The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

It’s March in Shanghai, just weeks before the city’s fashion week festivities kick off. Things are hectic but in a reassuringly pre-pandemic way.

A largely physical schedule of shows and presentations will take place in the city between April 6 and 13 in Shanghai Fashion Week’s second physical edition since going virtual last March. Across the country, editors, buyers and stylists will congregate in the fashion capital as local brands, buoyed by a rebound in domestic demand, celebrate their latest offerings.

“Buyers and designers are very excited to really gather together and see new collections,” says Tasha Liu, founder of emerging designer platform Labelhood. “You can feel a collective faith, a confidence in local talent and the Chinese market.”

The Chinese are hardly alone in recognising this resilience. Since the pandemic, the mainland has only risen in importance for global brands, thanks to accelerated growth across categories like luxury and most digital channels.

ADVERTISEMENT

The country, which nearly doubled its share of the global luxury market in 2020 thanks to the repatriation of spending, according to Bain, saw total retail sales of consumer goods in January and February rise 33.8 percent year-on-year, according to data released this week by the country’s National Bureau of Statistics. Knowing what to sell to Chinese shoppers has never been so important. From trending categories to local competitors, here’s what brands need to know.

Comfort, Chinese style

As China only went into lockdown once, loungewear didn’t get as big a boost as markets like the US and UK. People have, however, taken to dressing more casually.

It’s not like people are wearing tracksuits, but they are looking for comfort.

“In Europe and the US, you see people wearing hoodies and Luluemon leggings but here, you don’t see that unless you’re in front of a [gym,]” said Bryant Lee, Shanghai-based brand consultant and marketing manager at global brand development consultancy Seiya Nakamura 2.24. “It’s not like people are wearing tracksuits, but they are looking for comfort.”

On social media platform Xiaohongshu, the tag “comfortable dressing” is full of bloggers in wide-legged trousers, sneakers and sweatshirts. But many users pair their hoodies with structured outerwear, like a blazer, or a statement boot, as opposed to sporting a head-to-toe loungewear look.

The goal, as advertised by KOLs, is to evoke gaojigan — a high-class feel synonymous in fashion with timeless dressing, minimalism, effortlessness and neutral tones — while being dressed casually. For global brands, tapping into these aspirational buzzwords can help localise their brand and target online shoppers across top digital platforms.

All eyes on accessories

The lack of an extended lockdown and caution around new waves of the virus meant there wasn’t a surge in pent-up demand for items like party dresses and stilettos — the “roaring twenties” rebound that brands are betting on in the west as restaurants and other establishments reopen. Rather, the trend towards comfortable clothing made room for growth in accessories people could buy to make their casual outfits more interesting.

ADVERTISEMENT

Especially popular are jewellery items like necklaces, rings and earrings, particularly at accessible price points between 1,000 and 2,000 yuan ($154-308), said Lee. “In the past six months, there’ve been 20 new emerging jewellery brands.” Footwear has also been exceptionally strong, he added.

When it comes to luxury items, accessories continue to perform well as entry-level items for first-time luxury customers — a rapidly growing demographic, thanks to accelerated e-commerce uptake in lower-tier cities. “There are probably more entry level luxury products in store than ready-to-wear, or even bags, nowadays,” Lee said.

The home advantage

Guochao, or the growing nationalism and pride in using Chinese-made goods, may not be as trendy a buzzword now, but brands are still reaping its rewards.

According to Launchmetrics data, in 2020 Yatsen-owned digitally native makeup brand Perfect Diary hit $166.6 million in media impact value (MIV, the agency’s proprietary currency that assigns a monetary value to marketing activities), a year-on-year increase of 197 percent. This can be attributed to the brand’s focus on marketing through a variety of ambassadors, key opinion leaders (KOLs) and key opinion consumers (KOCs), hit co-branded collaborations and investing in private traffic marketing.

