The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

In the global effort to vaccinate people against Covid-19 and recover from the economic shocks related to the pandemic, some countries are better positioned than others. The key parameters that will shape recovery patterns in the year ahead include levels of health resilience — a function of both Covid-related measures and domestic healthcare systems —and economic resilience. Gaps will also be impacted by varying levels of government fiscal support and the maturity of their digital economies. In response, fashion companies operating international businesses will likely need to tailor strategies to local conditions, as well as take steps to mitigate risks and boost their supply chain resilience.

A significant differentiator is access to vaccines, which varies substantially between low- and high-income countries. Of the approximately 5.5 billion vaccine doses that were administered globally by September 2021, some 80 percent were in high- or upper-middle-income countries, according to the World Health Organization. Looking ahead, many low-income countries may not receive enough doses to vaccinate all adults until well into 2022 or 2023. With the ongoing threat of new variants, these countries could stand to be the most exposed to further humanitarian crises and deeper economic shocks.

“The pandemic is reversing hard-won development gains, adding to the problems facing the most vulnerable. The post-Covid recovery must not leave anyone, or any country, behind,” World Trade Organization director-general Ngozi Okonjo-Iweala declared in a 2021 plenary session, calling for equitable access to vaccines and greater trade cooperation. “Keeping global markets open is essential for a strong and sustained recovery.”

ADVERTISEMENT

Countries that lack the digital infrastructures for remote working, or whose economies rely heavily on manual labour, are particularly susceptible to further shocks. The fashion industry has seen workers in manufacturing hubs impacted by ongoing Covid-19 outbreaks and associated shutdowns that have punctured production output. Throughout 2021, outbreaks in Vietnam led to the closure of numerous factories affecting supply for companies such as Adidas and Swiss shoe brand On. Meanwhile, Ethiopia, Honduras and India also saw increased uncertainty around job security and working conditions, while China’s zero-Covid policy continues to result in factory shutdowns. Coupled with the slow distribution of vaccines in some markets, these ongoing disruptions will have both upstream and downstream consequences on fashion.

The global fiscal response to the pandemic has been three times higher than the response to the 2008 global financial crisis, exceeding $10 trillion in the G20 alone. However, many countries struggling under high debt burdens have lacked the firepower to drive recovery. For fashion, this meant some companies used the financial support available to them to maintain labour and budget balances, while others have faced prolonged difficulties. With many existing fiscal support schemes set to come to an end in the year ahead — while others have already ended — companies will need to consider alternative strategies to support a return to growth.

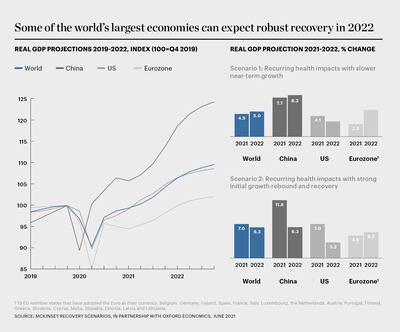

Looking ahead to the medium term, McKinsey in partnership with Oxford Economics has developed a range of scenarios for how the virus will likely influence the recovery of individual economies, based on the varying levels of effectiveness of their healthcare systems and fiscal responses. While some countries are likely to see their GDP growth return rapidly to pre-pandemic levels, others will likely face recurring health shocks and therefore weaker short-term growth or even prolonged downturns.

In the scenarios analysed across fashion’s largest consumer markets, 2022 is broadly expected to be a year of growth. However, there will be variations across countries, reflecting the unpredictable nature of viral outbreaks and differences in fiscal and healthcare responses. In the US, year-on-year GDP growth of 3 to 3.2 percent is likely in 2022, according to McKinsey analysis. While the economy in China had regained GDP levels from the third quarter of 2019 by as early as the end of the first quarter of 2020, further year-on-year growth of between 6.3 and 8.2 percent is expected in 2022. Across the Eurozone, the year-on-year GDP growth rate is predicted to be approximately 5.3 percent. For example, in Germany, the forecast is 5 to 5.3 percent GDP growth, following rising infections and accelerating inflation through mid-2021. Despite record numbers of Covid-related deaths and one of the most severe economic slowdowns, the UK outlook is brighter, with a forecast of 7.2 to 7.4 percent in 2022.

