The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

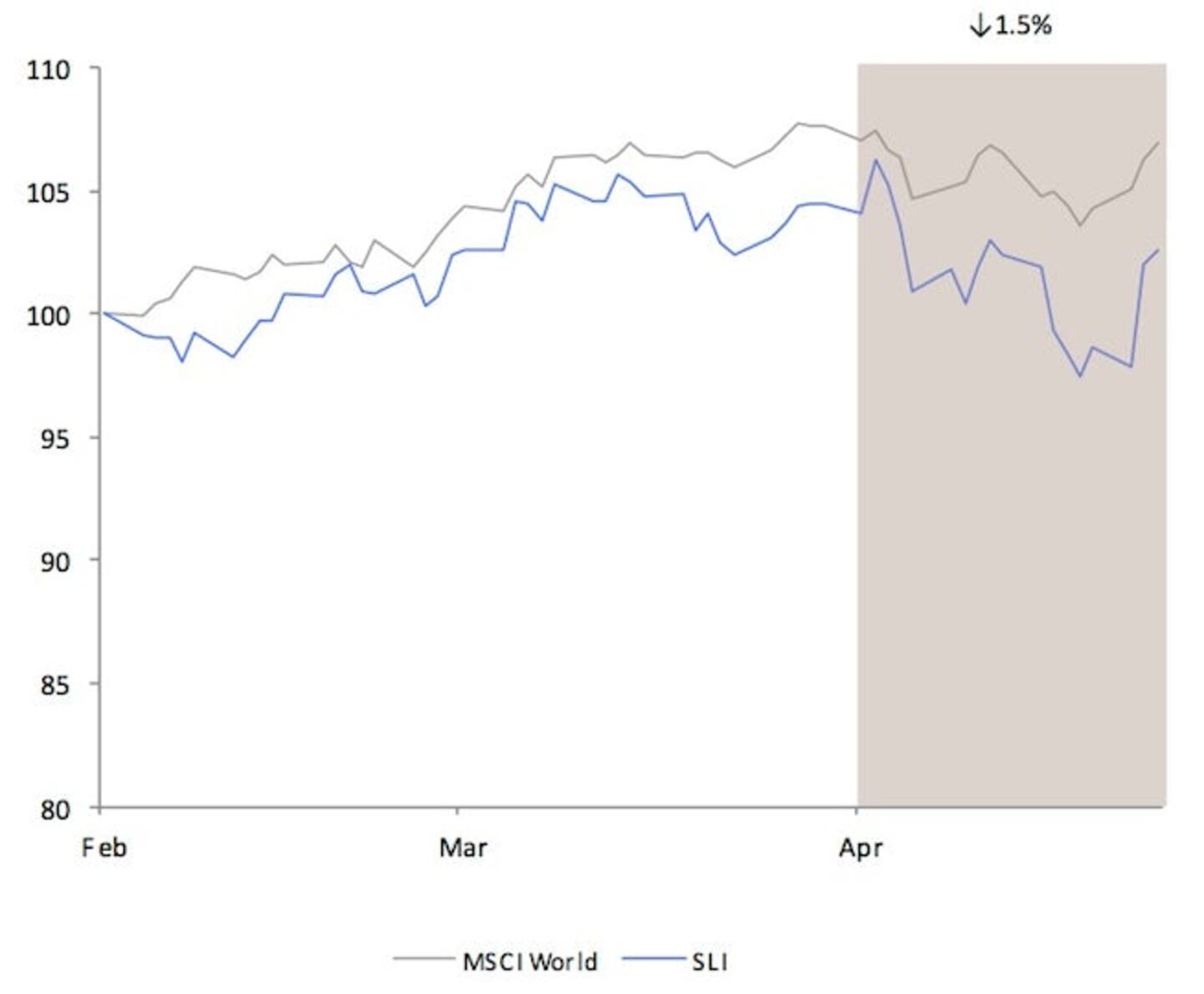

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") lost 1.5 percent in April, underperforming the MSCI World Index ("MSCI") by almost two percentage points. Luxury spending in Europe has been hit by a drop in tourist demand, as well as price increases by brands seeking wider margins. The unusually cold weather, particularly in March, also contributed to weak demand for Spring/Summer ready-to-wear collections.

Big news

• LVMH's first quarter results announcement mid-April caused a sell-off in the sector. Its fashion and leather goods division, dominated by Louis Vuitton, posted one of its lowest quarterly sales growths since 2009. A drop in Asian tourists has hit Louis Vuitton sales in Europe, while China has been sluggish. Mr. Arnault announced plans to slow down the brand's expansion and move its products more upmarket. Kering (formerly PPR), which published disappointing first quarter numbers, echoed its biggest competitor's remarks about depressed consumption in Europe and a China slowdown.

