The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This month, as a growing number of businesses sought to distance themselves from Ye, the company that had the most to lose was the slowest to act.

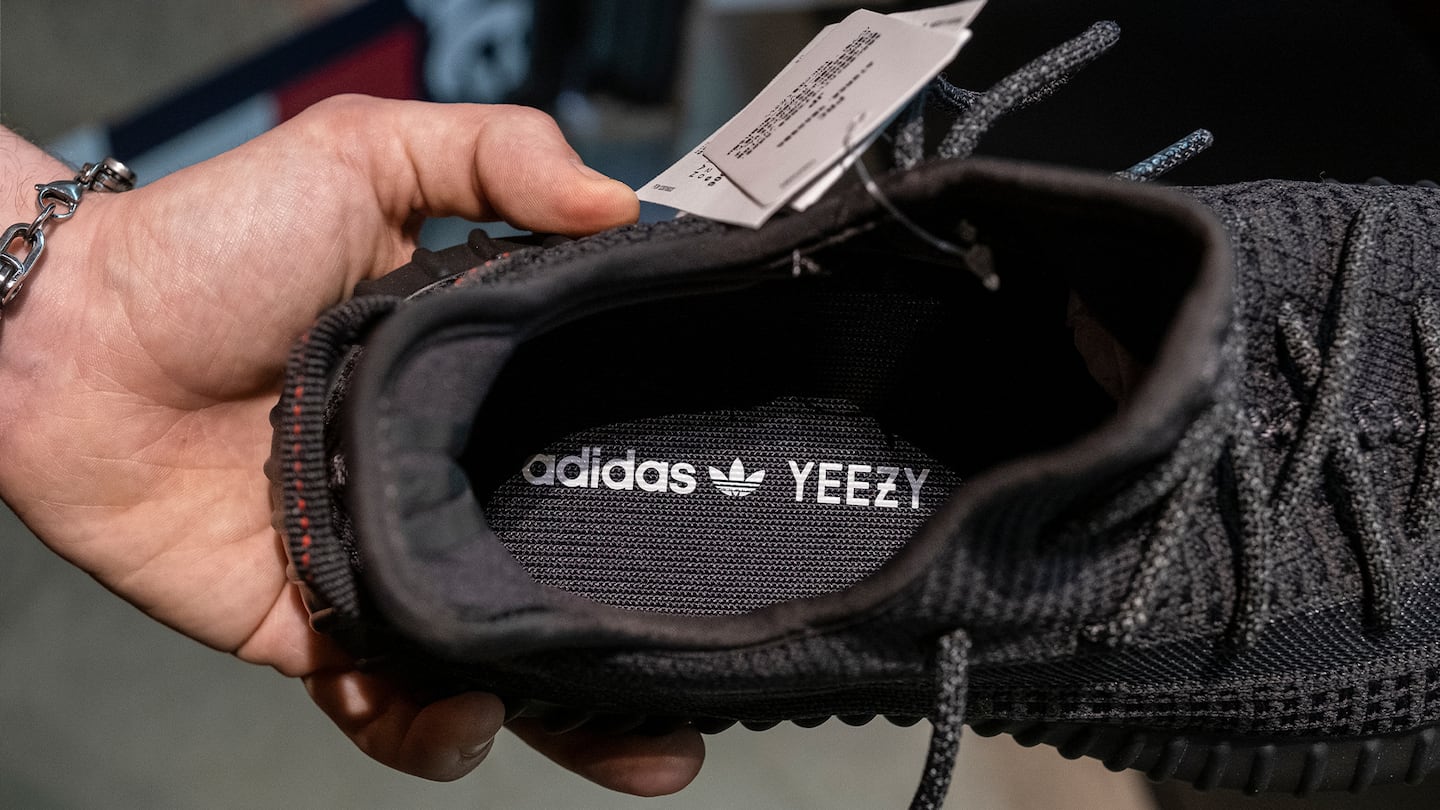

Adidas’ decision to end its partnership with the artist formerly known as Kanye West and his Yeezy brand will bear a heavy financial cost for the company. The brand’s line of Yeezy sneakers accounted for nearly 7 percent of its annual revenue in 2021, according to Bloomberg. Adidas expects the termination of the deal will slash up to €250 million ($246 million) from its net income this year, while an analysis by RBC Capital put lost revenue for the remainder of the year at €500 million. In 2023, lost revenues are expected to total €1.7 billion to €1.8 billion, added RBC Capital, with net income expected to suffer by €700 million to €750 million.

