The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

Before the Covid-19 pandemic, 30 to 40 percent of luxury sales were generated by shoppers in transit and abroad. However, international travel flows plunged to new lows at the height of lockdowns and by 2021, global tourism spending had been cut nearly in half. With tourists set to stay local in 2022, consumers and brands alike are doubling down on domestic luxury shopping.

Amid restricted international travel, consumers have switched to buying luxury online and at home, taking advantage of local duty-free offerings and the narrowing price gap between domestic and international markets. With tourism stalled, domestic shoppers helped buoy some of luxury’s biggest players. LVMH, Kering and Richemont were among the companies to defy expectations, seeing sales surge above pre-Covid levels by the second quarter of 2021 thanks to consumer enthusiasm to shop locally and online, particularly in Asia and the US. In 2022, much of this new onshore business will remain intact.

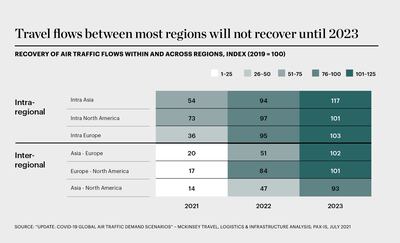

Aside from flows between Europe and North America which will get close to their 2019 performance next year, inter-regional travel is unlikely to return to pre-pandemic levels before 2023. Moreover, the recovery of travel between China and Europe — formerly a cornerstone of luxury purchases in Europe — is likely to lag other pairings, only reaching 50 percent of 2019 levels by 2022. In comparison, travel between the Middle East and Europe and between North America and Europe is expected to rebound to 110 and 105 percent of 2019 levels respectively by 2024.

ADVERTISEMENT

When travel becomes possible, luxury will be one of the first categories to benefit.

— Benjamin Vuchot

“[Recovery will be] phased across different regions,” said Benjamin Vuchot, chairman and chief executive of LVMH-owned luxury travel retailer DFS Group, in mid-2021. DFS is planning to open new T Galleria stores which will be fully operational by 2023 in Australia and New Zealand, two countries Vuchot predicts will be among the early beneficiaries of a resumption in travel. “When travel becomes possible, luxury will be one of the first categories to benefit.”

With cross-border travel restricted throughout 2021, domestic markets have had an opportunity to pick up the slack. Indeed, despite some reopening to international traffic, most shopping has been comprised of local customers. Following the reopening of non-essential retail in the UK, the Bicester Village designer outlet reported a flood of domestic shoppers and only a trickle of international visitors. Luxury retailers including Harvey Nichols and Selfridges in London and Galeries Lafayette in Paris have tried to adapt to the changing conditions, with the latter offering online clienteling and next-day home delivery.

Governments have been similarly proactive in encouraging luxury shoppers to spend more at home by cutting local consumption taxes, reducing import duties and promoting duty-free zones. In China, the popular holiday destination of Hainan saw duty-free sales surge by 257 percent in the first half of 2021, to 26.77 billion yuan ($4.13 billion). This followed a Chinese government announcement that it planned to transform Hainan into the world’s largest free-trade port. The plan included reduced corporate and individual tax rates, relaxed visa requirements and a drastic expansion of the Hainan duty-free programme. The government also lifted purchasing limits from 30,000 yuan to 100,000 yuan ($4,646 to $15,487) and allowed consumers to buy duty-free products online for six months after returning home.

The success of China Duty Free Group (CDFG), which controls around 95 percent of the Hainan market, has attracted companies such as LVMH’s DFS, Dufry and Lagardere over the past year. Looking forward, CDFG expects 20-fold revenue growth between 2019 and 2025. If that is accurate, the island province will account for one third of China’s luxury market by 2025. Meanwhile, elsewhere in China, municipalities in the city of Shenzhen are considering developing their own downtown duty-free zones.

Brands have also played their part in the shift to domestic sales. Many have launched or expanded local marketing campaigns and invested in their domestic physical footprints. In November 2021, Dior opened its first Middle Eastern exhibition in Qatar, which was adapted specifically for the region and will run until March 2022, and Chanel hosted its 2022 cruise collection in Dubai. In the US and UK, luxury brands such as Dior and Prada have compressed price differences between markets, reducing the allure of “travelling for a bargain” and shoring up consumer confidence in domestic purchases.

In China, Louis Vuitton and Prada have shifted some of their attention away from tourism hotspots and first-tier locations to new stores in cities such as Wuhan. Meanwhile, the activities of China’s daigou (grey-market surrogate shoppers who buy goods overseas to sell on the mainland) have shifted, with supply chain bottlenecks and closed stores and factories adding to the complexities of the trade.

While domestic markets have prospered, international airports and city-centre retail locations, which are often designed for the international traveller, have seen store closures and strategic shifts. In Japan, the ongoing travel ban has hurt duty-free retailers and tourist-focused outlets, leading to retailers shuttering more than a dozen stores in Tokyo’s high-end Ginza Six mall in early 2021. Meanwhile, tourism shopping tax refund company Global Blue, headquartered in Switzerland, saw a more than 80 percent drop in its first-quarter 2021 revenues compared with pre-pandemic levels.

With airports maintaining strict social distancing measures and border controls, the sense of a fun, airport-based experience will likely continue to diminish in the year ahead. Of course, this does not spell the end of international travel. In countries that have seen rapid vaccine rollouts, the appeal of leisure trips abroad is returning: seven in 10 Americans are eager to book a vacation, according to a recent Nielsen survey. Still, even as international bookings rise, the practical difficulties and risks (such as uneven vaccination rates, testing and quarantine requirements and the threat of viral mutations) will mean many consumers continue to favour domestic trips.

