The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

At the height of summer, Chinese influencer Feng Xiaoyi’s account on social media platform Douyin was suspended after he posted a seemingly innocuous video of him eating peaches.

In the clip, Feng sported a furry, animal-eared hoodie and pouted as he ate spoonful after spoonful from the can, uttering in a baby-like voice between bites that the peaches were “so, so cold.” After the video went viral in August, some commenters called him a slur, ‘niang pao’ (meaning ‘sissy’, in Chinese), and his account was disabled soon after for “promoting negative social habits,” according to a post made by the platform.

Days later, China’s National Radio and Television Administration (NRTA) announced a ban on “niang pao and other abnormal aesthetics” on television, encouraging broadcasters across the nation to promote traditional Chinese aesthetics instead. It was a forceful statement in an ongoing campaign against men appearing in the media who are perceived as effeminate, and the first time the slur was used by the government ministry.

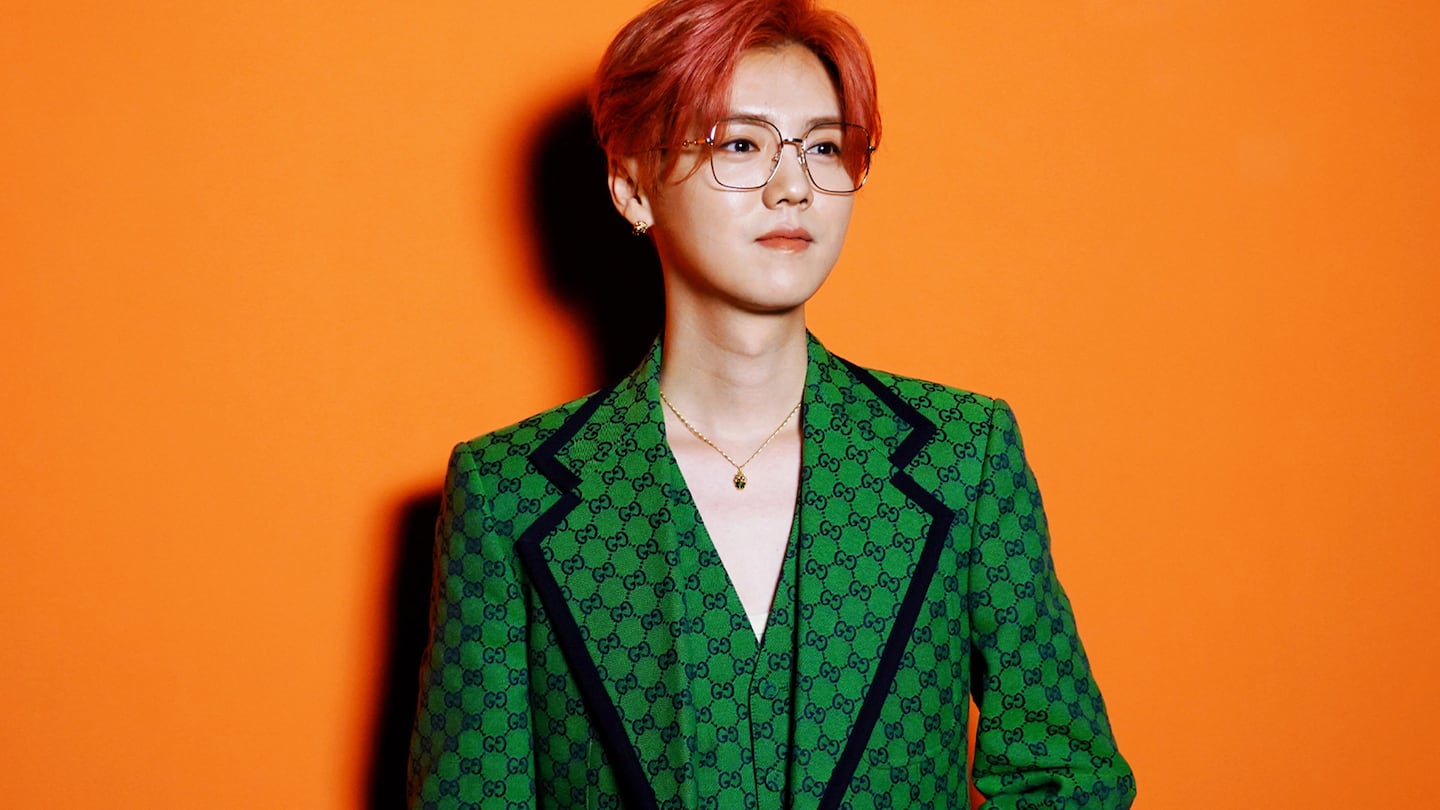

Androgynous male stars, many of whom gained popularity in recent years and continue to enjoy a large fanbase, are still a fixture in fashion and beauty brands’ marketing campaigns — for now. Take Lu Han, who has appeared in several videos for Gucci Beauty, or Lay Zhang, who continues to feature in Valentino’s Weibo posts. But if the Chinese government’s prohibitive stance continues through its media regulators or other authorities, it could mean more than just shrinking opportunities for male stars deemed to be effeminate.

ADVERTISEMENT

“From a community standpoint, banning or cracking down [on effeminate men] affects diversity. It disrupts the diverse [portrayal] and inclusion of all kinds of men,” says Raymond Phang, co-founder of Shanghai Pride, the longest-running LGBTQI pride organisation in mainland China, held from 2009 until 2020 when it was unexpectedly cancelled.

“Effeminate men aren’t [necessarily] homosexuals [so] I don’t want to jump [straight] to homophobia; it’s related but not the same,” Phang says. He adds, however, that the NRTA’s move does deepen the stigma against effeminate presenting men, their sexual orientation notwithstanding. “It’s kind of like a warning, it’s a guideline telling people to try not to go there.”

It’s kind of like a warning, it’s a guideline telling people to try not to go there.

Indeed, the ban indirectly but no less insidiously signals the further censorship, inequality and oppression of members of China’s LGBTQI+ (lesbian, gay, bisexual, transgender, queer, intersex, asexual, non-binary and genderfluid) communities, including both people working in the fashion industry and fashion consumers.

