The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

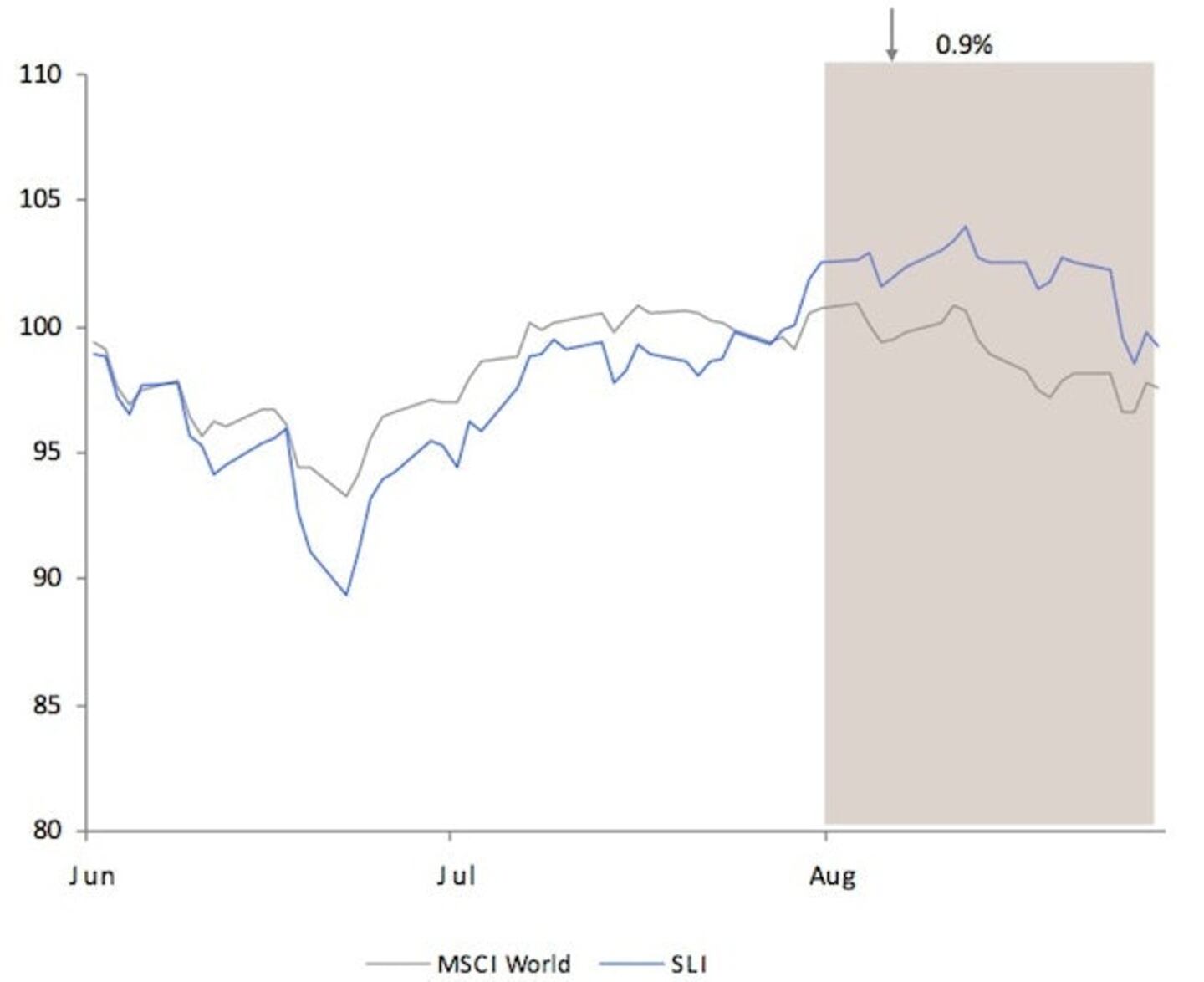

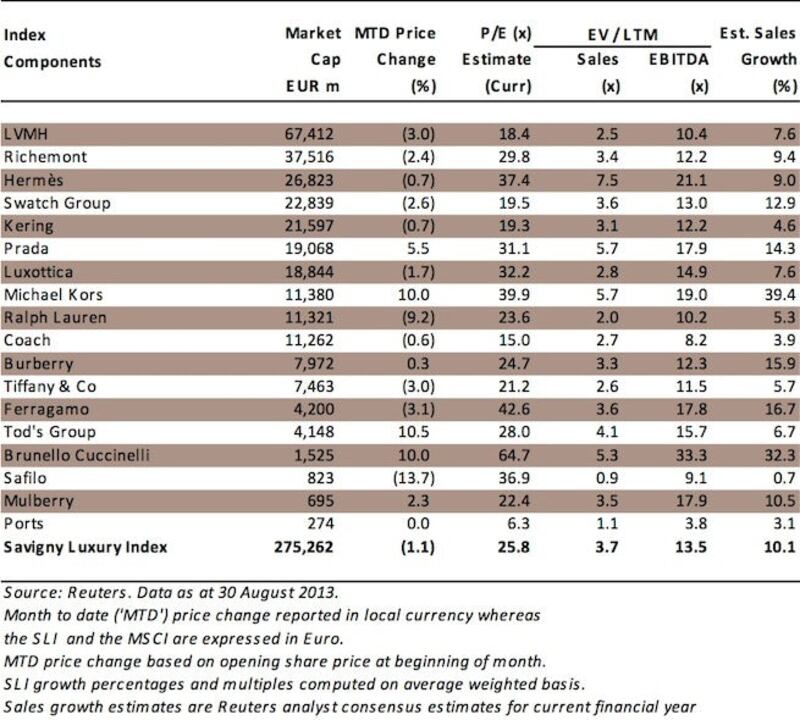

LONDON, United Kingdom — Despite a string of positive results announcements, the Savigny Luxury Index ("SLI") lost 0.9 percent in August, nevertheless outperforming the MSCI World Index ("MSCI") by close to one percentage point, as markets shuddered at the prospect of foreign intervention in the Syrian conflict.

Big news

• Hermès, Ferragamo, Brunello Cuccinelli, Tiffany, Tod's and Michael Kors all announced strong quarters/semesters. Hermès is looking to almost repeat its record operating margin of 32 percent achieved in 2012 for this full year, with a 14 percent growth in operating profit in the first half. Ferragamo's 25 percent uplift in first half EBITDA was driven by strong growth in Asia and affluent tourists in Europe, whilst it registered an impressive 81 percent jump in net profits resulting from the full integration of its distribution operations in Greater China, Korea and South East Asia. Cuccinelli and Tod's also benefitted from growth in Asia and tourism in Europe, in addition to resumed growth in the US. Tiffany's sales were boosted by increased demand for diamond jewellery in China, resulting in an improved outlook for the year. Kors continued to outperform in all areas, notably wholesale shop-in-shops and in Europe, resulting in a doubling of quarterly profit.

• All this positive newsflow was countered by the massive concern shown by markets over the potential for the Syrian conflict to escalate into a stand-off between the world’s powers, pitting the US, France and the Arab League against Russia, China and Iran.

ADVERTISEMENT

