Index ("MSCI") by almost six percentage points. Luxury sector investors seem to have received the reassuring they needed through a number of positive signals.

Big news

• Industry leader LVMH adopted a positive stance in its recent results announcement. The acceleration in revenue trends at Louis Vuitton and a more favourable view on the cognac market in China have helped rebuild confidence.

• An easing of restrictions on inbound Chinese travel has led to more Chinese consumers travelling and buying luxury goods overseas, mitigating the slowdown in local demand.

ADVERTISEMENT

• More positive news from Hermès, which posted a 13 percent growth in sales, significantly higher than the sector average of 6-8 percent. The understated style of its products and more exclusive positioning has helped it weather the crackdown on corruption in China.

• Swiss watch exports rose in December and January, hinting at a pickup in demand in China. Swatch Group CEO Nick Hayek expects double-digit growth this year on the back of an improvement in Chinese demand. He says that consumption from "normal" people has now overtaken that of government officials. With its Longines and Tissot brands, Swatch has good exposure to the mid and entry price segment.

• M&A activity in the sector is picking up. Blackstone acquired a 20 % stake in Versace; LVMH took a 45% stake in young Italian designer Marco de Vincenzo; Mayhoola, an investment-vehicle held by the Qatari royal family, acquired Italian menswear and suit manufacturer Forall; TPG bought US colours cosmetics brand e.l.f. cosmetics; Sandbridge Capital, a US-based investor consortium, invested a minority stake in Derek Lam; German retailer Douglas acquired French perfume chain Nocibé.

Going up

• Michael Kors' share price jumped nearly 23 percent from an already lofty valuation on the back on much better than anticipated quarterly earnings as third-quarter revenue increased 51 percent in North America and more than doubled in Europe.

• Tiffany also enjoyed a boost of more than 12 percent, the market expecting margin improvement from the decrease in the price of silver.

Going down

• The weak sales and earnings momentum affecting Tod's since last summer continued to delay any share price recovery. Tod's was down another 2.4 percent this month.

ADVERTISEMENT

• Safilo dropped by nearly 7 percent following the announcement of a €21 million tax dispute settlement .

What to watch

Whilst topline growth prospects have reassured investors, luxury groups remain cautious about their bottom line given recent adverse currency effects (appreciation of euro versus dollar and versus yen). Both Hermès and Louis Vuitton have announced double-digit price increases in Japan this month to counter the yen’s weakness. Other brands are bound to follow. Will sales be hurt as a result?

Sector Valuation

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.