The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

In the investment community, fashion has long been considered a risky bet. It’s difficult for brands to differentiate themselves in a saturated market, and even harder to achieve the scale required to turn a significant profit.

However, early in the pandemic, appetite for fashion acquisitions increased as investors saw distressed assets as good deals. (Licensing firm Authentic Brands Group, for instance, picked up Lucky Brand Jeans in August 2020 and Brooks Brothers in September 2020.) Then, as winners emerged from the crisis — with 2021 sales significantly up from 2019 — valuations rose, putting still-flush investors in a race to partner with top brands.

Now, the tables have turned once again. As inflation rises and consumer spending slows, dozens of fashion brands are looking for backers. But potential acquirers are thinking twice before they cut a deal, as stock markets sink and the likelihood of a global downturn grows. In the first quarter of 2022, total transaction value in the global M&A market dropped to $725 billion, nearly 23 percent lower than the previous quarter, according to research firm Global Data.

“Buyers have become very selective,” said Elsa Berry, founder of Vendôme Global Partners, which has advised brands including Dries Van Noten and Bally. “There is still a lot of money looking for investment opportunities, but growth, profits and brand DNA need to be solid. There is less forgiveness for underperforming companies or for brands that are not agile or not relevant to today’s consumers’ interests and expectations.”

ADVERTISEMENT

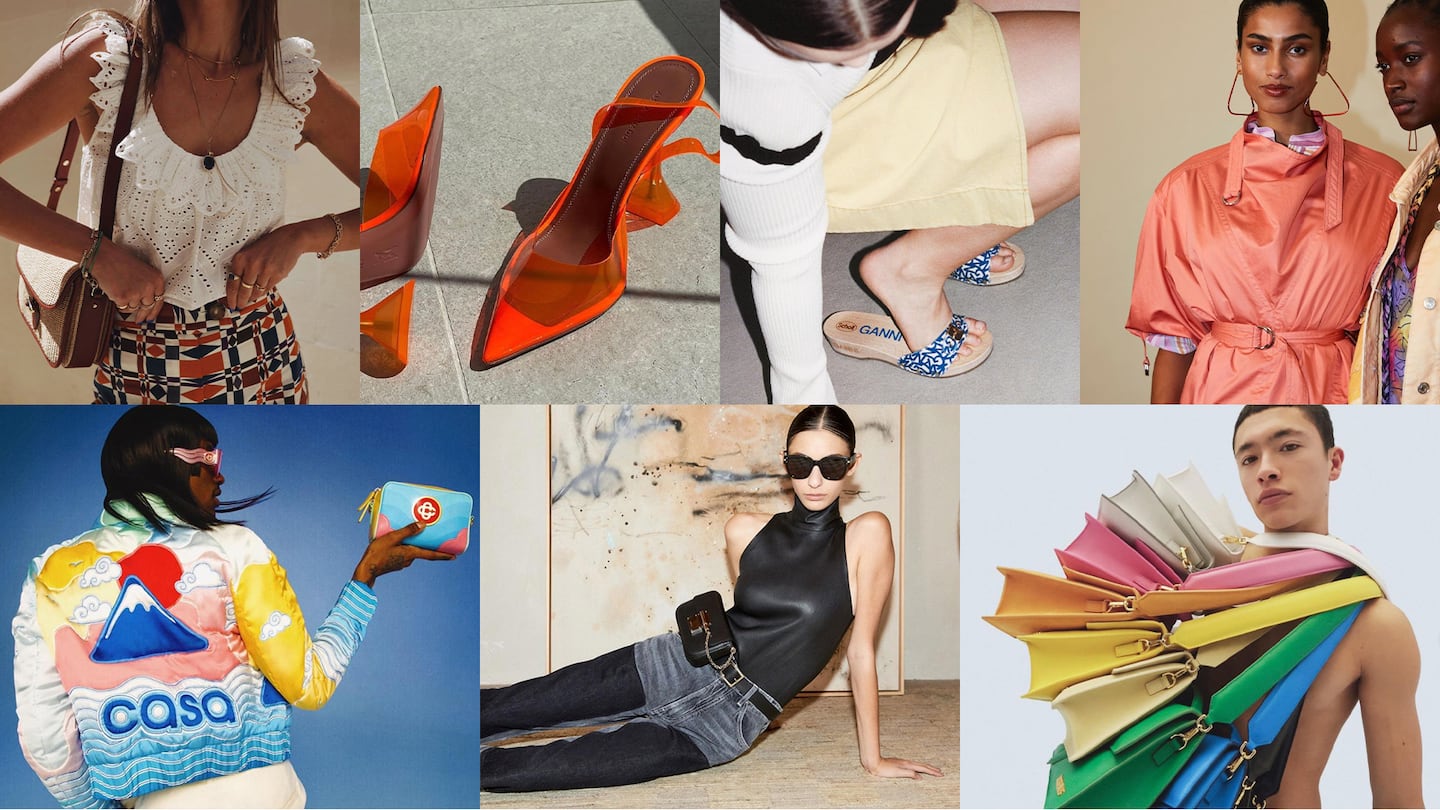

So, which are still worth pursuing? BoF spoke with industry executives, financial advisors and investors to identify seven fashion labels with strong identities and sound business models.

