The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

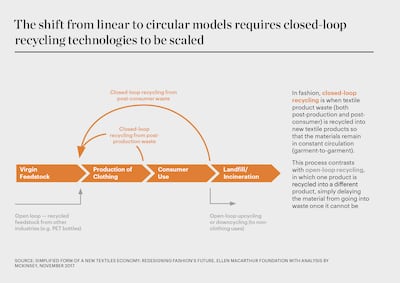

Globally, the fashion industry is responsible for around 40 million tonnes of textile waste a year, most of which is either sent to landfill or incinerated. Textile production, meanwhile, consumes vast quantities of water, land and raw materials. Engaging in closed-loop recycling is seen as a critical opportunity to both reduce the extractive production of virgin raw materials and limit textile waste. Closed-loop systems recycle materials again and again, so that they theoretically remain in constant circulation.

Textile production is more resource-depleting than many other sectors. In the European Union, for example, the textile sector is the fourth-biggest consumer of primary raw materials and water (following food, housing and transport), while the industry’s reliance on fossil fuel-based textiles like polyester only adds to the challenge. Yet there are pockets of the global fashion industry that are starting to get serious about addressing these challenges at scale by working towards developing closed-loop recycling processes that have the potential to limit textile waste, reduce carbon footprints and partly upend fashion’s extractive business model.

Currently, less than 10 percent of the global textile market is composed of recycled materials, and this is largely the product of open-loop recycling using PET (polyethylene terephthalate) bottle waste, which does not address the need to recycle materials from the fashion industry and has been criticised for breaking the well-established closed-loop process of recycling plastic bottles into other plastic bottles. If the industry is to reduce the volume of waste going to landfill and limit the extractive production of textiles, closed-loop recycling systems will be required at scale.

ADVERTISEMENT

The shift to more closed-loop systems is underway, driven in part by regulatory efforts to support a circular economy, which aim to relieve some of the pain points relating to waste collection and sorting. The EU’s Circular Economy Action Plan, scheduled for adoption in the third quarter of 2021, incorporates an objective to ensure circular economy principles are applied to textile manufacturing, products, consumption and waste management. Meanwhile, the EU’s Waste Directive Framework requires countries to separate all textile waste by 2025, and several European nations have implemented extended producer responsibility schemes, making brands and retailers responsible for post-consumer waste and requiring financial contributions from producers for the collection, recycling and reuse of products.

“Regulators should keep on putting that pressure on markets,” said Patrik Lundstrom, chief executive of Swedish textile recycling company Renewcell. “Every country needs to take responsibility and create that circularity.”

China published a five-year plan in July 2021 to develop its circular economy by promoting recycling, remanufacturing and renewable resources. In the US, the National Institute for Standards and Technology is making progress in its ambition to facilitate a circular economy for textiles. Still, if the industry is to align with global climate objectives and its own commitments on sustainable materials, it will also need to take action at a brand level to make a difference.

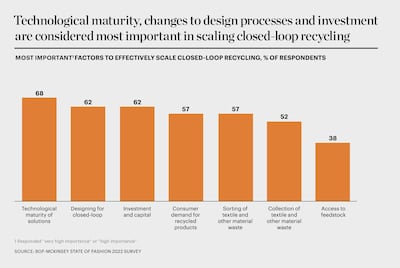

One challenge the industry faces is achieving sufficient scale in closed-loop processes. However, recent innovations are starting to reach maturity, moving from pilots to proofs of concept on industrial levels.

Mechanical cotton recycling, through which cotton is shredded into reuseable fibres, has been in use for a long time. One example of mechanical recycling is the large-scale pilot in Bangladesh by the Circular Fashion Partnership, led by the Global Fashion Agenda, which aims to capture and direct post-production waste back into the production of new textiles, as well as developing solutions for deadstock. The partnership plans to roll out to countries including Vietnam and Indonesia.

