The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Last month, Richemont said it would sell 47.5 percent of Yoox Net-a-Porter (YNAP) in exchange for an estimated 12-13 percent stake in Farfetch. The Swiss conglomerate is selling another 3.2 percent of YNAP to Dubai Mall developer Mohamed Alabbar’s Symphony Global, Richemont’s joint venture partner in the Gulf region. The deal leaves YNAP without a controlling shareholder, a point that was important to Richemont when negotiating the transaction, and offers Farfetch a path to a full acquisition of YNAP within the next 5 years.

At one level, the deal doesn’t look particularly great for Richemont. The group announced that, based on the value of Farfetch shares on 23 August, it would have to write down its investment in YNAP by €2.7 billion. The implied valuation of YNAP (based on Farfetch’s share price on 23 August, the day before the announcement) is around the €900 million mark, although this will have increased quite substantially on the back of Farfetch’s share price increase following the announcement of the deal. Farfetch shares climbed over 50 percent soon after the deal and are currently over 20 percent up on their 23 August closing price. But whether YNAP’s valuation is €900 million or €1.3 billion, it’s a far cry from the €3.4 billion valuation at which Richemont paid to take full control of the company back in 2018, not to mention the substantial operating losses racked up over the past few years.

The deal was nevertheless well received by analysts and Richemont’s stock gained almost 4 percent on the back of the announcement. (Not quite the 50 percent rally seen at Farfetch but that’s more to do with the size difference between the companies — Richemont’s market capitalisation is nearly 20 times bigger than Farfetch’s — and the fact that Farfetch’s share price had lost a lot of ground since the beginning of the year in line with other tech stocks).

That’s because, strategically, this is a great deal for Richemont. YNAP has long been a thorn in the side of the group. Richemont became one of Net-a-Porter’s earlier investors back in 2002. But after its 2010 exercise of a pre-emption right to acquire the business at a valuation significantly lower than other potential suitors were prepared to pay, relations between Richemont and Net-a-Porter’s management (including founder Natalie Massenet) soured. The relationship further deteriorated as Richemont negotiated a 50/50 merger deal for Net-a-Porter with Yoox largely behind Massenet’s back in 2015, valuing Net-a-Porter at around £950 million. Massenet and angel investor Carmen Busquets fought tooth and nail to buy back control of Net-a-Porter from Richemont and eventually went to arbitration in order to ensure that a fair value was paid out to Net-a-Porter’s management and founder shareholders, with the arbiter attributing a valuation of £1.5 billion to Net-a-Porter in the merger. So, the history is messy, and the financial returns have been disastrous.

ADVERTISEMENT

This latest deal allows Richemont to progressively offload its troubled investment in YNAP and, in exchange, gain a share of around 25 percent plus a board seat in what will be the undisputed global leader in luxury e-commerce. (Ironically, it is also a long-awaited “told you so” for Massenet and Busquets, who believed as far back as in 2015 that Net-a-Porter and Farfetch would make for a better combination than YNAP).

Additionally, the deal will allow Richemont to tap into Farfetch’s platform and expertise to set up and run its own e-commerce channels for its stable of brands. The potential for sales and profit growth in this area is huge. It has always been a challenge for watch and jewellery brands to reach secondary and tertiary markets, leading to heavier reliance on the wholesale and franchising models than in other luxury segments, a problem that can be solved by developing a strong digital presence with global fulfilment capabilities.

Separately, Richemont has also been quite aggressively pursued by activist investors dissatisfied with the group’s governance (namely the control powers granted to the class of shares owned by Rupert family). The latest such activist, Bluebell, has been trying to appoint former Bulgari CEO Francesco Trapani as board director to represent holders of Richemont’s A shares. The group was successful in repelling the push during its September 7th AGM, citing Trapani’s links to LVMH. Does the LVMH connection really matter? Both groups are listed, meaning a lot of information on their strategies is publicly available. Plus, both groups employ powerful executives that have previously worked for the other.

