The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Thanks in large part to the rise of streetwear — and the elevation of the sneaker into a status symbol — alongside the impact of the pandemic on lifestyles, designer footwear shoppers today are looking for both comfort and statement styles that push the boundaries of traditional features. The latest report from BoF Insights, The New Statement Shoe: Reimagining Designer Footwear, explores this creative shift and what it means for brands jostling for market share in this multi-billion-dollar category.

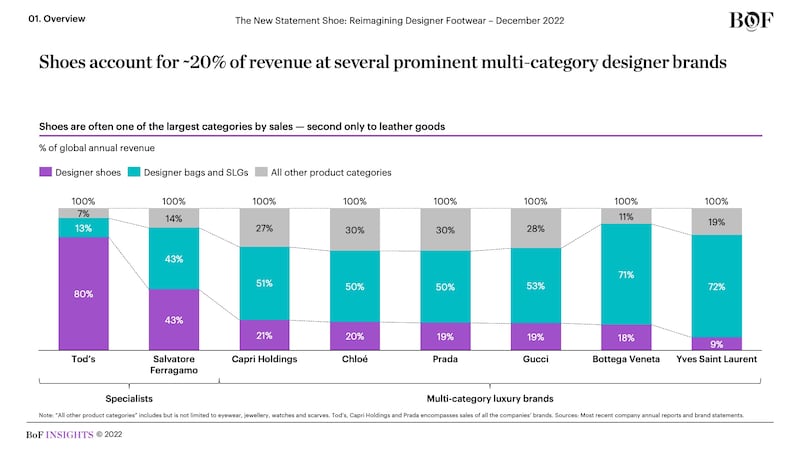

According to market research firm Euromonitor International, designer shoes are expected to grow globally from $31 billion today to $40 billion by 2027. Designer shoes are a “power category,” meaning they function as highly visible opportunities for fashion brands to display house codes like logos on the vamp or signature stitching, while satisfying consumer desires for experimentation and self-expression. Shoes can also be important revenue drivers, accounting for between 10 percent and 25 percent of overall sales for some of the most prominent multi-category luxury brands.

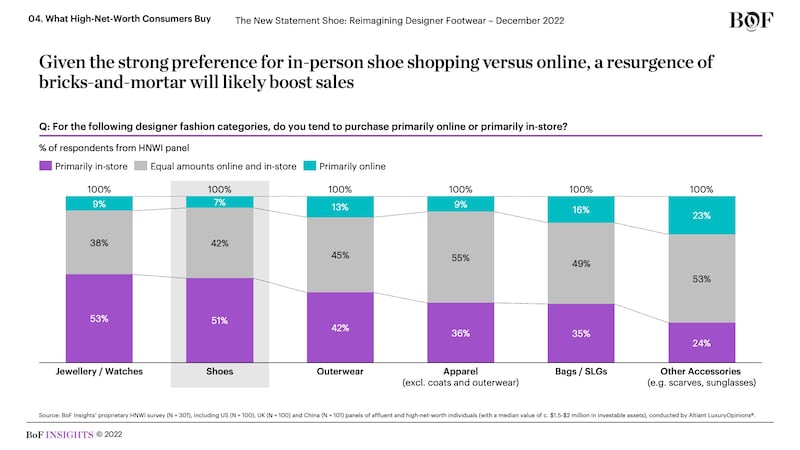

Designer shoes stand to benefit from a post-pandemic shift in fashion consumer behaviour, including the return of in-person shopping. BoF Insights fielded a survey via Altiant, a luxury and wealth research firm, of 300 high-net-worth individuals in the US, China and the UK — each with investable assets worth a median value of around $1.5 million to $2 million. All surveyed HNWIs were “engaged” in the category, defined as having either purchased designer shoes in the last year and / or intending to purchase designer shoes in the next year. The survey found that 51 percent purchase designer shoes primarily in-store, compared to 36 percent who purchase apparel primarily in-store.

Additionally, HNWIs have changed what they are looking for when shopping for designer footwear since the onset of the pandemic – 72 percent of the surveyed HNWIs say they tend to look for more comfortable shoes now, while 63 percent say they are more likely to seek versatility in their designer shoes to reflect a lifestyle shift. Moreover, over half of the surveyed HNWIs say they are seeking out more statement shoes than before the pandemic.

ADVERTISEMENT

This desire for a combination of style and comfort underpins the growing popularity of designer variations and collaborations with comfort-oriented shoe brands, such as Birkenstock teaming up with the likes of Dior and Manolo Blahnik.

But there is still room for heels, as in-person events and special occasions return to pre-pandemic levels. Data provided for the BoF Insights report by fashion search engine Tagwalk reveals that 16.4 percent of the shoe styles on runways during SS2 were high heels, compared to only 8.5 percent in SS22.

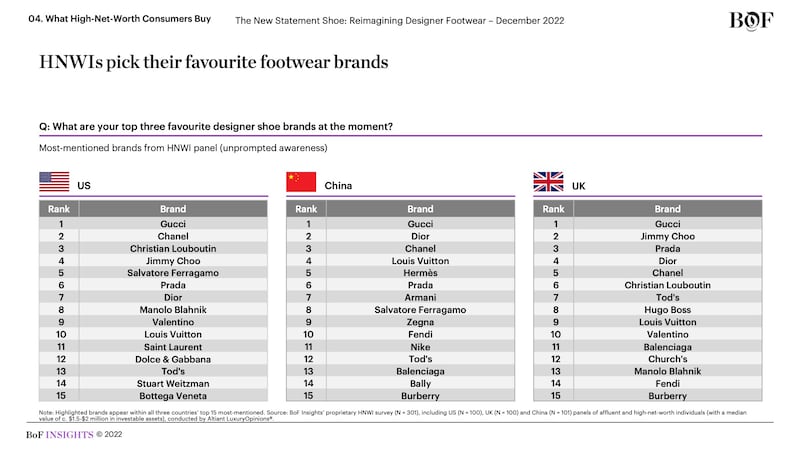

BoF Insights’ survey also reveals which brands are resonating the most with HNWIs. Gucci leads as a brand favourite, with Chanel, Dior, Prada and Louis Vuitton consistently appearing in the top 10.

Against this backdrop, the competitive landscape indexes on a matrix of price versus fashion-forwardness, with innovation across features including silhouette, heel height, heel shape, materials, colour and sole innovation. Novelty is introduced season after season with the potential to become a brand emblem or patentable feature, which can translate well on social media and generate viral success. For brands, this means the power of a statement pair of shoes is greater than ever.

As part of a series of category-focused analyses from the team at BoF Insights — The Business of Fashion’s research and data unit — the latest report explores how brands and retailers must rethink growth strategies in the face of designer footwear shoppers’ evolving preferences and motivations.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Diana Lee is the Director of Research & Analysis at The Business of Fashion. She is based in London and oversees the content strategy and roadmap for BoF Insights.

Rawan Maki is Associate Director of Research and Analysis at the Business of Fashion (BoF). She is based in London and is part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.

Luxury brands need a broader pricing architecture that delivers meaningful value for all customers, writes Imran Amed.