The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

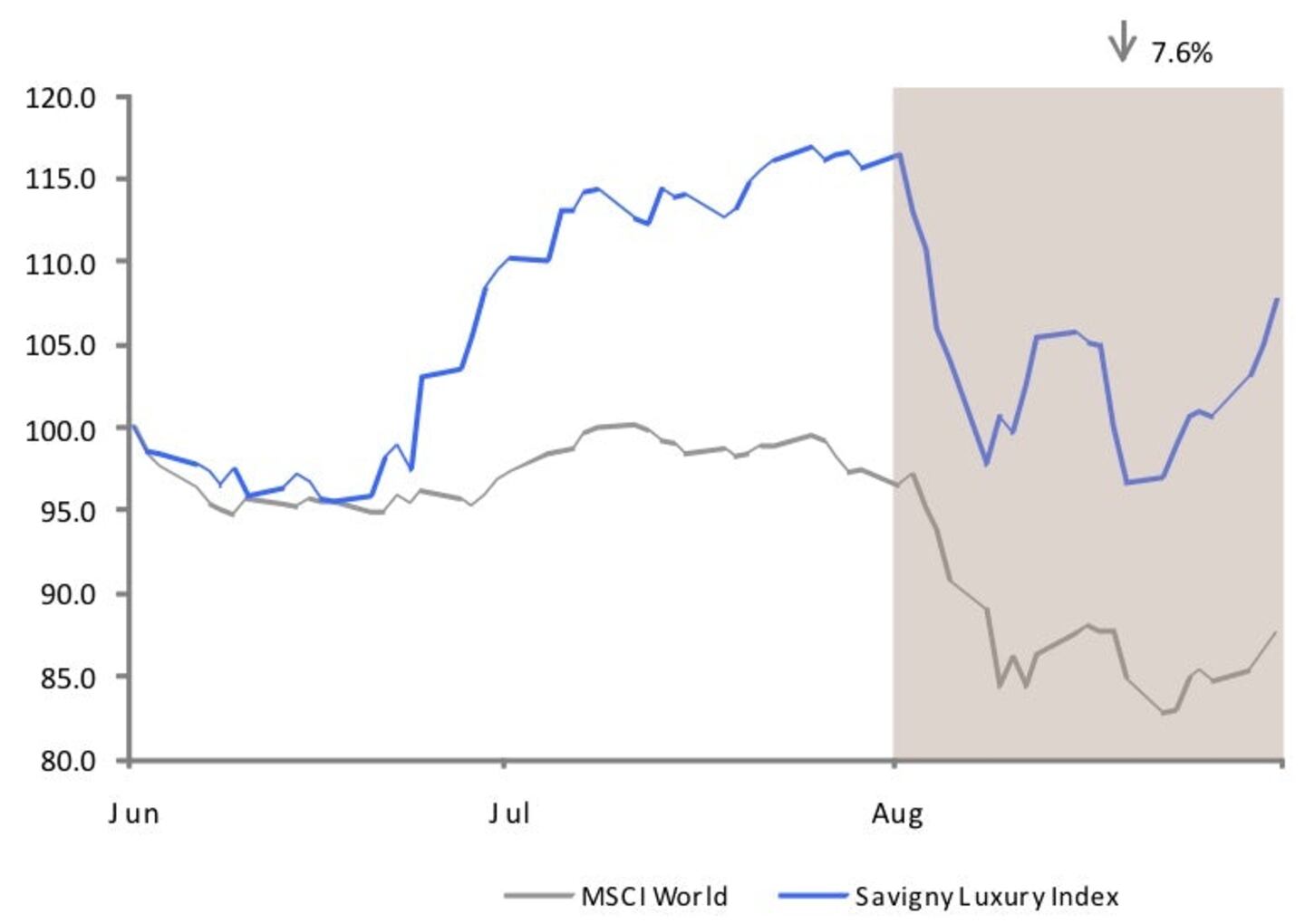

LONDON, United Kingdom — Hurricane Irene wasn't the only storm wreaking havoc during the month of August. The financial markets were also stormy. Ongoing economic uncertainty on both sides of the Atlantic had investors in a panic, and luxury stocks were were hit hard, though they bounced back towards the end of the month.

