The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

The pandemic fashion era will be remembered for a surge in comfortable clothing among other things, but some shifts in spending between categories were temporary, while others will see sustained momentum over the longer term. The net result is an altered consumer demand structure comprised of new baselines for some fashion categories, a change which will compel some players to adjust strategies across product development, merchandising and marketing in 2022.

Consumers’ lifestyles were drastically altered through the pandemic, causing lumpy seasonal purchases characterised by irregular spikes and lulls of activity, such as surging demand for athletic wear and loungewear. Resizing needs have also disrupted usual demand patterns. In the US, 40 percent of women and 35 percent of men are a different size than in 2019. Now, some categories and products are starting to experience demand fatigue as the recent torrent of irregular purchases is set to subside.

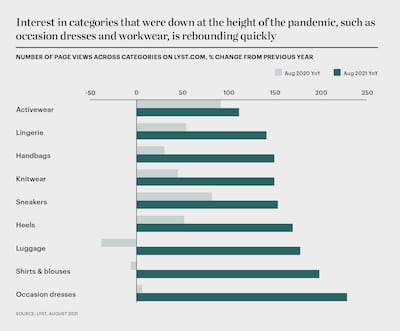

According to analysis by online fashion platform Lyst, pandemic-resilient categories such as nightwear, activewear and underwear are starting to see decelerating demand compared with the more-than 100 percent growth rates that were common in 2020. While 2022 will certainly not see a collapse of loungewear and leisurewear, some brands operating in these categories are beginning to slow down their inventory turnover. Launches of new activewear shorts and tops in the US and UK were down 20 percent and 50 percent respectively in late 2021 compared with the same period in 2020, according to e-commerce trend research by data analytics platform StyleSage, reflecting a similar trend in China.

ADVERTISEMENT

On the other hand, as more people return to the workplace and formal occasions are reinstated on social calendars, consumers will reinvigorate the formalwear business in the year ahead, building on momentum established in the latter half of 2021, as pent-up demand manifests as so-called “revenge shopping” in some markets after people’s social lives resume. Global monthly searches for occasion dresses, such as homecoming, wedding guest, cocktail and formal dresses, were already up 200 percent in 2021 compared to the previous year, according to StyleSage.

Similarly, in footwear, consumers will look beyond the sneakers and comfy sandals that ruled lockdown-era shopping. In August 2021, online searches for women’s heels were up more than 200 percent compared with the same month in 2020. However, more practical heel shapes that cater to adjusted consumer preferences will likely remain popular even as people dress up again: footwear styles with the highest number of units sold in 2021 were wedge heels, rubber heels, thick or block soles and kitten heels. In summer 2021, similarly comfortable options like Gucci pool sliders and Tory Burch “Miller Cloud” sandals were cited as bestsellers by Bloomingdale’s footwear merchandiser. Dressier sneaker styles were also high on consumer wish lists, particularly in the US, where searches for platform sneakers and brands such as Golden Goose were up 28 percent and 104 percent respectively.

In contrast to the reinvigorated demand for occasion dressing, workplace wardrobes will witness increased casualisation in some markets, such as the US and UK, as people adjust to new ways of working, including hybrid office-home patterns. “Work looks and feels different now,” said US-based retail consultant Kathy Gersch. “Virtual work and flexible hours aren’t going to go away. Brands that believe old patterns will revive will fall by the wayside.”

In another sign of creeping casualisation, workplace returnees in many regions have been shopping for casual blazers rather than suits: global search volumes for blazers were more than 100 percent higher in August 2021 than in August 2019. In some markets like Germany, searches for suits were down. Even some traditional and corporate offices will adopt hybrid styles, replacing suits and heels with business-casual styles and sneakers. Of course, there are nuanced differences between markets, where dress codes in some regions and professions will necessitate a return to formality. This said, brands will still find opportunities to tap into the casualisation shift by developing products with new fabric options or hybrid styles. For example, athletic brands Lululemon and Athleta have expanded into workwear, while Hugo Boss collaborated with Russell Athletic to produce suits in jersey fabric, some of which have shorts in place of trousers.

In addition to the changes companies make across design, product development and merchandising, they may also need to employ fresh marketing strategies that align with those changes. For example, exuberance in marketing campaigns will likely mirror consumers’ eagerness to dress up for social occasions again. As such, brands should consider bold ads and ambassadors suitable for the new mood, fine-tuning their approach to rapid shifts in social marketing trends on platforms like TikTok and Instagram to enable customers a seamless and instantly gratifying route to purchase new styles. At the same time, leveraging marketing channels that were largely ignored during pandemic, such as in-store events, will be increasingly important to build a sense of community and loyalty.

