The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Amazon announced this week that under the current circumstances, the world's largest retailer will free up both space and resources in its UK and US warehouses until April 5 to prioritise vital necessities, which include health, household, personal care, medical, baby and pet care items. The increased demand — for not only essentials, but for delivery — is such that Amazon may indeed be one of the only companies currently hiring during what is otherwise a staggering coronavirus deep freeze, adding 100,000 employees to its workforce.

The current situation is a stark reminder that in a beauty market so often focused on luxuries, it is in fact the less-than-glamorous everyday essentials that really add up.

Of the United States Census Bureau’s estimate that there are roughly 7.58 billion people currently walking around the planet, think of the number of those people who buy toothpaste. And toothbrushes. Think of the number of men worldwide who shave every day and the number of women who menstruate monthly. Face cream and lipstick are lucrative, sure, but the basics — the utilitarian things that we all have to buy, and have to keep buying, even during unprecedented times of quarantine — are certainly where the really big opportunities lie.

For the categories including deodorant, oral care, shave and feminine hygiene, Mintel forecasts the overall global market value will reach around $93 billion in 2020, up from $85 billion in 2016, an increase of around nine percent, said Senior Innovation Analyst Rosalia Di Gesu.

ADVERTISEMENT

In this traditionally unsung sector, not only growth, but change, has been afoot.

