The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — The fashion industry faces a worrying year ahead. The macroeconomic context is challenging, and players will find that their route to value creation is either unclear or it requires levels of investment that are hard to swallow. Digitisation remains critical, while players must address increasing consumer concerns over sustainability, if they want to secure their future.

Overall, the McKinsey Global Fashion Index predicts that the fashion industry will continue to grow at 3 to 4 percent in 2020, slightly slower than the 3.5 to 4.5 percent estimate for 2019. This slowdown will stem from consumers being increasingly cautious amid broader macroeconomic uncertainty, political upheaval across the globe and the continued threat of trade wars.

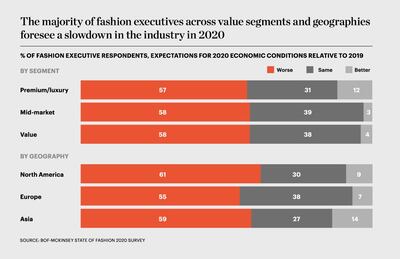

Naturally, this uncertainty is reflected in our annual BoF-McKinsey senior executive survey. Strikingly, only 9 percent of respondents think conditions for the industry will improve this year, compared to 49 percent who said the same last year. “Challenging,” “uncertain” and “disruptive” were the most frequently used words to describe the industry compared to last year’s more neutral “changing,” “digital” and “fast.” Another divergence from previous years is that now pessimism holds broadly true regardless of region or segment, with more than half of respondents in every region predicting a deteriorating environment. The most optimistic region is Asia, although, even here only 14 percent of executives expect an improvement in conditions. And in luxury, where performance has been strong, there is still little hope of an upturn.

Our ten defining themes for 2020 are a sharp evolution from previous years, with the risks closer at hand and more severe. What is clear is that setting a course through the turbulence ahead, now more than ever, requires companies to be attuned to their environment and agile in their responses. While the winners at the top maintain their industry dominance, the rest will have to work even harder to keep pace.

ADVERTISEMENT

The 10 fashion industry themes that will set the agenda in 2020:

Continued caution is advised for the year ahead as mounting underlying turmoil could disrupt relations among both developed and emerging market economies. Indicators of recession risk are spurring companies across industries to build a resiliency playbook and plan for other macro risks such as geopolitical instability and the inflammation of trade tensions.

China will continue to provide exciting opportunities and play a leading role in the global fashion industry, but the colossal market is proving harder to crack than brands anticipated. As some successful players become over-reliant on China and others struggle, companies should consider spreading their risk by expanding to other high-growth geographies.

As traditional engagement models struggle on established social media platforms, fashion players will need to rethink their strategy and find ways to maximise their return on marketing spend. Attention-grabbing content will be key, deployed on the right platform for each market, using persuasive calls-to- action and, wherever possible, a seamless link to checkout.

Consumer demand for convenience and immediacy is prompting retailers to complement existing brick-and- mortar networks with smaller format stores that meet customers wherever they are and reduce friction in the customer journey. The winning formula will feature in-store experiences and localised assortments in neighbourhoods and suburbs beyond the main shopping thoroughfares.

The global fashion industry is extremely energy-consuming, polluting and wasteful. Despite some modest progress, fashion hasn’t yet taken its environmental responsibilities seriously enough. Next year, fashion players need to swap platitudes and promotional noise for meaningful action and regulatory compliance while facing up to consumer demand for transformational change.

Fashion brands are exploring alternatives to today’s standard materials, with key players focused on more sustainable substitutes that include recently rediscovered and re-engineered old favourites as well as high-tech materials that deliver on aesthetics and function. We expect R&D to increasingly focus on materials science for new fibres, textiles, finishes and other material innovations to be used at scale.

Consumers and employees are putting increasing pressure on fashion companies to become proactive advocates of diversity and inclusion. More companies will elevate diversity and inclusion as a higher priority, embed it across the organisation and hire dedicated leadership roles, but companies’ initiatives will also come under increasing scrutiny in terms of sincerity and results.

ADVERTISEMENT

Established fashion brands and retailers will face growing competition from new Asian challengers, as manufacturers and SMEs step out of their traditional roles and sell directly to global consumers. Expect greater competition from hitherto unknown players in the Asian supply chain who design popular items to sell at affordable prices using cross- border e-commerce platforms.

Traditional trade shows must respond to the increase of direct-to-consumer activity, shorter fashion cycles and digitisation by embracing new roles and fine-tuning their target audience. In a bid to differentiate themselves — or even just to survive — more of these events will add B2C attractions or launch new services and experiences to improve relationships with their traditional B2B audience.

Valuations of digital fashion players have reached dizzying levels and, despite a slew of high-profile IPOs and private firms achieving unicorn status, investor sentiment is taking a turn for the worse. Investor apprehension is growing over the path to profitability for some digital players, from online pure play retailers and marketplaces, to direct-to-consumer brands and other digital-first business models.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.