Mechanical cotton recycling has historically been more difficult to implement for garments that are already worn, mainly due to challenges in collection and sorting. As a result, less than 1 percent of cotton was recycled in 2020. However, among recent initiatives, Hong Kong-based yarn spinner Novetex Textiles, in collaboration with the Hong Kong Research Institute of Textiles and Apparel (HKRITA) has developed a method called The Billie System for the mechanical recycling of cotton blends. The system does not consume water or produce chemical waste and currently processes up to three tonnes of fabric per day.

To enable recycling of the various textile fibres on the market, more innovative recycling solutions other than shredding are required. For non-blended materials, a number of industrial-scale solutions are beginning to hit the market, and further capacity is set to become available. For example, Renewcell has partnered with brands including H&M and Levi’s and has an agreement with Beyond Retro’s parent company Bank & Vogue, which supplies post-consumer waste to Renewcell. Renewcell is building a new plant that will be able to recycle 60,000 tonnes of textiles a year by 2022. Meanwhile, US materials company Eastman is investigating using polyester in its new $250-million recycling plant.

One of the technical challenges facing the industry is the high proportion of garments made from material blends such as cotton and polyester, which make them hard to separate. Still, after years of research and development and pilot ventures, this is another area that is reaching maturity and scale. In Europe, viscose producer Lenzing and recycling company Sodra are working in partnership to increase the annual capacity of Sodra’s technology for blended fibre, with the goal of processing 25,000 tonnes of textile waste per year by 2025. In Turkey, denim company Isko has signed a licensing agreement for the “green machine” technology developed by HKRITA, which recycles cotton and polyester blends. The technology is also being scaled with partners in Indonesia. In Australia, BlockTexx is building a textile recycling facility for polyester-cotton blends that aims to recycle 10,000 tonnes a year by the end of 2022.

ADVERTISEMENT

A critical piece of the used clothes recycling puzzle is collection and sorting. “If there can be larger-scale collection and sorting, that would help us tremendously,” said Ronna Chao, chairman of Novetex. “I have limited space where The Billie System is housed, so I can’t be the collector, storer and sorter all at once… [but] if we can partner with, for instance, NGOs or other players within the industry [in other countries], where they can do the collection and the sorting… then we can process that in a more meaningful way.”

To that end, authorities, waste companies and brands are making efforts to develop solutions. These offer some promise, but further efforts are required, including moving from manual to automated sorting at scale. For example, in Sweden, Sysav waste treatment and recycling company opened the world’s first industrial-scale, fully automated textile sorting plant in 2020, with the capacity to sort 24,000 tonnes of textile waste a year. In the same year, Belgium-based Valvan Baling Systems launched Fibersort, an automated sorting machine that can sort around 900 kilograms of post-consumer textiles per hour.

Some companies are also pioneering digital solutions to manage material flows. Sorting for Circularity, created by Fashion for Good in 2021, is planning to launch a digital platform on which textile waste from sorters can be matched with recyclers. Brands including Adidas, Bestseller and Zalando are facilitating the project. In addition, a number of brands are helping to solve the sorting problem by encoding detailed information about materials into products with digital identifiers (see “Product Passports”).

While these initiatives show the industry is making progress, some issues remain to be resolved. One significant challenge is that recycling facilities are sometimes far from the source of the feedstock, which could lead to significant emissions resulting from long-distance transport.

“We’re taking clothes from [Asia] and bringing it all back to Sweden, making new Circulose [material], stripping it back and then making new viscose fibre. However, our next plant is going to be next to a harbour [and], of course, in the long-term, we probably want to have a plant also in Asia, and maybe one in the Americas,” said Lundstrom of Renewcell. “There will be capex investment needed to make all this happen. How do we make that as low as possible and manage that? So that’s another trade-off with going circular.”

Experts mostly agree that closed-loop recycling will not realise its potential until products are specifically designed for that purpose, for example by facilitating the easier separation of materials through design. Claire Bergkamp, chief operating officer at Textile Exchange, a nonprofit aimed at improving the environmental standard of raw materials production, suggests that this also means incorporating the intention to recycle into design curriculums and industry-wide organisational thinking: “What’s going to happen to the product when the first user is done with it? Is it durable? Will it have a long enough life? That’s the crux. If you are intentionally making something that is not long-lasting, it needs to be recyclable,” she said.

