The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Tapping into the touristic expenditure of wealthy consumers has long been a cornerstone of the luxury industry. In 2022, it was not just at home that Americans continued to shop — as pandemic-related travel restrictions lifted, shopping in Europe was made even more attractive to Americans bolstered by a strong dollar against the euro and pound sterling. Luxury brands in Europe cited American tourists as a key driver of increased first-half sales, including a 47 percent rise at LVMH and 53 percent rise at Kering, according to the company’s financial reporting.

However, while travelling Americans mattered most last year, this year it will certainly be the Chinese consumer once again. In a recent McKinsey & Co. survey, 40 percent of Chinese travellers said they wanted their next trip to be international. While Hong Kong became accessible to mainland China late last year, and Japan was especially popular during last month’s cherry blossom season, Chinese travel agency Trip.com also identified Thailand, Singapore, Australia and South Korea as some of the most-booked outbound destinations for Chinese travellers in March.

It will not be until this quarter or the second half of the year that most destinations will see a bigger wave — the China Outbound Tourism Research Institute forecasts 110 million outbound trips from the mainland this year. The institute cites the figure as two-thirds of the traffic seen in 2019, due to capacity limitations more than anything else.

Global Blue, the duty-free tax refund company, also said that in March, mainland Chinese spending in Europe had already reached nearly half of what it was in 2019 — a large rise from the 22 percent seen in the first two months of the year. The recovery is expected to gradually strengthen in the months ahead, but analysts predict that Chinese outbound travel will not overtake pre-Covid levels until next year.

However, to take advantage of the bumper tourism flow expected in 2023, and drive performance in today’s market — businesses need to align to emerging trends in luxury travel, addressing shifting consumer sentiment towards expenditure and leisure time.

