The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

This week, Glossier and Rent the Runway both raised large funding rounds at billion-dollar 'unicorn' valuations. But for both the direct-to-consumer beauty brand, which raised $100 million at a $1.2 billion valuation, and the "Netflix for fashion" rental service, which raised $125 million at a $1 billion valuation, these deals come with more intense pressure to scale, which can be challenging.

Just look at the failures of Nasty Gal and Gilt Groupe. Like Glossier and Rent the Runway today, these companies were once valued at multiples more akin to technology companies, but in the end, proved much harder to scale. Both generated nine-figure sales and racked up round after round of venture capital, but eventually hit a snag. Nasty Gal filed for bankruptcy in 2016, and the following year it sold to Boohoo for a mere $40 million. Gilt Groupe was acquired by Hudson's Bay Company for $250 million — a fraction of its $1 billion valuation. Late last year, it was once again sold, this time to Rue La La for an undisclosed amount under $100 million.

Consider Glossier's $1.2 billion valuation, which implies a sales multiple of 12 — staggering, but not completely unheard of in beauty, which benefits from extremely high margins. (Pat McGrath Labs raised investment from Eurazeo Brands last summer at a $1 billion valuation, according to market sources, that implied a sales multiple of 17.)

ADVERTISEMENT

For investors, Glossier is likely to have stood out from peers because of its cult popularity among millennials and founder Emily Weiss' focus on direct-to-consumer sales, which bypasses wholesaling with beauty giants like Sephora or Ulta, a typical path to scale for other fast-growing beauty start-ups like Huda Beauty, Charlotte Tilbury and Pat McGrath. A direct-to-consumer focus not only protects margins, but also makes it easier to maintain brand integrity and marketing narrative. The company's valuation is also likely to have been the product of a competitive bidding environment which is typical for a buzzy company like Glossier in an environment where there is a lot of capital floating around.

As for Rent the Runway, the company's revenues are well above $100 million (the company's reported revenue in 2016) making its sales multiple much more reasonable. The service has overcome many of the challenges it faced in netting brand partners that long resisted joining the platform over fears of sales cannibalisation and brand dilution. Now, as department stores struggle, more labels are approaching the company, not the other way around, according to founder Jennifer Hyman. What's more, subscribers to the company's unlimited monthly rental service are up 160 percent year-over-year, growing largely by word-of-mouth, she said.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Stella Maxwell for The Kooples | Source: The Kooples

Lacoste owner in talks to acquire The Kooples. Private Swiss investor Maus Frères, which bought Lacoste in 2012, has entered into exclusive negotiations with shareholders to acquire French label The Kooples. The brand, which competes with "affordable luxury" brands like Sandro or Whistles, had a turnover of €227 million ($258 million) in 2018, 10 years after launching, and has 334 points of sale centred in Europe and the United States.

Prada shares tumble as China slowdown hits profits. The company's shares fell 7.2 percent, the most since January, following an unexpected drop in annual profit, down 10 percent to €323.8 million ($366 million). The stock has dropped about 35 percent in the past year. Fresh shapes like this year's Sidonie bag have returned Prada's revenue to growth for the first time since the brand's 2014 peak, but investment in e-commerce and social media incurred additional costs.

Hermès still benefiting from buoyant Asian demand. Along with rivals Louis Vuitton and Gucci, the French label, known for its squared silk scarves and Birkin handbags, is still riding high on strong demand from Asian clients with net profit up 15 percent to €1.4 billion ($1.6 billion) and operating income up 6 percent to €2 billion. Hermès had already reported 10 percent comparable sales growth for the fourth quarter, with revenue expanding in Asia Pacific.

ADVERTISEMENT

Levi Strauss valued at $6.6 billion as IPO tops target. Ahead of its debut on the NYSE, the US jeans maker sold $623.3 million in shares in its initial public offering (IPO), as it looks to return to the stock market after 34 years as a family-owned company. Shares were priced at $17, above the target range of $14 to $16 valuing the company at about $6.6 billion.

SMCP expects slower growth as French protests drag on. The French fashion group — which owns Sandro, Maje and Claudie Pierlot, among others — forecast more moderate sales growth in 2019 as street protests rock France and Britain's messy EU exit spreads uncertainty. SMCP, controlled by Chinese retail group Shandong Ruyi, expects sales to expand 9 to 11 percent in 2019, after 13 percent growth in 2018. The company's adjusted EBITDA rose 11.6 percent to €171.5 million ($196 million) in 2018.