“It could be argued that everyday LGBTQI people aren’t the real target of the most recent policy [but] it isn’t difficult to envision more anti-LGBTQI bullying, harassment and violence in schools and workplaces as a result,” Shuaishuai Wang wrote in an article for The Conversation. “After all, if the government condones a slur, who’s to say it’s wrong to use it to attack others?”

The ban — which is inherently ambiguous and subjective — has the potential of infringing upon an even wider range of people who don’t conform to traditional notions of masculinity or gender identity, or simply enjoy dressing and grooming themselves in genderless styles.

These issues present a point of tension for fashion and beauty brands operating in China, where many are reliant on the colossal market to boost their bottom lines but publicly committed to disavowing social injustice and introducing inclusive policies in other markets around the world — and increasingly compelled to display these values in their marketing strategies.

Advocacy for LGBTQ Employees and Consumers

According to a 2021 report on LGBTQI rights in China, authors Iris Ren and Rebecca Pan wrote that the government’s stance of “not encouraging, not discouraging and not promoting” LGBTQI communities has nonetheless categorised their desires and identities as “‘abnormal’ and ‘unhealthy’” in society.

ADVERTISEMENT

The report, which was commissioned by ILGA Asia (the Asian Region of the International Lesbian, Gay, Bisexual, Trans and Intersex Association) representing more than 170 LGBTQI organisations in the region, adds that “the discourses of the state seem to be focusing more on maintaining a harmonious society instead of defending LGBTIQ rights.”

Unfortunately, it’ll be much harder [for LGBTQI people].

“Unfortunately, it’ll be much harder [for LGBTQI people],” says Dr. Xiaoning Lu, reader in modern Chinese culture and language at SOAS University in London. “Privately, there’s still room for that expression, but Pride [and other] events, might not be able to go ahead this year.”

While progress has been made in some forums when it comes to China’s LGBTQI community — a cohort that numbers over 70 million — promoting a pro-LGBTQI message explicitly has become harder for ordinary citizens and corporate advocates alike.

“For some brands, they will think twice [about experimenting with LGBTQ marketing in China]… but there’s always a way to navigate these things,” says Phang.

This year has seen some advocacy groups shuttered amid an increasingly hostile environment. For LGBTQI and androgynous men working in China’s fashion and beauty industries, concerns are both personal and professional.

“It’s sad to see but I feel like it was only a matter of time,” a Chinese PR professional in the fashion industry in Shanghai, who wishes to remain anonymous, tells BoF. “It took a long time for me to feel comfortable dressing as I do [in public], as people stare. I’m not going to stop, but I have a feeling that things could get worse, for [LGBTQI] people and others that don’t fit into Beijing’s mould.”

