The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Woman carrying Anya Hindmarch bag at Milan Fashion Week Spring/Summer 2019 | Source: Shutterstock

ADVERTISEMENT

Anya Hindmarch sold to Marandi family. The brand is parting ways with its long-time backer Mayhoola, after the companies reached an agreement to sell the luxury accessories label to Iranian-born entrepreneur Javad Marandi and his wife. Qatari Mayhoola first acquired a stake in Anya Hindmarch in 2012, building up ownership to at least 75 percent of the company by mid-last year, but had been seeking an exit after a tumultuous period of restructuring, during which the brand struggled to turn a profit.

PVH to exit high-end collection of Calvin Klein label. Missteps at high-end Calvin Klein's 205W39NYC clothing line have hit sales as customers balked at the label's high prices. PVH has said it will shut the label's flagship store on New York's Madison Avenue as the line failed to strike a chord with customers, and is in talks with partner G-III Apparel Group to license out Calvin Klein's women's jeans unit. PVH still reported better-than-expected quarterly sales boosted by an increased demand for its Tommy Hilfiger brand, sending its shares up about 7 percent. Net income rose to $158.7 million from $108.5 million a year earlier.

J.Crew turns again to debt restructuring lawyers. The group has tapped restructuring lawyers for the second time in as many years to explore options for reworking its debt, as the US clothing chain struggles with falling sales and a dwindling cash pile. A misguided shift to pricier apparel and competition from e-commerce firms like Amazon has led to the persistent business challenges J.Crew faces, despite recent turnaround and financial restructuring efforts.

Neiman Marcus creditors in preliminary agreement to extend debt maturities. A majority of the luxury retailer's lenders and noteholders have preliminarily agreed to extend maturities on the company's debt, giving the department store more time to overhaul its $4.6 billion in borrowings. The company has a $2.8 billion loan due next year. The transactions would extend the loan maturity to 2023, and its unsecured notes to 2024, with the latter happening through a debt exchange.

Lululemon jumps as investors cheer full-year sales forecast. The yoga-wear maker's sales forecast eased investor concerns that growth will slow too much from the fastest pace in years. Shares soared 20 percent Thursday after Wednesday's results showed the Vancouver-based athleisure wear maker moving strongly into menswear, improving online sales and potentially challenging bigger rival Nike on its home turf.

Champs Elysées as Galeries Lafayette opens 'concept' store. As top-tier department stores pitch themselves as day-trip destinations to counter competition from online rivals such as Amazon and Net-a-Porter, Galeries Lafayette opened a new outlet in Paris this week. The four-storey, 6,500-square-metre store will sell smaller brands such as Rouje, Walk of Shame and Mira Mikati, as well as top-end labels like Gucci and Chanel. French consumer confidence levels rose in March to reach a seven-month high indicating that the country's retail is recovering from the damage of the "Yellow Vests" protests.

THE BUSINESS OF BEAUTY

Feals CBD products | Source: Courtesy

ADVERTISEMENT

New wellness start-up Feals brings the direct-to-consumer treatment to CBD. Co-founded by ex-ad tech colleagues Drew Todd, Alex Iwanchuk and Eric Scheibling, Feals aims to make CBD as approachable as possible by applying a direct-to-consumer sales model to society's new favourite wellness addiction. The start-up seeks to clear up the stigmas and misconceptions surrounding CBD with features such as the first-ever CBD hotline.

Unilever set to buy French cosmetic brand Garancia. The consumer goods giant has made a binding offer to buy French skincare and cosmetics brand Garancia, adding to its portfolio of premium beauty products. The terms of the deal, which is expected to close in the second quarter, were not disclosed.

Shiseido's Clé de Peau Beauté signs retail deal in the UK. Set to launch exclusively at department store Harrods this September, customers will be able to purchase products from its 250-strong product line-up. Ranges include collections across skin, body and sun care, and colour cosmetics for the face, lips and eyes. Today, the brand is available across the Asia-Pacific market, Canada, the US and Russia.

PEOPLE

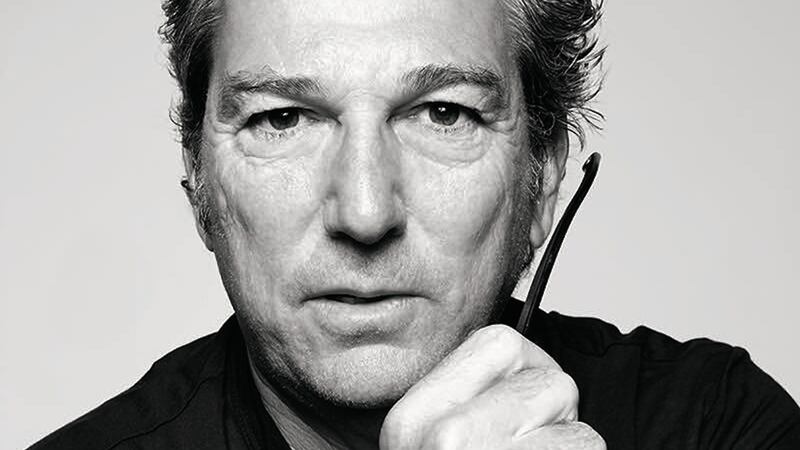

Andrew Rosen | Photo: Amy Troost

Theory's Andrew Rosen relinquishes chief executive role. The founder is stepping down from his role as CEO of the New York-based brand, but will remain as an advisor, spending approximately half of his time on Theory and the other half on other pursuits. At Theory and Helmut Lang, which Rosen also oversees, he will be replaced by Dinesh Tandon, Theory's global chief operating officer.

Paul Surridge quits as Roberto Cavalli creative director. The designer has announced that he is resigning from his position as creative director of the Italian fashion house, confirming press rumours about his imminent exit. Surridge, who joined the Florentine label in 2017, said in an Instagram post he wished to "focus on other projects that I put aside in order to achieve our common goals with Roberto Cavalli Group."

Glossier hires Elle.com editor as first head of content. The direct-to-consumer beauty unicorn is one of the first brands to prove that content and commerce can work, and is now doubling down on content by poaching a Hearst editor to lead its strategy. Leah Chernikoff, Elle's digital director since 2013, will join Glossier as its first head of content in April.

ADVERTISEMENT

Lawyer Michael Avenatti charged in $20 million Nike extortion scam. The lawyer who represented adult film star Stormy Daniels in her legal battles against US President Donald Trump is accused of embezzling a client's money to cover his own debts. Avenatti threatened to expose allegations of misconduct from Nike employees unless the apparel company paid him and an unnamed co-conspirator $22.5 million.

MEDIA AND TECHNOLOGY

Condé Nast's results show its future lies outside Europe. The publisher of Vogue, GQ and Vanity Fair among others is facing challenges in the US and Western Europe, but Asia is a bright spot. Condé Nast's business in the UK, France, Italy, Germany and Spain registered a combined turnover of £373 million (about $493 million) in 2017, down 7 percent from the year before. Meanwhile, its Western European part lost £27.4 million (about $36 million) that year, which it attributed to one-time costs related to a restructuring of the business that included layoffs and office moves. Excluding those expenses, it recorded a £3.2 million (about $4.2 million) profit.

The Face is back. The British style bible, which had sizeable cultural influence in 80s and 90s under founder and editor Nick Logan but has been out of publication since 2004, is making a long-awaited return as a digital and quarterly print publication. Led by new managing director Dan Flower and editor Stuart Brumfitt, the revamp will debut online in late April and in print in September. On Monday, it launched on social media.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.