The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Christmas has come early for Harry Winston. The legendary jewellery house acquired the Pink Legacy at auction for a record $50 million this month. The stone will be renamed the Winston Pink Legacy and will be added to the company's Legacy collection of rare jewels, which also includes the Winston Legacy, a 101-carat 'D' flawless diamond bought in 2013.

Big news

Richemont, Tiffany and Michael Kors all reported a slowdown in sales growth, with Tiffany causing a panic by revealing that the ever-important Chinese tourists were not turning up in droves to its shops in the US and Hong Kong. Richemont's sales in September were beginning to feel the pinch as a result of moves to combat the grey market and efforts by the Chinese government to discourage consumers from spending overseas; the company's management set a cautious tone for the second half of its financial year.

Salvatore Ferragamo and Tod's both announced further declines in quarterly turnover, as the two brands still struggle to find a new identity. Not all has been doom and gloom though: bullet-proof Hermès reported quarterly sales ahead of expectations, Burberry's results were buoyed by Riccardo Tisci's designs and a robust business in mainland China, and Brunello Cucinelli continued on its impressive growth trajectory.

ADVERTISEMENT

Following major moves by LVMH and Richemont to boost their online businesses, Kering announced that it would bring all of its own online shopping sites in-house by 2020. Seven of Kering brands' e-commerce platforms are currently operated through a joint venture with YNAP, which was set up in 2013. The Kering-YNAP joint venture included an option for the French group to buy — and for YNAP to sell — its stake in 2020. This meant a breakup was always on the cards; nevertheless, the Richemont takeover of YNAP clearly accelerated it. It begs the question: will more brands will exit their YNAP partnerships in the future?

Corporate activity was relatively subdued this month, with only two deals being announced. Hong Kong-based luxury leather-goods manufacturer Sitoy Group acquired a controlling stake in luxury Italian shoe brand Testoni, while Swiss watch-parts manufacturer Queloz was sold by its parent company DKSH Holdings to Cendres+Métaux SA, a Switzerland-based company specialising in high-precision micro-mechanical parts for the medtech and watch industries.

Hopes of an end to the Sino-US trade war, which had prompted a brief rally in the Savigny Luxury Index (“SLI”) at the beginning of November, were dashed as the month progressed, resulting in a spectacular tumble of 11.3 percent, whilst the MSCI edged up 1.3 percent.

SLI vs. MSCI

SLI Graph November 2018 | Source: Courtesy

Going up

Going down

This is the second month running that 17 out of the 18 stocks making up the SLI have witnessed share price decreases.

ADVERTISEMENT

What to watch

China’s woes are pivotal to the luxury goods sector as evidenced by investor reaction to any sign of slowdown in the dragon economy. So far, it is Chinese tourist spending that is showing signs of abatement, with demand in mainland China remaining robust, partly due to the Chinese government’s restrictions on personal imports of luxury goods coupled with a harmonisation of prices in and outside of China. Despite the recent truce agreed at the G20 summit, China and the US are still staring down the barrel of a gun at each other in relation to trade. The outcome of this standoff has significant repercussions for the luxury sector, as the health of its two largest markets hangs in the balance.

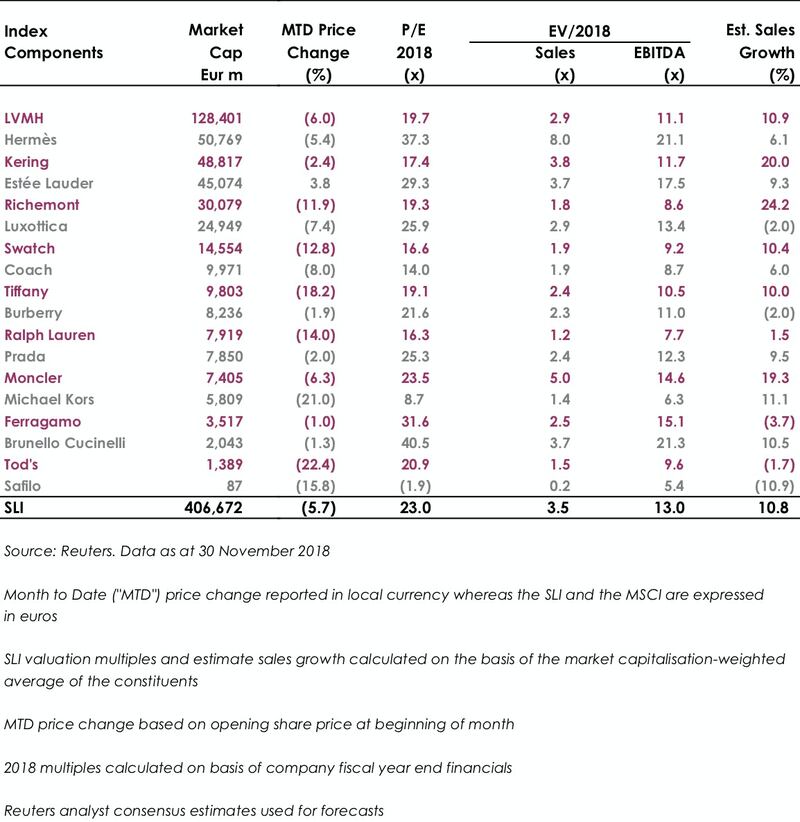

Sector Valuation

SLI Table November 2018 | Source: Courtesy

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.