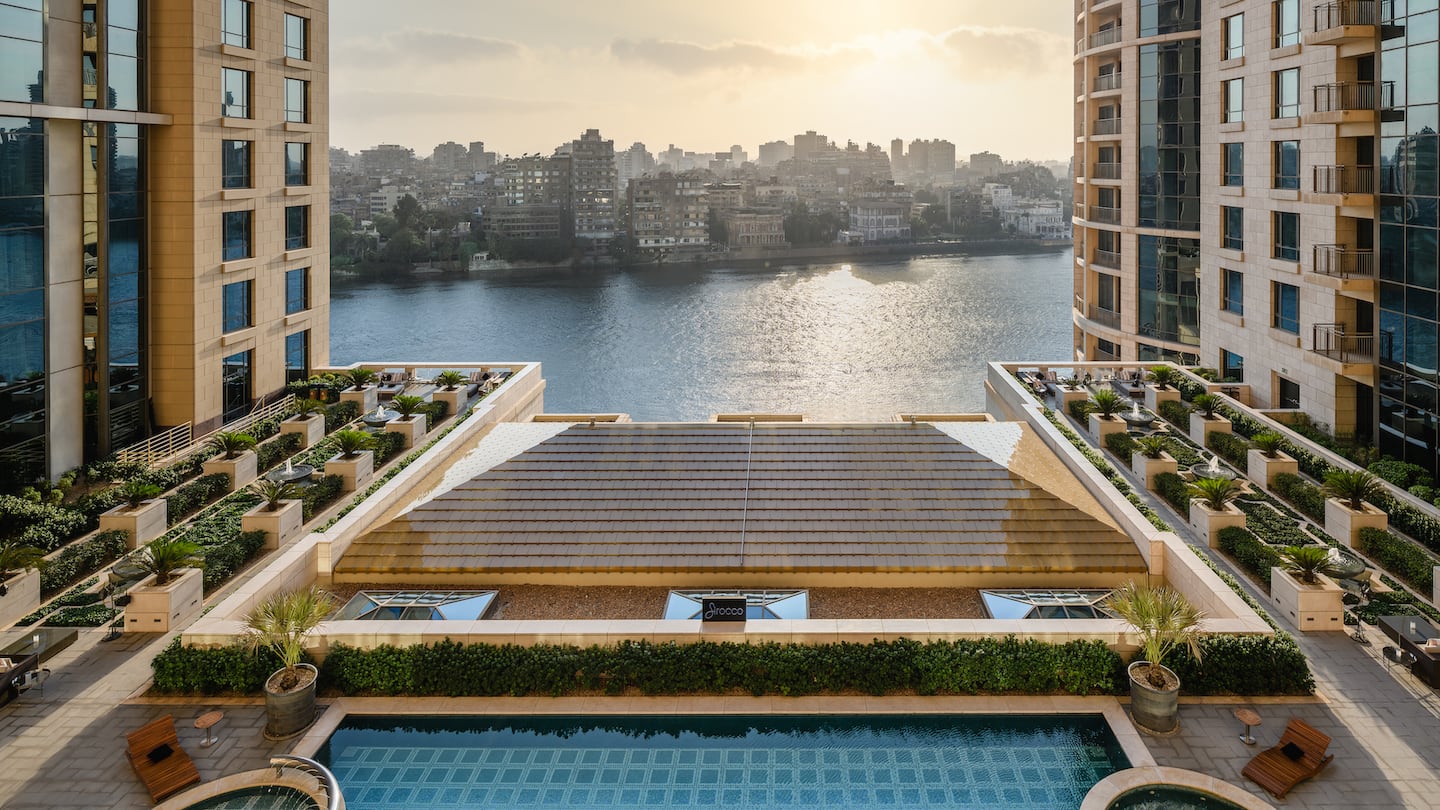

To discover more about how consumers are replacing bucket lists with revenge buying, and how remote working has blended travel itineraries to create a “bleisure” culture, BoF sits down with Marriott International’s president of luxury, Tina Edmundson, who oversees nearly 500 properties globally for the group — with 200 further locations from the company’s 8 luxury hotel brands planned.

How would you characterise the demand for travel as we enter the second half of 2023?

Recovery in the luxury segment, particularly for our industry, was swift compared to other segments. Travel is booming and we don’t anticipate it will taper off any time soon. Year to date, our rooms booked are 11 percent higher in March 2023 versus 2019. Not only have we recovered versus 2019, we have exceeded it.

We fundamentally believe that coming out of the pandemic, a reprioritisation of values has taken place. Before, people would perceive travel as discretionary. When times were tough — either because you don’t have the time or the money — travel was something that was a nice-to-have. Now, I think we have gone from a nice-to-have to a need-to-have. We have realised through the pandemic that travel is fundamentally a primal desire — we need to do this to be happy.

What shifts in luxury consumer behaviour are you seeing in terms of discretionary expenditure?

We see this shifting notion from being well-travelled to travelling well. We are seeing an indulgence in luxury travel, and a focus on: “If I’m going to do this, if I’m going to make time, I want to connect with people I love, and broaden my horizons. I am going to do it properly.” People have realised that time is short — they want to connect with family, with their friends.

We fundamentally believe that coming out of the pandemic, a reprioritisation of values has taken place.

The number of millionaires and billionaires continues to increase, so that is certainly one piece of it. The second piece is that people want to make a positive contribution in how they travel. They want to discover the world. They want to get immersed in local experiences and they want to do it with a little bit of indulgence. There’s the high-net-worth customer, but there’s also the aspirational customer — a very wide swath of the population that is choosing to go above and beyond, even their means, to have that memory, to have that once-in-a-lifetime experience.

Consumers also want to have that non-traditional experience. So, when they are travelling, they want to experience new things that they haven’t before. We just launched The Ritz-Carlton Yacht Collection in October last year, and Evrima is our first superyacht - with 149 suites. It has been wildly successful, and we are launching two more in the next few years. Interestingly, 70 percent of the people that have booked Evrima are first-time cruisers. Another recently debuted property, JW Marriott Masai Mara Lodge, has 20 private tents overlooking the River Talek in Kenya’s Masai Mara National Reserve — it is spectacular and there is huge demand for it.

How are business and pleasure itineraries merging and what does that mean for brands and retailers?

Critically, our unlocked desire to travel was coupled with the fact that we have adopted an entirely new way of working remotely. Because we now have the ability to work from anywhere, we can take a long weekend and do a Thursday through Tuesday if we wanted to, with really no issue from an employer perspective.

Another thing that has become more acceptable is the ability to bring along your spouse, your partner, a friend or family on a trip. We have seen that in our data, which has created a need for more connecting rooms and suites so that you can work from the living room and still have a partner or whomever in the space. The work from anywhere mindset, coupled with this fear of missing out and wanting to make travel a priority, all these elements have contributed to a new sort of behaviour.

