The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Designer Alessandro Michele’s abrupt departure from Gucci last November was welcomed by investors. His radical reinvention of the Kering flagship tripled annual sales to almost €10 billion. But after several quarters of underperformance, the consensus was that Gucci needed a creative change to keep growing. Now, after two months of uncertainty, Kering has named Valentino fashion director Sabato De Sarno to be Gucci’s next designer.

Historically, Gucci has benefitted from sweeping, fashion-driven reboots going back to Tom Ford and, no doubt, needs fresh blood to power a new cycle of growth. But leaning too heavily on another aesthetic shakeup would be a mistake.

In the last year, Kering chairman François-Henri Pinault has repeatedly highlighted the importance of balancing designer-driven creativity with timeless products, a point that Gucci chief executive Marco Bizzarri underscored when he said De Sarno would be tasked with “reinforcing the house’s fashion authority while capitalising on its rich heritage.”

If a brand’s underlying codes are not sufficiently strong, it may be doomed to rely too heavily on periodic reinventions, an inherently risky proposition.

ADVERTISEMENT

At Kering stablemate Balenciaga, Demna has captured the zeitgeist with an aesthetic transformation as radical as Michele’s Gucci revamp, pushing Balenciaga past the €1 billion mark. Indeed, Demna has created some of the most striking moments in recent fashion history — from a shrouded Kim Kardashian at the 2021 Met Gala to a dystopian runway on Wall Street — along with commercial success stories such as the brand’s Speed Trainers and Hourglass bag, both of which reference Balenciaga’s heritage. But Demna has taken that heritage and twisted it almost to the point of breaking, a problem deeper than the scandal the brand is facing over its recent advertising campaigns.

To be sure, zeitgeisty reboots like Demna’s and Michele’s can drive stellar results, and leaning too much on heritage can result in the kind of stagnation that has weighed down brands like Salvatore Ferragamo. The holy grail is finding the right balance between relevance and timelessness. Here, Chanel offers a masterclass. The brand leans heavily on longtime signifiers of its heritage — tweed, matelassé, pearls and camellia flowers — but has enough fashion novelty to keep it current, a mix that has helped make it luxury’s second-largest brand.

Of course, it’s easier to play the heritage card with a business model that’s firmly rooted in accessories, as handbags are a more perennial proposition than fashion. Chanel’s 2.55 bag, designed by Gabrielle Chanel in 1955, is a textbook example.

A strong accessories business, in turn, allows a brand to play more liberally with its fashion collections, generating buzz without the risk of diluting its heritage. Take Virgil Abloh’s work at Louis Vuitton, where he was highly successful in opening the brand’s doors to new consumers without challenging the primacy of its backstory.

It’s no coincidence that most luxury brands aim to build big accessories businesses, and that, in the long run, those who succeed consistently outperform their more fashion-driven peers.

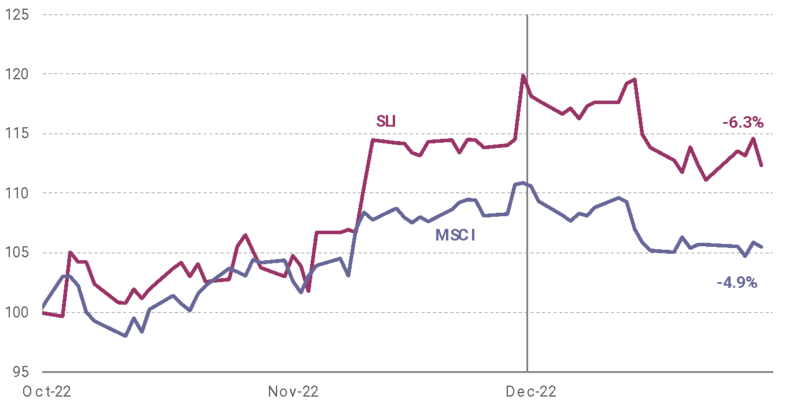

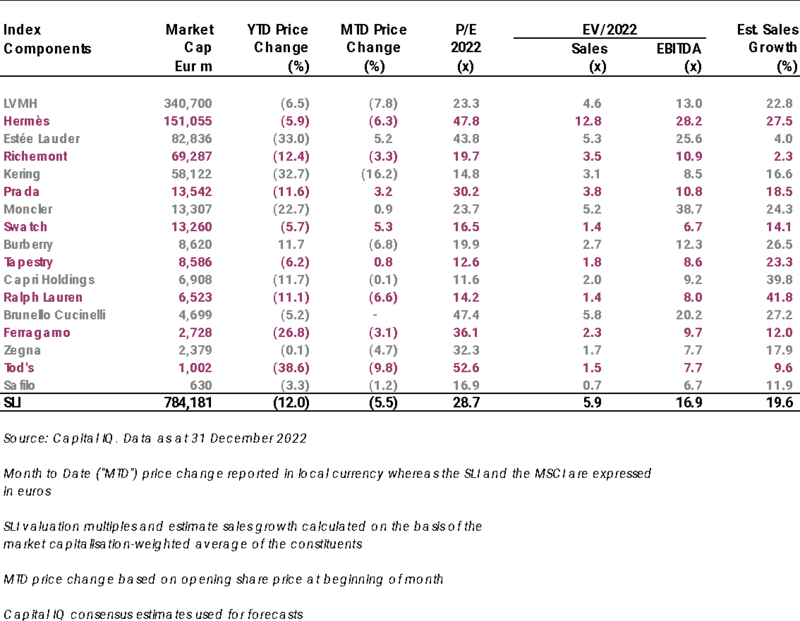

The Savigny Luxury Index (“SLI”) fell 6.3 percent in December, underperforming the MSCI which fell by 4.9 percentage points. Both indices responded to interest rate hikes, not only in the US, which came with a warning of worse to come, but by 7 out of the 10 major central banks in the world. 2022 has seen the fastest and largest increase in global interest rates in at least two decades as policy makers went all out in the battle to contain surging inflation.

Going up

Going down

ADVERTISEMENT

What to watch

Investors have been nervous about Gucci. Kering shares lost more than 15 percent of their value in the last 12 months (during which LVMH was 9 percent up). The Gucci-owner has been fairly swift in naming a successor to Alessandro Michele after his abrupt departure. Sabato De Sarno, although largely unknown to the public, has a solid reputation and Gucci CEO Marco Bizzarri will remain at the helm of the brand, according to Kering chairman François-Henri Pinault. This should be reassuring to investors. Yet the fact remains that Gucci relies more heavily on its fashion momentum than its more heritage-driven peers. Resetting the balance by boosting Gucci’s heritage story will be key to how the brand and its parent company are perceived by investors. A lot is still up in the air at Kering’s golden goose.

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

Brands from Valentino to Prada and start-ups like Pulco Studios are vying to cash in on the racket sport’s aspirational aesthetic and affluent fanbase.

The fashion giant has been working with advisers to study possibilities for the Marc Jacobs brand after being approached by suitors.

A runway show at corporate headquarters underscored how the brand’s nearly decade-long quest to elevate its image — and prices — is finally paying off.

Mining company Anglo American is considering offloading its storied diamond unit. It won’t be an easy sell.