The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States – At Bandier's new store, the windows display a mix of performance gear and fashion. Half the mannequins are outfitted in Nike's spring neon – a bit flashier than your typical black tights, but fairly standard as far as activewear goes. The rest are decked out in Adam Selman's rhinestone encrusted sports bras and sheer white leopard leggings.

Inside, a dome-shaped installation houses additional pieces from Nike and Selman, and beside it, a large circular display contains nearly 20 beauty brands, from Dr. Barbara Sturm to Starskin and Ouai. A sneaker “wall” faces a café, which will sometimes transform into an event space.

Co-founders Neil Boyarsky and Jennifer Bandier call their new 4,600-square-foot SoHo flagship "Bandier 2.0." They're attempting to evolve the five-year-old activewear seller, which already has six locations in the US, into a hybrid of the latest retail trends: athleisure, beauty and in-store experiences designed to convert customers into a loyal community, all bound together by the concept of wellness. They've also brought on a new chief executive, Adrienne Lazarus, to spearhead Bandier's next phase.

“We’re going to double down on the lifestyle portion of our business,” Bandier said. “The whole concept of that is community.”

ADVERTISEMENT

Bandier is part of a new breed of retailers exploring the business potential of wellness, a flexible term that encompasses products as diverse as gym clothes, face masks and vitamin supplements. It’s a fast-growing market and is attracting attention from venture capital and private equity investors (Bandier recently completed a $34 million funding round led by a division of Paris-based private equity firm Eurazeo). Other players in the space include Alo Yoga, Free People’s FP Movement and Goop, the Gwyneth Paltrow-founded lifestyle website that helped popularise many of today’s hottest wellness trends.

Goop Store | Source: Courtesy

Though the bulk of sales are still online, wellness-themed stores and pop-ups are driving much of Goop’s growth, said Kim Kreuzberger, Goop’s chief revenue officer. Goop opened its second permanent store, Goop Lab, in New York last November, selling apparel and beauty products, and incorporating a kitchen that hosts cooking demos and events. More stores and pop-ups are planned, including a temporary location in Austin that opens on Friday.

BoF talked to Goop and Bandier about how they’ve created wellness empires – online and off. Here’s what we found:

EXCLUSIVE PRODUCTS

Bandier sells about 90 brands, with roughly two-thirds in the apparel category. The biggest, including Nike, Beyond Yoga, Aviator Nation and Koral, make up about 60 percent of total business.

The brands - a mix of global labels and small independents - are mostly known quantities to customers entering Bandier's store. However, a majority of products for sale are exclusive to the retailer. For instance, Bandier carries lines by Splits59, Koral and Ultracor in extended sizes, with all apparel going at least up to 2X.

Bandier has also collaborated with Cushnie, Prabal Gurung, Fila and Veronica Beard on exclusive lines. These partnerships give customers a reason to stop by their stores, even as SoHo becomes crowded with wellness retailers.

“Established brands that we have the best relationships with have very strong lines that they sell to everyone,” Boyarsky said. “We buy those and we figure out ways to create exclusivity.”

ADVERTISEMENT

POINT OF VIEW

Bandier evaluated about 250 brands for inclusion in its stores last year, but only added 40, including newcomers Beach Riot, an LA-based “beach to streets” clothing line, and Warm, which makes cosy hoodies and sweatpants.

Bandier Store| Source: Courtesy

The goal is to create a “curated” selection of goods. Bandier said quality is the first priority, i.e. no see-through leggings. Boyarsky said brands make the cut if they capture a trend, have a sustainability angle or are “cutting edge” fashion.

Price is also a factor: Bandier caps most items at about $200, though some of the best-selling items, such as Ultracor’s star printed leggings, approach that ceiling.

About 10 lines are dropped each season to make room - often lines that were “one dimensional and don’t have a second act,” Bandier said. Also, “crazy prints” are out, with “tastefully done animal prints” (including Selman’s new line) the exception.

BEAUTY

A significant part of Goop’s retail business comes from beauty, and there’s been a heavy investment in its own beauty lines, including skincare, fragrance and dietary supplements.

ADVERTISEMENT

The retailer also sells about 250 third-party beauty brands on goop.com, and about 100 of these are sold in-store at Goop Lab.

“We believe that people don’t necessarily shop one brand exclusively, so it’s about creating an assortment that complements each other,” said Erin Cotter, senior vice president of beauty at Goop.

Bandier began selling beauty products in a substantial way last year, but now carries 18 brands, ranging from ingestible supplements to bath salts and skincare. Price points range from $10 sheet masks from Starskin to $300 Dr. Barbara Sturm hyaluronic serum. There are plans to bulk up the range of beauty products this year.

