The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Just before the Thanksgiving holiday, LVMH-owned Dior opened a new La Collection Privée fragrance boutique at JFK Airport, one of its first monobrand travel retail spaces dedicated to fragrance worldwide. The outpost signalled a marked shift from the line’s previous strategy, one that long centred on Asia.

“North America used to be one of the biggest markets as far as travel retail,” said Andre Marzloff, managing director for travel retail Americas of LVMH Beauty. “[This] is where we want to focus our investment.”

With international travel at 80 percent of pre-pandemic levels, according to the most recent data from the United Nations World Tourism Organization (UNWTO), beauty has been one of travel retail’s bright spots, bolstering companies like LVMH and Coty as they expand their offerings. But with Chinese traveller numbers yet to recover from the pandemic, the recovery speed has varied widely as conglomerates such as Estée Lauder Companies and Shiseido have been hit hard by the continued slump in outbound Chinese travel. Smart labels have been quickly adapting to these changes, adjusting product assortments as well as changing regional and channel priorities.

“We were maybe focusing a little bit too much on Chinese travelling [shoppers] because they were the ones driving the trends, and year-on-year travelling more and spending more,” said Marzloff. “Covid has reminded us that we also have other customers which we need to take care of.”

ADVERTISEMENT

According to UNWTO data, the Asia-Pacific region still has dramatically fewer international tourist arrivals than pre-pandemic times, with 39 percent lower volume than 2019. The Middle East, meanwhile, has recovered with 20 percent growth since 2019.

“All regions except Asia have recovered to 2019 levels,” said Marzloff of Dior’s travel retail business.

As a result, beauty companies heavily reliant on travel retail in Asia, including the Estée Lauder Companies and Shiseido Group, have been feeling the pain. Both conglomerates reported sales decreases in their most recent quarterly earnings reports.

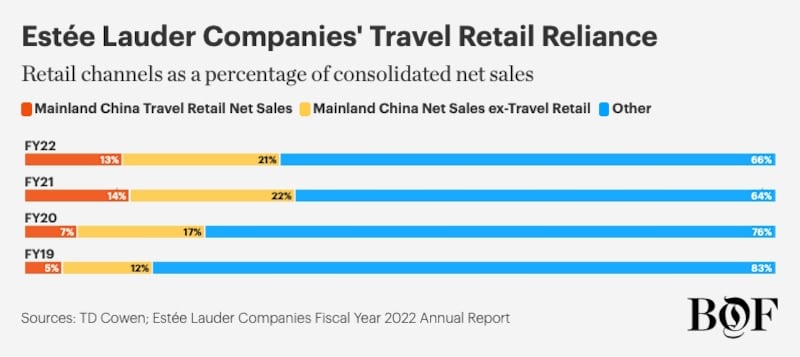

In a recent downgrade note about Estée Lauder Companies, TD Cowen pointed out that in 2022, Chinese travel retail made up 13 percent of the company’s revenues, but in 2023, the size of the business shrunk. China including travel retail made up 28 percent of net sales, while China travel retail was no longer disclosed separately. Oliver Chen, the managing director and senior equity research analyst at TD Cowen, said the conglomerate’s reliance on Chinese travel retail included a heavy focus on duty-free shopping in the vacation hub Hainan. “Other companies have smaller businesses there,” he said.

Companies with a more diversified global strategy have fared better. Dufry, now Avolta, reported double-digit year-over-year growth in its most recent third quarter report for the EMEA, North America and Latin America regions after sales in those regions had approached 2019 levels as of the end of 2022. Asia, which only made up 2 percent of its business at the start of 2023, was still only a fraction of 2019 levels.

Coty is also faring well in travel retail, reporting in November that its revenue had grown 20 percent year-over-year for the first quarter of the 2024 fiscal year, due to success in Europe and the Americas. Fiscal year 2023 travel retail sales were up 30 percent.

