The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Launching a business in any sector right now is a daunting prospect. This is especially true if your would-be clients are hard-hit fashion brands that can no longer afford to spend on models for flashy ad campaigns and runway shows.

That didn’t stop Amber Alston and Tyler Stafford from launching Hyphenate Management, a New York-based modelling agency with a roster of six models, on July 13.

Even a business as young as Hyphenate had to deviate from its initial vision. “We decided we wanted to market ourselves as more readily available for remote content production, and when we were starting to build our network, [we thought] ‘let's not just look within New York, but reach out to other clients that we maybe wouldn't have considered if we had launched at a different time’,” said Stafford.

To achieve this, Stafford and Alston bought ad space on Google and Instagram to target potential clients across the US.

ADVERTISEMENT

Three of Hyphenate's six models [left to right:] Ariel Binns, Leo Acevedo and Llewellyn Doris | Source: Courtesy of Hyphenate

Hyphenate’s pivot from its original plans for a mix of high-end, editorial and mass-market clients to focus more on e-commerce and smaller digitally native brands is a sign of the times for model agencies. Earlier this year, quarantine measures across the world put fashion weeks and campaign shoots on hold, bringing the modelling industry to a screeching halt with no clear timeline for recovery.

With some fashion weeks now scheduled to return in September and key fashion markets gradually emerging from lockdown, it would be easy to assume that the modelling industry simply went into hibernation from which it can now begin to emerge relatively unscathed. However, the events of the last few months will have long-term implications and compel the modelling industry to adapt further.

How Bad Will It Get?

The health of the modelling industry is contingent on the financial health of the fashion brands, retailers and publications that deploy their services, all of which have been hit hard by the pandemic and are bracing for a slow recovery.

A recent report by IBISWorld estimates that revenue for the US model agency industry will decrease 7.5 percent to $1.53 billion in 2020 alone, almost double the contraction the industry experienced in 2009, at the height of the last recession. Both corporate profit and total advertising expenditure, which have a strong bearing on companies’ willingness to assign budget for models, are expected to contract 25.1 percent and 18.3 percent respectively.

The rug truly got ripped from underneath us.

It is predicted that the coronavirus crisis will lead to "massive waves of consolidation, M&A activity and insolvencies," as noted in The State of Fashion 2020: Coronavirus Update report by BoF and McKinsey & Company. Model agencies are not likely to be an exception.

"Since it’s such a fragmented industry, there are smaller agencies that are very exposed to the downturn in work brought on by Covid-19," said Douglas Hand, a fashion industry lawyer and founding partner at New York-based law firm Hand Baldachin Associates. "Those firms have a role [and have models] under contract that still can generate revenue, but the pandemic has exposed how thinly they are capitalised. And that may well lead them into the arms of a larger agency."

ADVERTISEMENT

IMG Models, a global agency that represents household names like Gigi and Bella Hadid, Joan Smalls and Gisele Bündchen, has the largest market share in the US, followed by Wilhelmina International, Elite World and Ford Models, according to IBISWorld estimates, but none have an overwhelming lead over the rest of the pack. The vast majority of agencies are, in fact, small enterprises with an average employee headcount of two.

Whatever their size, most agencies have been implementing cost-cutting measures as work dried up for models and that is expected to continue throughout the remainder of 2020. "One of the biggest cost-saving measures is that we're not using our expenses [account]," said Ivan Bart, President of IMG Models.

At some smaller agencies, the financial impact of the pandemic has been more severe. London-based AMCK is one of many agencies around the world that placed some members of staff on furlough or equivalent schemes during lockdown, while MNG, an agency based in Guangzhou, China, considered cutting some of its workforce as significant overheads like model apartments and office rent were almost impossible to renegotiate.

Most industry experts agree that agencies will have to do a lot more belt-tightening in the next six to 12 months.