Big news

• August, which is a typically quiet month, has seen some high trading volumes driving substantial market movements. Global markets fell sharply in the first week of August due to the US losing its AAA credit rating for the first time in history and growing eurozone debt concerns. The SLI was hit more harshly than the overall markets and lost 10.2 percent in that first week compared to 7.7 percent for the MSCI.

• At the end of the second week, financial markets once again endured severe price falls as investors moved to perceived safe havens of gold, the Japanese Yen and government bonds. The catalyst for the sell-off was poor economic news from Germany, the eurozone's power house, compounded by weak US manufacturing and employment data, which raised fears of a global slowdown. Again, the SLI suffered stronger volatility than the MSCI and lost 8 percent between the 12th and 22nd, compared to 5.2 percent for the MSCI.

ADVERTISEMENT

• Equity markets have rebounded in the last week on better-than-expected US consumer spending data, a critical driver of US economic growth. The SLI accelerated faster than the MSCI, more than making up for lost ground during the downfall and finishing down by 7.6 percent over the month (compared to a decrease of 9.3 percent for the MSCI).

Going up

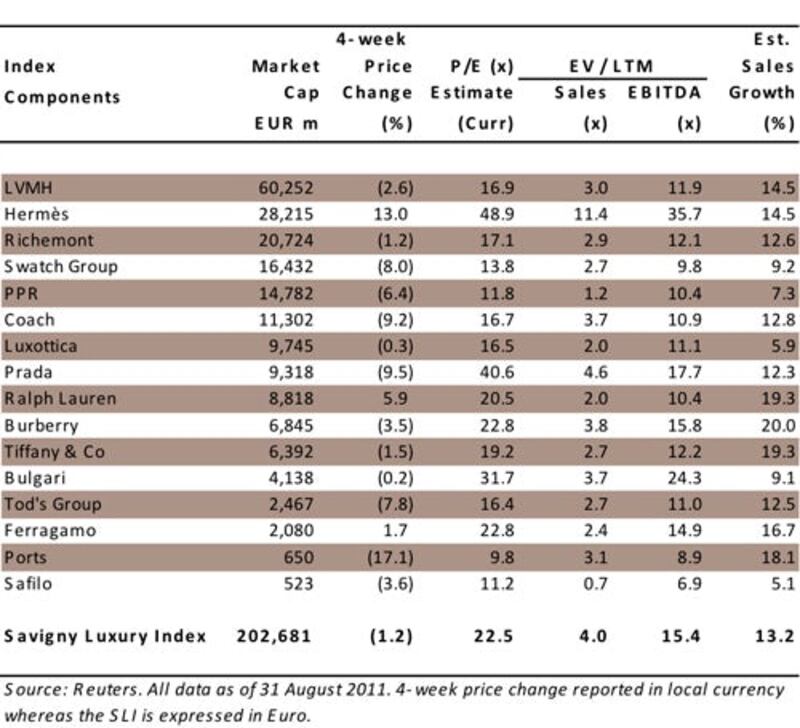

• Continuing what seems to be a never-ending rise, Hermès' share price gained almost 9 percent in the last month, jumping to second place in our market capitalisation ranking. The share has reached a new high of €266 on August 31st, fuelled by the company's outstanding H1 results (an increase of almost 50 percent in net profits) and the company's share buybacks

• Ralph Lauren gained 5.9 percent on the back of better-than-expected Q1 results underpinned by strong wholesale and retail sales growth as well as favourable currency effects.

Going down

• Tod’s share price lost 7.8 percent over the month. Despite reporting excellent H1 results, the group is still very exposed to Europe and in particular to Italy which represents over half of sales.

• Ports’ share price has slid down a further 17.1 percent this month due to lacklustre H1 results. The increase in distribution costs and the substantial increase in its effective income tax rate have deteriorated the company’s profitability.

What to watch

ADVERTISEMENT

• Despite greater volatility, the luxury sector seems to consistently outperform the general market index by capturing a greater share of the upside. Is this a sustainable long-term trend?

Sector Valuation

Pierre Mallevays is a contributing editor at The Business of Fashion and founder and managing partner of Savigny Partners, a corporate advisory firm focusing on the retail and luxury goods industry

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.