It took a long time for me to feel comfortable dressing as I do [in public], as people stare. I’m not going to stop, but I have a feeling that things could get worse.

For brands, some of which have made moves in recent years to advocate for their LGBTQI customers through marketing campaigns, options are narrowing. “I won’t be surprised if [male] models and celebrities in campaigns become masculinised and tone down their make-up. The [China] market is too important for brands to risk getting censored,” the PR professional source adds.

As a growing number of fashion and beauty brands invest in Chinese digital channels and environments like the metaverse, this should also be of concern. LGBTQI topics are frequently censored online, and the NRTA’s rules further narrow the online platforms where these communities can be represented, supported, or even communicate in an authentic way. In September, the South China Morning Post reported that an internal memo drafted by the country’s state-backed gaming association identified games about gay romance, androgynous characters and “effeminate males” as problematic and likely to fall foul of censors.

ADVERTISEMENT

The Fan Economy and Patriotic Masculinity

Beijing’s recent media ban is a part of a wider campaign, which in January saw the Ministry of Education reveal plans to “cultivate masculinity” among male adolescents and combat what top advisor Si Zefu deemed a nationwide “crisis of masculinity.”

But these policies are motivated by more than a desire to champion outdated gender norms. “They want to regulate consumption through gender,” says Lu. She points to the hyper-enthusiastic fan culture in China that many attribute to South Korea’s export of K-pop, where fans’ spending power can propel their idols to the top of music charts (and sell 100,000 copies of Vogue).

“That’s what Beijing thinks is unhealthy, that irrational consumption,” Lu tells BoF. Indeed, state-run outlet The Global Times reported in August that the country’s Federation of Literary and Art Workers’ Professional Ethics Committee criticised, during a forum in Beijing, “unhealthy fan culture” around celebrities and singled out those with a “feminine” aesthetic.

Much of this spending — whether it is reading BL (“Boys’ Love”) webtoons or watching homoerotic shows like “The Untamed” — is by women, Lu notes. “You see this collective patriarchal anxiety about women, [who] have the spending power and this desire to consume alternative culture.”

You see this collective patriarchal anxiety about women, [who] have the spending power and this desire to consume alternative culture.

According to Lu, there is also a perceived link between androgynous men and what the government sees as a looming demographic crisis: the decline of China’s population of 1.4 billion, which the UN in 2019 predicted would reach around 1.3 billion by 2065. Another, more drastic estimate, published last year in peer-reviewed journal The Lancet by researchers from the University of Washington, predicts that the Chinese population will halve by 2100.

For years, authorities have introduced policies intended to avert this trend such as childcare subsidies, paternity leave, relaxing family planning policies and incentivising families to have third children. Alongside this year’s ban on extracurricular tutorial schools — an expensive burden that discourages many to have more children — the crackdown on men deemed to be ‘niang pao’ is another way Beijing is trying to avoid the negative economic implications of a declining population, claims Lu.

China’s desire to assert its strength on geopolitical fronts, such as the dispute over Taiwan and clashes with the US, is also adding to fuel to the fire by underscoring long-held notions of patriotic masculinity. In a proposal last May, aforementioned advisor Si called the “feminisation” of Chinese boys a matter of national security and a threat to the country’s survival.

Evidently, these efforts are not only attempts to police the self-expression of Chinese men but are built on misogyny. For years, nationalist commentators on forums and social media platforms lashed out at effeminate celebrities by spreading slogans like “strong youth produce a strong nation; feminine youth lead to a feminine nation.”

A Divisive But Invisible Law

The extent to which Beijing’s efforts will succeed in dissuading fans of China’s top male celebrities remains to be seen. Nor is it clear whether androgynous or transgender female celebrities, some of whom have been embraced by the likes of Gucci, Chanel and Dior in recent years, will also come under fire in the future.

“I don’t see major, popular artists being banned,” says Phang, raising the example of “Lipstick King” and livestream celebrity Austin Li Jiaqi. “He’s out there, he still looks the same, he’s still selling lots of beauty products, where is the line? As usual, we won’t know.”

In their private lives, China’s younger generations are increasingly progressive when it comes to their gender politics, be it challenging misogyny and gender roles or discreetly supporting LGBTQI causes. “I believe people will just continue to support whoever they love,” echoes Miro Li, founder of Hong Kong-based Double V Consulting. In the public realm, however, they increasingly put themselves at risk when demonstrating that support.

