The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

The use of social media to discover and shop for fashion gained traction over the course of the Covid-19 pandemic as customers — unable to visit stores or socialise in-person during global lockdowns — spent more time at home scrolling through their feeds. Indeed, 74 percent of consumers say that they are now more influenced to shop via social media than they were before the pandemic, and 70 percent cite clothing as one of the product categories they shop for most on social media.

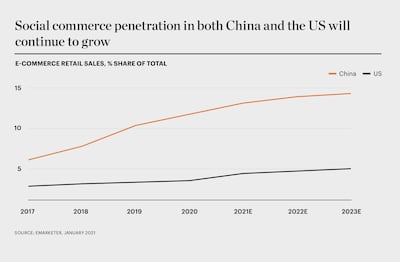

While Western markets may still lag China in rates of adoption, social shopping has gained a global foothold and is poised to grow in the year ahead as social media giants from Facebook and Instagram to YouTube and Snap Inc. invest heavily in shopping features and take advantage of new functionalities. Looking forward, in the US alone, annual sales through social commerce are expected to surge from approximately $37 billion in 2021 to $56 billion in 2023 (this includes sales of all products and services agreed on social platforms regardless of the method of payment or fulfilment). By 2027, worldwide social commerce sales are set to reach over $600 billion.

In some markets, social media is fast becoming a preferred way of shopping and interacting with brands, as social platforms are increasingly augmented with advanced technology. Indeed, social commerce — from in-app checkouts on social media platforms to sales transactions on livestreams — is already booming in China, where super-apps like WeChat offer users a wider array of functions than just social networking and messaging services, and social media players like Douyin and Xiaohongshu have boosted their e-commerce capabilities. In 2021, sales from social commerce across all sectors in China are set to top $363 billion (which includes products or services purchased on social networks regardless of the method of payment or fulfilment), up 35.5 percent from the previous year. This is approximately 10 times higher than social commerce sales in the US.

ADVERTISEMENT

Product discovery and engagement with brands on social media is already commonplace across most global markets, with customers used to seeing brand activity and references alongside social exchanges with one another and influencers and within entertainment platforms. In fact, nearly half of US TikTok users say they have purchased a product or service from a brand after seeing it advertised, promoted or reviewed on the platform. However, the next frontier for social commerce in Western markets is at the narrow end of the marketing funnel — seamlessly checking out in-app and paying for products within the social media ecosystem — where a reduced number of clicks to convert an impression into a sale offers a promising route to sales for brands.

As such, social media platforms are making moves to embed the entire shopping journey — from discovery to checkout — into their core user experiences with functionality ranging from livestream sales and integrated product catalogues to augmented reality try-on. Fashion is the largest single category sold via social media in the US, as well as the leading category for livestream events, suggesting that brands will find consumers willing to shop on these channels.

“There’s no reason to say that just because we [in the West] don’t have [companies like] Alibaba [whose platforms Tmall and Taobao have livestreaming functionality baked into their ecosystems], we won’t have [livestream] e-commerce,” said Sophie Abrahamsson, chief commercial officer at Bambuser, a B2B player equipping brands with livestream technology that in 2021 entered into a master agreement with LVMH. “I don’t see it as an obstacle, it’s just a different starting point.”

Engaging with social commerce formats including those in livestream channels in China can provide brands with learnings that are beneficial when adapted for other geographies and platforms. Tommy Hilfiger held a livestream in China that attracted 14 million viewers and sold 1,300 hoodies in two minutes, which encouraged the brand to extend its livestream programme to Europe and North America thereafter. However, specific market characteristics in China — including longstanding consumer comfort with in-app shopping and the outsized influence of key opinion leader (KOL) hosts for livestreaming — cannot be simply replicated in other markets.

“Tech, corporations and consumers need to be at the same pace. In China, all three things came together way before Europe and the US,” said Mei Chen, Alibaba Group’s head of fashion and luxury for the UK, Spain and Northern Europe.

Nevertheless, interest in social commerce is growing fast in markets like the US, where the number of people who make at least one purchase on a social channel during the calendar year is expected to be 50 percent higher in 2022 than it was in 2019, reaching 96 million customers. In the UK, where consumers have been more hesitant, compound annual growth rates for social commerce usage are still expected to be more than 15 percent from 2019 to 2022, growing a further 9 percent in 2023 — suggesting that 15 million people will have made a social commerce transaction during that year.

Social commerce consumers typically skew young, meaning the medium has special appeal for brands targeting Gen-Z and Millennial consumers. This means there is still significant room to grow as consumers become more comfortable with in-app payments and platform functionality improves. Brands have a window of opportunity to tap into local consumer needs and build strategies that capture market share early.

To connect brands with consumers, global social media giants are doubling down on developing in-app shopping experiences. Instagram, which launched its Shop feature in 2020 and partners with brands such as Chloé, Michael Kors, Oscar de la Renta and Marc Jacobs to make products shoppable either in-app or by steering customers back to their own websites, is ramping up shopping features such as Drops. This is a new destination within the app where consumers can discover and buy the latest and upcoming product drops from brands like Adidas.

ADVERTISEMENT

Meanwhile, Snapchat is applying its augmented reality capabilities to enable users to virtually try on clothes and accessories from brands such as Prada and Piaget, and TikTok has been expanding commerce partnerships and functionality, testing livestreamed shopping with select brands. In the US, during Walmart’s first shoppable livestream fashion event with TikTok, it gained seven times more views than anticipated and grew its TikTok followers by 25 percent, according to William White, chief marketing officer for Walmart US. In August 2021, the social video platform announced an expansion of its partnership with Shopify including a pilot test of TikTok Shopping with select merchants across the UK, US and Canada, which could help brands enable social commerce.