While Ye had business ties to Gap and Balenciaga through the short-lived Yeezy Gap partnership, neither of those companies had invested nearly as much money or time in Ye as Adidas. (On the heels of Adidas’ announcement, Gap said yesterday it would pull its remaining Yeezy items from sale in stores and online.)

Adidas hadn’t made any public comments on the matter since its Oct. 6 statement that the Yeezy deal was under review after Ye targeted company executives by name on Instagram, even posting a fake news image saying chief executive Kasper Rorsted had died, and debuted a “White Lives Matter” T-shirt at Paris Fashion Week.

ADVERTISEMENT

But as Ye veered into antisemitism, he practically dared the German sneaker giant, which has a sensitive history with antisemitism (its founder Adi Dassler and his brother Rudolf were both members of Germany’s Nazi party), to cut ties.

“I can say antisemitic things and Adidas can’t drop me. Now what? Now what?” Ye said during the Oct. 16 episode of Drink Champs, a podcast that is popular in the hip-hop community, in a clip that circulated on Twitter earlier this week.

Yesterday, the pressure became too much and Adidas announced it would “terminate the partnership with Ye immediately, end production of Yeezy branded products and stop all payments to Ye and his companies.”

Now, the company must chart a course forward without Ye, though not necessarily without Yeezy designs. In its announcement, Adidas noted that it is “the sole owner of all design rights to existing products as well as previous and new colourways under the partnership,” suggesting that it could continue to release Yeezy styles without Ye’s involvement or Yeezy branding.

Their success with Yeezy customers is far from assured, however. “Speaking to the company, it believes it can limit the loss of revenues through this strategy, and adidas will also save on expenses related to royalty and marketing fees no longer payable in 2023,” wrote RBC Capital analyst Piral Dadhania in a note Wednesday. “We believe this may prove to be too optimistic — as the price point will likely have to be lowered, and the core Yeezy consumer may not be as willing to purchase given lack of tie with Kayne West.”

The company’s financial position makes giving up entirely on such a substantial part of its business difficult to say the least. Recently it lowered its sales forecast for the year and warned of a hit to profit as demand for its sneakers and activewear weakens in key western markets and China. It is currently in the process of searching for a replacement for its outgoing CEO. Its share price has fallen to its lowest since 2016.

The tie-up with Ye was a major sales driver. In recent years, the line has “disproportionately contributed” to Adidas’ growth, UBS analysts said in a recent research note cited by Bloomberg.

Ye owns the majority of the Yeezy brand. (His ex-wife, Kim Kardashian, holds 5 percent, he said on Drink Champs.) The deal between Yeezy and Adidas was set up as a profit-sharing arrangement rather than a traditional licensing agreement, Bloomberg previously reported. It was jointly run with Ye as creative lead and Adidas handling manufacturing and distribution, though the exact terms of the deal remain closely guarded.

ADVERTISEMENT

Online, Ye claimed Adidas offered $1 billion to buy him out of the agreement, adding it would cost the company “billions” to keep him or let him go. (Ye had also previously accused Adidas of reproducing his ideas in non-Yeezy products without his consent).

But one thing’s for sure: Yeezy’s success is not something Adidas has been easily able to replicate.

“There was a lot of discussion about how other business units could look like Yeezy and produce like Yeezy did,” said a former designer at the company who left in 2021 and asked not to be named.

In 2013, when Adidas first partnered with Ye, then still known as Kanye West, the company’s sales growth had slumped and it was looking for a way to reignite its business. Ye had just parted ways with Nike, and Adidas promised him more creative freedom.

