The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

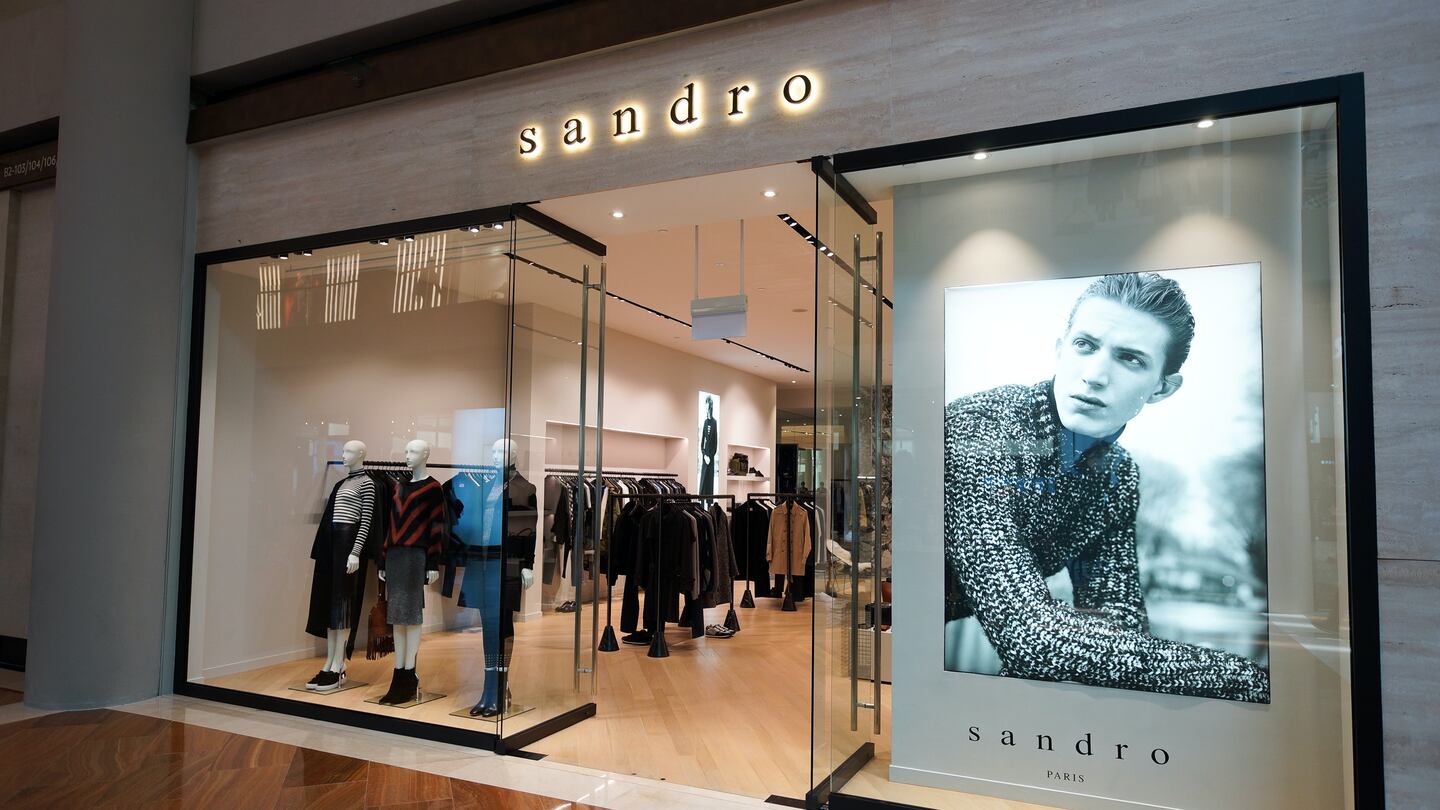

PARIS, France — SMCP, the fashion group behind brands including Sandro, said on Monday it would ramp up spending on advertising and focus store openings mainly on the Chinese market, pausing efforts elsewhere after years of rapid expansion.

The French group, which is owned by China's Shandong Ruyi had multiplied its shop network in recent years, with over 80 new stores every 12 months, though it also cut back on openings in 2020 due to the coronavirus pandemic.

In a strategy update, SMCP said it would reduce the rate of openings to roughly 40 a year between 2021 and 2025, as part of efforts to improve its like-for-like sales growth — a measure that strips out new stores and currency effects.

It said half of those openings would be in China, a major market for high-end fashion groups, which are increasingly having to cater to Chinese customers at home as the Covid-19 crisis hammers travel.

ADVERTISEMENT

With brands including Sandro, Maje and Claudie Pierlot, SMCP operates in what is known as the affordable luxury segment, selling dresses into the €250 to €400 ($295 to $473) price range.

Retailers were hit hard by the pandemic, after governments forced shops to close during lockdowns, and SMCP's sales fell 10.6 percent like-for-like in the third quarter from a year earlier.

It took aid in the form of a €140-million government guaranteed loan earlier this year.

Like rivals, the company said it would invest more in increasing online sales, and CEO Daniel Lalonde said each brand would double its marketing spending from 2021.

SMCP aims to derive half its growth from Asia-Pacific by 2025. The region makes up a quarter of revenue now.

By Sarah White; editor: Matthew Lewis.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.