The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowThis article first appeared in The State of Fashion: Technology, an in-depth report co-published by BoF and McKinsey & Company.

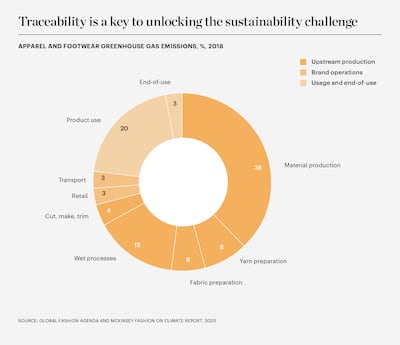

More than ever, fashion brands are being held accountable for their environmental and social impact. In terms of greenhouse gas emissions alone, it is estimated that the industry is accountable for 2.1 billion tonnes (or 4 percent of the global total), a figure that it set to rise if action is not taken.

Brands are largely ill-equipped to monitor and manage social and environmental practices across their supply chains, including greenhouse gas emissions, of which only 6 percent on average is generated from their direct operations. Fashion players are operating with very limited visibility of their supply chain beyond their tier one suppliers with whom they have direct relationships.

Now, new legislation and the increased frequency of supply chain disruptions, alongside consumer and investor pressure, are forcing corporate action.

ADVERTISEMENT

If fashion brands are to achieve sustainability objectives, ranging from better materials sourcing to improved regulatory compliance to emissions reduction, they will need to establish full line of sight into how their products are manufactured.

Currently, the industry’s traceability efforts are hampered by manual processes and unreliable data.

Complete traceability entails brands identifying the history, location and distribution of product parts and materials throughout all stages of the supply chain — including contractors and subcontractors. More than 50 percent of fashion decision makers say traceability will be a top-five enabler to reduce emissions in their supply chain before 2025. This visibility provides stakeholders with information that can inform sustainability-related decisions:

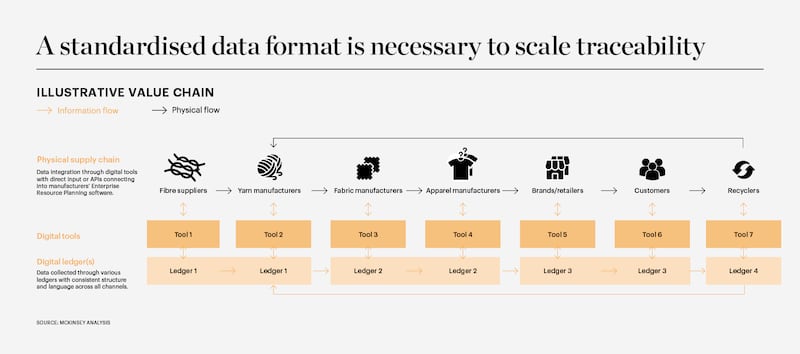

Currently, the industry’s traceability efforts are hampered by manual processes and unreliable data. This is exacerbated by the lack of industry-wide standards, leaving both brands and their suppliers to struggle with tracking and aggregating data.

For traceability to operate successfully at scale, a common data language is essential. This will create the level of standardisation required for comparability and allow manufacturers and suppliers to share data more easily with multiple brands, encouraging a higher level of buy-in across the value chain. To achieve a common language, brands will need to collaborate, both in terms of the types of data collected and the way in which key metrics like water usage and emissions are compiled and assigned on a product level.

The industry is showing promising initial signs of moving closer to this objective of great collaboration. Companies such as Kering, LVMH, Fast Retailing and Inditex have adopted the Taskforce on Climate-Related Financial Disclosures to align on how they assess and disclose climate risks and opportunities. Some initiatives offer certification labels (such as Cradle to Cradle) or self-assessment tools (like the Higg Index, developed by the Sustainable Apparel Coalition, an industry-wide non-profit).

There are concerns, voiced by players such as the Changing Markets Foundation, that the fragmented nature of these schemes makes comparability and a holistic and granular view of impact difficult. As industry-wide labelling standards emerge (along with mechanisms to validate the data), consolidation of traceability and impact tracking standards will likely occur and will be an important enabler for the acceleration of traceability efforts given the network effects of such solutions.

