The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowIn 2023, fashion leaders have an opportunity to review their talent rosters and team structures. Despite the many challenges on the horizon, as inflation dampens consumer sentiments and costs spike for many companies, fashion leaders cannot put off the difficult work of reinventing their organisations.

As fashion companies chase growth in the unpredictable year ahead, talent and organisational structures will become a key differentiator in performance. This follows on the heels of the industry encountering unprecedented challenges — ranging from pandemic-enforced remote working patterns to supply chain turmoil — and forcing entrenched processes to evolve. Challenges will likely persist in 2023 — 84 percent of fashion executives in the BoF-McKinsey State of Fashion 2023 Survey expect the industry to worsen next year. This will have repercussions for their businesses; 97 percent expect their costs of goods sold as well as selling, general and administrative expenses to rise.

It will be tempting to put investments in talent and operational improvements on hold to focus on navigating an economic slowdown. But the most successful leaders will balance short-term crises with long-term needs by prioritising new hires and elevating existing roles to position their companies for growth. In our survey, 55 percent of executives cited the talent crunch as one of the top three areas having the greatest impact on their businesses in the year ahead. Executives should work to align their organisations, from top management to frontline staff, around the key strategic themes that will drive growth.

For some companies, the moment may call for elevating existing roles around critical areas like sustainability, even creating new C-suite positions that fill gaps in expertise within senior leadership.

ADVERTISEMENT

For other brands, the greater need will be to build out existing functions, such as those supporting omnichannel strategies, and to empower them with expanded leadership roles that have increased decision-making responsibility and accountability. Human resource teams in charge of a company’s talent may be included in role expansions and elevations. When Chanel appointed Unilever’s chief human resources officer Leena Nair as its new chief executive in 2021, the fashion label signalled to people teams across the industry that they are strategic operators. “HR is no longer a backroom department,” said Nair in an interview before her appointment. “It’s a vital part of running any successful business.”

The talent market is ripe for a reset. The sharp increase in voluntary attrition since the beginning of the Great Resignation of 2021 surfaced a deep fissure between companies and their employees — in the US, for example, it has led to 25 percent higher voluntary resignation rates than pre-pandemic levels. According to a recent McKinsey survey, 76 percent of people who left consumer retail jobs since the start of the pandemic entered another sector, the highest exit rate of any industry.

Half of fashion professionals believe the industry has lost the appeal it once had as other sectors like technology eclipse it, in terms of career growth opportunities and pay. The exodus can also be observed in C-suites as top executives depart for roles outside of the fashion industry.

The employee exodus is unlikely to reverse completely as economic conditions worsen in the year ahead. Retail workers remain difficult to retain, with 50 percent of US frontline workers and 63 percent of retail managers reporting they are considering leaving their jobs. Many people are quitting because they are seeking better opportunities for career advancement, greater work-life flexibility or higher pay. Companies will feel more pressure to offer clear advancement paths along with prioritising culture, employee wellness and flexibility to attract top talent, whatever the role or seniority.

Meanwhile, the industry still needs to address diversity, equity and inclusion, including in top management positions. DE&I experts suggest that the industry’s work has only just begun when it comes to racial and ethnic diversity. Male candidates made up 76.9 percent of all CEO appointments in the fashion industry in 2021, according to retail merchandising company Nextail. Less than one-third of board positions are held by women at UK-listed fashion retailers, according to an annual survey from Drapers.

As fashion companies prepare for the challenges ahead, some are rethinking the structures of their senior teams, taking the opportunity to introduce new or adapted C-suite roles that focus on increasingly critical areas such as diversity, sustainability or logistics. Among other benefits, these appointments send a signal to the rest of the company, shareholders and customers about where the leadership is focused for both the short and long term.

One C-suite role gaining traction in the industry aims to help address companies’ sustainability practices. The C-suite teams at almost all of Europe’s 25 biggest fashion companies can count at least one executive with environmental, social and governance experience. These leaders design and execute a range of sustainability strategies, from cutting carbon footprints to reducing waste to improving labour relations. Chief sustainability officers are most successful when they are integrated into the rest of the business. Rather than creating an entirely new role, some companies are introducing a sustainability component to an existing one.