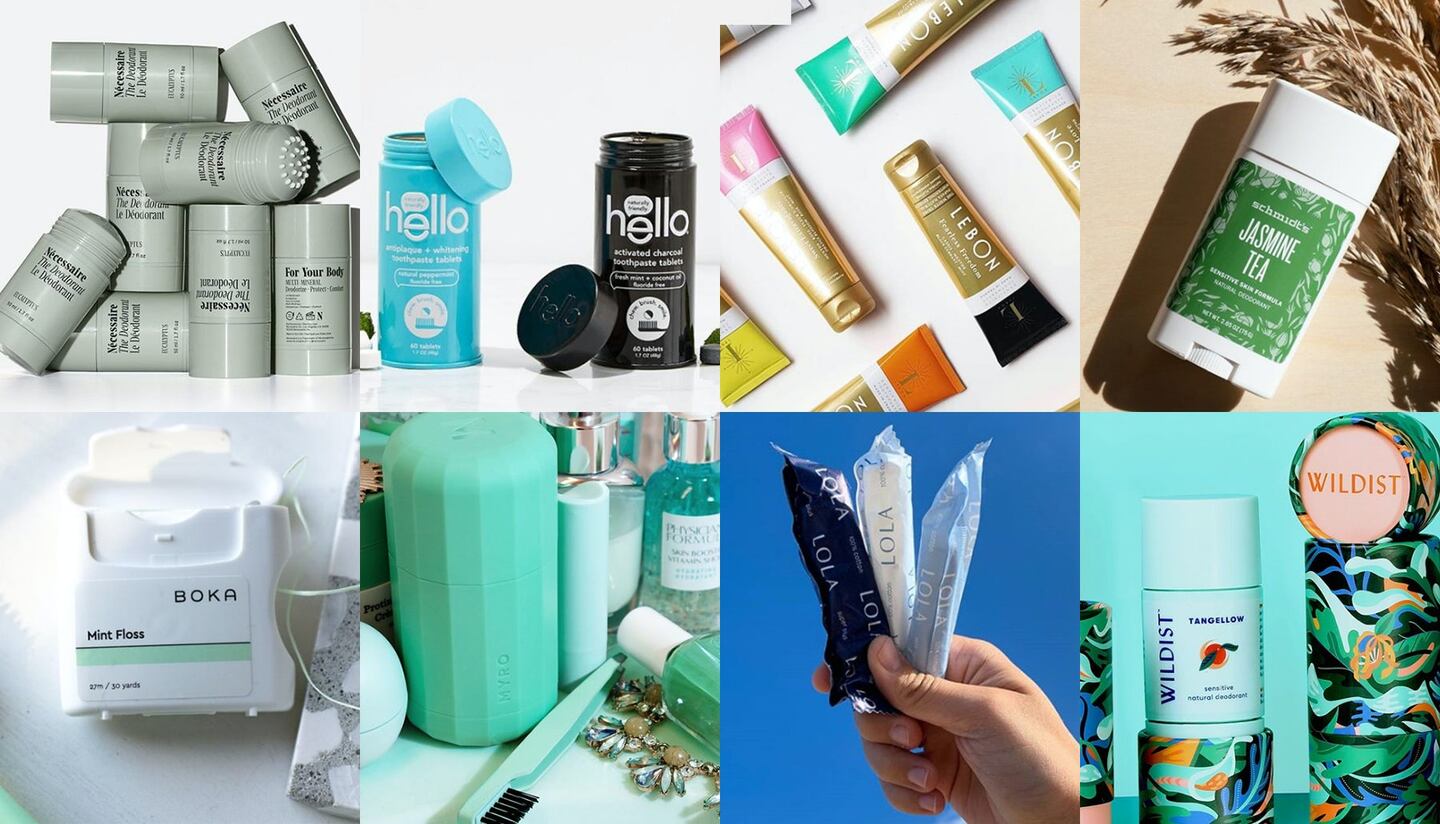

For decades upon decades we have accepted that when it came to basic care, there were only a few mass-market options: two dominant toothpaste brands, three female hygiene brands, two massive shave brands. They were reassuringly familiar, they did the job, and we didn't particularly question them, until somebody did. Why (why, why, why), for example, are tampons conventionally dipped in chlorine bleach? What's up with the (truly effective) sweat-clogging aluminum in antiperspirant? And should the fact that we are strongly advised against swallowing toothpaste, that stuff we swirl around in our mouths, be cause for… concern? As with every other pocket of the beauty industry, forward-thinking indies started cropping up — I unscientifically counted nearly 20 new deodorant brands alone — to seize the day. The legacy giants are snatching up these enterprising startups: Schmidt's to Unilever, Hello to Colgate, Native to P&G, Harry's almost to Edgewell, until the reported $1.37 billion merger was stymied by the FTC this past February. But they are also taking cues from them and introducing better, more thoughtful options for their own megabrands as they, too, see the markets they easily reigned atop for so long making meaningful change. Deodorant and toothpaste, exciting? Kinda!

In addition to burgeoning demand in emerging markets like Turkey and India, where, according to Mintel, education around personal care is increasing and there is more room for brand penetration, a handful of other key factors account for this broad sector’s explosive activity:

A Move to “Sustainable” and “Clean”

As with everything else in our industry and beyond, the move toward sustainable practices, non-toxic formulations and transparent modi operandi is a core feature of many of the buzziest new introductions to the essentials market. "Clean skincare is the fastest-growing component of skin right now, and as that fans out to other categories, consumers are questioning, 'why are these things in my other products? Are they more harmful than good for you? Why didn't anyone question this before?'" said Larissa Jensen, vice president, industry advisor for beauty at the NPD Group.

In a beauty market so often focused on luxuries, it is in fact the less-than-glamorous everyday essentials that really add up.

While concern about ingredient profiles is greatest among consumers in the upper echelons of the income spectrum, notes Jensen, it is not purely a luxury play.

“For the 100 percent, not the 1 percent” is the tagline of Hello Products, the stylish and well-priced clean oral care brand Craig Dubitsky (a co-founder of EOS lip balm) started after a chance stroll down a drugstore toothpaste aisle.

Of his a-ha moment, Dubitsky recalled, “At the time, Sensodyne had switched to a hologram of an extracted tooth on its package and it freaked me out. The last thing I’d ever want to see on toothpaste is an extracted tooth. I started picking up products and looking at ingredients, and I thought, ‘Wait a sec, this has saccharine? Didn’t that get vanquished from diet soda decades ago? And it’s in toothpaste, and children’s toothpaste? And there’s alcohol in mouthwash?’” Triclosan, an effective antimicrobial he learned was a suspected endocrine disruptor, was also a star ingredient in many products, despite the fact that the US Food and Drug Administration at one point had banned it from hand soap.