Nike shares drop as it misses North America estimates. Amid higher spending on new products and online initiatives, the world's largest sportswear maker missed quarterly sales estimates in its home market sending shares down about 4 percent Thursday. Overall, Nike shares have gained nearly 19 percent this year, as investors cheered its "consumer direct offence" strategy, and total revenue also increased 7 percent to $9.61 billion, in line with average analyst estimates.

French investment group sells stake in Moncler. Eurazeo has sold its entire stake in Italian luxury clothes company Moncler for around €445 million ($505 million). The group sold just over 12 million Moncler shares — representing around 4.8 percent of Moncler's share capital. Eurazeo said its eight-year investment had generated proceeds of €1.4 billion and an internal rate of return (IRR) of 43 percent, but it gave no reason for the decision to sell.

Ted Baker posts first annual profit drop since financial crisis. The British fashion retailer reported lower annual pretax profit of £50.9 million, down 26.1 percent, its first decline since the financial crisis, as discounting and uncertainty on Britain's high street weighed on the company. Ted Baker's founder and chief executive Ray Kelvin quit this month after misconduct allegations, and stock fell more than 40 percent in 2018, hurt by lower wholesale sales and retail sluggishness.

Asos maintains full-year outlook after December profit warning. The British e-tailer's shares fell the most since December after second-quarter sales growth fell short of the full-year target. Retail sales grew 11 percent for the three months ended February 28, leaving it playing catch-up to reach its full-year guidance of 15 percent. This is the first update since Asos cut its sales-growth guidance after a "significant deterioration" in November sales, which drove its shares down 43 percent.

JD Sports to buy smaller rival Footasylum. The sports retailer raised its stake in Footasylum to more than 18 percent last month, and had previously denied that it was planning to make an offer. Now, in a deal valued at up to £90.1 million, JD Sports has agreed to buy its smaller rival. Footasylum's sales during Christmas were dismal, forcing it to cut prices and lower its profit expectations for the full year.

