The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Designer bags and small leather goods (SLGs) show no signs of relinquishing their role as a mainstay of fashion brands, according to The New Era of Designer Bags: Redefining Leather Goods, the latest report from BoF Insights. The category, at $72 billion today, is expected to grow to $100 billion by 2027 as per data from market research firm Euromonitor International, despite lingering pandemic effects and today’s rising economic pressures.

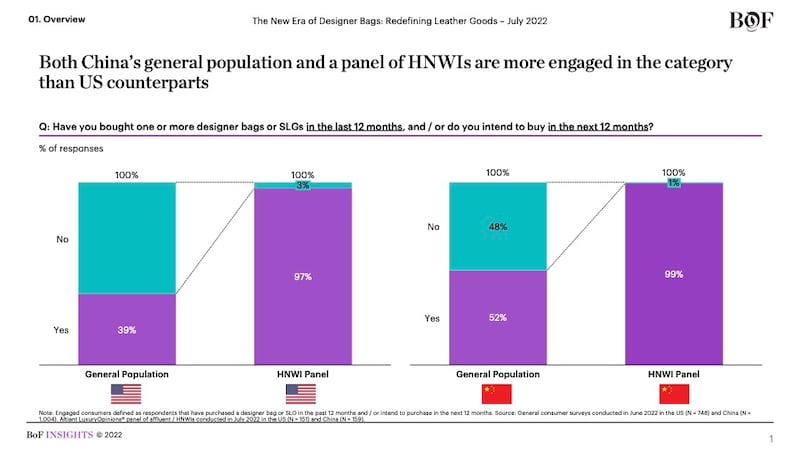

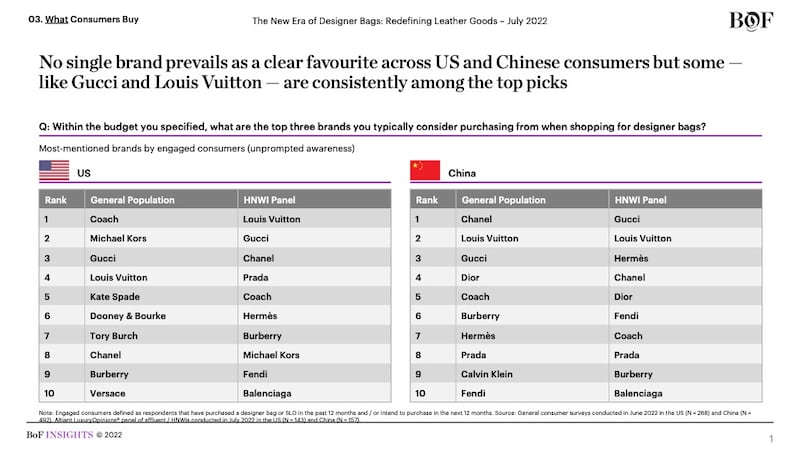

Most of this growth will take place in the world’s two largest markets for designer bags and SLGs: the US and China. Proprietary research from BoF Insights finds that even as shopping behaviours shift and tastes evolve, consumers in both countries remain loyal to the category that provides functionality, style and, in many cases, a highly valued status symbols. Among the general population surveyed in June 2022, around 40 percent in the US and 50 percent in China are “engaged” consumers in the category, having purchased designer bags or SLGs in the last year or intending to purchase in the next year. In both countries, nearly all high-net-worth individuals (HNWIs) — with investable assets worth a median value of between $1.5 million and $2 million — are engaged in the category.

For brands, the market for designer bags and SLGs is increasingly crowded. To stay relevant, designer brands aim to “own” a specific style, be it in terms of silhouettes, materials or colourways, often requiring a balancing act between classic and novel features across a portfolio. Even so, imitation is rife in the category and once a brand designs what becomes an “It” bag, rivals often aim to go to market with their own versions of that design, creating pressure to be in a cycle of constant innovation.

Heritage brands are often now competing head to head with contemporary brands that have identified and moved swiftly into gaps in the market. For both incumbents and newcomers, collections now need to speak to an expanded definition of “luxury,” which taps into a new zeitgeist that values accessibility, casualisation and sustainability. Bag strategies that aim to elevate brands, optimise pricing and innovate with celebrity tie-ups equally need to consider the communities they want to be part of and the value systems to which their consumers belong.

ADVERTISEMENT

As the first in a series of category-focused analyses from the team at BoF Insights — The Business of Fashion’s data and analysis think tank — the report also explores how brands and retailers need to refine their strategies to prepare for the next chapter in designer bags and SLGs, as consumers are already changing how and where they shop for products in the category.

BoF Insights research finds that over half of engaged consumer journeys for this category now start with browsing online and, in the case of China, are influenced by livestreaming. Meanwhile, resale and rental have scaled dramatically from their former existence in physical boutiques, thereby enabling greater access for consumers and altering how they perceive and value bags as an investment asset.

Companies featured in the report include: Bottega Veneta, Burberry, Coach, Gucci, Hermès, Jacquemus, Kate Spade, Louis Vuitton, Mansur Gavriel, Mark Cross, Off-White, Prada, Rimowa, Saint Laurent, Stella McCartney and Telfar.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Diana Lee is the Director of Research & Analysis at The Business of Fashion. She is based in London and oversees the content strategy and roadmap for BoF Insights.

The fashion giant has been working with advisers to study possibilities for the Marc Jacobs brand after being approached by suitors.

A runway show at corporate headquarters underscored how the brand’s nearly decade-long quest to elevate its image — and prices — is finally paying off.

Mining company Anglo American is considering offloading its storied diamond unit. It won’t be an easy sell.

The deal is expected to help tip the company into profit for the first time and has got some speculating whether Beckham may one day eclipse her husband in money-making potential.