The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

On Thursday, top diplomats from Ukraine and Russia failed to reach a ceasefire agreement, lowering hopes the two-week war would end soon. That same day, news that Russia had bombed a maternity hospital in Mariupol underscored the unspeakable human cost of the conflict.

There are economic costs, too. While the West is funnelling arms to Ukraine, it is also trying to avoid direct military engagement with its nuclear-armed adversary. Instead, it has deployed new forms of economic warfare in the shape of heavy sanctions, including stopping some oil and gas imports and freezing the foreign assets of high-net-worth individuals.

Russians and Ukrainians only account for 2 to 4 percent of global luxury sales, including purchases made abroad, according to Bernstein. So a disruption of sales in the region has relatively little impact on fashion’s bottom line.

But the sanctions — although aimed at crippling Russia’s economy and applying pressure on the country’s elite — have delivered a serious shock to the global economy as well. While economists are divided, some say the possibility of a global recession is rising, with major consequences for the fashion industry.

ADVERTISEMENT

Even before the war, there was trouble on the horizon. Prices for energy and raw materials were rising rapidly as sales began to decelerate from a late-pandemic rebound. In January, production in Italy, a key manufacturing hub, contracted by 3.4 percent in a single month, according to the Italian National Institute of Statistics.

Now, sanctions are sending prices for oil, gas and other commodities surging higher, with implications for both supply and demand, as production and distribution costs rise and consumers feel the impact at the petrol pump and in their heating bills, damaging the “feel-good” factor that drives demand for fashion goods.

Despite what Bernstein analyst Luca Solca has called a “silver lining,” as governments elect to postpone post-pandemic monetary tightening and budget austerity, fashion is going to take a hit. The low end of the market will likely be hit hardest, as lower-income families spend a larger share of their salaries on food and fuel. However, luxury brands will also begin to feel the pressure if consumer sentiment dips and those who traded up during the late-pandemic boom pull back once again.

The best-case scenario, according to Solca, is that the war ends soon and the luxury sector still grows 10 to 18 percent in 2022. But in a worst-case scenario, the war rages on, sanctions remain in place indefinitely and the industry slows to almost-zero growth. Jeffries has lowered its projections for sector growth from 14 percent to 9 percent.

What can fashion brands do to protect themselves?

Supply chain flexibility is critical, so brands can ramp manufacturing up or down in response to uncertain demand. Luckily, many companies became more nimble at this during the pandemic, and will now be able to more easily accelerate or decelerate production or find alternative suppliers.

Brands will also need to watch consumer sentiment closely and figure out where to best spend their marketing budgets in terms of customer segments, product categories and platforms. Preparing investors for lower growth is also key.

Top fashion leaders navigated the economic upheaval of the Covid-19 crisis by adopting the flexible mindset required to develop new tools and processes. They may need to do it again.

ADVERTISEMENT

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Swatch, Rolex, Levi’s, Adidas, Uniqlo and PVH exit Russia. The companies join the growing list of fashion brands that have halted commercial activities after the country’s invasion of Ukraine. Prior to Thursday’s reversal, Uniqlo owner Fast Retailing came under public scrutiny for refusing to shut up shop.

Ferragamo to revamp product offer, won’t give guidance for 2022. Marco Gobbetti, who became chief executive of Ferragamo in January after over four years at Burberry, said he aims to boost sales and plans to appoint a new creative director to inject the product range with “energy and newness.”

Adidas expects Russia hit in 2022, but China recovery. The German sportswear company said it expected a halt to its business in Russia due the war in Ukraine to put up to €250 million ($273.10 million) in sales at risk in 2022. It forecast net income to grow between €1.8 billion and €1.9 billion in 2022, up from €1.49 billion in 2021.

Boohoo hits revised sales goal but customer returns keep biting. Full-year sales rose 14 percent and the company is set to report adjusted earnings of about £125 million ($165 million), Boohoo said in a trading update Thursday. The retailer expects to continue to see higher return rates in the first half of this year, even while struggling with supply chain pressures.

Hugo Boss targets €3.1 billion in sales, halts Russian operations. The recently rebranded group is forecasting that sales will reach between €3.1 billion and €3.2 billion this year, following a return to pre-pandemic levels in 2021. Revenue for the year ending Dec. 31 reached €2.8 billion, flat on 2019 levels. Net income reached €144 million, up from a €219 loss in 2020.

ThredUp sales grew by 35 percent in 2021. The online resale platform posted record sales in the fourth quarter of 2021, it said Mar. 7, but profitability won’t be on the horizon this year. ThredUp garnered $73 million in sales in the quarter ending Dec. 31, 2021 — a 68 percent uptick from the same period in 2020 and an all-time quarterly sales high for the 13-year-old company.