Meanwhile, four-year-old makeup brand Florasis tapped into its traditional Chinese aesthetic, celebrities and livestreaming to reach a MIV of $66.7 million in 2020, up 656 percent from 2019.

For fashion brands too, guochao wasn’t just a flash in the pan. The Hanfu movement, where fans dress up in traditional Chinese garb from the Ming, Song and Tang dynasties, is still having an impact on categories like fashion and beauty, said Yeli Gu, the founder of China’s biggest trade show, Ontimeshow. “I foresee Hanfu gaining in popularity among younger Chinese and over time, its cultural focus driving trends in other industries and fields.”

New, niche and unseen

ADVERTISEMENT

Discovering new designers has long been a form of social capital for young Chinese fashion enthusiasts, but with travel restrictions in the way of their trips to London’s Machine-A and Paris’ Tom Greyhound, local multi-brand stores have stepped up. Indeed, orders returned to their normal levels by last October and most brands have seen 30 to 50 percent growth compared to pre-pandemic levels, said Gu.

The increasingly diversified understanding of fashion among China’s younger generation is striking.

“The best-performing brands are contemporary labels with a unique concept and brilliant design,” said Eric Young, founder of Le Monde de SHC, a much-loved boutique in Shanghai’s French concession. “Young designers from London, Paris, Tokyo and Shanghai can find a large community of fans here.”

Smaller brands of the moment in the China market include Parisians Coperni, Phipps and Casablanca; London-based Charlotte Knowles and Rokh; and Japan’s Mame Kurogouchi. Local brands, like Marchen and Samuel Gui Yang, are also popular.

For up-and-coming designers and retailers focussed on indie brands, this represents a major opportunity as younger shoppers in the world’s biggest fashion market look beyond established names. “The increasingly diversified understanding of fashion among China’s younger generation is striking,” said Young. “They are very willing to accept and try new designers.”

One-of-a-kind joy

As first-time luxury shoppers opt for entry-level accessories, seasoned luxury buyers are on the hunt for something more.

Those accustomed to buying luxury ready-to-wear are looking beyond the minimal black jean or white sneaker. “Very special, runway pieces or new drops like the Givenchy bags by Matthew Williams are key right now,” said Lee, whose friend recently bought a pair of metallic Balenciaga boots for 35,000 yuan ($5,382) to display in his home as a collector’s item. “They want one-off pieces that are special, off the runway.”

Domestic travel can also boost growth for brands that target shoppers planning holidays, whether this involves tropical attire or skiwear — a category gaining ground as the country’s 2022 winter Olympics nears. “Global travel restrictions haven’t changed people’s shopping needs,” said Gu. “Rather, it’s happening domestically, which has brought about a lot of growth for local brands.”

Considering the buoyancy of China’s fashion market, it’s actually difficult to name categories that are performing poorly, said Liu. But like many across the world, people are looking for brightness and levity in fashion and beauty. “Avant garde, darker styles don’t resonate as well at the moment,” she said. “Right now, people want brands and products to lift our spirits with joy and playfulness.”

