The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

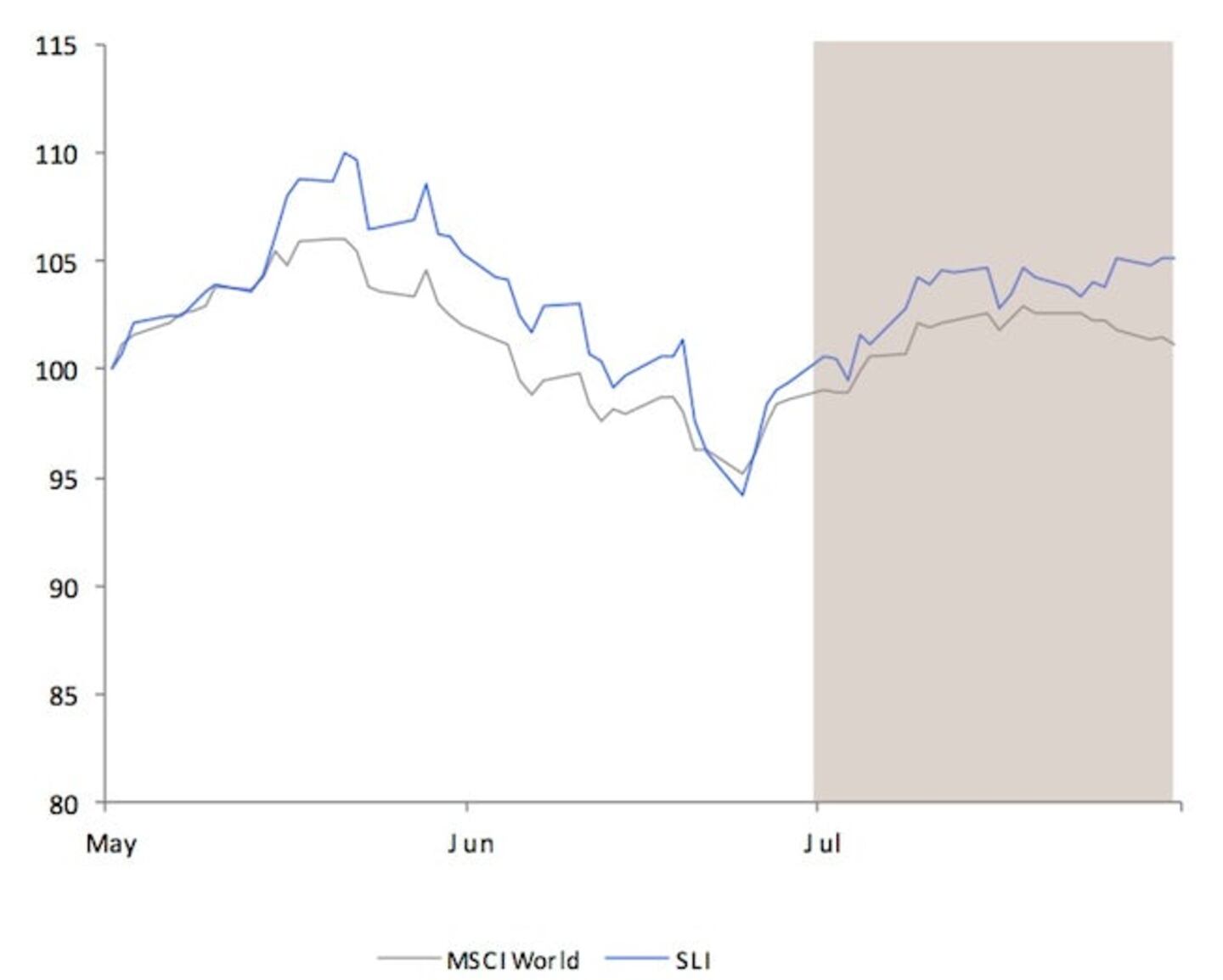

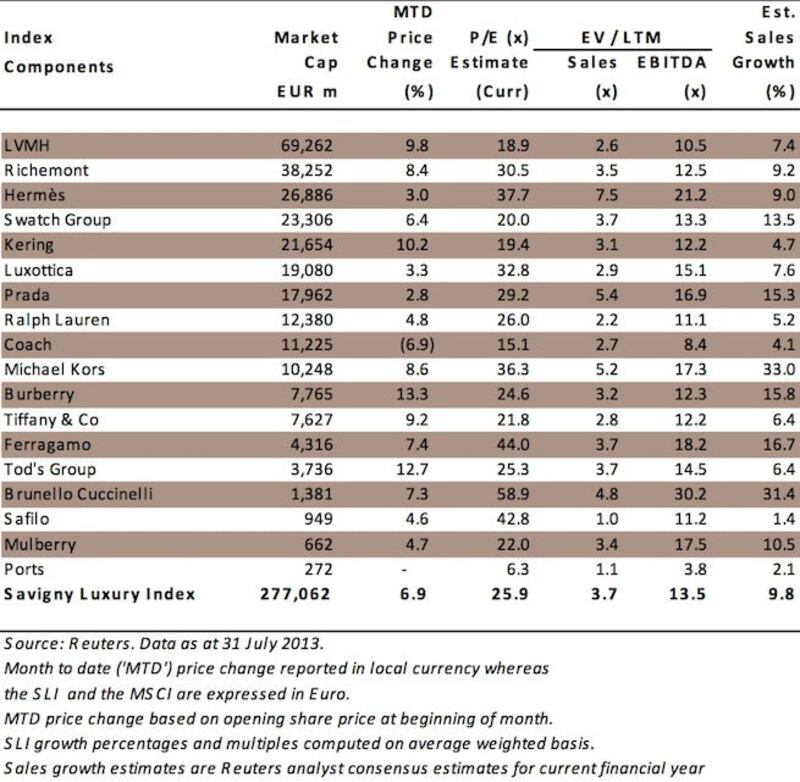

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") gained 4.5 percent in July, overperforming the MSCI World Index ("MSCI") by over two percentage points. Market sentiment has turned back in favour of the sector, driven by solid second quarter results, and all SLI constituents have gone up.

Big news

• Growth in tourism spending in Europe accelerated to 15% in the second quarter from 11% in the first quarter, according to tax-free shopping facilitator Global Blue. The luxury goods industry, being the principal beneficiary of tourism spending, has seen its sales improve as a result.

• Both LVMH and Kering reported a pick-up in luxury sales in the first half of the year, partly due to an improved demand in Europe and solid growth in Japan. The Japanese have been spending their money at home, partly because of the weak yen. Hermès continued to impress the market with double digit growth in second quarter sales and a forecast to exceed its full-year revenue target. Burberry's first quarter results beat expectations.

ADVERTISEMENT

• The Swiss competition authority (Weko) blocked Swatch’s plans to cut supplies of movements and other components to competitors as there are too few sourcing alternatives available. Swatch will renegotiate to partly cut deliveries in 2014. This is good news for competitors and smaller watchmakers who have been struggling for supplies.