On the Frontline of a Contracting Market

For every weak balance sheet at model agencies, there are countless models who are feeling the financial strain of the pandemic. Even when models do get work, there is a profound sense of insecurity due to the worry that more fashion and retail clients will become casualties of the Covid-19 crisis.

Etro show on July 15, 2020 in Milan, Italy | Source: Getty

"When you do a job, you have to realise that, even though this company is hiring you right now, in six weeks they could be filing for bankruptcy and you might not see that money again," said Rachel Finninger, a Dallas, Texas-based model who has posed and walked for the likes of Dior, Off-White, Gucci and Calvin Klein since she started out in 2009.

ADVERTISEMENT

Finninger is currently in litigation over an outstanding five-figure payment from a client who recently entered insolvency and says a total of three recent clients have filed for bankruptcy. “I just have to come to terms with the fact that I’ll never see that money,” she said.

Even pre-pandemic, for some, modelling was a line of work defined by financial precarity of late or non-payments where feelings of disempowerment and exploitation were aggravated by other forms of mistreatment at the hands of agents, clients, stylists or photographers. But will the post-pandemic era convert these grievances into a reckoning or simply compel those in power to tinker around the edges?

"All of these issues… have long been of concern to us, but I think are all the more pressing today," said Sara Ziff, founder and executive director of Model Alliance. "This pandemic has opened a can of worms with respect to agencies' responsibility to their young charges and issues around visa status, financial transparency and timely payments."

A survey of 212 working models conducted by Model Alliance and the Worker Institute at Cornell University between March 20 and April 1 this year found that one in five respondents said they did not have enough money to cover basic needs and 51 percent of respondents were concerned they would not be able to make ends meet if they were unable to secure work in the next three months. Over half said they were owed money by clients, 49 percent said they were owed money by agencies, and just over a third said they were owed money by both.

The pandemic has exacerbated the barriers to entry to modelling at a time when the industry is fast losing its aspirational sheen and coming under increased scrutiny. At the same time, agencies are facing their own financial and existential threats.

How Agencies Are Learning to Pivot

Men’s fashion month for Spring/Summer 2021, initially scheduled for June this year, was one of the most obvious casualties of the coronavirus crisis. For AMCK Models, which represents male talent exclusively, that has posed some significant challenges.

“The rug truly got ripped from underneath us,” said AMCK Founder Aicha McKenzie. AMCK, which also represents dancers and choreographers, has been hit hard across the business. To better adapt, she said, separate divisions have been “working more in tune with each other,” with scope for cross-pollination of talent across the divisions, such as its relatively nascent wellness venture called AMCK Fit.

AMCK is not the only agency to diversify during the pandemic. Shanghai-based Paras Talent Management, for example, has a separate projects department for organising events and swiftly adapted to work on Shanghai Fashion Week's digital events. This also appears to have given the model agency greater leverage to push its own talent for clients' consideration at a time when opportunities were few and far between.

IMG Models, no stranger to industry crossovers following its acquisition by talent agency WME in 2014, became something of a content publisher during quarantine, launching over seven new projects across its social media channels. These include a “Model Logs” series on YouTube, Spotify playlists curated by models, Instagram Live “takeovers” and a video series hosted by President Ivan Bart called “Model and a Meal,” where Bart conducts a video interview with one of IMG's models while cooking.

https://www.instagram.com/p/CAvwAEXHbyn/

However, it is unlikely that many modelling agencies will be able to monetise such activities. What's more, few agencies have the financial safeguards that IMG has as a multi-million-dollar firm with a multi-billion-dollar parent company.

Ripe for Reform and Disruption?

Scouting is a costly time- and resource-intensive process that is often contingent on international travel — all factors that make it less than attractive as the industry reels from the restrictions and economic fallout of Covid-19.

The uncertain future of fashion has left some agencies reluctant to invest in new talent over the course of quarantine. The worry now is that the talent funnel will suffer more in the months ahead as agencies are forced to underinvest in the scouting function once the economic fallout worsens.

