The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

THE CHEAT SHEET

TikTok in Trouble

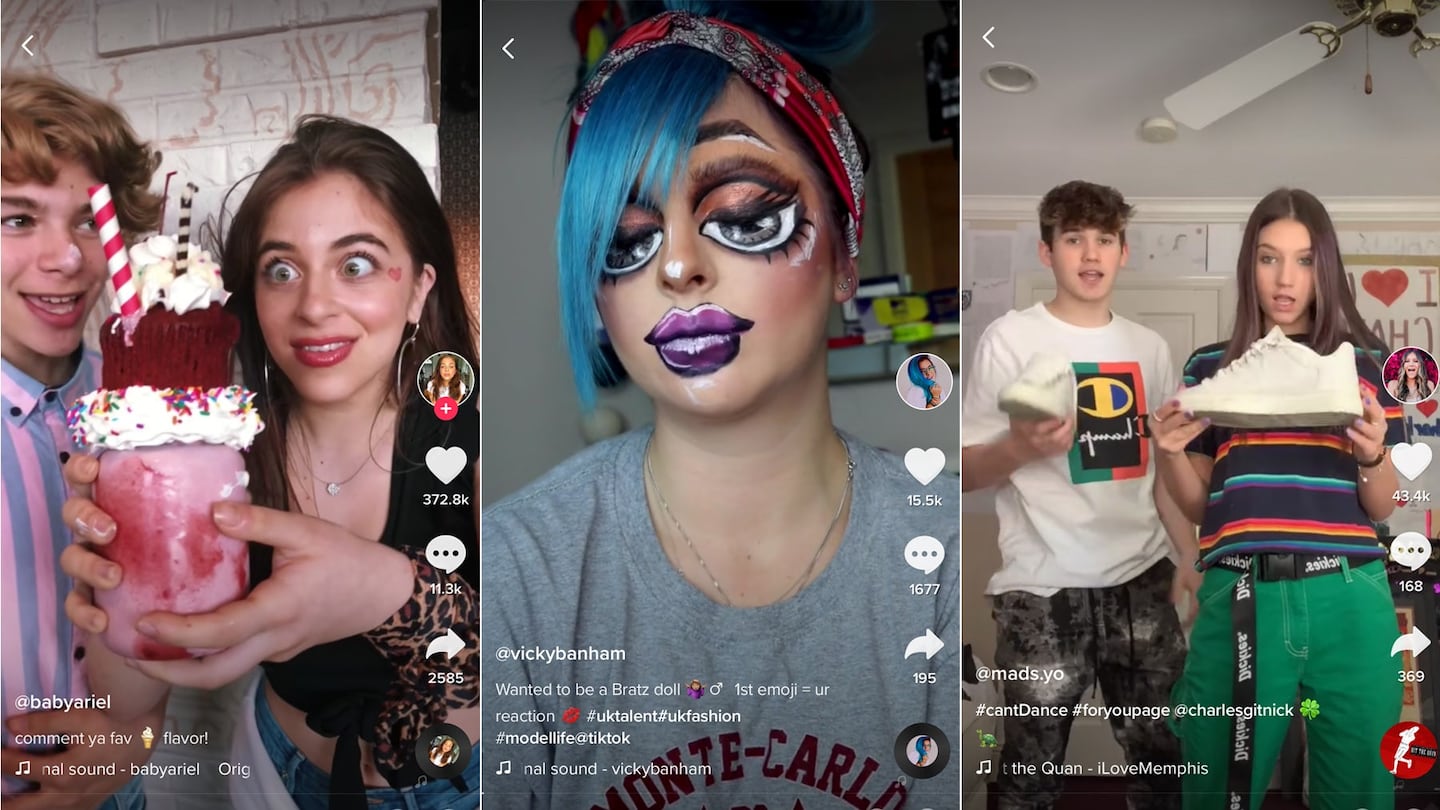

Beauty brands were first to strike it big with TikTok challenges, but fashion is catching up| Collage by MC Nanda for BoF

The Bottom Line: Whatever the outcome of the negotiations with the Trump administration, TikTok, or at least, the platform's underlying concept, appears here to stay. Brands looking to resonate with Gen-Z will need to adjust their marketing strategies accordingly.

ADVERTISEMENT

J.Crew Gets a New Lease on Life

A J.Crew campaign from 2013 | Source: Courtesy

Covid-19 Returns to Europe, Just in Time for Fashion Week

Chanel Autumn/Winter 2020 show at Paris Fashion Week | Source: Getty Images

The surge in new Covid-19 cases in France, and potentially Italy, is a reminder that the coronavirus crisis was never really "over," even as many countries appeared to bring the pandemic under control. The timing could not be worse for luxury brands, which are planning to show up in force for fashion weeks in Paris and Milan in the second half of the month. Legally, events with under 5,000 people can proceed in France, clearing the way for conventional runway shows, in stark contrast to the US, where audiences at the few in-person New York Fashion Week shows are limited to 50 people in some cases.

Whether that remains the case if the current infection rate continues is an open question. Many international invitees were already nervous about hopping on a flight to attend shows that are no longer so important from a financial perspective that they warrant risking one's health. Americans may be unable to attend at all, given restrictions on most travel between Europe and the US.

The Bottom Line: Barring a return to the dark days of March and April, brands are unlikely to abandon their plans for September. The digital shows clearly aren't getting the job done. And many labels showing in Paris have the marketing budgets and savvy to compensate for smaller crowds and safety measures.

SUNDAY READING

ADVERTISEMENT

Professional Exclusives You May Have Missed:

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Was this BoF Professional email forwarded to you? Join BoF Professional to get access to the exclusive insight and analysis that keeps you ahead of the competition. Subscribe to BoF Professional here.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.

BoF Careers provides essential sector insights for fashion's technology and e-commerce professionals this month, to help you decode fashion’s commercial and creative landscape.

The algorithms TikTok relies on for its operations are deemed core to ByteDance overall operations, which would make a sale of the app with algorithms highly unlikely.