IN-HOUSE BRANDS

Goop began selling its own skincare in 2016 and has since expanded to about 10 in-house lines, from ingestible supplements to apparel. While they’re mixed with hundreds of other labels, Goop’s own brands are the fastest growing revenue stream for the company and are on track to double this year.

That doesn’t mean Goop brands are given preferential treatment in store displays.

“Store design and shopability is our focus, so it's more about creating a beautiful apothecary … than pushing our brands at retail,” Cotter said.

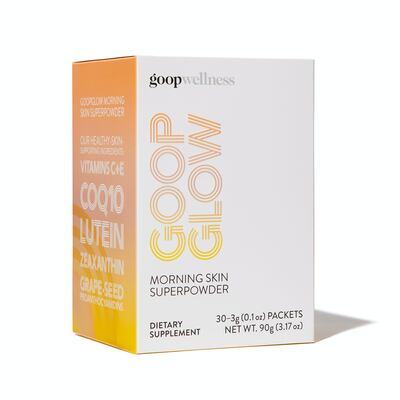

Goopglow Superpowder| Source: Courtesy

Both Goop and Bandier looked at how third-party brands were selling – as well as their own private labels – and then used that data to build out their own lines. At Goop, reader feedback has led the company to broaden its range of in-house products. For example, the success of the Goopglow superpowder led to the development of a complementary skincare product.

"[Customers] are interested in a holistic approach to taking care of themselves … they don't believe that just applying a topical product is the holy grail," Cotter said.

Bandier last year introduced four private label brands, each filling a different niche. All Access is “high performance” but fashionable, while WE/me is inspired by yoga and palates with a softer colour palette.

Bandier sells its own label in stores and online, and has begun to sell through Net-a-Porter. Later this year, Bandier will add more of its own brands to the mix and introduce its first private label influencer line.

POP-UPS

“It’s the full immersion into the Goop lifestyle and you can shop the products. It’s the first time we’re introducing restorative wellness [experiences] meets store,” Kreuzberger said of the 2,300-square-foot space in Austin’s South Congress neighbourhood that’s strategically timed to SXSW (where Paltrow is speaking and hosting a cocktail party). The space also includes cardio dance or jump rope classes with Amanda Kloots (who also teaches at Bandier’s Studio B), and treatment rooms for facials. It’s also about plugging into cultural moments like SXSW or Coachella in a way that’s on-brand.

Goop views pop-ups as an “audience development test.” Usually, pop-ups in a particular market cause a lift in traffic to Goop’s content and commerce portions of its site.

Goop Store | Source: Courtesy

“We use that data to see what people are reading on our content verticals and what they are buying in store versus online,” Kreuzberger said.

If sales for a pop-up far surpass projections, Goop either extends the duration of the space or turns it into a permanent store. Kreuzberger noted that sales were so strong at the company’s first pop-up in Europe, in London’s Notting Hill neighbourhood, that it was converted into a permanent store immediately.

Bandier has set aside space in its SoHo store for brands to stage pop-ups. The first is with NuFace, which will bring in aestheticians to perform on-site facials and treatments using the brand’s microcurrent facial devices and skincare products.

ENGAGE WITH CUSTOMERS OUTSIDE THE STORE

Bandier also operates “Studio B,” a fitness studio in New York featuring workouts with celebrity trainers like Megan Roup. The tie-in is obvious: Bandier customers buy clothes and products to use at their boutique gyms and yoga sessions, so why not offer the classes themselves.

But the classes also serve to buff Bandier’s image as a lifestyle brand that customers can engage with in ways other than buying products in a store.

Goop stages popular events including In Goop Health, a wellness summit that will stage its fifth edition on March 9. Tickets, costing $1,000 and up, are already sold out.

Like its pop-ups, Goop uses summits to create an immersive environment to engage its existing customer base and attract new ones. For instance, the summit will be used as a venue to give top customers an early preview to the first skincare product from the Goopglow collection that comes out in late March. Panels (including one on clean beauty with Gucci Westman and Beautycounter's Gregg Renfrew), mirror Goop's editorial content and e-commerce selection (Beautycounter is sold on goop.com).

“Whether it’s fashion, beauty or wellness, our job is to simplify and curate her lifestyle...helping her make every choice count,” said Kreuzberger. “We aren’t just throwing more product at her. We’re being strategic and thoughtful.”

Related Articles:

[ Why Beauty Needs to Jump on the Wellness BoomOpens in new window ]

[ Is Health and Wellness the New Luxury?Opens in new window ]

[ The BoF Podcast: Gwyneth Paltrow on Her Goop JourneyOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.