ADVERTISEMENT

Jacquemus to stage Hawaii show. Just as Fashion Month wraps, Simon Porte Jacquemus is taking his collection to another continent. The French designer, whose 2019 stopover in Provence was an Instagram hit, is heading to the island of Oahu to stage his Spring/Summer 2022 show on May 9.

Galeries Lafayette to make Macau debut. The store is one of six retail and lifestyle brands new to Macau that will anchor a five-star hotel and shopping precinct. The new development will be built on a site that was previously earmarked as a casino, plans for which collapsed along with the business of Genting Hong Kong, its previous owner.

Shanghai Fashion Week postponed. The Fall/Winter edition of China’s most important fashion week event was originally scheduled to be held from Mar. 25 to Apr. 1. New dates have not been announced. The postponement comes as China’s financial capital battles its most serious outbreak of Covid-19 since early 2020.

JD.com posts quarterly loss as costs rise, revenue growth slows. The e-commerce firm posted a quarterly loss on Thursday as its operational costs surged, and reported its weakest revenue growth in six quarters amid slowing consumer spending, sending shares down 6 percent in premarket trade.

BEAUTY

A-Frame, the celebrity brand-building platform, raises $11.2 million. The company, which backs personal care lines fronted by the likes of John Legend and Naomi Osaka, is gearing up for three launches over the next six months. The round was led by venture capital firms Forerunner Ventures and Initialized Capital, with additional investment from Manzanita Capital, Moise Emquies and Columbia Care, as well as the Gap-founder Fisher family.

Estée Lauder Companies, L’Oréal and Unilever pull out of Russia. The beauty conglomerates halted commercial activities in the region. Procter & Gamble, which counts beauty names SK-II and Olay among its stable of brands, said it would reduce its product portfolio to focus on basic health items needed by Russians.

Beauty giant Natura defies sceptics with unexpected margin gain. The firm, which owns Avon Products Inc., Natura, Body Shop and Aesop brands saw its adjusted Ebitda margin rise by 90 basis points from a year earlier to 13.3 percent, the Sao Paulo-based company said in a statement Wednesday.

PEOPLE

Michael Kors chief executive Joshua Schulman to exit Capri, group head John Idol to remain. Schulman became chief executive of Michael Kors last August and was slated to succeed Idol in the top spot at Capri Holdings later this year. Analysts were surprised by the news, but not entirely discouraged about Capri’s future prospects.

Adidas announces new China chief as it looks to revive sales. The German sportswear brand appointed Adrian Siu — the former chief executive of Chinese fashion label Cosmo Label, who has held multiple roles at Adidas in Hong Kong and Shanghai — to take over from Jason Thomas, who became Adidas’ Greater China managing director in 2019.

Marks & Spencer chief executive Steve Rowe to step down in May. Rowe, who joined M&S at 15 years old and rose through the ranks, will step down after six years on the job.

Beautycounter names Amazon veteran chief commercial officer. Kara Trousdale, formerly Amazon Fashion chief marketing officer, will oversee the company’s e-commerce, retail and partnerships.

MEDIA AND TECHNOLOGY

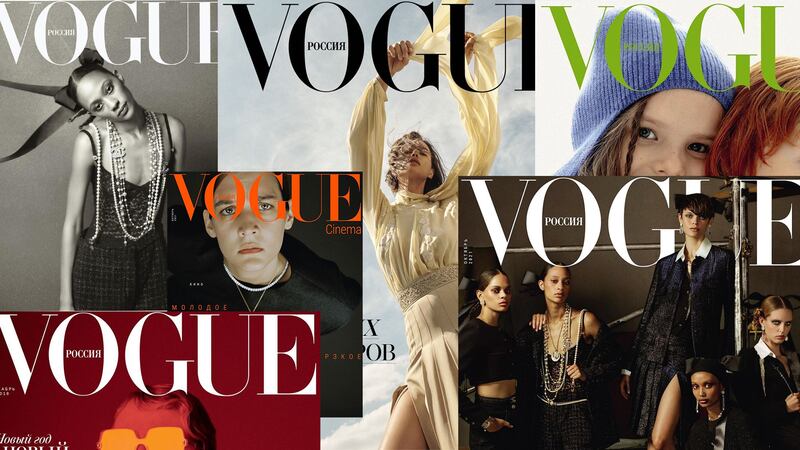

Condé Nast and Hearst halt publishing operations in Russia. The media companies both announced that they would pause publishing in Russia due to concerns over censorship, with Hearst suspending its relationships with its Russian publishing partners.

Highsnobiety’s newest venture is an NFT studio. The publisher and creative agency is adding a new technological dimension to its business that will see it launch its own NFTs and help other brands execute projects in the space.

Compiled by Joan Kennedy

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.

Resourceful leaders are turning to creative contingency plans in the face of a national energy crisis, crumbling infrastructure, economic stagnation and social unrest.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.