Richemont’s dominance in hard luxury is, however, being seriously challenged by LVMH, notably since the French luxury group acquired American jeweller Tiffany. Whilst the gap in turnover is still relatively wide — last year, Richemont’s luxury watches and jewellery sales amounted to €14.5 billion, significantly above LVHM’s €9 billion — Richemont can no longer take its lead for granted. In that context, offloading a cash-consuming business and investing more heavily in hard luxury makes a lot of sense. The deal will increase Richemont’s firepower to buy any of the few remaining independent Swiss watch brands should they come to market and, of course, use Farfetch’s expertise to build a stronger digital platform,

In sum, the Farfetch deal signals an end to Richemont’s relationship with YNAP but it may well prove to be a new beginning for its ambitions in e-commerce.

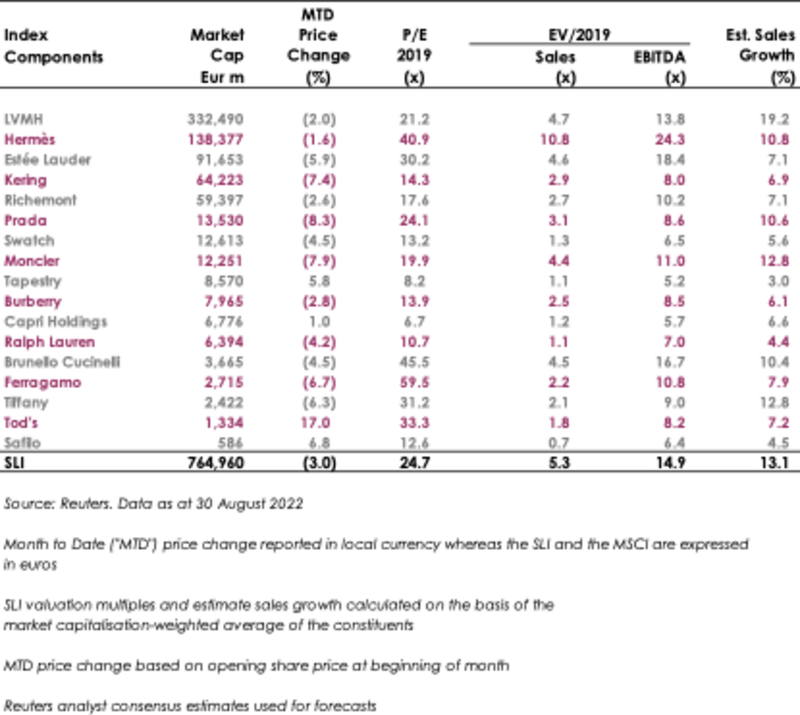

The Savigny Luxury Index (“SLI”) fell 3 percent in August driven despite a string of positive results announcements for the first half of 2022. No doubt investors are pricing in risk for the second half bearing in mind the uncertainty surrounding lockdown measures in China and the scale of the cost-of-living crisis in Europe. The MSCI underperformed the SLI, falling almost 5 percent over the month.

Going up

Going down

ADVERTISEMENT

Will Farfetch become the Amazon of luxury? CEO José Neves makes no bones about his ambition to build Farfetch into the global platform for luxury and parallels have already been drawn between his vision and that of Bezos for Amazon. Whilst there is a way to go before Farfetch reaches that goal, the YNAP deal is a giant leap forward in that direction.

Scale is one thing, but power is another, and Farfetch achieving, in the luxury sector, the kind of grip that Amazon has on the wider e-commerce landscape would not be good news for luxury brands or their consumers. This is unlikely to happen, however, as luxury brands have too much “soft power” and will always be able to draw customers directly, counterbalancing the power of a giant distribution platform. Also, in fashion, there will always be room for other multi-brand e-tailers provided they are able to offer a differentiated point of view.

Sector valuation

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.