The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The post-pandemic casualisation of fashion has now also left its imprint on designer footwear. In the aftermath of Covid-19, high-income shoppers today are looking for comfort, versatility and style reinvention when shopping for designer shoes. For many brands, it’s a creative shift that they will need to accommodate in order to compete effectively and appeal to consumers’ changing demands, according to the latest report from BoF Insights, “The New Statement Shoe: Reimagining Designer Footwear.”

In exploring the post-pandemic luxury footwear market, BoF Insights zeroed in on high-net-worth individuals (HNWIs) to find out more about their preferences when buying designer shoes, including a survey fielded by luxury research firm Altiant on behalf of BoF Insights. Of the more than 300 HNWIs surveyed in the US, China and the UK, the vast majority of respondents have both purchased designer shoes in the past 12 months and intend to purchase more in the next year.

For sure, the sign of growing HNWI demand is promising for brands competing in this category, which global market research firm Euromonitor International expects to increase to $40 billion by 2027 from $31 billion today. While China and the UK are important markets for luxury footwear — at 9 percent and 2 percent of global sales, respectively — it’s the US that commands the biggest share, at nearly 40 percent today.

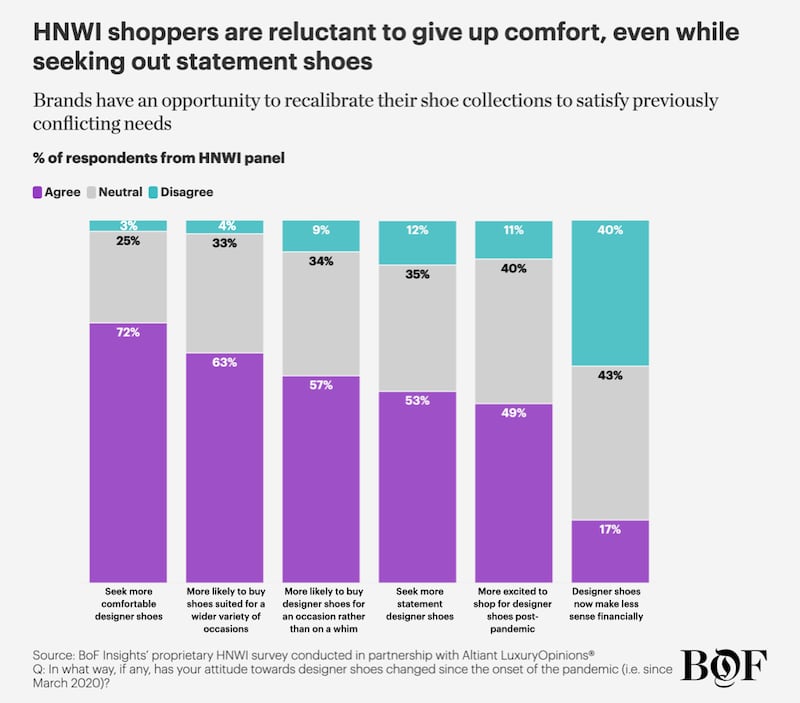

Capturing the market now requires brands and retailers to adapt their assortments to reflect new, and perhaps more challenging, consumer preferences. Shoppers want luxury shoes to have the same style impact as before, while being reluctant to relinquish comfort. BoF Insights finds that in the aftermath of Covid-19, over 70 percent of HNWIs say that they tend to look for more comfortable shoes — even while the majority are seeking out statement styles.

ADVERTISEMENT

New contemporary brands have taken note, carving out a space in the competitive landscape by offering a combination of style and comfort. As designer Amina Muaddi, whose namesake brand was launched in 2018, told BoF Insights: “I have very few styles that have an extremely high heel or a more sculptural silhouette that is not for every day,” adding, “I try to create shoe styles that you can feel comfortable in for hours, that are pretty to look at and that are practical to walk in.”

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Read the latest BoF Insights report to get BoF’s perspective on designer shoes, covering shifts in the competitive landscape, product innovation and what high-net-worth individuals in particular are looking for when buying designer shoes.

Amina Muaddi’s glitzy heels have continued to sell out, even though lockdowns mean shoppers have few places to wear them. Why?

The recent popularity of colourful shoes from independent labels like Mach & Mach and Amina Muaddi, as well as Paris Texas, Arielle Baron, The Attico, Ancuta Sarca and Pīferi speaks to the post-pandemic hunger for novelty footwear.

Diana Lee is the Director of Research & Analysis at The Business of Fashion. She is based in London and oversees the content strategy and roadmap for BoF Insights.

Rawan Maki is Associate Director of Research and Analysis at the Business of Fashion (BoF). She is based in London and is part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.