The crackdown has already made an impact on the entertainment industry. Alongside its ban on so-called “sissy” men in September, the government announced it would bar networks and streaming platforms from airing idol training shows (competitive reality programmes that have produced several male and female stars), in a move that also suggests an attempt to rein in tech giants. Many firms, like Alibaba and Tencent, house production arms that count on celebrity-driven programs for views and ad revenue.

Some celebrities, like members of The TF Boys and Huang Zitao, have already shifted from gender neutral aesthetics to more traditionally masculine looks, says Ben Cavender, Shanghai-based managing director at China Market Research Group. Cavender predicts that e-commerce players, social media operators and other tech firms will adjust production budgets accordingly. “It likely never needs to be an official law in order for changes to take effect.”

Rather, the rules will operate as an ambiguous and invisible, but nonetheless harmful measure by urging platforms to self-censor their content. This goes for users, too — Phang sees the rules taking the form of censorship of people like drag queens on social media apps like Douyin, where users can report content for removal.

“TV producers will be more careful [when presenting] the looks of male celebrities in their shows, and content platforms may use algorithms to push more ‘masculine’ content,” predicts Li.

Increasingly Risky Celebrity Marketing

Despite the emphasis Beijing has placed on male idols’ appearances — from censoring stars’ earrings to criticising men for wearing too much make-up — and the decrease in media opportunities where effeminate stars can gain exposure, experts say fashion and beauty brands have more to worry about than their ambassadors’ perceived masculinity.

In the wake of several recent high-profile celebrity controversies, the government and the public are both increasingly aware of idols’ professionalism and morality. While the NRTA’s ban is already reshaping China’s entertainment sector, it’s just one of many issues considerations brands must take into consideration when aligning themselves with local influencers. Scandals like those that have embroiled Kris Wu who was once a partner for the likes of Louis Vuitton, Lancôme and Bulgari; Zhang Zhehan, who had relationships with Lanvin, Pandora and Japanese jeweller Tasaki; and former Prada face Zheng Shuang, continue to land stars in hot water with Beijing and damage the reputation of brands they work with in the eyes of the Chinese, says Li.

“The CCP (Chinese Communist Party) think celebrities are ambassadors [and that] they should play a leading role in shaping morality,” echoes Lu.

The CCP think celebrities are ambassadors [and that] they should play a leading role in shaping morality.

In a country where finding and marketing a brand ambassador was already a high-stakes game, these shifts are only making things more difficult. Not only will stars need to be a good match for brands in terms of aesthetics and values, they will need to be vetted with regards to their righteousness, patriotism, professionalism and gender expression. “It’s getting harder for [brands] to find the right person,” says Lu.

While Lu predicts that this will lead to a period of stagnancy for China’s once-booming celebrity culture, it’s clear that idols and KOLs (’key opinion leaders’ as influencers are known locally) are here to stay even if they must operate in a more understated way. “[But brands] need to think very carefully about who they are working with, look at that person’s body of work and how it fits with the government’s long-term objectives,” says Cavender.

More broadly, the ban on effeminate men in the media means brands may need to reassess their approaches to casting, grooming and styling men. It raises more fundamental issues like the way brands should engage with menswear magazines, which merchandise assortments they should prioritise and how they should advertise and retail their men’s collections for the China market.

It also brings into question what global fashion brands can and should do to support China-based employees impacted by the ban and how they should engage with consumers and communities about the issue, particularly those brands and businesses that have a history of advocating for LGBTQI rights. Will any brands choose to take a stand in such a high-risk, high-stakes market?

Additional Reporting by Casey Hall

时尚与美容

FASHION & BEAUTY

Report: LVMH Mulls First Louis Vuitton Duty Free Store in China

The French luxury behemoth is thinking about opening Louis Vuitton’s first Chinese duty free location in tourism hotspot, Hainan, two sources told Reuters. According to the report, executives are mulling over plans for a store in Sanya’s Haitang Bay shopping centre and a partnership with its state-owned operator, China Duty Free Group — one of the many beneficiaries of the country’s post-pandemic domestic tourism boom and the world’s largest travel retailer. A link-up would allow LVMH to tap directly into the mainland’s burgeoning travel retail opportunity, and marks a U-turn for the Louis Vuitton brand, which is known for avoiding mark-downs. Louis Vuitton confirmed it is looking at opportunities in Hainan, but denied it was considering any options in the licensed duty free market. China Duty Free Group did not immediately respond to a request for comment. (BoF)