时尚与美容

FASHION & BEAUTY

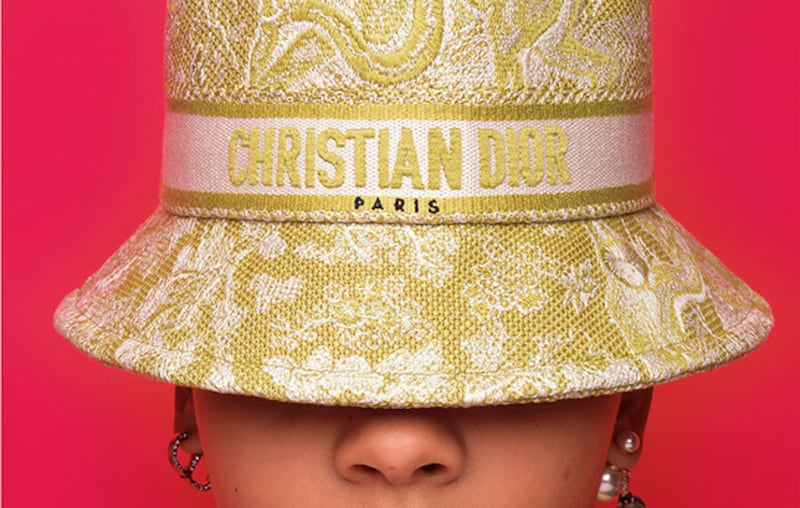

Dior’s Pre-Fall Collection to Make Runway Debut in Shanghai

Dior will bring Maria Grazia Chiuri’s pre-fall 2021 collection on tour, with its runway debut to be staged in Shanghai on April 12. The date coincides with Shanghai Fashion Week, which runs from April 6 to 13. Dior’s colourful Pre-Fall collection was originally unveiled last December with a video presentation. The French luxury giant has regularly staged shows in Shanghai in recent years, often reshowing its haute couture collections here after their initial Parisian outings. These shows have regularly featured additional looks designed specifically with the China market in mind, but it’s still unclear as to whether the upcoming show will also feature any new looks. (BoF)

Labelhood Releases Schedule Ahead of Shanghai Fashion Week

The platform for emerging designers is gearing up for a banner season, which will run from April 6 to 11 and feature 30 physical runway shows. The programme, title Odyssey, features a wide range of labels at different stages of development, including five student-led labels making their debut. The schedule also spotlights brands now known to buyers and shoppers in China and beyond, including Yirantian, Yuhan Wang and Private Policy on April 8; Oude Waag on April 9; and Shushu/Tong on April 11. (Labelhood)

China’s New Expo in Hainan Attracts Global Brands

Hainan’s Haikou city will host the first China International Consumer Products Expo from May 7 to 10, organised by the Ministry of Commerce and Hainan’s provincial government. A number of international luxury, fashion and cosmetic players including Tapestry Inc., Swatch Group, L’Oréal Group, Shiseido and Kao have confirmed their participation alongside retailers like Galeries Lafayette and LVMH-owned travel retailer DFS Group. Brands can use the platform to tap into growth in the China market and Hainan’s future as a free trade port. A tax exemption policy is one of other major draws for exhibitors and consumers alike. An official document released last June said international exhibitors will be exempt from duty on imports and sales during the exhibition period. (BoF)

科技与创新

TECH & INNOVATION

Tmall Launches Intellectual Property Trading Platform

The Alibaba-owned e-commerce player has built IPmart, which will facilitate intellectual property licensing transactions between copyright owners, designers, illustrators and brands. The new platform will incorporate blockchain technology from Alibaba affiliate Ant Group to mitigate trust issues when authorising transactions. It will reportedly cover areas like copyright, contracts and operations to support businesses with product development and marketing in the mainland, which has long been a contentious jurisdiction for global brands looking to protect their assets. (DoNews)

Reports: Chinese Government Pressures Alibaba to Divest Media Assets

Alibaba Group Holding Ltd has been told to dispose of its media assets, which include stakes in South China Morning Post and Chinese social media platform Weibo, the Wall Street Journal reported. In recent months, Alibaba affiliate Ant Group has come under regulatory pressure after its blockbuster $37 billion IPO was halted and the firm was forced to restructure. The Journal’s sources said that Beijing sees Alibaba’s dominance and widespread influence as a challenge to the government’s control over the media. Despite the emergence of younger digital platforms like Douyin and Xiaohongshu, Weibo remains a vital channel for fashion and beauty brands to engage with — and sell to — Chinese netizens. Like many of its rivals, the platform has introduced e-commerce capabilities and plays a role in driving traffic and sales to Alibaba marketplaces like Taobao. (BoF)