"Honestly, we're investing in the existing models that we currently have," said Chris Gay, co-chief executive of Elite Model World, the parent company of agencies including Elite Model Management and the Society Management. "These are talents with existing success and narratives… models that will have a longer career."

As a result, he added, “we’re moving away from scouting and development a little bit more.”

Influencers are content creators and right now clients are looking for content creators.

Conversely, IMG Models is going full steam ahead with its scouting plans. "We're actually investing heavily [in talent discovery] because the evolution of IMG models is based heavily on the new generation of talent and faces," said IMG President Ivan Bart. The agency adapted its #WeLoveYourGenes campaign from Instagram to newer platforms such as TikTok and Twitch, and has already signed over 25 new faces from TikTok alone.

However, going forward platforms like Instagram and TikTok could also pose a threat to model agencies if struggling clients are willing to take a gamble and bypass agencies altogether by scouting new faces and unsigned models who represent themselves.

The lasting economic damage of Covid-19, which is forcing businesses to operate on a leaner model and cut as many external costs as possible, lay bare the inefficiencies of a complex industry that involves many gatekeepers in the casting process and, as such, is ripe for disruption.

Since lockdown began, Claudia Wagner said higher-end brands have been increasingly approaching her firm Ubooker, an app that allows clients to directly book talent without the involvement of an agency. Wagner claims that one client estimated that they could have previously been saving anywhere between $400 and $600 a day by using a service like Ubooker, "but [that they didn't use it until now because] it really wasn't a necessity."

The Home-Grown Talent Opportunity

The pandemic and associated international travel restrictions have at least temporarily changed the globe-trotting nature of the modelling industry. But some see this as an opportunity for agencies to reassess their priorities and to better leverage locally based models in the future.

In some markets, this could mark a lasting cultural shift. China's current self-isolation restrictions for international visitors has the potential to nudge previously reluctant brands to book local talent for their ad campaigns. Consumers and brands in China, Japan, South Korea and other places in Asia have a complicated relationship with representation of local models, often pushing for white European faces to front campaigns instead.

You want to make sure that talent can perform, can be not only photogenic but also telegenic, eloquent and have something to say.

“There are definitely more opportunities for domestic models [now],” said Lizzie Chen, overseas department director of Shanghai-based Paras Talent Management, citing current travel restrictions for models going into China. “I think there were some projects that were originally supposed to happen in Europe or the United States that moved to Shanghai.”

“Some clients said, ‘let’s switch to Asian girls’… but some are so attracted to foreign girls, they [haven’t] changed at all,” said Xiao Weijie, head booker of MNG’s International Department.

“But still, at the end of the day, the biggest problem is how much money can they afford to invest in modelling? Clients in China think, ‘If we invest in [models] they have to be supermodels… If they don’t make this kind of noise outside of China then they’re not worth the money.’”

Deeper Relationships for Models with Diverse Skills

Like many sectors of the fashion industry, the coronavirus crisis has accelerated changes that were already underway in the world of modelling, one example being the blurred boundaries between models and influencers.

“Influencers are content creators and right now clients are looking for content creators,” said Finninger, who recommends investing in a good camera and lighting or bringing in the help of creative partners or roommates.