• M&A activity remains strong with LVMH’s €2 billion takeover of Loro Piana. The acquisition boosts the group’s presence in menswear and luxury clothing, and provides it with a supply chain platform and strategic know-how in cashmere and other high-end fabrics.

Going up

• All SLI constituents have their share price increase over the month, the biggest winner being Burberry which gained over 13 percent. The company posted double-digit sales growth in its first quarter results, driven by robust demand for its spring/summer ready-to-wear collections and a recovery in demand in China.

Going down

• Coach is the only stock in the SLI which hasn't enjoyed any of the sector uplift. Its shares have fallen by almost 7 percent in July. Its fourth quarter results were below estimates as a result of weaker sales in North America. The brand is suffering from consumer fatigue and too many management changes.

What to watch

Recent moves by LVMH and Kering seem to confirm that they are taking increasingly different long-term strategic options. On the one hand, Kering is pursuing a contemporary/lifestyle route (acquisition of Christopher Kane and Pomellato), effectively bridging the gap between its luxury portfolio and its sports brands. On the other, LVMH is consolidating its domination of the luxury sector by snapping up sizeable assets as they come available, as evidenced by the Loro Piana takeover this month, but also the Bulgari acquisition last year.

Pierre Mallevays is a contributing editor at The Business of Fashion and founder and managing partner of Savigny Partners, a corporate advisory firm focusing on the retail and luxury goods industry.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.