The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MELBOURNE, Australia — The announcement in April that American e-commerce giant Amazon would arrive on Australian shores left the nation waiting with bated breath. Suspense built as Black Friday and Cyber Monday — prime opportunities to enter the market — passed without so much as a peep from Amazon, which only sold e-books and audiobooks in the country since 2013.

In the US, Amazon will account for over 40 percent of the country’s e-commerce sales this year, according to research firm eMarketer, while the “Amazon Effect” has contributed to the mass-closure of brick-and-mortar retailers nationwide. Back in Australia, e-commerce represents a small but rapidly growing percent of overall retail revenue, as in-store foot traffic slows to historic lows. “The market is very turbulent,” says Russell Zimmerman, executive director of the Australian Retailers Association. “Clothing and footwear, along with department stores, have got it very tough. But even though the industry is in turmoil, we have a fairly low unemployment rate in Australia,” he continues. “So why wouldn’t you look at a country like that to develop an online business?”

Early this week, Amazon Australia quietly went live, with just over three weeks to go until Christmas. In anticipation of the move, many Australian retailers had prepared themselves by upgrading their e-commerce platforms and delivery capabilities. But nonetheless some say the arrival of Amazon could be nothing less than fatal for parts of Australia's retail sector. "The industry is unprepared and this could be a winner-takes-all game," predicts David Lawn, private equity investor and former chief executive of Lululemon Athletica's Australian operation. "There will be real winners and losers." The losers, Lawn believes, will be brick-and-mortar department stores. "The big stores are in real trouble, there are just too many of them. Some of the department stores have 70 to 80 stores, whereas [US department chain] Nordstrom have only got something like 20 stores in the US."

It’s early days, but so far, Amazon Australia’s limited product offering and pricing, which is not as low as some anticipated, actually served to restore investor confidence in competing retailers, with shares at department chain Myer Holding Ltd, for example, rising 2 percent since the launch. Shares in electronics retailer JB HiFi and white goods store Harvey Norman Holdings Ltd also rose 5 percent.

