The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The FashionStake Diaries is a four-part series that giving a behind-the-scenes look at the crucial first months of a crowdfunding fashion startup, seen through the eyes of its founders. In Part I, we examined how FashionStake got from idea to traction with $1000. Today, the founders reveal how they were able to finance their business.

NEW YORK, United States — Our business school professors used to say that startups were about getting four things right: the Context, the Opportunity, the Deal and the People. Having focused our early efforts on understanding how fashion has changed forever with the rise of Web 2.0 (the Context) and how an online marketplace connecting designers directly with the public could yield benefits for everyone (the Opportunity), it was time to turn our attention to funding (the Deal) and acquiring talent (the People).

Not all investment paths are equal

Consumer internet marketplaces like ours typically have "land-grab" dynamics. Whether the marketplace is for hand-made items, for example like Etsy, or discounted deals, like Groupon, a first-mover can capture 80 percent market share with later entrants left to fight over the remaining 20 percent.

ADVERTISEMENT

Network effects are the main force at work here: great startups reach a critical mass of suppliers and buyers, which attracts even more suppliers and buyers. It’s the secret sauce that makes competing with established marketplaces like eBay a tough task.

But of course, getting to critical mass fast usually costs money. To start with, you need to build great products and hire great people. This is the main reason why we sought out external investment.

We recently closed our first round of funding with Battery Ventures, a Silicon Valley-based venture capital firm, and a handful of fashion industry angel investors. We've found that working with a well-known VC has many benefits: they have a blue-chip reputation, are well-connected — especially when it comes to sourcing employees — and can participate in, or lead, the next round of financing. But we've also found that angel investors from within fashion are a great complement to a VC, as they've operated within the industry themselves and can offer targeted advice.

Fashion startups are different

For a fashion startup, investor dynamics are unique. The average VC specializes in a few “themes” (consumer internet, enterprise software, cloud computing etc.) and builds a portfolio of companies within those themes. Most fashion-tech startups we’re seeing now are two-sided platforms that would technically fall under the consumer internet theme.

That said, until now, fashion startups have not attracted significant investor attention, so there is sometimes an investor education process that needs to happen. We found that sending a pre-reading document to investors made meetings more productive. Still, many of the VCs we met with had never made a fashion investment before.

How to pitch investors

In our treks to and from New York and Silicon Valley, the world’s largest venture capital and private equity hub, we learned three important lessons. First, present a story, not a slideshow. When meeting investors for the first time, we learned to tell a succinct chronological narrative from the birth of our idea to the present day, focusing on key turning points and milestones.

ADVERTISEMENT

Secondly, don’t contact investors. Well, at least don’t contact them directly. We were lucky enough to have generated enough interest in the press that VCs and angel investors came to us.

While this may be atypical, the best way to get to a VC is to be recommended by someone the investor trusts. Usually this will be a partner at their firm, a peer at another firm, a close friend, a startup lawyer or accountant, or a well-respected startup CEO. Your job as the entrepreneur is to get introduced to an investor through these people. We spoke to a 15 year VC veteran who told us he has never invested in a cold-call. Introductions matter.

Finally, focus on opportunity-team fit. After the first few meetings, we had focused our story on how our backgrounds and specific professional experiences fit the opportunity we presented. VCs and angels are always looking for the advantage of domain expertise in their teams. If you don’t have it, find it and your team becomes instantly more fundable.

But after all is said and done, it’s important to put the funding process into perspective. We think about it less as an end and more as a ticket to play.

