The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When Julia Lang launched her unisex jewellery brand in November 2020, the New York-based marketing veteran wanted to make a splash.

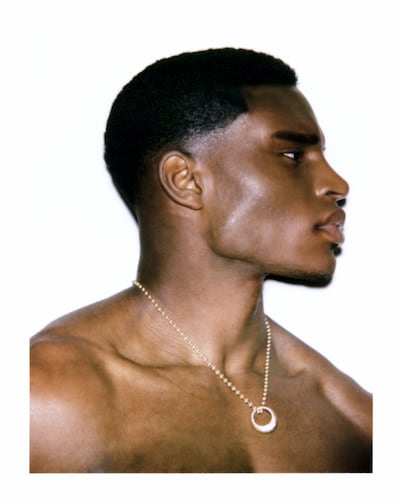

Instead of casting female models to showcase her heart-shaped earrings and pearl necklaces in the launch campaign, she shot the products on men. It proved a recipe for success.

Her label, Veert, quickly gained a following, 90 percent of whom are men, including celebrities like Brad Pitt, The Weeknd, Steph Curry and American singer Miguel (who was in Veert’s debut campaign). Sales tripled last year, and the brand recently added H. Lorenzo to a roster of over 15 stockists that includes Saks Fifth Avenue, Ssense, Kith and Selfridges.

Veert is hardly the only jewellery business tapping into the traditionally underserved male consumer group, who in recent months, have driven a boom in menswear overall.

ADVERTISEMENT

A number of brands and retailers have reported soaring sales recently from men shopping for rings, bracelets and necklaces. Global sales in the category grew 9 percent year-on-year last year, according to Euromonitor, compared to the 4 percent growth achieved by the women’s category, which still dominates the overall jewellery market.

Luxury retailer Browns has seen triple-digit growth in its men’s jewellery sales in the past three seasons, led by brands such as coloured stone specialist Bleue Burnham, LA hit Spinelli Kilcolli and emerging UK jewellery designer Shola Branson, according to buying director Ida Petersson.

Across the US and Europe, men’s jewellery assortments doubled in the first quarter of this year compared to the same period in 2021, with styles like pearl necklaces and beaded bracelets leading the way, up 111 and 200 percent respectively, according to retail intelligence firm Edited.

Capitalising on demand on the men’s side, retailers are now seeking out products that cater to their distinct jewellery preferences. For example, while women’s assortments are dominated by yellow gold pieces, “men’s preferences are silver and white gold,” said Petersson.

Beaded bracelets and signet rings are two other popular pieces across brands. Brooches are another item fast gaining the attention of male consumers, buyers say.

Younger brands seeing ever-increasing interest in fine jewellery from male consumers are opening stores, while others are introducing fashion jewellery lines at accessible price points to tap into the unprecedented demand.

Experts say the success of the men’s jewellery category can be attributed to the factors driving overall interest in menswear, like the casualisation of fashion and blurring gender codes.

“A more fluid approach to masculinity, which has been apparent across ready-to-wear for a number of seasons, is now changing how men look at jewellery too,” said Maxim De Turckheim, senior buyer of fine jewellery and watches at Mr Porter.

ADVERTISEMENT

It certainly doesn’t hurt that early adopters of the trend are celebrities in every realm of culture, from red carpet regulars to high-profile athletes.

Timothée Chalamet and Lil Nas X, for example, have expanded the once rigid boundaries of men’s dressing, jewellery included. Chalamet, for instance, wore a backless Haider Ackerman halter top at the Venice film festival last year. Key to their outfits are their bejewelled statement pieces: Chalamet has frequently worn vintage Cartier rings and brooches, while Lil Nas X Lil Nas celebrated his birthday last year with a $30K diamond-encrusted manicure.

Luxury brands are tapping influential tastemakers as brand ambassadors. In March, Jimin of Korean supergroup BTS joined Tiffany as its global brand ambassador, while Louis Vuitton tapped American rapper Kid Cudi to promote its unisex “Volt” jewellery line. Gucci cast Chinese actor Xiao Zhan in a recent jewellery campaign. (Chinese consumers, in fact are fuelling the menswear boom, accounting for 37 percent of men’s jewellery sales last year, according to Euromonitor).

Many men’s fine jewellery brands find loyal consumers and brand ambassadors in professional athletes — who, for decades have loved to splash out on often ostentatious pieces. NBA star Ja Morant, for example, flashed a smile at reporters at a press conference earlier this month, revealing a $30,000 diamond-encrusted grill designed by celebrity jeweller Johnny Dang.

Since 2012, UK-based jewellery designer Matthew Jones has created custom jewellery and watches for celebrities like Lionel Messi and other coveted athletes. Jones’ extensive fine jewellery collection — which includes £12,500 diamond-encrusted blue gem rings, and £7,500 rose gold pendants — makes up the bulk of his sales.

But for sports fans who might not be able to afford flashy precious stones, Jones introduced a more accessible jewellery offering last year alongside his main line, MJ Jones. The pieces start at £150 for a beaded bracelet, and the fashion jewellery line has already helped boost the brand’s overall sales 30 percent year-over-year in 2021.

“We’re now able to reach a lot more people who’ve been fans of the brand and are aware of us through our sports star client base” Jones said.

New York-based jeweller Greg Yuna is a top-seller in the men’s jewellery category at Mr Porter, in part thanks to celebrity clients like Drake, Floyd Mayweather and J Balvin, as well as his sizable personal following on Instagram. At this month’s Met Gala, NBA star Russell Westbrook wore a pearl necklace statement piece paired with a custom Patek Philippe Nautilus watch designed by Yuna, adorned with diamonds and sapphires.

ADVERTISEMENT

Retailers, meanwhile, have devised buying strategies that account for the styles, stones and aesthetics favoured by men, such as signet rings and silver tones, rather than rely on one traditionally female-forward jewellery counter.

Mr Porter is increasingly stocking labels that make dedicated jewellery for men — such as Greg Yuna, Norwegian label Tom Wood and beaded bracelet specialist Shamballa Jewels — rather than stocking pieces in men’s sizes from unisex brands. Tom Wood is a top seller at Mr Porter thanks to its speciality in “subtle silver pieces,” De Turckheim said.

London-based demi-fine jewellery brand Missoma offers a full range of rings, necklaces and bracelets to male consumers on its online shop.

Shola Branson, a fine jewellery line that makes pieces for both men and women, has also been approached by multi-brand retailers particularly interested in his men’s collection, the designer said. His e-commerce shop customer, however, remains largely female. Branson said he does not plan to increase his men’s assortment because he believes men today feel comfortable with buying pieces on the women’s side.

To reach more consumers, Greg Yuna will be opening his first store this summer, on Manhattan’s Mulberry Street. MJ Jones is eyeing growth through a selection of wholesale partnerships for its fashion jewellery, its founder said.

Many anticipate the trend to maintain relevance in the years to come.

“Men are definitely becoming way more expressive in how they dress and accessorise,” Branson said. “It’s no longer just about having a nice watch.”

From casualisation to the decline of streetwear, BoF unpacks what’s driving the “unprecedented” boom in the men’s market.

In a rare interview, the menswear entrepreneur and creative director of New Balance’s ‘Made in USA’ line outlines his plans for the footwear giant.

High-profile athletes used to make money by inking licensing deals with retailers that use their names on jerseys and shorts. Today, sports stars like Russell Westbrook and Megan Rapinoe are launching their own labels, with full financial and creative control.

Daniel-Yaw Miller is Senior Editorial Associate at The Business of Fashion. He is based in London and covers menswear, streetwear and sport.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.