Adjacent to fiscal and healthcare responses, consumer sentiment will play a large part in determining the speed of return to pre-pandemic social and working lives. Spending restrictions by consumers during Covid-19 lockdowns combined with stimulus payments boosted savings across key consumer markets such as the US, where saving rates in 2020 were double that of 2019. This will translate into increased optimism next year, particularly among younger and wealthier customers who will continue to drive spending in fashion categories, particularly in the luxury segment. The spikes in spending that emerged in China during so-called “revenge shopping” periods in 2020, when lockdowns ended and consumer confidence returned, are expected to play out in some other fashion markets as they recover. In the US and UK, these spending spikes will likely occur after the start of 2022, according to McKinsey analysis.

As a result of these and other factors, McKinsey Fashion Scenarios project an almost complete recovery to pre-pandemic sales levels in 2022 in Europe, the US and China, with the latter’s incremental growth in domestic luxury spend outperforming. Globally, these scenarios suggest that total fashion industry sales could surpass 2019 levels by 3 to 8 percent in 2022, with the luxury segment surging by 15 to 25 percent over 2019 levels.

However, lower- or middle-income countries that have lower vaccination rates face the risk that Covid-19 could become endemic, causing cyclical waves of the virus and subsequent slowdowns in economic growth. On top of this, the highly transmissible Delta variant has accelerated the spread of Covid-19 in some countries, with its high levels of vaccine resistance disrupting the recovery trajectory. For example, in India, the variant’s proliferation in the first half of 2021 pushed consumer sentiment to a record low and disrupted fashion industry suppliers. While spending has rebounded in urban areas especially, with the country’s GDP predicted to expand by around 8 percent in 2022 according to McKinsey, supply chains remain impacted amid ongoing factory closures.

Across other regions, growth projections remain uneven and subject to rapid change. In Latin America, McKinsey projects between 2 to 5 percent GDP growth in Mexico in 2022, which is linked to growth in the US economy, while Brazil is set to experience slower growth of 1.5 to 3 percent. In the Middle East, growth is expected to pick up overall, driven by the loosening of travel restrictions and increased oil output. Meanwhile in Africa, the outlook is mixed and will depend on vaccine dissemination and the severity of potential new waves of Covid-19. In Nigeria for example, the outlook is increasingly muted for 2022, with growth expected to be 2 to 4.5 percent following another wave of the Delta variant in 2021.

ADVERTISEMENT

Given such a mixed global picture, there will likely be significant variation in recovery profiles across consumer markets and sourcing countries that play a critical role in fashion’s supply chains.

Given such a mixed global picture, there will likely be significant variation in recovery profiles across consumer markets and sourcing countries that play a critical role in fashion’s supply chains. Moreover, the outlook remains volatile as Covid-19 continues to send shockwaves across the global economy. This, combined with the inflationary impact of additional supply chain disruptions — including shipping industry consolidations, global labour shortages, longer-term regulatory changes and a burgeoning energy crunch — and other macroeconomic and geopolitical risks, means significant and unpredictable challenges will remain in the year ahead.

“We are living in very uncertain and uncharted times,” declared the International Monetary Fund’s chief economist Gita Gopinath at an October 2021 press briefing for the organisation’s world economic outlook. “We have never seen a recovery of this kind… and we have to be particularly vigilant.”

As fashion leaders consider potential scenarios for the markets in which they operate in the year ahead, they will need to plan for accelerating growth in some and delayed recoveries in others. As a result, they should adopt market-specific strategies that reflect conditions in their key centres of commerce. Those who navigate this uneven outlook by better anticipating granular demand trends across specific income groups, cities and demographics within each market will likely fare better (see “How the Global Wealth Gap Is Impacting Fashion”).

Furthermore, given the supply chain uncertainty embedded in this outlook, fashion brands should reassess the risks of relying on each manufacturing hub in their sourcing footprint while weighing up the need for supply chain resilience with the increased cost of sourcing from new and diversified locations. In any event, brands should consider avenues to strengthen their supply chains and logistics networks, where a renewed focus on flexibility, sustainability, transparency and cost management will help them meet consumer demand as it ebbs and flows across markets. By planning for an uneven recovery and allocating resources accordingly, fashion players are more likely to achieve a smoother upward growth trajectory in 2022 and beyond.

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

Widening income inequality and other demographic pressures in 2022 could exacerbate the already uneven global economic recovery from the pandemic.

This week’s round-up of global markets fashion business news also features Korean shopping app Ably, Kenya’s second-hand clothing trade and the EU’s bid to curb forced labour in Chinese cotton.

From Viviano Sue to Soshi Otsuki, a new generation of Tokyo-based designers are preparing to make their international breakthrough.

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.

Resourceful leaders are turning to creative contingency plans in the face of a national energy crisis, crumbling infrastructure, economic stagnation and social unrest.