THE BUSINESS OF BEAUTY

ADVERTISEMENT

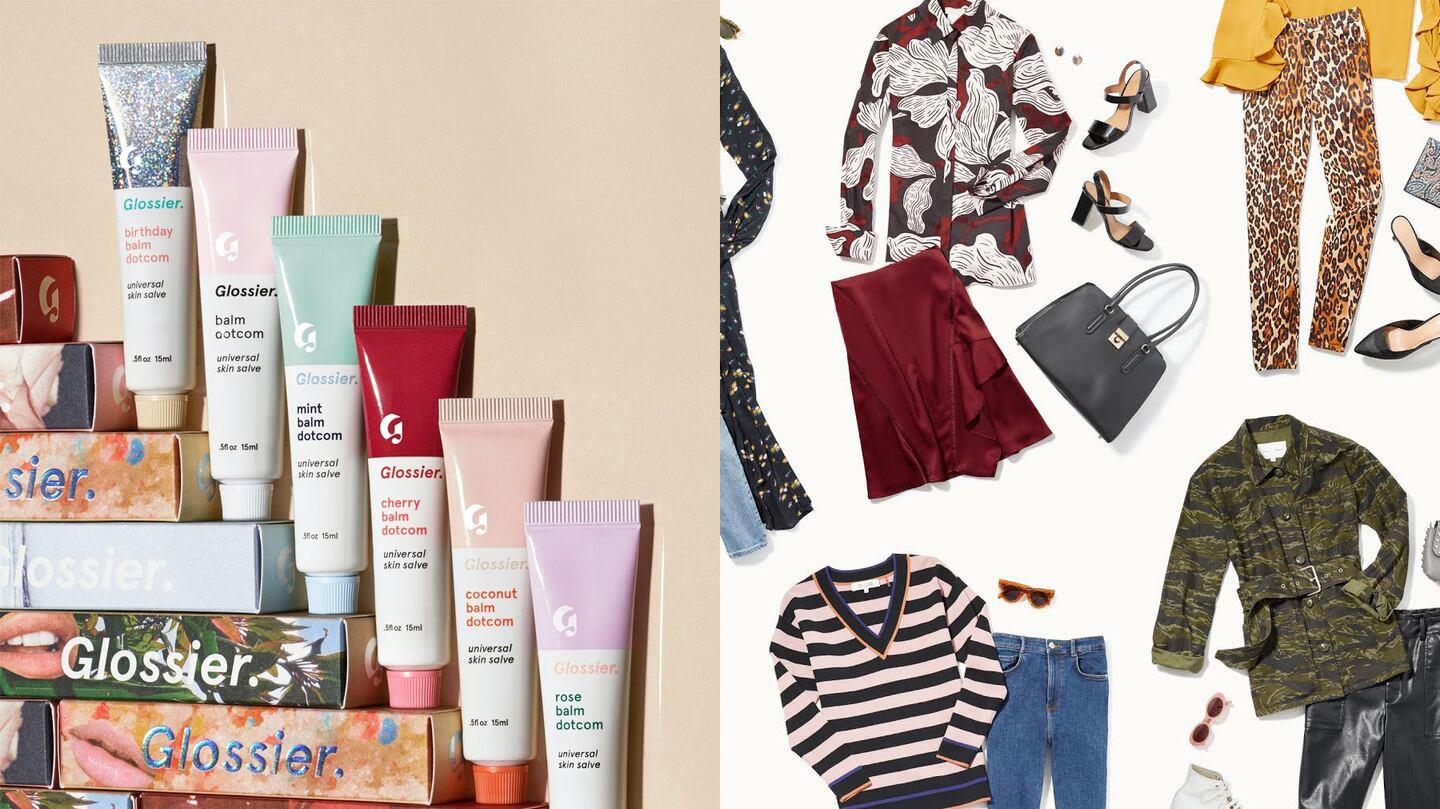

Glossier's balm dotcom | Source: Courtesy

Glossier raises $100 million after sales double. The millennial-favourite brand has raised $100 million in a funding round as it readies new products after doubling sales last year. The series D funding round included some existing investors as well as new investors Tiger Global Management and Spark Capital. Now valued at $1.2 billion, Glossier's annual revenue doubled in 2018, while its direct-to-consumer business crossed $100 million in revenue.

Hermès to launch skincare and cosmetics. The French luxury house plans to launch skincare and cosmetics ranges in 2020. The collections are being developed in-house but will be manufactured by third-party suppliers, mainly in France and Italy. Although most top luxury brands offer skincare and makeup ranges, this is a new challenge for Hermès, which saw sales grow 10.4 percent in 2018 to reach nearly €6 billion in revenue.

Revlon stock plummets. The beauty brand saw disappointing fourth-quarter sales and a delayed 10-K filing that may reveal a "material weakness" in its financial reporting controls, which sent shares plummeting as much as 18 percent post-market Monday. In Revlon's latest quarterly results, sales sank 5.7 percent year-over-year, with declines in every portfolio except prestige brand Elizabeth Arden.

Gwyneth Paltrow's Goop cashing in despite "pseudoscience" claims. The lifestyle brand is best known as an online product platform for luxury goods. Yet, to the surprise of the medical community, the company has become the epicentre of the multi-trillion dollar wellness industry. Goop now makes 70 percent of its total revenue through product sales, with its own line of products becoming the company's fastest growing revenue stream. Revenue from wellness products and events has nearly tripled in the last two years.

PEOPLE

What Tom Ford's CFDA post means for American fashion. The designer has been voted chairman of the CFDA, succeeding Diane von Furstenberg, who held the position for 13 years. Ford will assume the role in June, and told BoF that, as chairman, he wants to bring a more international perspective to the trade association. He will be joining the ranks of American designer legends like Perry Ellis, Bill Blass and Oscar de la Renta, who have all served as the face of the organisation throughout its 57-year history.

Glossier appoints CFO. Following the close of a $100 million funding round, Glossier has announced the appointment of its new chief financial officer, Vanessa Wittman. Prior to joining Glossier, Wittman was chief financial officer at media conglomerate Oath. She replaces company veteran Henry Davis, who stepped down as president and chief financial officer late last year.

MEDIA AND TECHNOLOGY

Instagram unlocks in-app purchasing. The Facebook-owned photo-sharing app announced plans for a new shopping feature that allows users to purchase products within Instagram. The beta version, launched on Tuesday, will be tested by brands including Nike, Revolve and Burberry. The move indicates that Instagram, long touted as a discovery tool, is looking for more ways to drive sales to the platform, which is expected to make up 20 percent of Facebook's overall revenue in 2019.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.