2022 Estimated Revenue: $320 million

The preeminent export of French bohemian-bourgeois chic since 1994, designer-founder Isabel Marant sold a 51 percent stake in her namesake business in 2016 to Paris-based fund Montefiore Investment, which has helped to steadily increase the label’s sales and expand its reach beyond hero products like the wedge sneaker, a global hit in the early 2010s. The company’s balanced distribution — both geographically and between wholesale, direct retail and e-commerce channels — as well as its accessible-luxury prices, gave it a leg up during the pandemic. Now, Montefiore is seeking an exit at a valuation of about $1 billion, according to multiple sources, most likely to a strategic partner that could help manage further retail expansion. While talks with a prospective buyer stalled in February 2022, a deal could be back in play, the source said.

2022 Estimated Revenue: $180 million

Ditte and Nicolaj Reffstrup’s transformation of a sleepy Coppenhagen-based knitwear label into a trendy global player known for its accessible, print-heavy separates, is well-documented. In 2017, LVMH-linked investment firm L Catterton took a majority stake in the business, providing the capital to grow its retail network to 36 stores. Now the company — whose mix of desirability and price point could help it weather a downturn — is a prime target for a new investor that could push it above $500 million in annual sales.

2022 Estimated Revenue: $200 million

Unlike most of the brands on this list, Jacquemus, which blends Mediterranean sensuality with youthful ease, is not seeking a backer, despite the fact that the digital-first label — 70 percent of overall sales are generated via e-commerce — is of interest to plenty of parties. It’s all thanks to designer Simon Porte Jacquemus’ ability to attract attention online — consider his show in the lavender fields — and create hero products — like his teeny-tiny handbags — that are both conceptual and commercial hits.

Now, he has hired former Paco Rabanne and Lemaire head Bastien Daguzan as chief executive to take the label to the next level. A beauty partnership with Spanish fragrance giant Puig — the owner of Rabanne — is in the works, and a Nike collaboration is launching in June 2022.

ADVERTISEMENT

2022 Estimated Revenue: $250 million

Los Angeles-based Mike Amiri has done particularly well in menswear and denim: his ripped, skinny jeans and ornate baseball jackets capture a certain American West Coast fashion niche. In 2019, the designer received a minority investment from Italian entrepreneur Renzo Rosso’s group OTB. The Diesel-owner tends to prefer majority investments in brands — Marni, Maison Margiela and Jil Sander are all part of OTB — so he would be a likely buyer if the brand was to sell. Amiri’s focus on denim, Rosso’s specialty, also helps.

2022 Estimated Revenue: $140 million

Morgane Sezalory‘s direct-to-consumer label Sézane, founded in 2013, used classic French tropes — with stripes and florals galore — to develop an easy-to-understand aesthetic that has appeal far beyond Saint-Germain-des-Prés. Its “French girl style” is a hit in the US, where other Paris-based contemporary brands have struggled to succeed because of poorly plotted distribution strategies and sizing that’s not so friendly to many American consumers. Sézane’s online-first approach smartly positioned it as a competitor to Los Angeles-based Reformation.

2022 Estimated Revenue: $58 million

An antithesis to the subdued flats and chunky sneakers that dominated women’s footwear for a decade past decade, Amina Muaddi’s colourful, plastic-fantastic heels — hefty with embellishment and sculptural in shape — managed to buck pandemic trends, with sales hitting $22 million in 2020 after just two years in business. A key challenge in the footwear business is distribution, and scaling up once distribution is secured: most luxury consumers tend to favour well-known brands more than in any other category. A partner could support an expansion into retail and a deeper product assortment.

2022 Estimated Revenue: $40 million

French-Moroccan designer Charaf Tajer made a name for himself co-founding the Paris-based streetwear label Pigalle with Stéphane Ashpool and working with Virgil Abloh and Supreme. With Casablanca, which he launched in 2019, he became the focal point (and a contender for several high-profile creative director positions, according to sources.) The line taps into the growing demand for resort wear for both men and women, with a heavy emphasis on relaxed silhouettes like boxer shorts and bowling shirts, done in silk twills printed with novel, tongue-in-cheek motifs.

The Spanish fragrance giant is taking a majority stake in the Swedish brand known for its crisp, minimalist branding and gender-free perfumes.

The purchase of the polarising streetwear label by the same company that backs Martha Stewart and Ben Sherman points to an M&A market in transition.

Private equity firms, mega retailers and strategic groups that emerge from the crisis with cash to spare will be on the hunt. But what will they be buying?

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.