The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") lost ground for a second month in a row, underperforming the MSCI World Index ("MSCI") by almost four percentage points and registering a decline of over five percent. Lack of clarity over the sector's performance in 2013 and prospects for 2014 caused a dip in the first half of January. In the second half, it suffered, along with global equity markets, from the effects of the Fed's measures to restrict quantitative easing.

Big news

• News out of China is worrying, with the wealthy spending 15 percent less than they did in 2013, and the government's crackdown on illegitimate gifting still continuing to hurt specific segments of the sector, such as high end watches and spirits. To add insult to injury, one in three HNWI's are reported to have left China to seek a healthier living environment and better education opportunities for their family.

• Although recent results announcements have been mixed, the balance has fallen on the positive side. LVMH's fourth quarter results beat analysts' expectations: not only did the group enjoy a step-up in demand for its repositioning Louis Vuitton brand, but the group's flagship brand maintained its profitability in 2013 and is now facing production constraints on its high-end handbags. Burberry enjoyed a strong Christmas, as did Tiffany, whilst Swatch announced record-breaking sales for 2013 and a strong outlook for 2014. Brunello Cuccinelli also announced double digit sales growth, driven mainly by menswear growth in Europe and North America.

ADVERTISEMENT

• A few companies have nevertheless disappointed. Richemont's third quarter sales fell short of analysts expectations; the company having suffered from continued weak demand for its expensive timepieces in China. Tod's also missed sales estimates in its last quarter results, feeling the strain from its extensive exposure to its Italian home market (40 percent of sales) and efforts to cut down its wholesale network there. Coach and Mulberry also came out with poor results, the latter even posting a profit warning.

Going up

• LVMH's flat performance over the month masked the positive market reaction to its fourth quarter results and year-end sales announcement, prompting its share price to increase by 7 percent on the day.

• Luxottica and Safilo marginally bucked the downward trend of the SLI, with Luxottica posting strong results for 2013, a confident outlook for 2014 and announcing an acquisition.

Going down

• Italian apparel and leather goods stocks took a battering in January partly as a result of depressed sentiment towards the luxury goods sector but mainly because of specific concerns over this group of stocks' rich valuations. Prada, Ferragamo, Tod's and Cuccinelli registered share price decreases in the high teens to low twenties.

• Mulberry issued a profit warning following a disappointing Christmas, causing the share to end the month 30 percent down.

• Coach disappointed the market with shrinking sales and market share in North America in its first half and a muted outlook for its second half. Its share price fell 15 percent over the month.

ADVERTISEMENT

What to watch

• It's tough at the top. Two of this month's laggards and yesterday's stock market darlings, Coach and Mulberry, are underperforming for different reasons, but both stories show how much vision and strategic execution are key to a brand's lasting success. Coach's management, which nurtured and developed one of the sector's most impressive affordable luxury successes of the last fifteen years in the accessories category, essentially fell asleep at the wheel, allowing the brand to become lame and less interesting, giving away market share to a rejuvenated and refocused Michael Kors. Mulberry, on the other hand, abandoned a very relevant and successful British affordable luxury positioning to pursue a high luxury game with a commensurate increase in price points. So far, the customer has not followed through. Both companies will need to do something about their situation. Watch this space.

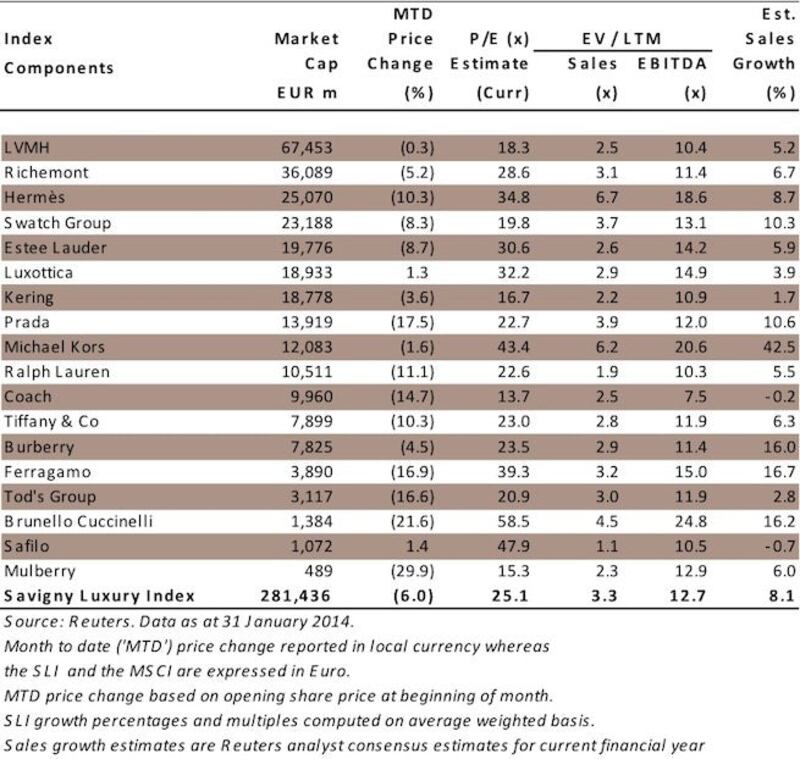

Sector Valuation

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.