The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

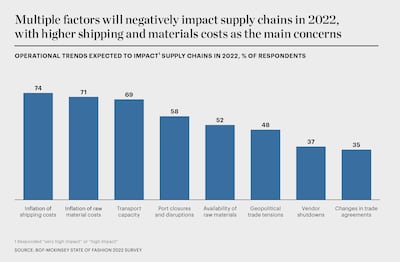

Around half of global businesses suffered supply chain disruptions in 2021, with one in eight severely affected. This was the fallout from a combination of global and local factors, including material and component shortages, transportation bottlenecks, staff unavailability and rising shipping costs. Many of these challenges show no signs of abating, and the majority of business leaders expect logistical roadblocks to persist through 2022 and beyond. Indeed, 87 percent of fashion executives in our BoF-McKinsey State of Fashion 2022 Survey expect supply chain disruptions to negatively impact margins next year.

It is likely that logistics challenges will only intensify in 2022, with global surges in demand clashing with unpredictable pressures on freight services, ports and terminals. There are growing concerns that increased levels of disruption and price hikes could last longer term, or even represent a new logistical normal for the global fashion industry.

“The supply chain assets are running at full capacity. It’s bursting at the seams. So my opinion is that these frustrations will continue until at least the second half of [2022 or]… even extend into 2023,” said Joseph Phi, group chief executive of supply chain management company Li & Fung, which counts fashion brands among its clients.

ADVERTISEMENT

Three structural factors are at play in creating these conditions, which add to the impact of the Covid-19 pandemic: operational challenges (caused in part by soaring demand), shifting industry dynamics and new waves of trade agreements and regulation.

After months of lockdowns, consumer demand is surging in markets such as the US and UK. However, some brands have struggled to obtain products on time, with manufacturing and transport delays — on sea, in the air and on land — leading to chronically depleted inventories in some cases. Brands with manufacturing operations in regions severely impacted by the pandemic have faced staff shortages and factory closures. In August 2021, Adidas said that pandemic-related supply chain disruptions could cost the company up to €500 million ($586 million) in sales.

Outbreaks of Covid-19 have also worsened port congestion and restricted ship availability. In July 2021, container ship supply was 11 percent lower than the previous September. The situation was exacerbated by the limited availability of steel container boxes, as surging demand to restock inventories amid shipping disruptions left thousands of boxes at sea, in freight hubs or in ports. The dislocation contributed to skyrocketing costs and undermined brands’ efforts to keep pace with demand. In response, some turned to air freight and trans-continental rail alternatives, leading to new capacity jams, longer waiting times and rising costs in air and rail freight, too.

Alongside logistical challenges, fashion and shipping companies are facing a range of new regulatory and trade hurdles. Among incoming regulations is the EU’s proposal for a world-first carbon border tax and new restrictions on emissions from ship engines. Companies must manage these alongside challenges such as import bans from China’s Xinjiang region. For companies shipping between the EU and the UK, Brexit adds new layers of paperwork and customs delays. Equally, ongoing trade tensions between the US and China threaten to exacerbate supply chain disruptions.

In 2021, the vulnerability of maritime chokepoints was highlighted by the Suez Canal blockage, when a container ship became wedged in the canal, preventing shipping in both directions. The six-day event delayed the transport of billions of dollars’ worth of goods. Though such events are rare, they demonstrate the industry’s reliance on a limited number of supply routes. “[With] the Panama Canal, there’s always a threat of closure, either by accident, or maybe intervention by government and other factors too [but]… what happened in the Suez Canal… is a call to action that we need to identify and build contingencies. Given what’s going on, overland freight [via train between China and Europe] is definitely a viable alternative,” said Phi of Li & Fung.

What happened in the Suez Canal… is a call to action that we need to identify and build contingencies.

— Joseph Phi

Today, it costs up to six times more to ship a container from China to Europe than it did at the start of 2019, and up to 10 times more from China to the US West Coast. In real terms, shipping a 40-foot container from Asia to the US West Coast cost between $1,600 and $2,100 in July 2019; now it will set companies back between $21,000 and $23,000. Looking ahead to 2022, shipping prices will likely continue to climb and remain above their pre-pandemic levels in the longer term, as shipping companies continue to consolidate and new capacity only slowly emerges.

In response, fashion brands may need to abandon the idea that cost increases are hiccups, instead planning for a permanently more expensive logistical future. Still, some fashion players will be more exposed to these factors than others. There may be opportunities for luxury brands to pass on higher costs to customers by raising prices.