• Two deals were closed this month: emerging resort/swimwear brand Orlebar Brown received investment from Piper Private Equity and LVMH boosted its luxury hotel holdings with the acquisition of Hotel Saint-Barth Isle de France.

Going up

• Tod’s posted an 11 percent share price increase, with its shares hitting an all-time high after better than expected first half results.

• Cuccinelli’s share price increased by 10 percent, driven by a 20 percent jump in its first half EBITDA.

• Michael Kors continued to outperform with a healthy share price increase of 10 percent. Its shares have tripled in value since its IPO in December 2011 as the company continues to grow in new territories and new formats and has successfully launched dedicated watch and jewellery shops.

Going down

• Safilo suffered a decrease of 14 percent in its share price, owing to its second quarter profits being halved by one-off charges related to the replacement of its chief executive.

• Ralph Lauren also posted a share price drop of 9 percent as the pace and success of its retail expansion were put into question and the US continued to be a difficult market for the company.

ADVERTISEMENT

What to watch

• The possibility for the Syrian conflict to escalate into a worldwide crisis has alarm bells ringing at most luxury groups. Always a significant consumer group for luxury goods, tourists, notably Asian/Chinese tourists, are now critically important to the luxury goods industry. The jury is out as to how this crisis will affect tourism flows from this key region.

Sector Valuation

Pierre Mallevays is a contributing editor at The Business of Fashion and founder and managing partner of Savigny Partners, a corporate advisory firm focusing on the retail and luxury goods industry.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.