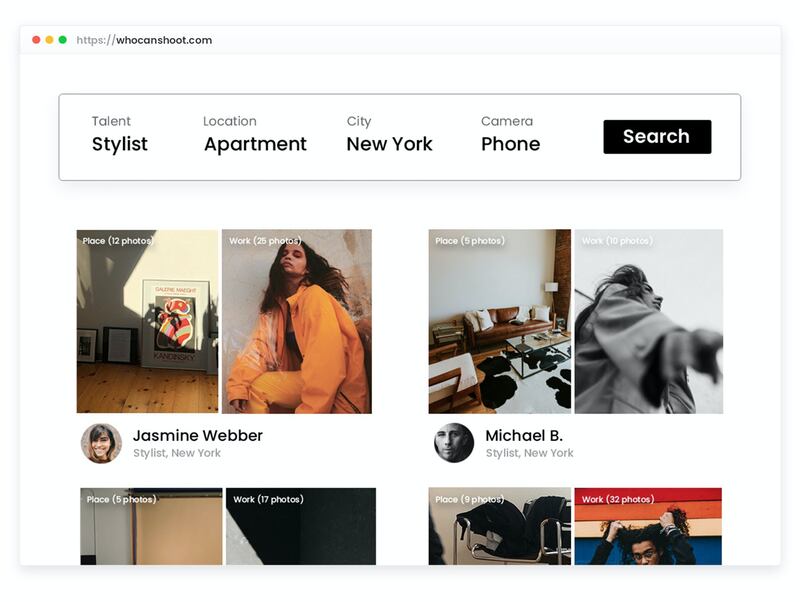

Qvsta, an online service that helps match casting directors and clients with model agencies, has helped facilitate this shift with “Who Can Shoot,” a free-to-use platform that lets models showcase their photography skills, types of camera available and photogenic apartment locations to potential clients.

Qvsta's "Who Can Shoot" search platform | Source: Courtesy

The platform, which has seen some 300 models register to date, remains relevant amid travel restrictions, but Qvsta Founder Ludwig Henne believes that the popularity of the at-home shoot will endure for some time. “I think that, actually, the whole production [process] will [become] more agile and distributed around different locations,” instead of being dominated by studio locations, he said.

The model-as-influencer shift could also lead to more collaborations between brands and models in lieu of one-off bookings. "I think the truth of the matter is that [brands are] going to have deeper partnerships with the talent," said Gay of Elite Model World, citing Adut Akech's work with Valentino and Josephine Skriver's longstanding relationship with Maybelline as some existing examples.

Some agencies are trying to futureproof their models’ careers by encouraging them to upskill and diversify their talents in a way that can be monetised. In this new era, moonlighting should actually be encouraged and time should be spent upgrading hobbies.

For instance, a number of IMG models have turned to content creation in the midst of lockdown, such as a podcast hosted by Nadine Leopold, and a site launched by Georgia Fowler featuring edits of her favourite fashion and lifestyle products. Grace Mahary, a qualified sommelier, has teamed up with chef and model Roze Traore to launch a cooking series called “Impeccable Taste.”

Even as the fashion industry emerges from lockdown, the changing nature of photoshoots will have a bearing on the kind of models — and skillsets — that brands will be looking for.

“There’s so much more of a process involved that you want to make sure that talent can perform, can be not only photogenic but also telegenic, eloquent and have something to say,” said Gay of Elite Model World.

Chen of Paras tells a similar story, highlighting the growing importance of mediums like short video and livestreaming commerce. "[Clients in China now] request models to be good at talking and introducing the brands and products through words, not just through posing," she said.

The modelling industry has been no exception to the conversational buzz about Covid-19 accelerating changes in fashion that were already happening but long overdue. However, with the immediate return of physical, high-production-value fashion shows, signs point to a system that has little interest in fundamentally changing.

“I think it’s energised our focus,” said IMG’s Bart of this period of forced introspection and creative, social media-led projects, “even though I do believe that we’ll get back to more traditional runway shows and fashion shoots.”

Related Articles:

[ End of the Model Agency as We Know It?Opens in new window ]

[ What Must Fashion Do to Safeguard Models?Opens in new window ]

To provide actionable insights and inspiration on how fashion and retail industries can further embed diversity, equity and inclusion in the workplace and business strategies today, BoF Careers co-hosted a panel discussion with The Outsiders Perspective. Now, BoF shares key learnings from the panel.

Discover the most exciting career opportunities now available on BoF Careers — including jobs from Tapestry, Alexander McQueen and Toteme.

A US regulator has banned most uses of the clauses, which started as a way for fashion companies to prevent senior executives from walking off with trade secrets, but have become a standard retention tool.

Check out this week’s new partners and openings on BoF Careers, the global marketplace for fashion talent.