The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

COPENHAGEN, Denmark — "The menswear talent emerging from Scandinavia is overwhelming," says Benn McGregor, contemporary menswear buyer at Harvey Nichols, referring to a wave of Nordic brands with a youthful, minimalist aesthetic that has been closing the gap between high fashion and streetwear since the early 2000s.

“People are appreciating Scandinavia in a way they didn't do before and a lot of it has to do with the overexposure of the traditional fashion capitals like London and Paris,” adds Jian DeLeon, senior menswear editor at WGSN.

The Swedish capital of Stockholm has long dominated the Scandinavian menswear scene, birthing a number of celebrated brands including Acne Studios, Our Legacy and Très Bien. But more recently, neighbouring Copenhagen has emerged as an alternative Scandinavian hub, home to brands such as Wood Wood, Soulland and Won Hundred.

“More publications and editors are coming to Copenhagen, who, next to the city's rich offering in design, architecture and food, are now focussing on the city's streetwear as well,” says Anne Christine Persson, vice president and development director at Copenhagen Fashion Week.

ADVERTISEMENT

It's easy to make a name for yourself within these small borders but you can't make your business.

Copenhagen's menswear brands have certainly benefited from growing interest in the city's fashion weeks and the Copenhagen International Fashion Fair, where emerging Danish contemporary labels have been showcased alongside established international streetwear brands including Off-White, Gosha Rubchinskiy and Filling Pieces.

And yet the Copenhagen scene remains small, as does the local market, which is dominated by mainstream fashion giants Bestsellers and IC Group. This means that Copenhagen-based brands must look further afield to drive growth.

“With only 20 percent of our turnover and retailers coming from Denmark, we can't live from our own country, so we have to get out,” says Jacob Kampp Berliner, chief executive officer of Danish contemporary menswear brand Soulland.

Indeed, the Danish fashion industry is currently worth about 42 billion Danish Krone ($5.65 billion), according to industry organisation Dansk Fashion and Textile. Meanwhile, in 2013, the Swedish fashion industry was worth 237 billion Swedish Krone (about $28.27 billion), with exports accounting for 62 percent, according to the Association of Swedish Fashion Brands.

“One big difference between Swedish and Danish fashion is that there is a big tradition of business investors in fashion in Sweden and we don't have that in Denmark,” adds Kampp. “Almost all of the brands in Sweden have investment money. There you make money from your investment money and then invest it again.”

Swedish brand Acne Studios' growth was supported by a minority investor that came on board in 2006 and owns 21 percent of the business. Since then, it has grown to €200 million ($233 million) in turnover for fiscal year 2016 — doubling in turnover since 2013 — and now operates 50 own-brand stores and has over 800 wholesale retailers worldwide. “Today, there is a democratisation of the message, where digitalisation and internationalisation have made it easier to grow outside of your own market than 15 years ago,” says Mikael Schiller, executive chairman at Acne Studios.

For many other Swedish menswear labels, global growth has also been a strategy from day one. “It's about thinking long-term and about building something long-lasting as well,” says Saif Bakir, co-founder of London-based, Swedish contemporary menswear label CMMN SWDN, which was founded in 2012 and blends style cues from youth sub-cultures with classic sartorial menswear.

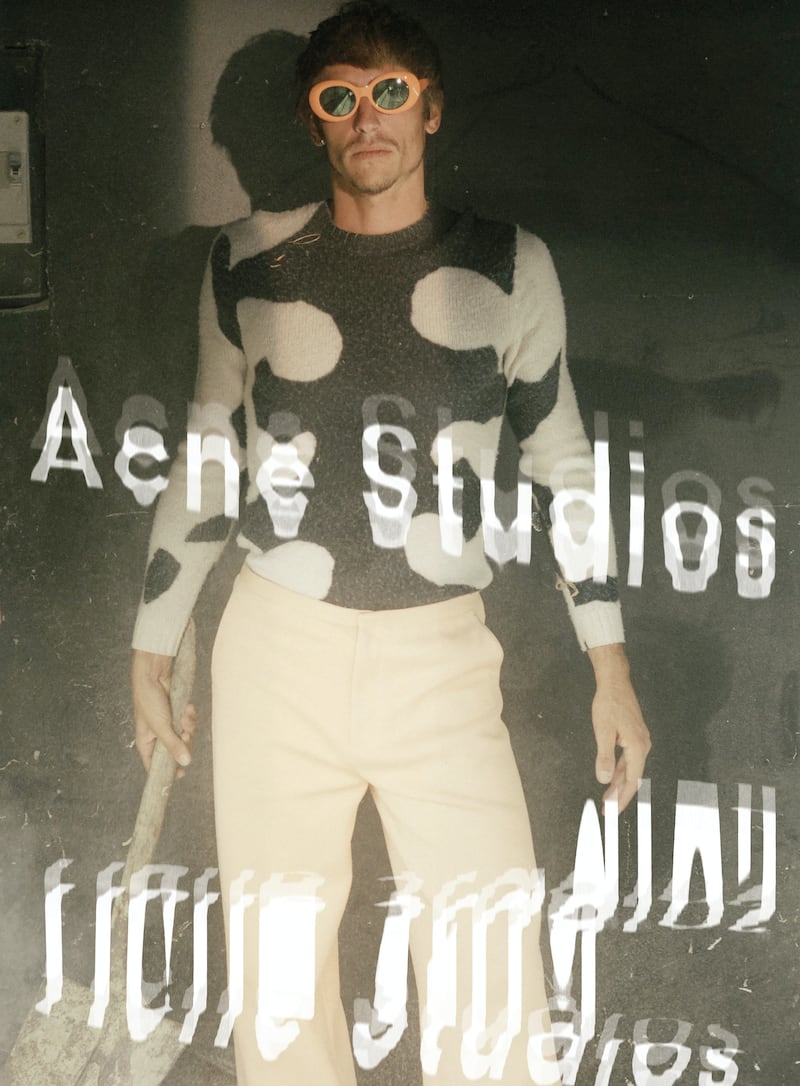

Acne Studios Spring/Summer 2016 | Source: Courtesy

ADVERTISEMENT

“In general, you could say that Swedes tend to be a bit more anxious, holding their cards close to themselves until everything feels 100 percent, before acting on it. The Danes have more of a ‘let's do this’ attitude,” says Hannes Hogeman, co-founder of Malmö-based Très Bien. “When it comes to counterculture, you need to get these details correct if you want to be perceived as genuine, which is crucial, especially in streetwear.”

The Danes also lack the Swedes’ legacy of fashion success stories, and some Copenhagen labels are now finding themselves at a crossroads as they aim to transform their niche brand appeal into long-standing industry success.

And with many such brands helmed by creatives instead of commercial heads, business growth can present a bigger challenge. A challenge, that is, but not an impossibility. One of the Copenhagen-based brands reversing this trend is Soulland, which has grown 250 percent in global wholesale over the last three years.

Likewise, Wood Wood’s successful Autumn/Winter 2016 collection now counts 375 global stockists. “It's easy to make a name for yourself within these small borders but you can't make your business,” explains the brand’s creative director Karl-Oskar Olsen, who has worked with collaborators including Adidas, Champion and Disney.

“The last couple of years we've been in a transition, coming from a [street] subculture to taking a decision in terms of what we want to do with the brand,” adds Olsen. “Growing a business and making your collection more mainstream but still cool, that's the hardest thing.”

Related Articles

[ Mikael Schiller on Acne’s Unexpected JourneyOpens in new window ]

[ Très Bien Expands With Winning Blend of Streetwear and FashionOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.