Technology will be critical for the development and adoption of a common data language. Given the complexity and fragmentation of value chains, brands — particularly large ones — will require tracking software for data gathering and marshalling. Brands can look to establish a decentralised ledger (a peer-to-peer shared database with no central administrator) to efficiently collect and distribute data and ensure its reliability — the data within digital ledgers is immutable. These ledgers may be open source or owned by individual brands, or third-parties and start-ups could create data interfaces for specific segments of the value chain.

Such traceability systems — whereby each entity along the value chain inputs data — are far from a reality today. However, pilots are running to test platforms that enable brands to track garments through the supply chain, alongside implementations of off-the-shelf solutions connecting suppliers and brands’ data systems. For example, TextileGenesis, which uses blockchain-based technology to assign a trackable digital token to recycled and organic fibres, has partnered with Fashion for Good, Lenzing and other organisations as well as retailers such as Bestseller, Kering, Zalando and H&M Group to use the technology to validate whether fibres originate from sustainable sources.

ADVERTISEMENT

Meanwhile, TrusTrace offers a centralised database of certifications and other evidence to document the sustainability claims from retailers, manufacturers and suppliers, as well as third parties such as certification agencies. Adidas, which has targets to use only recycled polyester by 2024 and to make 90 percent of its products in a way that is more sustainable by 2025, will use TrusTrace’s software to track all certified materials used in its products in the next two years.

Owing to the complex and fragmented nature of the value chain, technology is the key enabler to achieving traceability.

In addition, companies such as Applied DNA Sciences are experimenting with physical (for example, RFID) and molecular trackers that can be applied to products at various stages of manufacturing and can store product information. Thread manufacturer American & Efird has adopted molecular trackers to authenticate some lines of recycled thread. However, just 10 percent of senior fashion executives have invested in such physical “track and trace” solutions when seeking to address supply chain visibility and traceability.

For traceability initiatives to have a meaningful impact, brands will need to be more open about proprietary knowledge about their supply chains. Collaboration is required to achieve a common good. This is happening in some parts of the industry. The Aura Blockchain Consortium has united LVMH, Prada and Richemont-owned Cartier on a shared platform to solve traceability challenges by developing blockchain-based “product passports” for luxury goods. This would provide verified information relating to a product’s entire lifecycle. In addition, H&M Group has launched an open-source B2B service called Treadler to grant industry peers access to its suppliers list. H&M vets suppliers using Higg data and shares information as a paid-for service to allow other brands to engage with H&M-vetted suppliers without having to conduct their own assessment.

The onus will be on big brands with the capital to invest — and, ultimately, the biggest footprints — to lead the charge. It is likely that over time a handful of data platforms will emerge as principal solutions, so there is a potential return on investment for brands who can help develop them.

Traceability will put the industry on track towards a more transparent, accountable future, ensuring that investors, consumers and regulators can interact with brands based on sustainability information they can trust. What’s more, traceability will be critical in establishing a competitive business model. Owing to the complex and fragmented nature of the value chain, technology is the key enabler to achieving traceability. With this, brands need to embrace a new, collaborative mindset to enable information sharing, while extending tools and providing training and support to their suppliers so that they are also able to embrace a more traceable industry.

Opens in new window

Opens in new windowThe special edition of The State of Fashion report by The Business of Fashion and McKinsey & Company explores the great tech acceleration gripping the industry. Download the full report to understand the key imperatives that are spurring top brands and retailers to ramp up investments in technologies from AI to blockchain, to both address pain points and boost their competitive edge.

Catch up on the third installment of BoF's new five-part online learning series to find out how to measure the environmental and social impact of your business.

As the industry gets ready for unprecedented pace of technological advancements, leading brands and retailers are expected to double their spending by 2030 on everything from AI to hyper-personalisation tools to traceability. BoF and McKinsey’s new special edition of The State of Fashion unpacks what lies ahead.

The nature of livestream transactions makes it hard to identify and weed out counterfeits and fakes despite growth of new technologies aimed at detecting infringement.

The extraordinary expectations placed on the technology have set it up for the inevitable comedown. But that’s when the real work of seeing whether it can be truly transformative begins.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.