ADVERTISEMENT

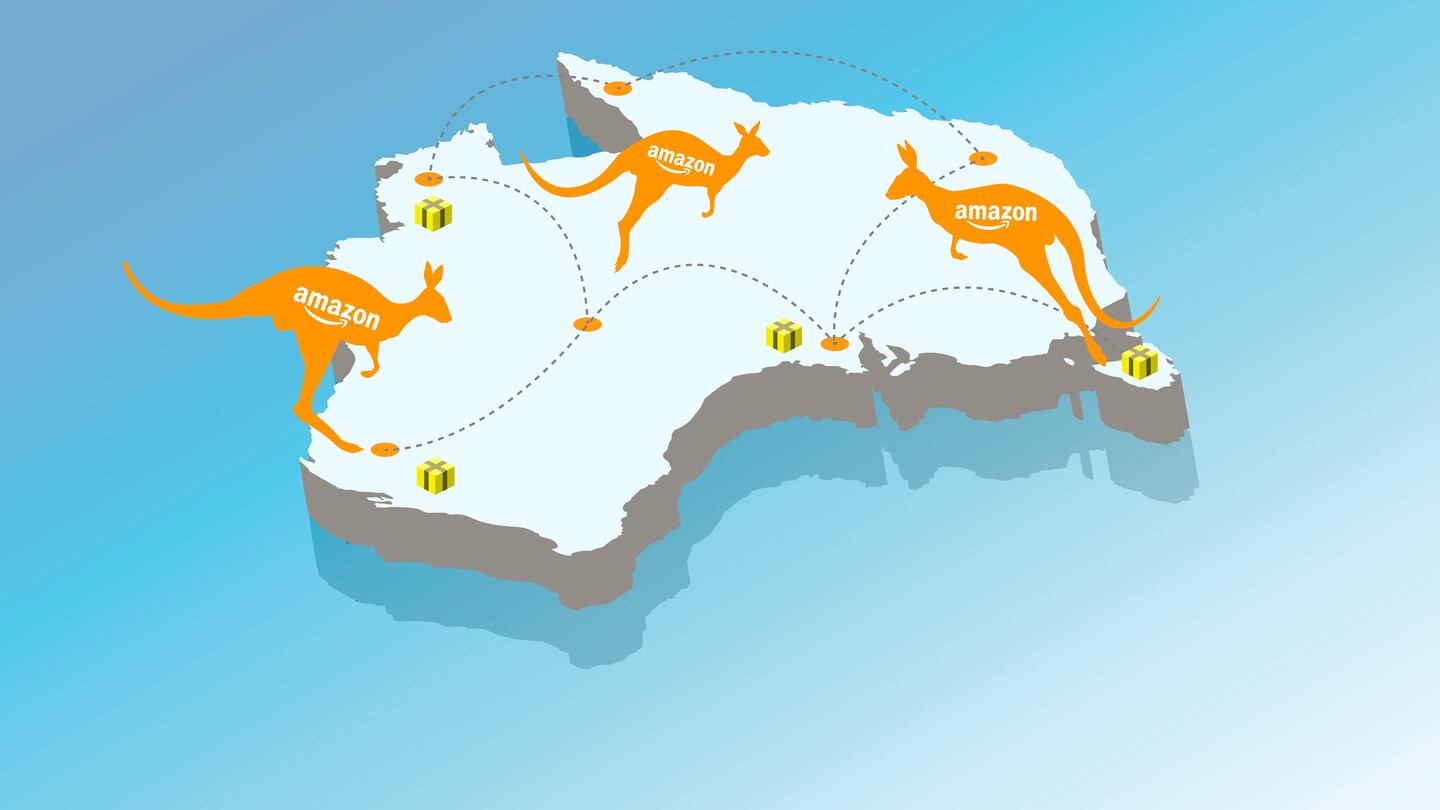

With only one fulfilment centre in Dandenong on the outskirts of Melbourne, the tyranny of Australia’s vast geography may well be an early challenge for Amazon. “One of the big problems they’ll have in a very short amount of time, might not even be getting something across to Perth, but how do you get something from Melbourne to Sydney in very quick time?” asks Patrick Schmidt, chief executive of The Iconic, Australia’s largest online fashion retailer. “You might be able to do fairly quick deliveries in capital cities, but getting it into the regional areas and getting it out in quick time, that’s going to be one of their problems.”

You can't afford to sit back on your laurels and think that Amazon won't affect you — it will affect every business in Australia in some way, and they should be well prepared for it.

“People are a bit cynical of e-commerce in Australia because, especially in the early years, service hasn’t been great and delivery hasn’t been fast,” continues Schmidt. “If you had a problem, you might not be dealt with and delivery wasn’t free — returns certainly weren’t free.” Lawn agrees. “There are huge differences between people’s attitudes to getting things delivered in the UK and US compared to Australia. If you live in the UK, people use delivery systems for toothpaste and just about everything, but that hasn’t been the case in Australia. It isn’t in the Australian DNA at the moment.”

But despite the challenges, Amazon is expected to force many smaller e-commerce competitors out of business. “We believe that the market, which is currently very fragmented in online fashion, is going to consolidate a lot in the next couple of years,” says Schmidt. “There are obviously a lot of players, like in any new market and just like there was in Europe. With Amazon coming in and ASOS being really big here as well, something has to give and there will be more consolidation.”

However, Schmidt believes Amazon will have a largely positive impact on the industry. “I think it’s a matter of the tide lifting most boats, because the market has a lot of growth potential,” he explains. “Many people say that Amazon will be bad for existing players, but if you have no competitor at all and you’re the only one playing in e-commerce, it’s actually very hard to grow a new market. You almost need your competition to do a great job in order for customers to have faith in a new product like e-commerce.”

Some small businesses also look set to gain from the size of Amazon’s global marketplace. “As a retailer, I would be looking to be on Amazon’s marketplace because they have 330 million dedicated customers out there,” says Zimmerman. “If you look at those 330 million customers that Amazon appeals to, at best 24 million of them could be Australian. Why wouldn’t you engage with Amazon if you’re a small retailer?”

“You can’t afford to sit back on your laurels and think that Amazon won’t affect you — it will affect every business in Australia in some way, and they should be well prepared for it,” continues Zimmerman. “What you have to do is embrace it, understand it, be smarter than them, but also engage with them. I don’t think it’s going to destroy Australian retail, I think it’s an opportunity to build Australian retail.”

Related Articles

[ How Amazon's Prime Wardrobe Will Impact Department StoresOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.