UK-based fast fashion retailer Primark, for example, put Michelle McEttrick, who is the company’s first chief customer officer, in charge of leading its sustainability strategy. These roles can also open the door to the top C-suite job. At Swedish fast-fashion company H&M, for example, Helena Helmersson was appointed chief executive in 2020 after serving as the company’s head of sustainability.

ADVERTISEMENT

Supply chain roles are also gaining more prominence in the C-suite, largely due to the increasingly complex nature of manufacturing today. Chief supply chain officers are the strategic bridge connecting manufacturing, procurement and sales, and operations and planning, while serving as a conduit for robust risk management and mitigation. Their work requires a wide view across departments to respond to crises, enable their companies to innovate production strategies and recruit specialised logistics talents.

Another C-level bridge-building position is the chief omnichannel officer, a role that consolidates offline and online channels under one operational umbrella as brands re-evaluate brick-and-mortar strategies alongside e-commerce and other channels. For instance, Parisian label Isabel Marant appointed a new chief omnichannel officer in September. Meanwhile, new chief experience officers, chief brand officers and chief technology officers are charged with overseeing and unifying customer experiences across distribution channels at companies like Under Armour, Moncler and New Look.

Even outside the C-suite, many fashion companies are investing in digital and data expertise with a view to becoming omnichannel-first organisations and achieving enterprise-wide digitisation. At consumer companies appearing in a ranking of top places to work, half of executives in a survey said their businesses integrate digital teams across functions and geographies. In contrast, only 26 percent of respondents at companies further down the ranking could say the same. The companies that ranked highly were also 1.4 times more likely than their low-ranking counterparts to maintain digital teams in-house rather than outsourcing.

Meanwhile, fashion executives have an opportunity to bolster teams responsible for communication strategies at a time when their companies may be expected to take a stand on sensitive topics impacting society at large, such as the war in Ukraine. Institutional communications and liaison roles will require specialist knowledge around areas like climate change, trade policy and data privacy. These roles will be critical in ensuring brands are able to make meaningful contributions to not only trade organisations, but also cross-industry forums and policy-making bodies.

LVMH, for example is an official partner of the World Economic Forum in Davos, while Kering’s chief sustainability officer is also head of international institutional affairs.

As the fashion industry intersects with government regulations that have a high potential of impacting business operations, communications and public relations teams will have a larger role to play.

For consumer-facing communications on complex social issues, these teams will need to understand the shifting concerns of diverse audiences and collaborate with other internal teams — such as diversity and inclusion executives, marketing strategists and sustainability specialists — to craft campaigns and messaging.

Even amid these times of tighter cost management, fashion companies will need to prioritise investment in new skills and collaborative structures. A successful talent strategy will require hiring and reskilling, pushing human resource teams to identify current and future skills shortages and set a strategy to address them.