ADVERTISEMENT

However, some travel retail players are ramping up their duty-paid airport concessions alongside duty-free operations in provincial hubs across markets like Brazil. “With our new shops spread across the whole [Salgado Filho Airport in Porto Alegre] we will be able to… serve both domestic and international travellers [tailored accordingly],” said Gustavo Fagundes, chief operating officer of Dufry in South America.

Globally, domestic travel is on a steeper upward curve than its international counterpart, and is likely to recover to more than 90 percent of pre-pandemic levels by 2022, compared to 50 to 80 percent for international travel. Demand for weekend and short shopping trips, which historically accounted for a large proportion of luxury tourism spend, will remain subdued. So too will business travel, amid continued adoption of digital alternatives.

Domestic luxury consumption has similarly benefitted local and regional online players. In China, Alibaba expects to see a continued rise in cross-border e-commerce through 2022, as consumers browse for both foreign and domestic goods on local sites. Global luxury e-commerce platforms such as Net-a-Porter may see more traffic from regions like the Middle East, where they have a localised offering with competitive delivery and payment options and offer access to local designers. UAE-based luxury players with an online presence, such as Al Tayer Insignia’s Ounass and Chalhoub Group’s Tryano and Level Shoes, are also expanding fast across the region.

Citing the shift of international travel-based spending back to countries like the UAE and Saudi Arabia, Khalid Al Tayer, chief executive of Ounass and managing director of Al Tayer Insignia, which operates joint ventures with brands including Gucci and Saint Laurent, said the trend “has really accelerated the brands in their adaptation of local tastes and local cultures and local celebrations by coming up with communication, [events] and merchandising that appeals to them.”

Given the increased choice in home markets, both in terms of brands and channels, the rise of domestic luxury is likely here to stay. Another outcome of this shift is that consumers are discovering new local designers or investing more in familiar local names.

“Here in Shanghai, many showrooms are still reporting a big boost in sales of Chinese designer brands,” said Shaway Yeh, founder of fashion innovation and sustainability agency Yehyehyeh. “With consumers having less access to international fashion than before, this isn’t surprising, but it also speaks to the rising national confidence that consumers are tapping into, and a newfound sense of solidarity to support local businesses that won’t go away anytime too soon.”

A similar pattern is emerging in key African markets like Nigeria, where luxury consumers have been unable to travel abroad as easily as they did before the pandemic to shop in hubs like London and Dubai. “While we do expect customers to return to previous [international] buying habits, we’re certain that [more] ‘repatriated spending’ will become the norm. As consumers search for quality products they don’t have to travel for, local designers and artisans are exceeding expectations and matching — sometimes surpassing — the quality demanded,” said Avinash Wadhwani, co-founder of Lagos multibrand store Temple Muse, which stocks both global and local luxury brands.

Looking ahead, brands will need to adopt a two-pronged approach to capture the shift in luxury spend, targeting both domestic shoppers and aligning with new travel and purchasing behaviours. However, in line with projections that a travel rebound and sustained domestic luxury spend will not be mutually exclusive, the pressure will be on — particularly from investors who increasingly expect a full sales recovery in 2022 — to prioritise the right opportunities at the right time. Indeed, consumers may begin to cautiously travel internationally, while temporary VAT exemptions and other domestic incentives support demand at home. But most likely, luxury consumers will shop for more novel, local designs abroad, while continuing to spend on staples, accessibly priced luxury items and local brands in domestic markets.

ADVERTISEMENT

In response to these dynamics, travel retail and duty-free players will need to expand their horizons, offering more than the usual merchandise mix to travellers and broadening the travel retail proposition beyond the simple offer of tax savings. Companies must offer value-adds, such as unique local products or collaborations, that enrich the customer experience and create a pull factor for reluctant travellers.

European luxury hubs will be especially hard-hit by the sustained domestic spending boom in China and other markets and will need to find ways to compensate. In Paris, London and Milan, brands and retailers most dependent on international shoppers will likely see sub-par performance through the end of 2022 at the earliest. Leading European luxury department stores that are able to adapt their approach will remain influential in their respective cities. However, while many have expanded their e-commerce operations, they will continue to rely largely on in-store shoppers, meaning they will need to increasingly court local customers using enhanced localisation strategies.

Luxury brands will need to continue to expand their footprints across regions, moving away from an over-reliance on tourist destinations. In towns and cities, retail locations in transport hubs and domestic terminals offer potential for growth. To build meaningful relationships with domestic customers, players will need to sharpen their localised marketing strategies. This may mean introducing enhanced clienteling, holding community-building events or offering tailored merchandise mixes to accommodate local tastes.

As the dynamic between travel and luxury shopping shifts, luxury brands need to formulate new solutions to capture both domestic shoppers and incoming tourism in the longer term, reallocating their investments accordingly. This, in turn, will require a rethink of all aspects of doing business, across product development, marketing, merchandising and retail.

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

São Paulo-based retail behemoth JHSF Participações has had to strengthen its relationships with local luxury clients during the pandemic. With tenants ranging from Louis Vuitton and Christian Dior, the group’s chairman has a plan to persuade well-travelled Brazilians to keep shopping domestically.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.