ADVERTISEMENT

“The other thing that got me was that the driving force in the category was shame,” said Dubritsky, referring to generalised marketing tactics that preyed upon consumers’ terror of the dentist and fear of less than fresh breath. “I thought, ‘This category seems very unfriendly.’ The friendliest word I could think of was ‘Hello,’ so I trademarked it all over the world.”

The feel-good brand, founded in 2012 and currently available everywhere from Walmart, Target and CVS to Publix, Whole Foods and Ulta, has been on a growth spurt. They’ve expanded from 19,000 doors a year ago to 45,000 today, launching innovative products like CBD toothpaste and mouthwash (“a fabulous humectant; great for your gums,” says Dubitsky) and the concentrated, coconut and MCT oil-rich Nakedpaste, which comes in a jar and turns mousse-y when stirred. (“It takes a little effort. It’s hardcore,” admitted Dubitsky). Thanks to the January merger with Colgate — for whom Dubitsky now also serves as chief innovation officer — international distribution is on the horizon, too.

Hello products | Source: Courtesy

It’s no wonder Hello was attractive to Colgate, the largest oral care company in the world. A report released by MarketWatch forecasts global toothpaste sales to reach approximately $37 billion by 2024, up from $26 billion in 2018. “We’ve been the chief driver for natural oral care in [US] mass retail for a while now, more than 50 percent,” said Dubitsky. “We’ve had triple-digit growth year-on-year for the past couple years, and we’re profitable.”

As brands emerge and innovate, the happy news is that established players are “taking note,” said Di Gesu, improving their existing assortments and launching new items in-step with the times.

Inspired no doubt by organic tampon brands like subscription-based Lola, Bon, Cora Period Care and The Honest Company, in 2019 Edgewell launched o.b. Organic and P&G launched Tampax Pure (called Tampax Cotton in the UK), made from organic cotton and free of dyes, fragrance and chloride bleach, and packaged with 90 percent plant-based applicators. Unilever’s Dove and P&G’s Secret both now make aluminium-free deodorant options, too.

For all brands in the basics category, the number-one opportunity for growth, said Di Gesu, is around sustainability: “There is a big gap for innovation there.” The British mouthwash brand Waken bills its stylish aluminum bottles as “endlessly recyclable.” Colgate’s vegan Smile for Good toothpaste range, introduced in Europe this past January, is packaged in fully recyclable HDPE tubes as an alternative to conventional tubes (whose layers of polymers, resins and plastics are estimated to take over 500 years to break down). Hello uses soy-based inks, FSC-approved cartons, and recently made the move to plant-based tubes, made from sugar cane. The brand’s new Toothpaste Tablets come in reusable tin canisters.

Indeed, refillability and reusability in packaging are the latest hot topics, Di Gesu said, calling out refillable natural deodorant brands like Myro and By Humankind and washable period underwear from lines like Wuka and Thinx.

ADVERTISEMENT

Nuts-to-Bolts Overhaul

The basics have long been categories ripe for reinvention: They feature workhorse items no one had much expectation for before. As consumers of these essential products, we’ve dutifully shelled out money to the same few companies over the course of our lifetime (talk about customer loyalty, even if unintentional) without ever really allowing ourselves to imagine that we could enjoy, say, our deodorant as much as the more lovely yet frankly just as utilitarian (…we use them every day… we immediately replace them when they run out…) cleansers and creams with which it shares shelf space.

The basics have long been categories ripe for reinvention.

For most brands, the opportunities for glossy, headline-making new launches have traditionally been in glamorous categories like makeup, facial skincare, and hair. But savvy entrepreneurs across mass and prestige recognised a unique opportunity to upgrade the everyday, in every way.