For that reason, some parts of the industry are coalescing around common design standards, such as the Jeans Redesign Project by the Ellen MacArthur Foundation. By May 2021, 80 percent of the project’s participants had made fabrics or jeans that complied with the guidelines. Additionally, designers have more access to software that can support design with recycling in mind, such as the Circular Material Library from Circular Fashion, which showcases materials that have been tested and validated for future recyclability. Furthermore, innovations such as Ecocycle, a dissolvable thread recently launched by industrial thread company Coats, are making the recycling process more efficient, unlocking the removal of non-textile components and facilitating easier sorting of materials from the same garment.

“We know that it will be more challenging for some fashion brands — probably SMEs, for instance — to invest in closed-loop solutions at this early stage in the technology’s development,” said Shaway Yeh, founder of Shanghai-based fashion innovation and sustainability agency Yehyehyeh. “But designers really do need to make meaningful efforts to embed this principle in their studios now, if they haven’t already. The creative teams in the business should be incentivised by leadership to harness some of their innate creativity to scale up circular material use. It’s just a matter of priorities.”

ADVERTISEMENT

As an increasing number of fashion players commit to circular materials, scaling will be essential in collection, sorting and recycling. However, the rollout of industrial processes will drive down prices and boost demand for garments made from circular materials. To maintain a competitive advantage and secure access to circular textiles, fashion players may need to invest directly in recycling facilities and contribute to finding solutions for collection and sorting. Scaling, of course, will require capex and will mean decision- makers will need to look past the still comparatively cheap costs of virgin materials.

[Closed loop] is not the silver bullet… the silver bullet is producing less stuff.

— Claire Bergkamp

To be sure, closed-loop recycling processes also present environmental challenges, including greenhouse gas emissions and significant water use, with some critics suggesting that the reduction in impact from closed-loop processes will not be enough to slow down fashion’s negative impact on climate change. “[Closed loop] is not the silver bullet… the silver bullet is producing less stuff,” said Bergkamp of Textile Exchange.

However, seen in the context of comparisons with open-loop — or indeed linear — models, closed-loop processes are an important part of a wider system change for circularity. “Recycled always has lower impact [than linear]. There’s no questioning it,” said Bergkamp. “It’s probably a perfect solution for an imperfect situation.”

While there is reason for optimism that many closed-loop technologies will reach industrial scale in 2022, fashion leaders will need to approach the challenge holistically, incorporating circular textile solutions into a wider effort to eliminate toxic chemicals, decarbonise the supply chain and reduce emissions, if the industry is to significantly reduce its levels of environmental harm.

Opens in new window

Opens in new window

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

Amid mounting evidence of fashion’s dramatically negative climate impact, countries, communities and companies are mobilising around protecting the planet. However, a new era of climate action will be required if fashion is to meet ambitious targets to reverse the damage being done.

As fashion brands pursue closed-loop recycling, they increasingly need to engage with suppliers who can help them source 'circular' materials and scale these efforts. However, the chairman of Novetex Textiles says meaningful mass adoption is a chicken-and-egg conundrum.

The fashion industry continues to advance voluntary and unlikely solutions to its plastic problem. Only higher prices will flip the script, writes Kenneth P. Pucker.

The outerwear company is set to start selling wetsuits made in part by harvesting materials from old ones.

Companies like Hermès, Kering and LVMH say they have spent millions to ensure they are sourcing crocodile and snakeskin leathers responsibly. But critics say incidents like the recent smuggling conviction of designer Nancy Gonzalez show loopholes persist despite tightening controls.

Europe’s Parliament has signed off rules that will make brands more accountable for what happens in their supply chains, ban products made with forced labour and set new environmental standards for the design and disposal of products.