In the years that followed, Adidas’ growth took off as it rode a wave of demand for retro styles like its Stan Smiths and Superstars, as well as novel styles it introduced with its cushy new Boost midsole. The Yeezy business started small, releasing in limited quantities as the brand scaled it slowly to keep demand high, but it quickly became a hit with sneaker fans, providing Adidas with a product whose hype could rival Nike’s Jordans. In 2016, Adidas cemented the partnership, which was scheduled to last until 2026.

Adidas’ sales growth peaked in 2016, but the Yeezy business has remained strong.

Whether shoppers will still snap up the products with the same fervour after the severing of ties with Ye remains to be seen. The resale market for Yeezy sneakers has remained strong in recent weeks, despite the controversy around the artist.

An analysis by Altan Insights, a data and research provider focused on alternative assets, found only a slight dip in Yeezy resale values on the marketplace GOAT, in line with a broader downturn in the secondhand sneaker market. On StockX, several Yeezy styles appear to be selling quickly and their prices beginning to tick up, presumably as buyers look to grab up what Yeezy stock remains, either to wear or flip later.

ADVERTISEMENT

For Adidas, whether it can continue to sell Yeezy designs without the Yeezy name may depend on the degree to which shoppers wanted the designs themselves or the association with Ye.

In the end, Adidas may have had little choice but to end the Yeezy partnership, valuable as it was to the brand. But its decision took time, even as pressure mounted.

In the wake of Ye’s comments, Adidas staff began to express their concerns about the partnership, according to an Adidas employee who asked not to be named because of the sensitive nature of the subject.

“I have to say I am hurt and disappointed by the complete silence of this company after the horrendous anti-semitic comments from someone that acts as a brand ambassador, Kanye West,” another employee who identified themselves as Jewish wrote in a post on Adidas’ internal communications platform on Oct. 10, according to a screenshot of the message shared with BoF. “There has been no distancing ourselves as a company, no condemnation, and perhaps most importantly, no reaching out to those like myself.”

After the message was posted, executives jumped in to reassure the employee they were seriously evaluating the relationship, according to the Adidas employee who spoke with BoF.

On Monday, the day before Adidas announced the end of the Yeezy partnership, at least two Adidas employees, Phillip Matos and Sarah Camhi, posted public messages on LinkedIn addressing Adidas’ silence.

“As a member of the Jewish community, I can no longer stay silent on behalf of the brand that employs me,” wrote Camhi, a director at the company according to her LinkedIn profile. “We have dropped adidas [sic] athletes for using steroids and being difficult to work with but are unwilling to denounce hate speech, the perpetuation of dangerous stereotypes and blatant racism by one of our top brand partners.”

Adidas declined to offer any additional comment.

The internal pressure may not have rivalled the outpouring of anger Adidas faced from employees in 2020 in protests against a company culture they said sidelined Black and minority staff, even as it publicly claimed solidarity with the Black Lives Matter movement. But they added weight to the public scrutiny Adidas faced over its inaction on its ties to Ye.

Now the company has another challenge ahead. It needs to reimagine its business without the Yeezy sales it had come to rely on. Investors are undoubtedly waiting to hear its plans too. The company’s stock fell more than 6 percent after news broke that it would cease its Yeezy collaboration.

Editor’s Note: This article was updated on Oct. 26, 2022, with new analysis by RBC Capital.

The sportswear giant caught lightning in a bottle with its Yeezy partnership, but the artist’s accusations against the company have turned the deal sour.

It’s an abrupt end to a tie-up envisioned as a billion-dollar opportunity to revitalise the Gap brand.

Clothes from the collaboration between Gap and rapper Kanye West went on sale in a physical Gap store for the first time today, in a blacked out space where clothes were piled into plastic bags.

Marc Bain is Technology Correspondent at The Business of Fashion. He is based in New York and drives BoF’s coverage of technology and innovation, from start-ups to Big Tech.

Daniel-Yaw Miller is Senior Editorial Associate at The Business of Fashion. He is based in London and covers menswear, streetwear and sport.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.