The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Investor sentiment in September was a tug-of-war between hope and fear, with hope pulling fear over the line at the last minute. Hope was driven by positive trading updates from Swatch, Prada, Capri Holdings and Tod's. UBS and Bank of America also published bullish notes, citing a strong rebound in post-lockdown sales and the opportunity for growth in digital and in mainland China. Fear took a tug of the rope mid-month as the World Health Organisation warned of a rapid rise in Covid-19 cases throughout Europe, which prompted more travel restrictions and local lockdowns.

Uncertainty was further fuelled by an increasingly polarised US election cycle that culminated in threats to the democratic process by the Commander-in-Chief himself. Finally, what would have been luxury's largest deal ever fell through, with LVMH and Tiffany locking themselves in a high-stakes legal dispute. It is therefore nothing short of a miracle that the Savigny Luxury Index, our company's measurement of the performance of 17 listed groups representing over 150 of the largest luxury brands in the world, ended in positive territory this past month.

Technology and luxury are venturing closer together. TikTok is launching a digital fashion month in partnership with brands such as Saint Laurent, JW Anderson and Louis Vuitton. It will host two livestreams per week until October 8 to showcase the latest Spring/Summer 2021 collections. On the final night, October 8, singer-songwriter Nick Tangorra will host the "TikTok Runway Odyssey," a virtual fashion runway livestream in partnership with UMA and Alice & Olivia.

Burberry livestreamed its Spring/Summer 2021 show on Twitch, becoming the first luxury fashion brand to use the Amazon-owned platform, which is typically used for video-gaming content. Amazon launched its Luxury Stores shopping platform: the platform is available, upon invitation, to eligible Prime members in the US. Rihanna's Savage X Fenty lingerie fashion show has also just dropped on Amazon Prime, featuring performances by Travis Scott, Miguel, Ella Mai and Bad Bunny, and casting Lizzo, Demi Moore, Irina Shayk, Paris Hilton and Willow Smith alongside famous drag queens, dancers and models of all shapes and sizes to reinforce a message of inclusivity. Amazon is still at the fringes of luxury but is clearly looking to make a big inroad.

ADVERTISEMENT

Also in September, Skincare brand Perricone M.D. was acquired by UK beauty and lifestyle group The Hut Group, and hair-and-skincare group Ales was bought out of administration by Impala, a French private equity group. Made in Italy Fund, a private equity investment house backed by Quadrivio and Pambianco, took a 60 percent stake in jewelled bag and accessory brand Rosantica.

Both Burberry and Chanel issued sustainability bonds this month, raising £300 million (about $389 million) and €600 million (about $708 million) respectively in issues that were heavily oversubscribed. Burberry will use the funds to invest in a number of sustainability initiatives, including buying and refitting more energy-efficient properties, sustainably-sourcing cotton and sourcing recyclable packaging. The terms of the Chanel bonds are explicitly linked to the achievement of sustainability commitments made earlier this year as part of Chanel Mission 1.5°, the company's climate strategy. This is the first time that outside investors will have access to Chanel securities, with the bonds due to be traded on the Luxembourg Stock Exchange.

The Savigny Luxury Index climbed against all odds in September, outperforming the MSCI by over 4 percentage points to end the month up 3 percent, as investors look to 2021 for further growth.

SLI versus MSCI

SLI Graph September 2020

Going Up

Going Down

What to Watch

ADVERTISEMENT

Golden Week, China’s national holiday, runs from 1 to 8 October this year. In 2019, when international travel was still possible, over $200 billion was spent in dining and shopping in China over the period. With the country’s 1.4 billion consumers unable to travel outside the country, luxury brands with a mainland presence hope that a local shopping bonanza will make this number significantly bigger. Fingers crossed.

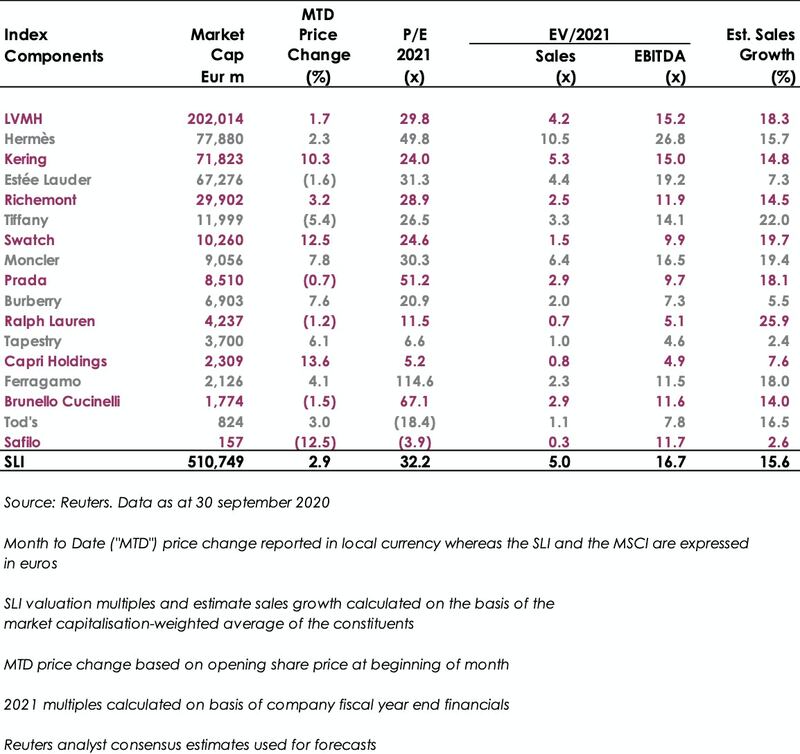

Sector Valuation

So as to align ourselves with investor focus on 2021 versus 2020, we have set out the valuation table below using multiples based on 2021 earnings and estimated sales growth for 2021.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.