Of the toothpaste landscape — now teaming with new introductions from aspirational brands like Estrella, Native, Boka and Kopari — Dubitsky said, “It was very much a low-interest category. People expected everything was at parity. There was the blue brand and the red brand and it seemed like the cola wars between Coke and Pepsi. Why did it take so long for innovation in toothpaste? There was a status quo; the category had been on autopilot.”

Jaime Schmidt wanted to change the conversation around perhaps the most unremarkable product, deodorant, when she launched Schmidt’s Naturals from her kitchen in 2010.

“I wanted to change the stigma around deodorant being just a product you throw in your drawer and forget about,” she said. “In the earliest days I was selling my products at farmer’s markets here in Portland. I had a lot of face-to-face time with customers. The people who didn’t know the brand they were using was really high. They saw it as a necessity. They didn’t care.”

Natural deodorant was initially a hard sell, as “the consensus was that it doesn’t work, so that was a challenge,” said Schmidt. She focused on performance, a powdery finish, innovative scents, and good packaging.

Today, Schmidt’s is everywhere, from Target, Urban Outfitters, Whole Foods and Costco to mom-and-pops down the street, and is sold in over 30 countries worldwide. “My goal was to get it into as many hands as possible,” said Schmidt. The brand has branched out into bar soap with fragrances like Bergamot + Lime that match those in the signature deodorant line, household cleaning products, and toothpaste and mouthwash, “in response to what people were asking for,” she said. A portion of profits from their Lily of the Valley deodorant benefits the Jane Goodall Institute, and they recently collaborated with Justin Bieber to develop the (for-profit) “mellow and woodsy” Here + Now deodorant stick.

Schmidt reports that the brand is seeing 400 percent growth year over year. “After launch, it never slowed down,” she said. “We’ve scaled from batches of twenty on my stovetop to 200,000 in a warehouse.” Unilever, which reports that brands like Seventh Generation in its Sustainable Living Plan portfolio have been a major driver of the conglomerate’s recent growth, targeted Schmidt’s for acquisition in 2017.

We’re not just witnessing a revamp of the supermarket and drug store aisles, though. As Randi Christiansen, co-founder and chief executive of the minimalist-luxe body care range Nécessaire points out, “You now see retailers like Goop and Violet Grey actively participating in this category, making it a dialogue around the space of wellbeing and beauty.”

You now see retailers like Goop and Violet Grey actively participating in [the basics] category.

When Nécessaire launched two years ago, Christiansen, a veteran of Estée Lauder, and her partner Nick Axelrod, a former journalist and co-founder of Into The Gloss, introduced three unisex products: body wash, body lotion and a personal lubricant (the well-named Sex Gel). “When we started, everyone asked, ‘Why in the world would you start with the body concept? Isn’t facial skincare or hair a bigger category?’” recalled Christiansen. “We wanted to start in body in these ancillary products that had been an afterthought for so long, and we wanted to make them a first thought. We felt we could make a difference. This market is prime.”

Everything the duo creates — from the recently launched Body Serum to the brand-new eucalyptus-scented deodorant — goes back to the brand’s name, which is also its mission. “We think about your body as the thing you have to take care of the most. We have branded that Nécessaire,” said Christiansen. “These are the tools to take care of yourself.”

As the afterthoughts continue to get made-over, other beauty brands are stepping out of their prescribed lanes and into the basics action, too. Aesop’s mouthwash has always been a cult favourite, as has Weleda’s gritty Salt toothpaste. Recent out-of-left-field launches include non-toxic deodorants from hair care company Briogeo, cosmetics company Tarte, and squalane-focused skincare brand Biossance. If deodorant looks like a particularly hot ticket, it is: Innovation abounds (see Surface Deep’s glycolic acid-laced anti-odorant pads, Megababe’s Happy Pits detoxifying underarm “mask”), and growth follows. A January 2019 report by Zion Market Research clocked the market’s 2017 global value at nearly $70 billion, and projected it will reach just under $93 billion by 2024, attributing expected growth to interest among young people (hello, Gen-Z), and describing the products as a “topmost” daily care item among women worldwide. Though solids dominate in the US, a study by Grand View Research reported that sprays were the preferred formulation in fast-growing regions like India.