消费与零售

CONSUMER & RETAIL

China Jan-Feb Retail Sales Rise Almost 34%

Total retail sales of consumer goods rose 33.8 percent year-on-year, according to data released today by the country’s National Bureau of Statistics (NBS). The dramatic rise is largely due to the fact that retail spending was hindered during the same period in 2020, when the coronavirus outbreak first took hold in China, leading to widespread lockdowns, limitations on movement and the closure of public spaces, including malls and restaurants, in many parts of the country. Having said this, the total sales for the two month period of almost 7 trillion yuan ($1.1 trillion) also represents growth of 6.4 percent over the same period in 2019. Online retail sales also continued their upward trajectory, growing 32.5 percent year-on-year for January and February. (BoF)

Max Mara Called Out on China’s Consumer Rights Day

The Italian brand was among the companies called out during China’s 315 Gala, an annual TV programme aired on national broadcaster CCTV on March 15 each year to mark World Consumer Rights Day. Max Mara’s alleged misdeed was utilising facial recognition cameras in store to collect consumer data without consent, a violation of Chinese regulations that require consent for facial recognition data collection. An official statement from the brand said the in-store camera in question was used only for collecting statistics about store foot fall, and all images taken in the store were automatically deleted each day. (BoF)

Peacebird Group Reports 29% Net Profit Growth

The Chinese fashion group’s annual revenues hit 9 billion yuan ($1.4 billion), up 14.3 percent year-on-year. Net profits reached 711 million yuan ($108.6 million), up almost 29 percent compared to 2019. The Ningbo-based company attributed this growth to its focus on sales channels, which has seen it grow direct-to-consumer stores, scaling franchise locations and expanding into social commerce while maintaining rapid growth in traditional e-commerce platforms. It has also become increasingly responsive to market demand in relation to product design, production and inventory. Lower rents during the pandemic also helped lower costs. (BoF)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

Chinese Regulators Squeeze Online Lending, Debt-Powered Spending

Beginning next year, fintech players like Alibaba affiliate Ant Group will be required under new regulations to fund at least 30 percent of the loans they make with banks — a decision that could temper spending by China’s younger shoppers. In recent years, online loans have helped drive consumption among a demographic keen to own the latest luxury goods but unable to afford them. Last week, Ant Group said that as part of its self-regulation efforts, its credit payment company Huabei and short-term consumer loan provider Jiebei would lend responsibly and refuse loans to young or low-income borrowers beyond what is needed to cover basic living expenses. But given Beijing’s interests in sustaining China’s economic momentum, the extent that regulations will dent consumption in the long-term remain uncertain. (BoF)

Possible Links Between Sandstorms and Cashmere Industry Raised

Sandstorms that hit northern China with a vengeance this week led to the deaths of six people, while dozens more (mainly herdsman from rural areas) remain missing. Now, questions are being asked about the role of the cashmere industry and the overgrazing it has caused in neighbouring Mongolia (where the storm originated, and the world’s second-largest producer of cashmere), in the disaster. According to International Monetary Fund (IMF) data, in the 30 year period to 2020, Mongolia’s livestock numbers tripled, leading, the IMF said, to increased degradation of grassland and feed shortages. This degradation is now seen as a leading culprit in an increase in the number and severity of sandstorms likely to continue to be seen in Mongolia, China, Japan and South Korea, if nothing is done to reverse the trend of increasing herds and decreasing grasslands. (BoF)

Chinese-Owned Garment Factories in Myanmar Attacked

China’s foreign ministry and the Chinese Embassy have called on authorities in Myanmar to protect Chinese-owned companies and personnel, according to an Associated Press report. This follows a series of attacks, mainly on textile and apparel factories in industrial parks across Yangon, some of which were set alight. A statement posted by the Chinese Embassy to Myanmar on Facebook about the importance of protecting Chinese businesses led to an overwhelmingly furious reaction in more than 52,000 comments, many of which accused Chinese authorities of turning a blind eye to the continuing police and army violence against the people of Myanmar. Many of the comments also alleged Myanmar’s police or other agitators were behind the destruction in order to incite further trouble. (BoF)

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.