The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Nearly nine years ago, frustrated by the skincare products she saw on the market, Drunk Elephant founder Tiffany Masterson started researching cosmetics ingredients for hours online, looking at the impact they had on the skin. She identified six she wanted to avoid, including essentialca oils and fragrance and dye. She had no experience in medicine or science, but wrote out ingredient lists for six potential products and went to a chemist, who brought the formulations to life. The line launched in 2013.

“Everyone thinks these brands in the doctor’s office are better than those at the drugstore, and the biggest revelation for me was....anybody can use those ingredients to make a formulation,” Masterson said.

A new generation of “clinical” or “cosmeceutical” skincare brands are banking on the idea that the over-the-counter products typically found in a dermatologist's office do not have a monopoly on potent ingredients, such as acids and peptides.

Today, a skincare brand doesn’t even need a founder with a background in dermatology, or medicine for that matter, to launch with a focus on the science behind the formulations. Doctor brands, having increased competition, are getting hip to the changes in the market too, expanding their social media marketing, rolling out sleeker packaging and launching new products.

ADVERTISEMENT

These brands are fighting over a large and rapidly growing market in which consumers are largely left to their own devices to figure out which products and ingredients will solve their skin ailments — and which mainstream ingredients to avoid. Cosmetics do not require the approval of federal regulators, and many of the ingredients and formulations in over-the-counter products lack extensive scientific research to support their claims.

The result is a boon for brands. Skincare sales grew faster than makeup in 2017, according to data from NPD Group. In the year ending June 2018, prestige skincare sales in the US grew 14 percent to $5.4 billion, while sales of clinical/cosmeceutical skincare grew even faster, by 16 percent, representing $1.3 billion in sales.

https://www.instagram.com/p/BmD0DlvBj_j

Drunk Elephant is now among Sephora’s most popular skincare brands. Another clinical brand, Tula, is setting itself up for similar success at Sephora’s rival, Ulta. The skincare and supplements line, founded by gastroenterologist Dr. Roshini Raj in 2015, uses probiotics in all products, claiming the live microorganisms typically used to treat digestive concerns can benefit the skin when applied topically. The L Catterton-backed brand launched on QVC but has since focused on its own e-commerce channel and influencer marketing. On August 16, it will arrive in 1,000 Ulta locations across the US as part of the retailer’s expansion into prestige skincare.

The skincare market is expected to continue to expand as millennials begin to think seriously about anti-aging and Generation Z — accustomed to smoothing social media filters — try to emulate the effects in real life.

Dr. Rachel Nazarian of Schweiger Dermatology Group in New York said the first big dermatologist-led brands developed followings in the medical community because they did extensive clinical research. When patients ask her about over-the-counter brands — “people come in with bags [of products] now” — she looks to see if the brand has really done the “legwork to prove ... that the products work.”

Even if a brand uses the right ingredients, they may not have formulated them correctly, she said. But if the patient is happy with the results, that matters too.

“There are many ways to skin a cat; it’s the same thing in medicine,” she said, adding that many patients overcomplicate their skincare routines because there are so many options on the market.

ADVERTISEMENT

And yet, consumers are responding positively to social-media-friendly versions of what they might have once only found in doctor’s offices. For example, Drunk Elephant’s C-Firma vitamin C serum ($80 for 1 ounce) draws comparisons to Skinceuticals’ C E Ferulic vitamin C serum ($166 for 1 ounce), one of the most famous and most emulated skincare products on the market. L’Oreal’s Skinceuticals was founded in 1994 and brought one of the first forms of Vitamin C for the skin to market.