With consumer demand rebounding alongside ongoing logistics challenges in many global markets, 2022 pricing strategies should also be re-examined. Indeed, fashion executives across different value segments have cited plans to increase prices in 2022, with an average expected rise of 4 percent in luxury, 2 percent in mid-market and 5 percent in value, according to the BoF-McKinsey State of Fashion 2022 Survey. These price hikes are in part due to ongoing supply chain disruptions that will impact margins (see “Logistics Gridlock”). However, they will also have downstream effects on how consumers in each segment shop new styles to reboot their wardrobes.

Looking ahead, there will likely be increased appetite for experimentation and self-expression as consumers seek out more playful and energetic ways of dressing, boosting demand for novel designs, more adventurous colourways and creative pairings across categories in 2022.

“Often it’s the case during times of crisis, people revert back to shiny fabrics, bright colours, clothing that can inspire happiness,” said London-based trend forecaster Geraldine Wharry. “If you look at the 2008 [global financial] crisis, a couple of years after that, there was the trend starting to really gain traction in terms of bright clothing, almost clothing inspired by toy colours.” In the US, patterned trousers and women’s garments in bright colours such as fuchsia, green, orange and purple were more commonly sold out through 2021 versus 2020, according to StyleSage.

ADVERTISEMENT

The budding new consumer mood, which was captured in late 2021 by fashion critics like GQ magazine’s New York-based Rachel Tashjian, is likely to continue feeding into aesthetic preferences in 2022. “During the opening stages of the pandemic, there was defeatism… but that’s evolved into this type of exuberant attitude,” she said. Brand leaders are increasingly aligning their creative teams with the changing consumer sentiment: “People are ready for a little bit of optimism… [and] looking to be inspired,” said J.Crew Group chief executive Libby Wadle.

Executives, merchandisers and buying team leaders at retailers including Moda Operandi and Intermix noted soaring appetite for bold and risqué styles in late 2021. Indeed, this theme will likely extend into next year, with luxury players’ Spring 2022 collections by brands such as Michael Kors and Chanel showing skin-baring looks at fashion weeks in New York and Paris.

In a bid to capture demand for new styles, particularly from younger consumer cohorts, fast and ultra-fast fashion players are upping their inventory turn. Asos, Boohoo and PrettyLittleThing are among those to have recently accelerated product introductions. Chinese ultra-fast fashion player Shein consistently introduces more than 6,000 new products per day in limited units, with designs informed by customer data, which can be turned around in as little as three days. However, companies reliant on these business models are facing increased scrutiny for their environmental impact and labour conditions.

There are huge contradictions at the moment [with the concurrent rise of both ultra-fast fashion and]… the mindful consumer.

— Geraldine Wharry

“There are huge contradictions at the moment [with the concurrent rise of both ultra-fast fashion and]… the mindful consumer,” said Wharry. “I think we’re at a tipping point when it comes to people associating the item they buy with its contribution to society… [but even for those who are less concerned about that aspect], there will be more awareness of ‘how can this item also be recycled into other occasions?’” As such, a growing number of consumers are likely to allocate more of their wallet share to investment pieces and versatile items, even as inexpensive items and impulse purchases remain an important part of the wardrobe mix for many in 2022.

For most brands, the demand for new styles does not necessarily mean adopting bigger assortments, but instead using greater thoughtfulness around data- and demand-driven product launches and inventory mixes. With increased opportunities to collect consumer data through the growth in e-commerce spend, brands should track category shifts and pay special attention to how new assortments resonate with consumers.

To respond rapidly to changing preferences amid next year’s wardrobe reboot, brands should also strengthen the reactivity of their supply chains and think differently about the highly seasonal nature of the traditional fashion business. This means reimagining their collections and production cycles, while being prepared for uneven supply and demand. To achieve this, brands will need to collaborate with suppliers to carefully manage orders and inventories. They should also be aware of the need to balance consumer demand and pricing opportunities with the need for increasingly careful allocation of budgets to marketing and supply chain operations.

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

The chief executive of the company that owns Calvin Klein and Tommy Hilfiger says creativity will be even more of a differentiator in 2022 as fashion players better align merchandise planning with demand and continue their quest for greater market share.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.