Our Next Step: The Countdown to Launch

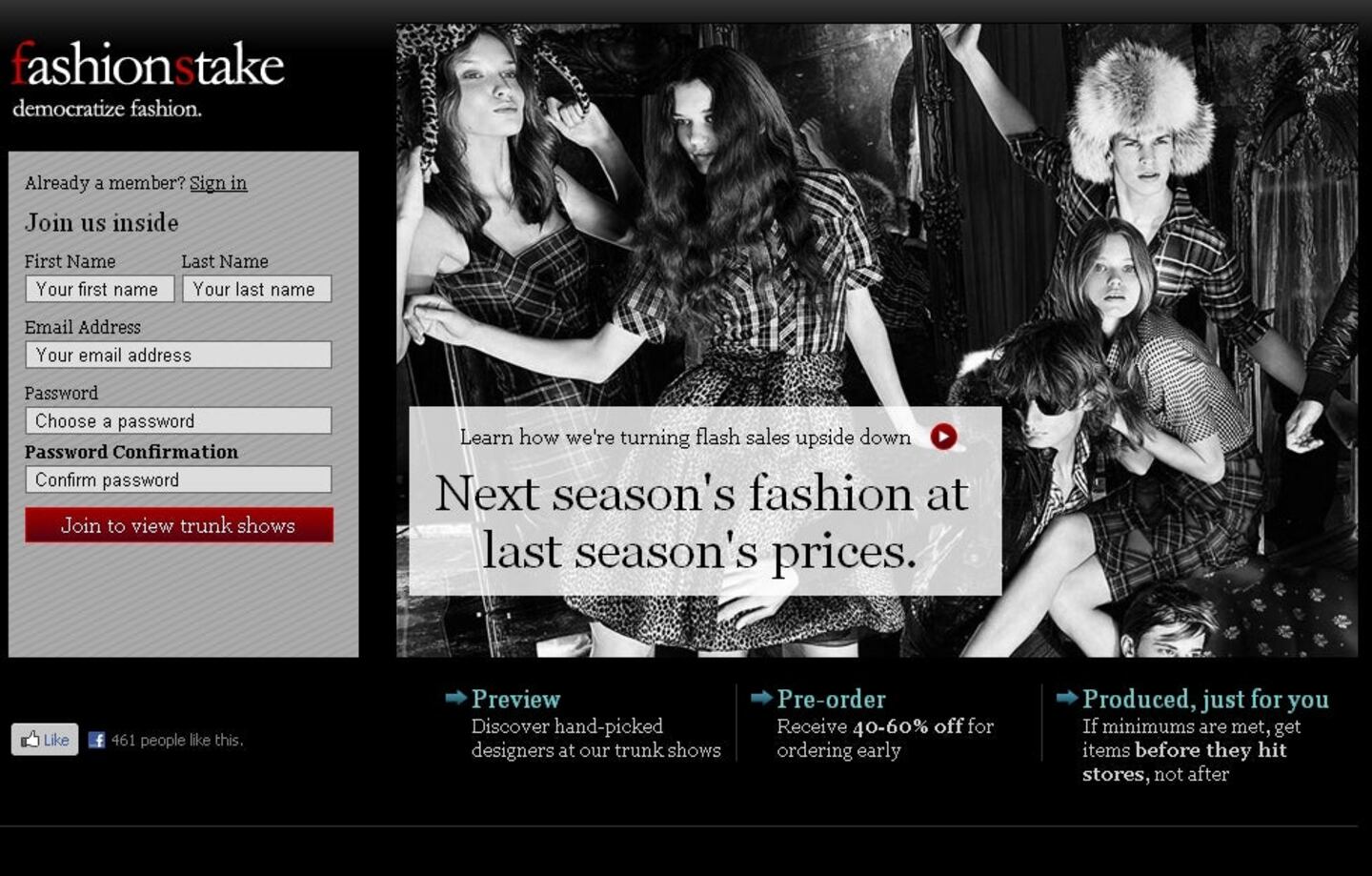

With the business model in place, designers signed, and funding secured, we’re on track for our September 1st launch. In our next posts, we’ll reveal our designers and share our reflections on the eve of launch. And most importantly, you’ll be able to click through and see the site for yourself.

Vivian Weng and Daniel Gulati are co-founders of FashionStake, a new online marketplace for fashion, launching September 1, 2010.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.