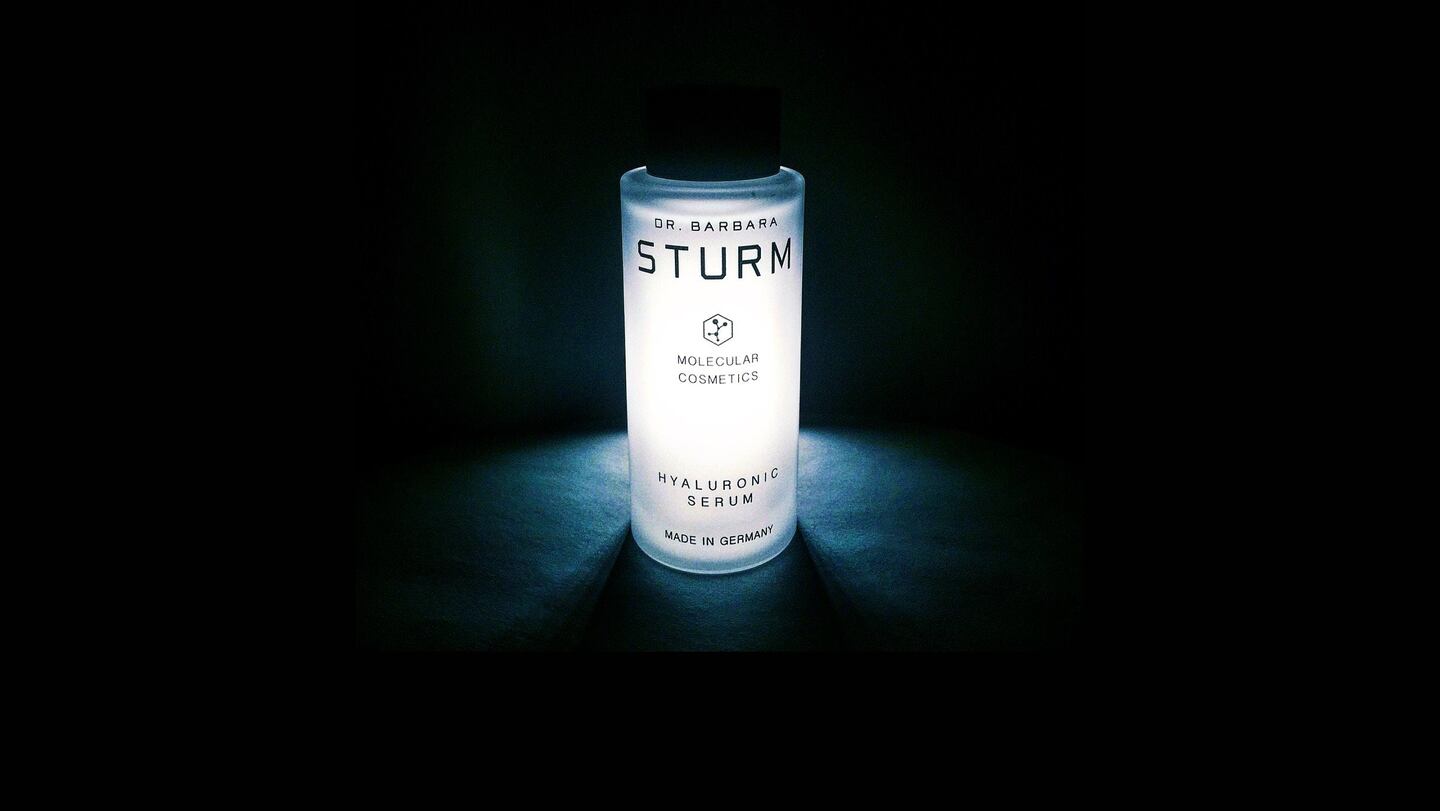

“People would tell me you can’t sell beauty online, this doesn’t work and I thought actually, my patients know me, they know my stuff and they want [their] friends to use my stuff,” said Dr. Barbara Sturm, a German aesthetician and doctor with a background in orthopedic medicine, who started developing her namesake line, starting with a custom cream, in 2003. Now she operates a clinic in Düsseldorf where she offers aesthetic, non-surgical treatments that often incorporate her therapies, in which a patient’s blood proteins are used to, according to her, provide anti-inflammatory and other healing benefits to facial skin.

Her line launched on Net-a-Porter in 2014 where its sleek, translucent minimalist bottles presented as more luxury than remedy, but only in the last three years has she focused on growing the business more strategically.

“People don’t want to be bullshitted, people want to be educated,” Sturm said. “That’s why I think this business is really fun.”

Dr. Sturm is her brand’s best ambassador, and frequently makes personal appearances and films videos to espouse her skincare philosophy.

Similarly, Drunk Elephant’s Masterson says she never goes an hour without answering questions about the brand and skincare on social media. “My job is to be accessible on social media and stay that way,” she said.

Long-running doctor’s brands are becoming more accessible too.

Carrie Gross, president and chief executive of Dr. Dennis Gross, the skincare line started by her and her husband in 2000 and available through Sephora since 2002, said the company started modernising its approach six years ago.

ADVERTISEMENT

“It’s hard to stay true to your clinical heritage, not use kitschy language, even if everybody else is,” said Gross, adding that the brand updated its approach to focus more on the customer than Dr. Gross, without losing the fact that he still sees patients every day from the narrative of the brand.

“I think that people really want a doctor to guide them,” she said, adding that Dr. Dennis Gross’s presence in the “professional channel,” meaning spas and salons where the product is used by licensed aestheticians, is a key differentiator that feeds retail sales.

https://www.instagram.com/p/BmMu-9-n-LK

Stéphane Colleu, the president and chief executive of 18-year old line Dr. Brandt, also said customers today want to know more about the science behind the brand. After founder Dr. Fredric Brandt died in 2015, Colleu put together a skin advisory board consisting of dermatologist, and estheticians and a nutritionist to speak on behalf of the brand publicly and help inform product development. The company released a probiotic mask early this year, for example, not long after it added the nutritionist to the board.

Even though he says brand can no longer let a product’s efficacy market itself, “it is very important for us to remain results oriented, despite all the trends and especially on social.”

Drunk Elephant’s Masterson is results oriented too, but has a different kind of feedback loop. When she launched the brand’s first face wash last year, the reaction on social media was negative within hours: the bottle leaked, the cleanser stung eyes.

“I view my consumer as my best girlfriend; I’m learning as much as they are,” she said. The cleanser is called Beste #9 “because it took me nine times to get it right.”

The customer is willing to wait, especially if the testing process happens in the early stages of growth for a digitally native brand, because overall demand for new products, is growing.

“It feels like an inflection point,” said Savannah Sachs, Tula’s chief executive. The brand will be the only probiotic skincare brand at Ulta, which is expanding its skincare offering. “They want to demystify skincare for their shoppers and make skincare really simple and approachable.”

The truth, however, skincare is anything but simple.

“Respect the skin, it's an organ,” said Nazarian, the dermatologist. “Respect the science behind dermatology.”

Related Articles:

[ Tracking the Rise of ‘Clean’ BeautyOpens in new window ]

[ 9 Trends Defining The Beauty RevolutionOpens in new window ]

[ Why the Beauty Industry Is Betting Big on SupplementsOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.