The Lifestyle Factor

Very simply, these days, we want everything we use to be nice. In this hygge-centric age of nesting and the fervent Instagram documentation that accompanies it — especially right now, as most of us find ourselves spending more time than usual at home under the current WFH edicts, finding comfort especially in self-care—we have become more aesthetic-, home- and design-obsessed than ever. We care about how we spend our money. We want experience. We want quality. We want a little bit of luxury, at every price point. Smart companies are delivering it.

Le Bon’s flask-like bottle of minty green mouthwash and Morihata Binchotan’s charcoal toothbrush might just be the best-looking things on my bathroom counter at the moment. Wildist’s chic BPA-free aluminum toothpaste tubes and whimsically printed cardboard cartons are worth buying just to look at. Nécessaire’s Sex Gel — a once taboo item — was purposefully designed to be elegant enough that “it can stand on the nightstand,” said Christiansen. Fashionable Instagram friends have taken to posting pictures of their Corpus and Agent Nateur deodorant sticks — what I imagine it might look like if The Row suddenly got into self-care. Deodorant, the new status symbol? Maybe. Meanwhile, I could not hurl my old razor — an eye-offending cheap hunk of purple plastic — into the trash fast enough when Flamingo’s sleek, off-white model came into my life. It lends my shower shelf a soothing, dare I say, almost spa-like feel. Making daily and weekly personal care chores into pampering rituals is the heart of self-care. Why not revel in the experience of shaving your legs?

Deodorant, the new status symbol? Maybe.

Even in the strictly mass channels, the bar has been raised exponentially. Personality and good taste don’t need to cost more. As Di Gesu confirms, “brands are trying to bring a design-led aspirational feel that you usually see in luxury markets to basics.”

“Usually, if things were well-designed, it meant they were expensive,” said Dubitsky, who set out to add the secret ingredient “fun” to his products. “Toothpaste is an everyday product. You have to brush your teeth. Turning those have-to’s into a bright spot in someone’s day is the magic.”

As NPD's Jensen remarks, these days it is getting harder and harder to differentiate mass from prestige. It is a trend she has already seen play out in the broader beauty arena. "Stuff looks good, it's well-designed and thoughtfully formulated. It's bringing the luxury feel to the masses and I think that's where the opportunity lies," she said.

It’s All Beauty

As toothpaste, deodorant and shaving cream start taking pride of place on bathroom shelves, and shelfies, once-rigid category lines are blurring as personal care, health, and beauty further converge. “The whole nature of the word ‘beauty’ is changing and has been for some time,” said Jensen. “The big shift is around wellness and wellbeing and that to me is the new beauty. It goes beyond the superficial.” She recalls judging entries for the Cosmetic Executive Women Awards 10 years ago, when “we wouldn’t accept personal care, like tampons, because they weren’t ‘beauty.’ I think times have changed. It’s about how we care for ourselves.” In terms of the market potential, the development of these categories “can definitely bring growth to the industry because it wasn’t in the industry before,” she said. “There are opportunities out there we haven’t thought about and this could be one of them.”

Related Articles:

[ Why ‘Masstige’ Could Be Beauty’s Most Important CategoryOpens in new window ]

[ How Big Brands Can Adopt a Start-Up MindsetOpens in new window ]

[ Why It's So Hard for Beauty Brands to Cross Over From One Category to AnotherOpens in new window ]

TikTok has birthed beauty trends with very little staying power. Despite this reality, labels are increasingly using sweet treats like glazed donuts, jelly and gummy bears to sell their products to Gen-Z shoppers.

This month, BoF Careers provides essential sector insights to help beauty professionals decode the industry’s creative landscape.

The skincare-to-smoothie pipeline arrives.

Puig and Space NK are cashing in on their ability to tap the growth of hot new products, while L’Occitane, Olaplex and The Estée Lauder Companies are discovering how quickly the shine can come off even the biggest brands.