The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — For the most part, first-quarter results were better than feared, with sales declines ranging from the high single digits (Hermès) to the mid-to-high teens (LVMH, Kering, Moncler), with a couple of outliers on each side (Brunello Cucinelli at minus 3 percent and Gucci at minus 22 percent). Companies pointed to a strong recovery in mainland China, albeit boosted by ongoing travel restrictions, but warned that the full impact of coronavirus will be felt in the second quarter.

However, the slow reopening of production sites in Europe (especially Italy) gives credibility to the prospect of a rebound in the second half. This is indeed good news as supply chain dynamics dictate that, for year-end holiday sales to happen, production orders need to be placed around now. Hopes were further fanned with talk of reopening non-essential retail stores in the US, sending share prices soaring.

Corporate activity was relatively subdued this month, with two deals being announced in the luxury resale segment: France-based Vestiaire Collective secured investment from its existing investors as well as Vaultier7, Korelya Capital, Cuir Invest and Fidelity International. UK-based Luxury Promise raised its first institutional round of capital from UK-US investment firm Beringea. Reports have also leaked of a potential buyout of UK-based makeup brand Charlotte Tilbury, citing interest from strategic players such as L'Oréal and Estée Lauder.

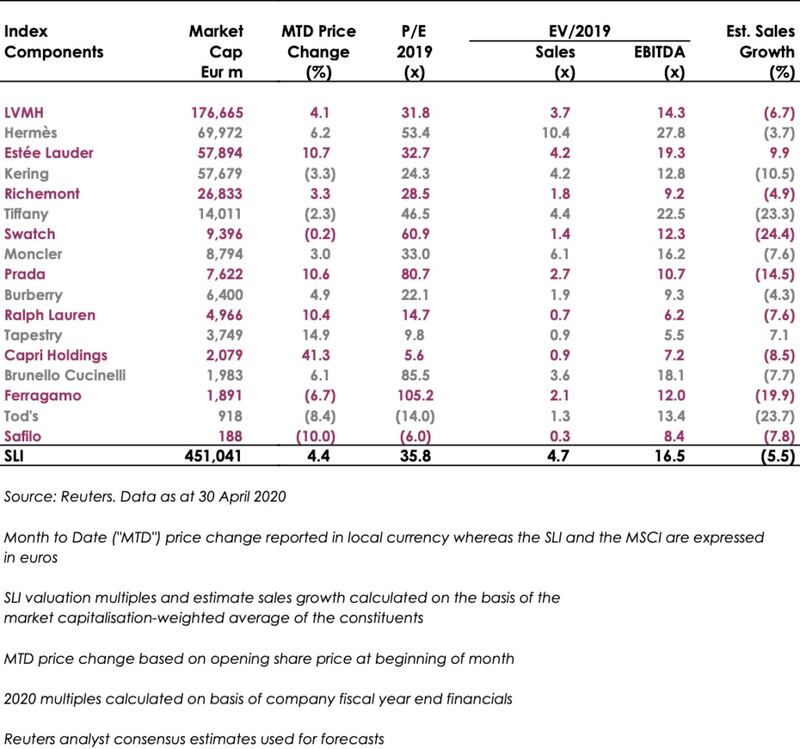

The Savigny Luxury Index (“SLI”) ended April 2 percent up, while the MSCI recovered lost ground against the SLI by gaining 11 percent this month. Both indices have been fuelled by prospects of life beyond lockdown, as evidenced by the recovery in China.

ADVERTISEMENT

SLI versus MSCI

SLI Graph April 2020

Going Up

Going Down

What to Watch

While the welcome lifting of lockdown restrictions is just around the corner, the true key to the sector’s recovery will be whether the world can remain out of lockdown in the second half of the year. A coronavirus comeback in the autumn would ruin the all-essential holiday season. Digital, to which some traditional luxury houses have only paid lip service, is fast becoming a priority.

Sector Valuation

Pierre Mallevays is the founder and managing partner of Savigny Partners LLP, a mergers & acquisitions advisory firm focusing on luxury brands and retail.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.