Now, our business has shifted from being about people that were transient business customers, there for work, to a much more leisure-driven or leisure-conscious experience. We call this combination of business and leisure: “bleisure”. When customers are in that mindset, they tend to be much more relaxed.

Fashion is an important part of the travel experience because when they are in another location, they want to explore what is interesting from a fashion and retail perspective in that destination. When travellers are of a more relaxed mindset, they tend to be much more open to seeing new ideas and to experiencing what is materially important in that locale.

Which countries or regions are driving growth in tourism?

International travel has opened and will continue to recover swiftly and strongly. However, we are seeing significantly increased costs with regards to airfares and capacity issues in many regions. That is putting a spotlight on people prioritising being able to travel easily, because the availability is just low.

That said, we have growth happening all around Australia, and Japan continues to be a hot destination, where we have just opened The Ritz-Carlton, Fukuoka. China is a bit slower right now, but as we see capacity being added from a flight perspective, we are seeing it open up. Outbound mainland Chinese travel is mostly in Asia, so there is a lot of travel to Thailand, for example, but really, we are expecting a sharp ramp up to further international destinations over the next couple of months.

We continue to see huge demand in the world’s most iconic cities. We are currently seeing a lot of activity in the likes of Rome and Madrid — more historically popular destinations. Earlier this year we debuted The Ritz-Carlton, Melbourne, which we opened right before the Australian Grand Prix in the city, and we have also announced that we will be bringing the St. Regis brand to London. Over the spring, we saw huge demand across the United States. So, it’s hard to pinpoint if the centre of gravity in the industry is indeed shifting.

How is the popularity of international destinations evolving?

People are expanding their travel itineraries. If you are going to Paris, you are also going to Bordeaux or other destinations outside of the city. Customers are looking to discover how else they can enrich their experiences and immerse themselves in local culture. These secondary cities have become incredibly important. And, of course, social media is playing an important role in educating consumers, creating desire, and building aspiration to visit.

The luxury customer is looking for their hotel to curate and facilitate the entirety of their experience.

From a consumer perspective, in terms of which second tier cities to look out for, it is less about how many hours away from major travel hubs that they are situated and more about how accessible it is. A traveller might think: If I can get there on a train in a couple of hours, great. If I can get there on a plane in an hour, great. But if it’s going to be getting there on a plane, and then having to complete a complicated drive, it becomes less compelling. It’s about whether it is interesting and then how hard is it to get there.

How are hotels integrating retail into their guest experiences?

The luxury customer is looking for their hotel to curate and facilitate the entirety of their experience. It’s not only about the product, or the design of the hotel — it is about the surrounding services and amenities. So, if we can provide them access and opportunities that would otherwise be unavailable, for example, through pop-up shops, that bodes well for us. This is also beneficial to retailers, who are realising that our hotels provide access to an audience that has the propensity to buy and the discretionary means to do it, who are also in a state of mind to spend. Retail and fashion, and our business, can be quite complementary.

For example, our Ritz-Carlton in Montréal launched an exclusive pop-up boutique with Christian Louboutin, which even included a limited edition Formula One capsule collection, which was perfect for those in town for the Canadian Grand Prix. We also had milliner Gigi Burris, who partnered with The Ritz-Carlton Maui, Kapalua, and spent time with the hotel’s Hawaiian cultural advisor, in order to create an exclusive collection of six pieces that paid homage to different elements of the resort and destination.

We want to make sure that the collaborations fit the retailer, the fashion house, and the hotel brand — so for the guest or consumer it feels like an integrated experience. We’re loving the way these types of collaboration can enhance the guest experience, and I think there are many more opportunities here.

This is a sponsored feature paid for by Marriott International as part of a BoF partnership.

Chinese fashion and beauty customers — long pivotal for the global luxury market — are reshaping how and where they shop, according to BoF Insights’ new report.

The deal is expected to help tip the company into profit for the first time and has got some speculating whether Beckham may one day eclipse her husband in money-making potential.

The designer has always been an arch perfectionist, a quality that has been central to his success but which clashes with the demands on creative directors today, writes Imran Amed.

This week, Prada and Miu Miu reported strong sales as LVMH slowed and Kering retreated sharply. In fashion’s so-called “quiet luxury” moment, consumers may care less about whether products have logos and more about what those logos stand for.

The luxury goods maker is seeking pricing harmonisation across the globe, and adjusts prices in different markets to ensure that the company is”fair to all [its] clients everywhere,” CEO Leena Nair said.