The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Short-term gloom put a dent in the upward trajectory of the Savigny Luxury Index (SLI), our company's measurement of the performance of 17 listed groups representing over 150 of the largest luxury brands in the world, as the US Federal Reserve poured cold water on hopes of a rapid economic recovery. This sentiment was echoed by both Chanel and LVMH commenting that the luxury sector may take longer to recover than previously anticipated. At any rate, the second quarter of 2020 has been a write-off for the sector: Tiffany's same-store sales fell by 44 percent, leading some commentators to question whether the deal with LVMH would hold, and market darling Moncler confirmed that its second quarter was more severely impacted by the temporary closure of a larger number of stores. A number of groups nevertheless reported a solid rebound in China, with Tiffany in particular seeing a 90 percent sales spike following store re-openings.

London's gender-neutral Fashion Week in June was entirely digital. Although this is a first among the four major fashion capitals and will be repeated in Paris and Milan for their men's fashion weeks in July, Shanghai was the first city to host a purely digital fashion week. Shanghai also made a commercial success of it, drawing in 11 million viewers and selling £2.2 million (about $2.76 million) of merchandise directly to consumers during livestreams. The jury is still out for London — there were no big names on the schedule and a limited selection of clothes on display, partly due to logistical problems caused by Covid-19 but also due to designers seizing the current zeitgeist to reinforce messages of inclusivity and sustainability.

There have been some notable management changes within the LVMH group. Frédéric Arnault has taken the helm of Tag Heuer following his drive to make the brand more digital as strategy director. His predecessor Stéphane Bianchi will go on to head the watches and jewellery division of LVMH.

Matthew Williams has been appointed creative director of Givenchy. The young designer, who started his own high-end streetwear label 1017 Alyx 9SM and has worked on costumes for Lady Gaga, is replacing Clare Waight Keller who left in April after a three-year tenure at the legendary couture house. Philippe Fortunato, who resigned in March from his post as chief executive of Givenchy after a 20-year career at LVMH, was appointed head of Richemont's fashion division.

ADVERTISEMENT

Coty invested in a second Kardashian business, taking a 20 percent stake in KKW (Kim Kardashian West's makeup line) valuing the business at $1 billion. Not to be outdone, Puig completed its acquisition of UK-based makeup brand Charlotte Tilbury for a reported $1 billion this month. Corporate activity also picked up with Safilo acquiring a 70 percent stake in Californian DTC eyewear brand Blenders Eyewear. Also in Italy, jewellery design company Villa Pedemonte Atelier was acquired by Equinox Partners, a private equity firm.

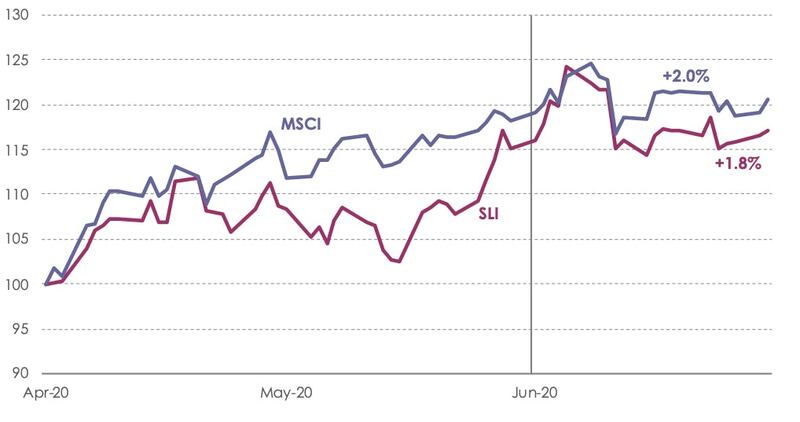

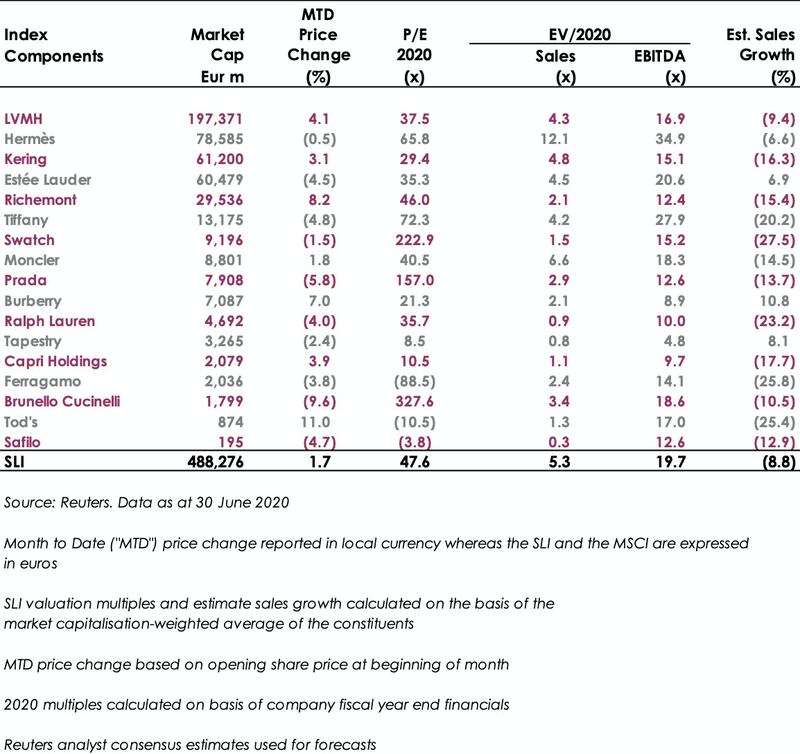

The Savigny Luxury Index recovered from a mid-month sell-off to gain close to 2 percent in June, in line with the MSCI. Volatility in both indices is being attributed to the heady stock valuations — the SLI has reached another record-high forward EV/EBITDA multiple of 19.7 — contrasting short-term gloom with solid hopes of a post Covid-19 recovery.

SLI versus MSCI

SLI Graph June 2020

Going Up

Going Down

What to Watch

Hong Kong is a ticking time bomb and has been so for several years. Protests against the Chinese government increasing its grip on the Special Administrative Region have significantly hindered its status as a luxury shopping destination. China passed further legislation this month to prohibit any protests, secession and foreign interference, ahead of the 23rd anniversary of Hong Kong's handover to China on 1st July. The current outlook for luxury retail in Hong Kong is grim, with many brands reducing presence there in favour of Mainland China or South Korea. The long-term impact of the current unrest in Hong Kong is yet to be fully assessed, but in all likelihood, there will be a sizeable void to be filled as luxury shoppers take a rain check on the island.

ADVERTISEMENT

Sector Valuation

Pierre Mallevays is the founder and managing partner of Savigny Partners LLP, a mergers & acquisitions advisory firm focusing on luxury brands and retail.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.