Looking beyond tech giants and incumbents, new venture capital-backed entrants, such as Flip and Chums, are offering fashion brands opportunities to engage with shoppers on hyper-immersive platforms, while platforms such as Amazon-owned Twitch, Discord and Clubhouse (which do not currently offer in-app checkout features) enable brands to target specific demographic cohorts. In the case of Twitch and Discord, for example, their gaming-enthusiast user skews male, attracting attention from menswear and streetwear companies such as sneaker marketplace StockX, which joined Discord to promote its latest products.

You don’t have to be like the audience, you don’t have to pretend [to be] one of them if you’re not, they’ll see straight through it. All you have to do is show you understand them.

— Adam Harris

Brands looking to leverage community-specific platforms as a way of boosting the discovery phase of social commerce should take care to engage authentically with users. “You don’t have to be like the audience, you don’t have to pretend [to be] one of them if you’re not, they’ll see straight through it. All you have to do is show you understand them,” cautioned Adam Harris, global head of Twitch’s brand partnerships studio. Meanwhile, outside the tech ecosystems of the US and China, specialist social commerce platforms are gaining ground such as Trell in India, which saw investment from the likes of H&M Group.

While social media channels have typically been viewed as a means to increase reach and drive traffic to brand-owned websites or multi-brand e-tailers — owing to limited platform functionality, hesitation on the part of brands to relinquish control of checkout and payment data to third-party channels and previously lukewarm reception from consumers — social commerce is reaching an inflection point. “The old ‘buy’ button doesn’t work… you are taking your shopper away from their online experience to fulfil a purchase… [so] you burst the bubble. You create what we call an ‘abandoned basket effect,’” said Maria Prados, head of vertical growth teams at Worldpay.

Soon, however, even seamless payments will become table stakes, so brand laggards must overcome the reluctance to surrender control and increasingly have conversion in mind when investing in social. With the number of fashion brands adopting Instagram as a sales channel growing, more are likely to follow their lead next year, moving away from a focus purely on reach and seizing opportunities to generate paying social customers.

Largely thanks to WeChat, China has seen huge strides in frictionless payments, shortening the sales funnel by reducing the time and friction between discovery and purchase. The ability to interact with sales agents on WeChat to make purchase decisions, and the importance of mini-programmes both on WeChat and other platforms in the Chinese social ecosystem, point to a future integrated model that global platforms could look to for inspiration.

Brands that may have had concerns about relinquishing valuable customer and conversion data to third-party channels will need to devise innovative ways to collect data, such as through discount code-driven sign-ups. Alternatively, some brands are choosing to build their own in-house social channels. For example, US retailer Nordstrom created its own livestreaming platform in 2021, where it hosted shopping events at which customers could chat and purchase products from featured brands such as Burberry.

Brands bold enough to test social-first strategies will be rewarded as younger consumers increase their time spent on digital platforms and spark trends that are born on social media. “Whether or not Gen-Z is your primary consumer, they definitely set the trends and drive brand heat. And when you look at where trends start and where things go viral, it is almost always with Gen-Z,” said Jenny Campbell, chief marketing officer at Kate Spade.

ADVERTISEMENT

To capture the demand for social commerce, brands will need to implement a strategy that can scale fast. The speed at which TikTok took the world by storm is just one example of the pace of uptake, so fashion brands will need to be agile to ensure they are meeting consumers in the digital spaces where they are spending time. As such, companies should tailor their approach for existing mainstream platforms, while conducting A/B testing on emerging platforms to experiment with reaching specific customer segments.

However, brands will need to apply a tailored approach to users of each platform; while some might welcome a more playful style of engagement, such as those on TikTok, others are more conventional. There are regional differences, too, with consumers in some Asian markets approaching livestreams with more of a transaction-forward, deal-focused mentality than consumers elsewhere. While navigating these nuanced considerations, brands will also need to stay abreast of the latest trends and innovations, as currently niche platforms could very quickly become mainstream — or currently buzzy platforms could just as quickly lose their edge over rivals.

Looking ahead, as shoppers place increasing importance on convenience, brands that can unlock the potential of social commerce by offering simple, frictionless shopping will be well-positioned to unlock revenue streams. Indeed, brands thinking ahead to the longer-term growth of social commerce and permanent changes in global consumer shopping habits will use next year to test and learn from approaches that leverage social media platforms to create seamless shopping experiences from product discovery to checkout.

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

Snap Inc.’s new global head of fashion and beauty partnerships is tasked with helping brands such as Prada, Dior and American Eagle harness augmented reality so that the social platform is more shoppable.

The algorithms TikTok relies on for its operations are deemed core to ByteDance overall operations, which would make a sale of the app with algorithms highly unlikely.

The app, owned by TikTok parent company ByteDance, has been promising to help emerging US labels get started selling in China at the same time that TikTok stares down a ban by the US for its ties to China.

Zero10 offers digital solutions through AR mirrors, leveraged in-store and in window displays, to brands like Tommy Hilfiger and Coach. Co-founder and CEO George Yashin discusses the latest advancements in AR and how fashion companies can leverage the technology to boost consumer experiences via retail touchpoints and brand experiences.

Four years ago, when the Trump administration threatened to ban TikTok in the US, its Chinese parent company ByteDance Ltd. worked out a preliminary deal to sell the short video app’s business. Not this time.