• Swiss watch exports to China fell by more than 25 percent in the first quarter of 2013. Sales to Hong Kong were down 9.1 percent. Luxury watchmakers expect sales growth of high-end watches to slow this year as a recovery of the US and Middle East demand fail to offset a China slump that seems more deep-rooted than a temporary blip caused by the anti-corruption climate. On the other hand, Swatch still sees double-digit sales growth in China this year for its mid- and entry-price brands.

ADVERTISEMENT

• Against the trend, Burberry posted forecast-beating fourth quarter results, boosted by its efforts to position the brand more upmarket as well as regained momentum in China. Hermès also reassured the market by announcing strong first quarter numbers, underpinned by continued high demand in China for its soft goods.

• M&A activity is picking up again: Kering acquired jeweller Pomellato and porcelain maker Richard Ginori, Hermès gained control of Swiss watch case maker Joseph Erard, Hong Kong-based watch group China Haidian acquired Corum, Manzanita Capital acquired niche fragrance brand Byredo, Italy-based private equity firm Clessidra acquired Buccellati.

Going up

• Coach beat market expectations in its third quarter with a 7 percent sales increase, which included continued growth in its core North American segment and an eye-popping 40 percent same-store sales growth in China. The stock is up almost 15 points.

• Safilo, helped by better operating performance throughout, stabilised balance sheet issues and excellent contribution from its Polaroid brand (acquired last year), has also gained momentum with an increase of over 14 percent over the month.

Going down

• Top luxury groups – with the exception of Richemont – all suffered this month following the announcement of their quarterly results, alongside the majority of the SLI components.

• Prada fell by over 8 percent over the month. Although it posted a 45 percent increase in full-year net profit, driven by strong growth in Asia, the result still lagged analysts’ estimates. The group outlined plans to expand in the Middle East and the Americas to offset softer demand in Europe and peaking demand in China.

ADVERTISEMENT

• Mulberry continues its descent after it issued its second profit warning last month. The stock is down almost 10 points.

What to watch

The sector may be hitting a turning point. Demand for luxury goods in China seem to be shifting from high-end to mid-segment goods as a result of the economic slowdown and the government’s crackdown on ostentatious gifting.

Luxury brands are moving their focus from China to other markets and are re-discovering the US, which has proven to be a resilient market in the last two years. It also still holds a lot of untapped growth as it is home to more than a one third of the world’s ultra HNWIs and is benefitting from more tourism from Brazil and Asia as the government shortens the visa application process.

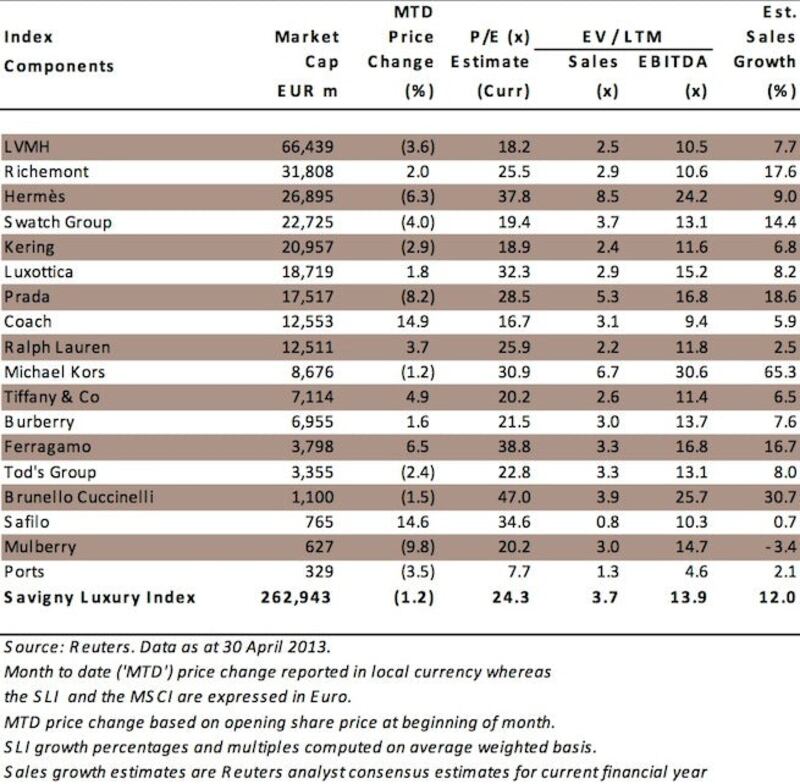

Sector Valuation

Pierre Mallevays is a contributing editor at The Business of Fashion and founder and managing partner of Savigny Partners, a corporate advisory firm focusing on the retail and luxury goods industry.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.