Globally, pressure on containers and shipping will continue to require logistics players to deprioritise some shipments, while a lack of road-transport drivers, both domestically and internationally, will exacerbate operational costs and delays. In holding back the delivery of products to stores and homes, these conditions will continue to make it difficult for brands to respond to booming consumer demand. To further complicate matters, customers have become accustomed to super-fast delivery, both online and in store, with delivery delays putting a strain on customer satisfaction, while adjacent trends such as accelerating demand for sustainable materials are putting additional pressure on supply.

ADVERTISEMENT

In the longer term, brands will need to balance the desire to enhance speed to market with the need to alleviate supply chain pressure. That may mean streamlining production, logistics planning and booking capabilities, as well as putting in place contingency plans and alternative suppliers, while remaining as agile and flexible as possible. To do this, some companies are bringing shipping in-house: in late 2021, companies such as Walmart and American Eagle invested in dedicated container services to avoid third-party shipping congestion. In the last mile of delivery, dynamic rerouting and drone delivery could present alternative solutions to short-staffed last-mile distribution in some circumstances.

At the same time, brands need to work with their suppliers to scale up nearshoring and reshoring activities to build production capacity and safeguard access to raw materials. Indeed, a number of European companies doubled down on nearshoring efforts through the pandemic, moving textile manufacturing from China to Turkey to minimise delays. Over 70 percent of companies plan to increase the share of nearshoring close to company headquarters, and roughly 25 percent intend to reshore sourcing to their headquarters’ country, according to McKinsey’s Apparel CPO Survey 2021.

“As an industry, we still have too long lead times,” said chief executive of PVH Corporation Stefan Larsson. “There is a big opportunity to better match planning and buying to demand, and that’s something that we learned when Covid hit. The second-biggest learning is to build resilience into the supply chain now.”

Of course, adapting operations and adjusting to rising demand will come at a cost to a company’s profitability. Shoe brand Steve Madden reported that supply chain disruptions were behind a $30-million cut in its first-quarter sales expectations in 2021, while Asos has warned that supply chain pressures and consumers returning to pre-pandemic behaviour could reduce 2022 profit by over 40 percent. There will likely be more profit warnings attributed to supply chain issues in the year ahead.

Given the hefty bottom-line implications of logistical gridlocks, many fashion executives are working hard to find solutions. “It has been difficult to plan inventory flow with much precision,” said Erik Nordstrom, chief executive at Nordstrom. “We do not expect those conditions to change any time soon.” Common practical measures have included introducing agile ways of working to improve efficiency, upgraded inventory management, reimagined supply chain organisations (incorporating visibility-enhancing solutions) and technologies such as sophisticated dashboards known as digital supply chain control towers.

As leaders innovate to create efficiencies, there is an imperative for slower-moving brands to expand their focus from efficiency initiatives to digital and operational enhancements which help to better plan and track logistics. In addition, expectations for prolonged logistical turmoil will encourage larger brands and retailers to consider more fundamental solutions. It is likely some will explore cross-functional or even vertical integration, such as bringing distribution or production in-house.

Fashion executives have pointed to further digitisation of supply chain operations as the way forward. VF Corporation chairman, president and chief executive Steve Rendle said that he sees “significant opportunities in creating a hyper-digital supply chain.” Meanwhile, H&M Group chief executive Helena Helmersson suggested that a lot of the firm’s supply chain development is focused on technology and that it is a priority to find “competitive advantages in a supply chain context when it comes to speed, agility, cost efficiency and price.”

With logistics caught in the industry’s crosshairs like never before, decision-makers should think carefully about how to adapt. In 2022, brands will aim to regain control of supply chains while communicating potential delays with customers at each step. It will pay to consider control towers, in-house distribution, nearshoring of manufacturing and cutting-edge inventory management, all while securing early access to raw material supplies.

Leading brands will collaborate closely with logistics providers, communicating frequently and expecting that providers will hold more cards in negotiations. To keep a watchful eye on finances at a time of rising supply chain costs, they may also consider using a zero-based budgeting system, requiring all costs to be re-justified at each budget review. In short, as the pressure intensifies, careful planning and a deeper integration of supply chain considerations into decision-making will become table stakes in the year ahead.

Opens in new window

Opens in new window

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

The Hong Kong-based supply chain management company’s chief executive says fashion brands should diversify sourcing, adopt top technologies and invest in critical contingency planning.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.