The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

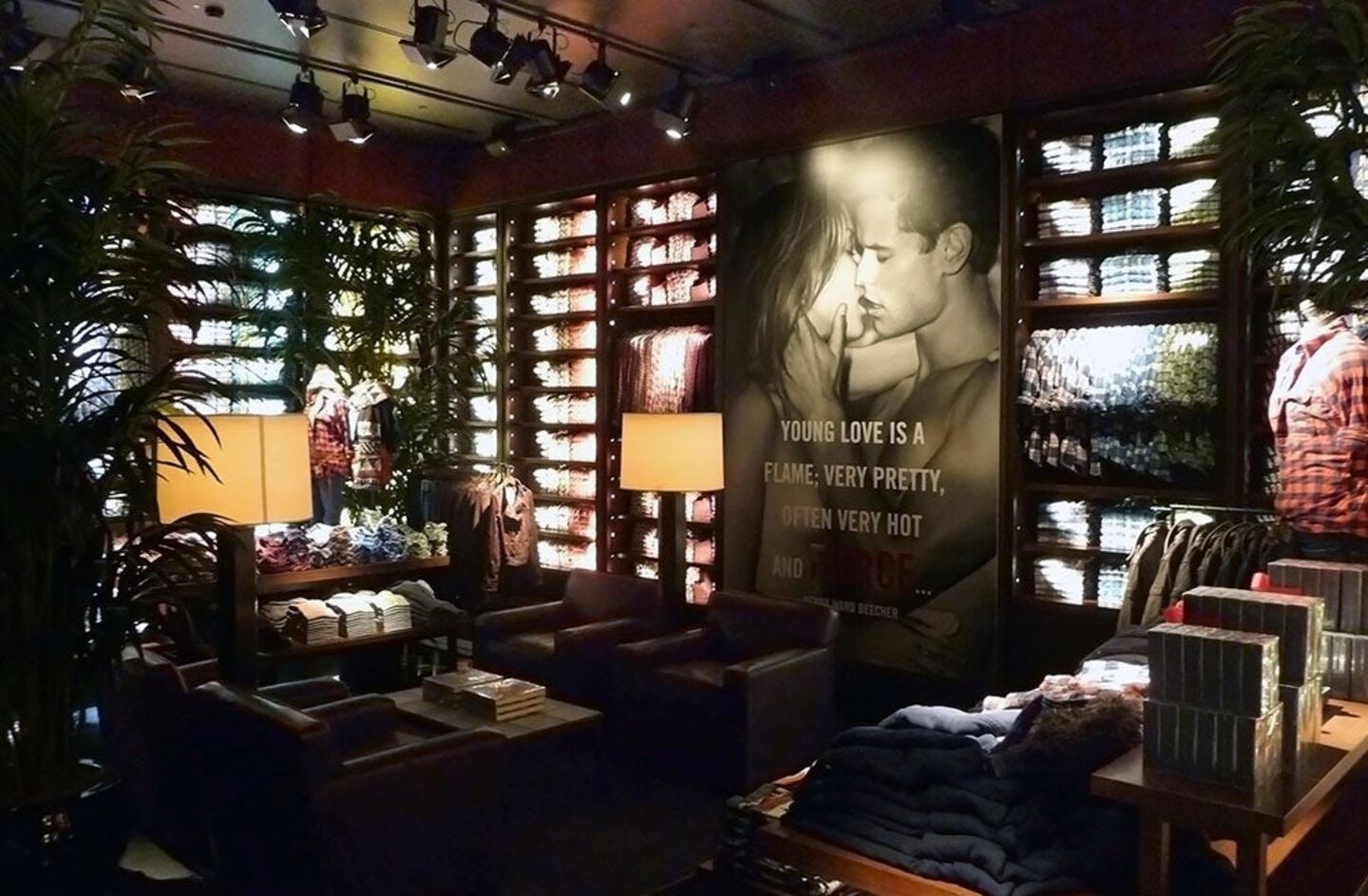

NEW YORK, United States – Abercrombie & Fitch Co., the clothing chain struggling to win back once-loyal teen shoppers, fell as much as 14 percent after weak store traffic took a toll on third-quarter earnings.

Excluding some items, profit was 40 cents to 42 cents a share in the period, the New Albany, Ohio-based teen retailer said today in a statement of preliminary results, down from 52 cents a year earlier. Analysts had projected 68 cents on average, according to data compiled by Bloomberg. On Dec. 3, Abercrombie will report official numbers for the quarter, which ended Nov. 1.

Declining store traffic, particularly in Europe, weighed on sales last quarter, Chief Executive Officer Mike Jeffries said in the statement. The company also is reducing its logo-adorned products because they no longer suit customers’ tastes. And Abercrombie’s beach-inspired Hollister chain is underperforming the retailer’s flagship brand.

“In the short term, we are reviewing measures to drive improvement in our results in the critical fourth quarter,” Jeffries said. “Longer term, we continue to believe we are taking the right steps strategically to position the company for future improvements in our performance.”

ADVERTISEMENT

Abercrombie shares fell as low as $30.51 in New York, marking the biggest intraday decline since November 2013. The stock had been up 7.5 percent this year through yesterday.

Jeffries is trying to compete with fast-fashion companies such as Forever 21 and Hennes & Mauritz AB, which use quick reaction to trends and low prices to win over teens. Heavy reliance on discounts across the industry and declining traffic in malls also have hurt retailers this year.

By Lindsey Rupp; editors: Nick Turner, Cecile Daurat.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.