ADVERTISEMENT

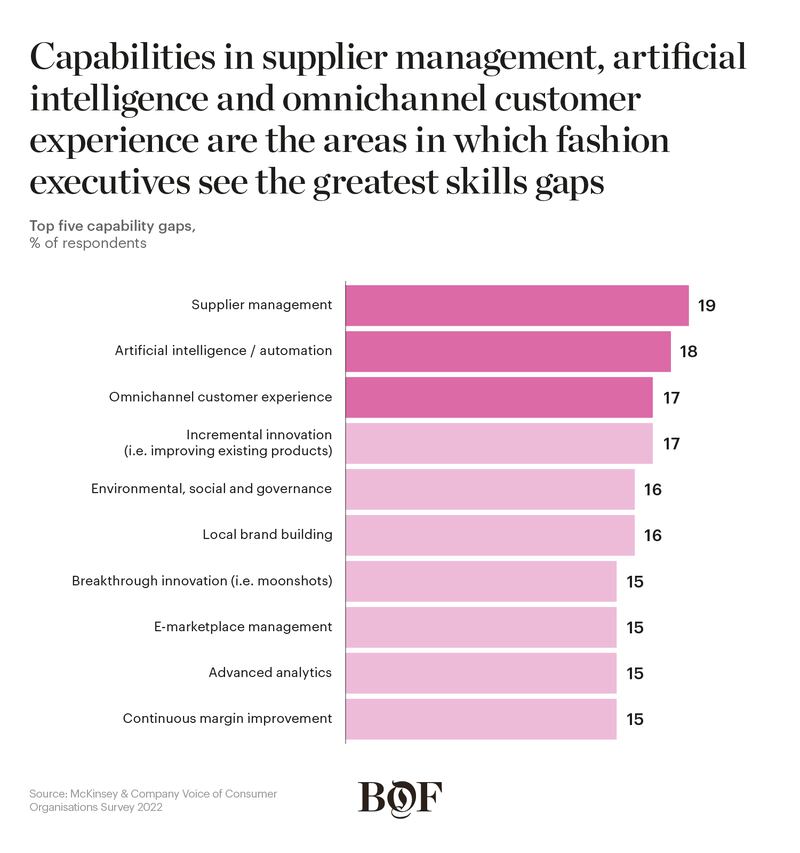

Nearly 90 percent of executives foresaw a skills shortage in their organisations, according to a 2021 survey, yet only one-third said hiring plans were robust enough to address talent challenges. In 2022, fashion executives cited supplier management, artificial intelligence and automation, and omnichannel customer experience as the top capability gaps in their organisations.

Competition will be stiff across the industry for the most in-demand roles. These include specialists in ESG compliance, including lawyers who are focused on international law and can help companies navigate evolving ESG-related regulations. Supply chain and operations leaders are also sought after, as are support roles like merchandising assortment planners as well as specialists in logistics and pricing.

There is plenty of scope for upskilling and reskilling, with the twin benefits of serving as a retention tool and improving a company’s competitiveness. The business case even in economically uncertain times is sound: education and training typically generate return on investment that is between two-and-a-half and three times higher than recruiting, according to McKinsey research.

This has not been lost on big companies that are already investing heavily to educate employees. Amazon, as part of its “Upskilling 2025″ initiative, is investing $1.2 billion to train more than 300,000 employees for higher-skilled jobs as automation eliminates many existing roles. At big box retailer Walmart, training support ranges from workshops on basic retail and emotional skills for frontline staff to subsidies for tenured employees to study retail management at university.

Enabling organisation-wide agility will be critical to building the resilience needed in 2023 and beyond. Speed will be essential, underpinned by cross-functional teamwork that eschews siloes, enabling fashion executives to allocate their talent to the strategic topics they believe will unlock growth. Top management must be prepared to change. Leadership teams must comprise executives with a diverse range of skills that reflect strategic priorities.

Above all, fashion leaders will need to prioritise talent and reconsider organisational evolution as the competitive advantage it has become. Human resource leaders will need to continue reconsidering how employees work together to ensure balance and efficiency around remote or flexible work policies that keep people engaged. Companies defined by strong diversity and inclusion leaders and focused on transparency will help attract top talent and enable a business to evolve and become even more resilient in the years ahead.

This article first appeared in The State of Fashion 2023, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

Opens in new window

Opens in new windowThe seventh annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals the industry is heading for a global slowdown in 2023 as macroeconomic tensions and slumping consumer confidence chip away at 2022′s gains. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

To provide actionable insights and inspiration on how fashion and retail industries can further embed diversity, equity and inclusion in the workplace and business strategies today, BoF Careers co-hosted a panel discussion with The Outsiders Perspective. Now, BoF shares key learnings from the panel.

Discover the most exciting career opportunities now available on BoF Careers — including jobs from Tapestry, Alexander McQueen and Toteme.

A US regulator has banned most uses of the clauses, which started as a way for fashion companies to prevent senior executives from walking off with trade secrets, but have become a standard retention tool.

Check out this week’s new partners and openings on BoF Careers, the global marketplace for fashion talent.