Luxury Brands Jump on Shanghai Art Week Bandwagon

Louis Vuitton, Prada and Dior were among the brands tapping into the creative and cultural cachet generated by a week of art and design fairs in Shanghai. Visitors to the Art021 fair — which ran Nov. 11 to 14 in the grand, neoclassical Shanghai Exhibition Centre in Shanghai’s downtown suburb of Jing’an — were greeted outside its entrance by a Louis Vuitton book store, selling volumes about the brand and more general travel titles. Next to to the West Bund Art and Design Fair, which also ran from Nov. 11 to 14, Dior held the opening of its Art’n’Dior exhibition, on show until Nov. 23, which included a series of Lady Dior handbags reinterpreted as part of the ongoing Dior Lady Art project by 12 artists, including Zhang Huan and Li Songsong. Meanwhile, on Wednesday evening, Prada unveiled its latest exhibition at its restored mansion, Rong Zhai. The exhibition, “A Moon Wrapped in Brown Paper” features works from Swedish artists Nathalie Djurberg and Hans Berg. (BoF)

科技与创新

TECH & INNOVATION

Alibaba Singles’ Day Posts Record Online Sales

The retail giant’s annual shopping extravaganza posted record sales of 540.3 billion yuan ($84.5 billion) — news that will see its investors to breath a sigh of relief, after the group’s shares fell 30 percent this year amid growing scrutiny from Chinese regulators. This year, the Singles’ Day gala featured appearances by Chinese heartthrob Jackson Yi and British actor Benedict Cumberbatch. The group departed from its habit of releasing data for its pre-sales performance and the first minutes of the event; chief marketing officer Chris Tung telling the media that it aimed to shift its focus from GMV growth to “sustainable growth,” a change likely made in light of Beijing’s recent focus on sustainability and common prosperity. (Reuters)

消费与零售

CONSUMER & RETAIL

China’s October Retail Sales Beat Expectations

In spite of new restrictions introduced to combat upticks in Covid-19 cases and supply shortages, industrial output and retail sales grew at a quicker pace than expected last month, data from the National Bureau of Statistics reveals. Sales grew 4.9 percent year-on-year, above expectations for 3.5 percent growth following September’s 4.4 percent rate. But economists predict that growth will weaken in the coming months, when fresh Covid-19 outbreaks will hit travel and a slowdown within the property sector, struggling amid an ongoing debt crisis, is expected to worsen. (Reuters)

Report: Shein Violating Labour Laws

On Friday, Public Eye, a Swiss watchdog group, released a detailed report that accuses the rising fast-fashion giant of violating Chinese labour laws. In Guangzhou, the city where Shein is headquartered and where many of its suppliers are located, independent researchers hired by the watchdog found some Shein partners were informal factories set up in residential buildings. Some also had barred windows and no emergency exits, according to Public Eye; conditions that violate Chinese labour laws. Workers in Guangzhou also told the researchers they sewed for 12 hours a day, working about 75 hours a week, and only received one day off a month. Chinese labour laws state workweeks cannot exceed 40 hours, and overtime cannot exceed 36 hours per month. Workers must also receive one day off per week. In an email to BoF, Shein said it “takes all supply chain matters seriously” and will soon initiate an investigation. (BoF)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

European Luxury Stocks Slide on China Stagflation Concerns

Shares in luxury brands like Salvatore Ferragamo, Kering, Hermès, Moncler, LVMH and Burberry underperformed the wider European market last week due to concerns over Covid-19 in Asia and a potential slowdown in demand in China. The mainland accounted for almost a third of European luxury goods sales in 2020, according to UBS, but economic growth in China is expected to slow further in coming months due to the the debt crisis unfolding in the country’s property sector and rising cases of Covid-19 in the region. Last week, Goldman Sachs cut its global luxury sales growth forecasts for 2022 by more than 33 percent to 9 percent. (Reuters)

China to Lose Preferential Tariff Treatment With 32 Countries

Beginning Dec. 1, EU member states and countries like the UK, Canada and Ukraine will no longer grant Chinese exports preferential treatment it was given in 1978 under the generalised system of preferences (GSP) programme, China’s General Administration of Customs announced last week. The decision is “a recognition from other advanced economies that China does not belong to the bracket of low-income and lower-middle-income countries anymore and that Chinese products are competitive enough in the market that (they need) no protections,” a statement read. (Fibre2Fashion)

Editor’s Note: This article was revised on 21st November 2021 to include additional context in the caption for the image of Lu Han.

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.