The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

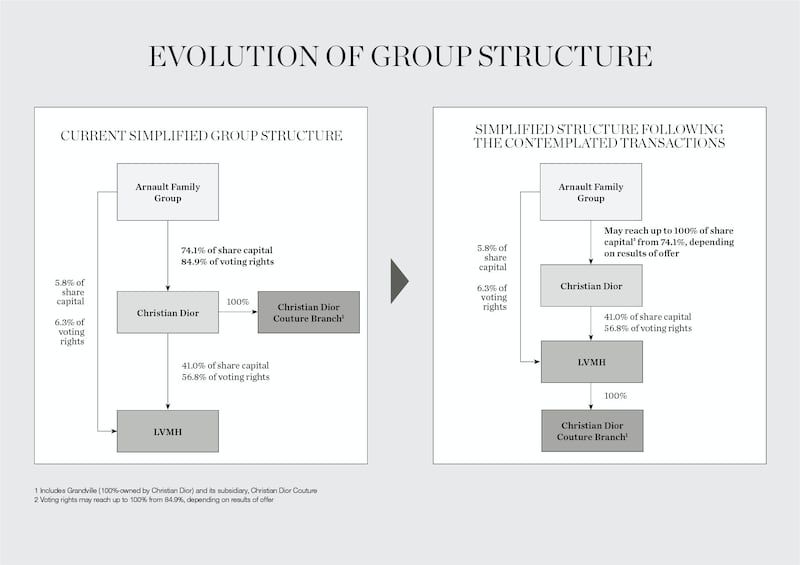

PARIS, France — LVMH announced on Tuesday that it plans to integrate the entire Christian Dior brand within the luxury group, as part of a two-pronged strategic deal to strengthen its fashion and leather goods division. In total, the deal is valued at around $13 billion.

In part one, the Arnault family group (Groupe Arnault) has offered to buy the 26 percent of Christian Dior it doesn't already own for €172 per share in cash and 0.192 Hermès International shares for each Christian Dior share. (These values represent a 14.7 percent premium over Christian Dior’s latest share price and an 18.6 percent premium over its 1-month average.)

In part two, LVMH will acquire Christian Dior Couture from Christian Dior for an enterprise value of €6.5 billion.

Graphic: Jan-Nico Meyer for BoF

ADVERTISEMENT

The deal fuses together the entire Dior brand, creating further synergies between Christian Dior Couture and the Parfums Christian Dior, the latter of which is already fully owned by LVMH.

Shares in LVMH rose by more than 4 percent, to €224 per share, by 13.41 BST as the markets reacted to the news.

Revenue for Christian Dior has doubled over the past five years and its profitability has improved over the same period, with an increase in operating profit from recurring operations of 24 percent per year. For the last 12 months ended March 31, Christian Dior reported revenue in excess of €2 billion and profit from recurring operations of €270 million.

Bernard Arnault, chairman and chief executive, said the move illustrated the commitment of his family group towards LVMH and its brands. "The corresponding transactions will allow the simplification of the structures, long requested by the market, and the strengthening of LVMH's fashion and leather goods division thanks to the acquisition of Christian Dior Couture, one of the most iconic brands worldwide," he said in a statement.

Luca Solca, head of luxury goods at Exane BNP Paribas, said he sees a number of positives in the deal. "It adds a strong brand to the LVMH portfolio at a reasonable valuation and on an accretive basis," he said. "It [also] reduces the risk of LVMH potentially buying 'trophy assets' at the expense of ROIC [return on invested capital] dilution."

LVMH expects the filing of the proposed offer by the end of May, with the acceptance period lasting around three weeks.

Disclosure: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholder’s documentation guaranteeing BoF’s complete editorial independence.

Related Articles:

[ As LVMH Posts Record Profits, Arnault Looks to 2017 With 'Caution'Opens in new window ]

[ Inside Dior’s Unseen Archive with Maria Grazia ChiuriOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.