“We are still relatively younger in Asia, and young in China. We do most of our business in Europe and the US, which means that we are less affected by the [global] slowdown that we see,” said Guilhem Souche, senior vice president of global travel retail at Coty. Overall, the company’s Asia-Pacific sales are ticking up, but sales to Chinese travellers are still only at 50 percent of pre-pandemic levels.

Brands and companies are responding by shifting their areas of focus when it comes to regions and product categories.

ADVERTISEMENT

“We need to pay attention to all our customer profiles, and therefore it will have an impact more on our assortment rather than really being there or not there,” said Marzloff. For Dior, that means a greater emphasis on fragrance, which is popular with customers in North America, than on skin care, which is the brand’s most sought-after purchase among Chinese travel retail shoppers.

For the APAC market, brands are eyeing whether or not there will be a long-term shift from travel retail to domestic spending as the Chinese government has continued a crackdown on grey-market sellers (daigou) to encourage local purchases. But beauty brands still believe Chinese customers will spend on international trips when flights become available.

“I would say that a few years ago, many companies were kind of obsessed with the weight of China,” said Souche. Now, he said that Coty is diversifying its travel retail approach to focus on a wider range of nationalities. The company had expected Chinese traveller numbers to return to 90 percent of what they were pre-pandemic this year. Although that did not happen, Souche is optimistic, stating that Chinese customers have a “strong expectation of the chance to travel, so I’m very confident that they will come back.”

The lack of Chinese shoppers travelling internationally has also had an impact on which channels beauty brands are focusing on. Downtown duty-free shops popular with Chinese customers have become less ubiquitous in favour of airports and cruises, which are seeing high growth in beauty spending.

“We’re really in places where consumers are staying for a longer period of time versus an airport,” said Beekman 1802 chief executive officer Jill Scalamandre. Now located on 14 Starboard cruise ships that serve 1 million combined passengers annually, the brand is in talks with another cruise line about entering an additional 16 ships in 2024. Meanwhile, the line is only in one airport’s duty-free location in New York.

In 2020, things were looking grim for the cruise industry. A cruise ship outbreak of Covid-19 was one of the first superspreader events to occur outside China. More than 700 passengers on a Diamond Princess ship that was quarantined off the coast of Yokohama, Japan contracted the illness and more than a dozen died.

But fear of disease did not deter cruise enthusiasts for long. The Cruise Lines International Association has projected that the number of cruise passengers will finally surpass pre-pandemic levels by the end of the year.

Cruise passengers’ beauty spending is growing even faster. LVMH-owned Starboard has seen 20 percent higher beauty spending than in 2019, said Sherrie Day, vice president of merchandising at Starboard.

ADVERTISEMENT

“It’s still one of the biggest and fastest-growing categories of business that we have today within our overall offering,” said Day.

Starboard has been eager to update its beauty offering, launching younger brands including Kylie Cosmetics, Nudestix, Goop and Supergoop, and expanding into categories not traditionally active in travel retail such as hair care.

“That’s very different [from] how we approached the business in the past,” said Day, who noted a prior strategy was primarily centred on colour cosmetics, fragrances and skin care for an older clientele. “That’s where your guests typically saw duty-free savings.”

Beekman 1802 has seen that demographic shift firsthand. The brand’s cruise sales are up 25 percent from 2019. It is holding off on further expansion into airports as cruises’ experiential format is key for building brand awareness.

“When you’re on a cruise, you’re stuck on that boat,” said Scalamandre. “You have the ability and the time to learn about our product and our brand.”

Even after China's borders reopen to international travel, holiday-makers will continue flocking to the luxury resorts on this tropical island renowned for duty-free shopping and golden sand beaches.

Liz Flora is a Beauty Correspondent at Business of Fashion. She is based in Los Angeles and covers beauty and wellness.

How not to look tired? Make money.

In a rare video this week, the mega-singer responded to sceptics and gave the public a look at what her beauty founder personality might be.

Request your invitation to attend our annual gathering for leaders shaping the global beauty and wellness industry.

Excitement for its IPO is building, but in order to realise its ambitions, more acquisitions and operational expenses might be required.